How to Calculate Credit Card Interest

Ever looked at your credit card statement and wondered, “Where did this interest charge come from?” You’re not alone. Credit card interest is one of the most confusing and expensive parts of personal finance—yet it affects millions of Americans each month.

According to recent data, the average U.S. credit card APR in 2025 is over 22%, and balances are rising post-pandemic. If you’re carrying debt, that interest can snowball fast.

But here’s the good news: once you understand how interest is calculated, you can:

- Avoid unnecessary fees

- Pay smarter

- Lower your overall debt

In this step-by-step guide, we’ll walk you through:

- What APR really means

- How daily interest is calculated

- What triggers interest

- How billing cycles affect your charges

- How to estimate and reduce your interest costs

Chapter 1: What Is Credit Card Interest?

1.1 What Is Interest?

Credit card interest is the cost of borrowing money from your card issuer. If you don’t pay your entire balance by the due date, you’ll be charged interest on the remaining balance.

Unlike loans with a fixed repayment schedule, credit card interest is revolving, compounding daily, and based on your APR.

1.2 What Is APR?

APR stands for Annual Percentage Rate—the yearly interest rate charged if you carry a balance. If your APR is 20%, that doesn’t mean you’re charged 20% monthly. It’s split into a daily rate and calculated every day.

There are different types of APRs:

- Purchase APR: interest on regular purchases

- Balance Transfer APR: interest on transferred balances

- Cash Advance APR: usually higher, often 25%–29%

- Penalty APR: triggered by late payments—can go up to 30%+

Understanding your card’s APR is the first step toward calculating interest.

Chapter 2: When Is Credit Card Interest Charged?

You don’t always get charged interest. Here’s when it applies:

✅ No Interest:

- If you pay your full statement balance by the due date

- During a 0% intro APR promotion

- If you haven’t carried a balance from the previous cycle

❌ You Get Charged Interest If:

- You carry any balance past the due date

- You only make the minimum payment

- You take a cash advance (interest starts immediately)

- You miss payments and trigger the penalty APR

Grace Period:

Most cards offer a grace period—typically 21–25 days after the close of your billing cycle—during which you can pay your balance in full and avoid interest.

Once you lose the grace period (by not paying in full), interest starts accruing daily.

Chapter 3: How Credit Card Interest Is Calculated

Now to the big question: How do banks calculate your interest charges?

🔢 Formula:

Daily Interest=Average Daily Balance×Daily Periodic Rate\text{Daily Interest} = \text{Average Daily Balance} \times \text{Daily Periodic Rate}Daily Interest=Average Daily Balance×Daily Periodic Rate

Then: Total Interest=Daily Interest×Number of Days in Billing Cycle\text{Total Interest} = \text{Daily Interest} \times \text{Number of Days in Billing Cycle}Total Interest=Daily Interest×Number of Days in Billing Cycle

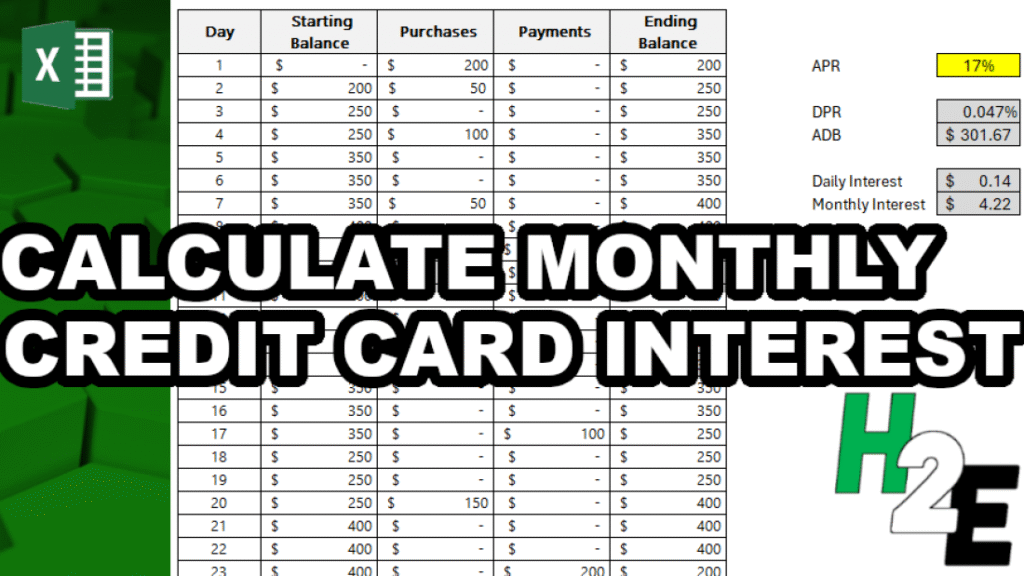

3.1 Step-by-Step Calculation

Step 1: Find Your APR

Let’s say your purchase APR is 20%.

Step 2: Convert APR to Daily Rate

Daily Rate=20%365=0.0548% per day\text{Daily Rate} = \frac{20\%}{365} = 0.0548\% \text{ per day}Daily Rate=36520%=0.0548% per day

Or: Daily Rate (Decimal)=0.000548\text{Daily Rate (Decimal)} = 0.000548Daily Rate (Decimal)=0.000548

Step 3: Calculate Your Average Daily Balance

Say your balances throughout a 30-day billing cycle were:

- Days 1–10: $1,000

- Days 11–20: $500

- Days 21–30: $1,500

Average Daily Balance=(10×1000)+(10×500)+(10×1500)30=10,000+5,000+15,00030=30,00030=1,000\text{Average Daily Balance} = \frac{(10 \times 1000) + (10 \times 500) + (10 \times 1500)}{30} = \frac{10,000 + 5,000 + 15,000}{30} = \frac{30,000}{30} = 1,000Average Daily Balance=30(10×1000)+(10×500)+(10×1500)=3010,000+5,000+15,000=3030,000=1,000

Step 4: Calculate Daily Interest

1,000×0.000548=0.5481,000 \times 0.000548 = 0.5481,000×0.000548=0.548

Step 5: Multiply by Days in Billing Cycle

0.548×30=$16.440.548 \times 30 = \$16.440.548×30=$16.44

So your interest charge is about $16.44 for that month.

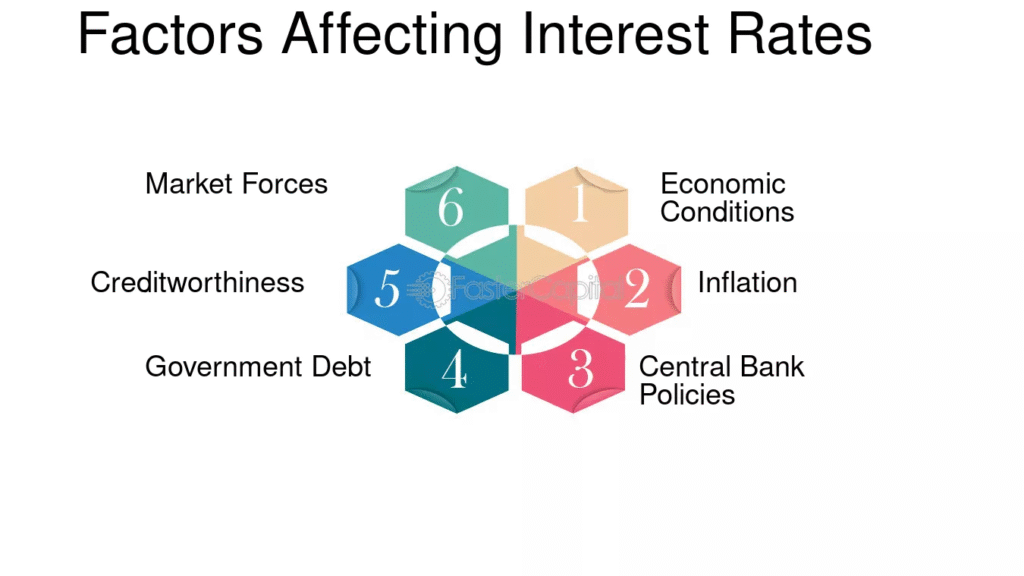

Chapter 4: What Affects Your Interest Charges?

Several variables influence how much interest you pay.

🔁 4.1 Carrying a Balance

- The more you carry, the more interest accumulates.

- Even small balances can lead to big charges over time due to compounding.

📆 4.2 Timing of Purchases

Making large purchases early in the cycle increases your average daily balance—and your interest.

💳 4.3 Type of Transaction

- Cash advances start accruing interest immediately

- Balance transfers may have special APRs or fees

- Purchases may qualify for a grace period

⚠️ 4.4 Missing Payments

One late payment can:

- End your grace period

- Trigger penalty APR (often 29.99%)

- Affect your credit score

Chapter 5: Tools to Help You Estimate and Track Interest

You don’t have to calculate manually every time. Use these tools:

📱 5.1 Online Interest Calculators

Sites like:

- NerdWallet

- Bankrate

- Credit Karma

…offer free interest calculators—just plug in your APR, balance, and payment info.

💼 5.2 Credit Card Apps & Statements

Most card issuers show:

- Your APR

- Your daily periodic rate

- Interest charges for the current statement

- Payment due date and grace period

📊 5.3 Budgeting Apps

Apps like:

- Mint

- YNAB

- Monarch Money

…help you track:

- Interest charges

- Debt payoff goals

- Cash flow predictions

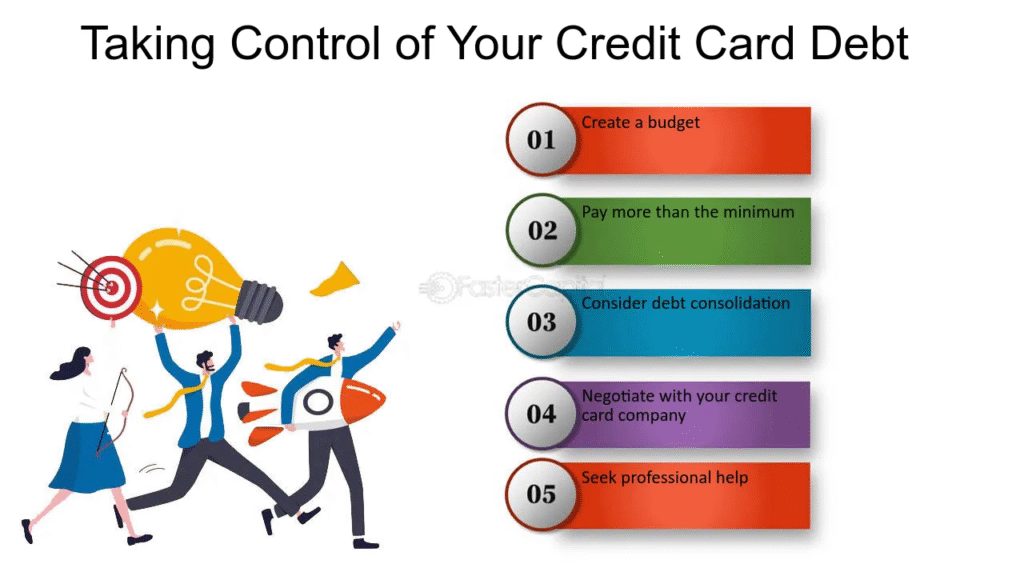

Chapter 6: How to Reduce or Avoid Interest Charges

✅ 6.1 Pay Your Full Balance On Time

This is the #1 way to avoid interest. Pay the entire statement balance by the due date every month.

✅ 6.2 Understand Your Billing Cycle

Know:

- When your statement closes

- How long your grace period lasts

- When your due date hits

✅ 6.3 Make Multiple Payments Per Month

This helps lower your:

- Average daily balance

- Credit utilization

- Interest accrual

✅ 6.4 Negotiate a Lower APR

Call your card issuer and ask:

- “Can you reduce my APR?”

- If you’ve been a good customer, they might say yes

✅ 6.5 Use a 0% Intro APR Offer

Many cards offer 0% APR for 12–21 months on purchases or balance transfers. Be sure to:

- Pay it off before the intro period ends

- Avoid new charges if not covered by the promo

Chapter 7: Real-World Examples

Example 1: Small Balance, Big Impact

- Balance: $1,500

- APR: 24%

- Minimum payment: $35

If you only make minimum payments, you could pay $1,000+ in interest over time.

Example 2: Grace Period Saver

- You charge $800, pay it off on time = $0 interest

Example 3: Compound Trouble

- $5,000 at 20% APR = ~$82/month interest

- Over 12 months = ~$980

The takeaway: small balances can turn into big costs quickly.

Chapter 8: FAQs About Credit Card Interest

1. Is interest charged daily or monthly?

Daily. Credit cards use a daily periodic rate that compounds each day.

❓ What is compounding interest?

Interest charged on both your balance and previous interest, increasing your total owed.

❓ Can I avoid interest if I make partial payments?

No. You must pay the entire statement balance to avoid interest.

❓ Do 0% APR offers charge interest?

Not during the promo. But interest starts immediately after the promo ends on any unpaid balance.

❓ Will paying early reduce interest?

Yes—payments reduce your average daily balance and can lower interest accrued.

Conclusion: Take Control of Your Credit Card Interest

Understanding how credit card interest works is one of the most empowering financial moves you can make.

To recap:

- Interest is based on your APR, daily balance, and billing cycle

- Paying in full and on time avoids interest altogether

- Even small balances can lead to large interest charges

- Tools like budgeting apps and calculators can help

- Reducing your APR and using 0% offers can save you thousands

With this knowledge, you’re no longer at the mercy of fine print or hidden charges—you’re in control.