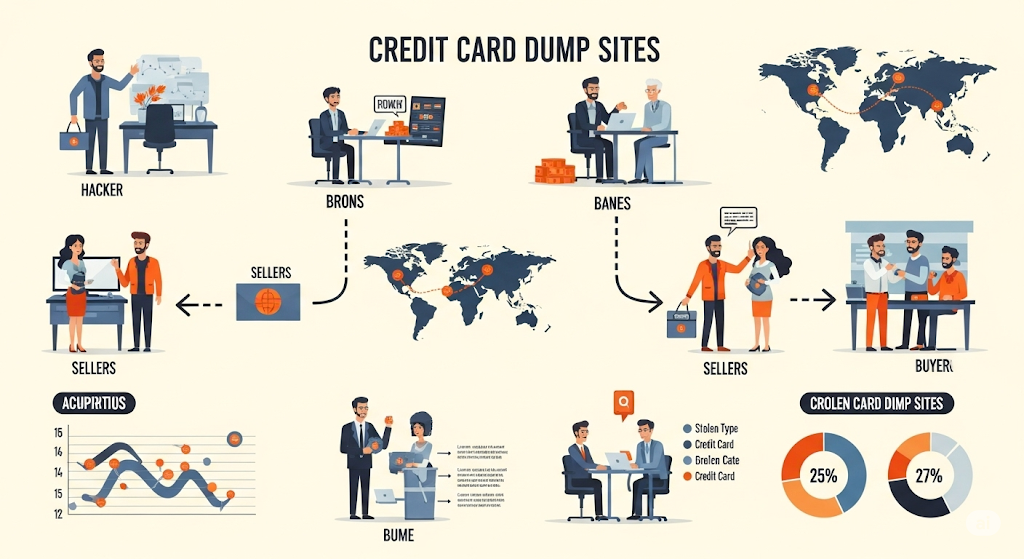

Credit card dump sites are online platforms where stolen credit card information is bought and sold, often enabling fraudsters to make unauthorized purchases or create counterfeit cards. These sites operate primarily on the dark web, offering access to large amounts of illegally obtained credit card data. They serve as hubs for criminals to trade digital copies of credit cards, commonly known as dumps, which can lead to significant financial loss for victims.

These sites are notoriously difficult to navigate and infiltrate but remain central to the underground economy of credit card fraud. Users can find various dumps sourced through hacking, skimming, or data breaches, often sorted by value or region. Despite the risks, some vendors have established reputations, making the marketplace more structured than one might expect.

Understanding what credit card dump sites are and how they function is key to recognizing the threat they pose. Awareness of these platforms helps individuals and businesses take proactive steps to protect their financial information from being exploited on these sites.

Understanding Credit Card Dump Sites

Credit card dump sites facilitate illegal trade in stolen credit card data, posing serious risks to victims and businesses. These platforms use various techniques to compile, sell, and distribute credit card information. They operate anonymously, leveraging digital currencies and encrypted communications to avoid detection.

Definition and Purpose

Credit card dump sites are online platforms, often on the dark web, where criminals sell unauthorized copies of credit card data. These dumps contain detailed information such as card numbers, expiration dates, and CVV codes. The primary purpose is to enable fraud, including cloning cards or making illicit online purchases.

These sites serve buyers who engage in credit card abuse, sometimes resulting in felony-level charges. First-time offenders caught using or distributing such data may face serious legal consequences depending on jurisdiction. The sites also create an underground economy for identity theft and financial fraud.

How Credit Card Dump Sites Operate

Dump sites operate anonymously, requiring registration or invitations. Sellers upload stolen card data, usually obtained via skimming, hacking, or data breaches. Transactions are primarily conducted through cryptocurrencies like Bitcoin, minimizing traceability.

Once payment is made, buyers receive data files to use for unauthorized purchases or card cloning. Some sites offer quality ratings for card dumps to indicate usability. Operators protect their platforms with encryption and often use proxy servers to evade law enforcement.

These sites contribute to credit card abuse charges and credit card theft cases. Legal statutes, such as felony credit card abuse definitions, vary, affecting how offenders are prosecuted.

Common Methods Used by Dump Sites

The most common method to gather card data is skimming, where devices capture card info at ATMs or points of sale. Another method is hacking into company databases containing stored payment information. Phishing attacks also trick victims into revealing card details.

After collecting data, criminals format it into dumps compatible with tools used for card cloning or fraudulent online transactions. Dump sites then resell this data in bulk.

In jurisdictions like Georgia, the statute of limitations for credit card debt may impact prosecution timelines but does not delay criminal charges related to theft or fraud. Understanding these methods helps users stay alert to potential fraudulent activity.

Risks and Legal Implications

Using credit card dump sites exposes individuals to severe legal consequences and significant harm to victims. The illegal activity involves fraudulent transactions that can lead to permanent financial loss and criminal charges. Authorities have intensified efforts to detect and dismantle these operations.

Legal Consequences of Using Dump Sites

Engaging with credit card dump sites is illegal and classified as credit card abuse. Those caught can face felony charges ranging from credit card theft to fraud. Penalties may include heavy fines, imprisonment, and a permanent criminal record.

In some jurisdictions, even first-time offenses involving credit card theft can result in felony-level charges. These crimes may also carry consequences beyond criminal courts, such as civil liability or liens placed by credit card companies if debt repayment is avoided.

Users of dump sites risk being prosecuted for credit card abuse charges, which can carry harsher sentences for repeat offenses. Courts often treat unauthorized use or possession of stolen credit card data as serious offenses due to their financial and societal impact.

Potential Victims and Impact

Victims of credit card dumps include individual cardholders, banks, and merchants. Fraudulent transactions drain victims’ accounts and can damage their credit scores for extended periods.

Merchants face chargebacks and loss of sales revenue, sometimes incurring unrecoverable financial losses. Consumers often experience identity theft, requiring costly and time-consuming recovery efforts.

Beyond monetary damage, victims suffer reputational harm and erosion of trust in financial systems. The impact extends to authorized users who may become liable for unexpected debts if credit card abuse charges are filed against them.

Law Enforcement Efforts

Law enforcement agencies prioritize tracking and shutting down dump sites due to their role in enabling widespread fraud. Cybercrime units collaborate internationally to investigate and prosecute operators of these illegal platforms.

Agencies employ advanced digital forensics and undercover operations to infiltrate networks. Efforts include seizing servers, freezing assets, and arresting key figures involved in the creation and distribution of stolen credit card data.

Public awareness campaigns stress the risks of using dump sites. Legal frameworks have been updated to increase penalties and enable faster prosecution, deterring users and sellers alike from participating in this criminal activity.

Techniques Used on Credit Card Dump Sites

Credit card dump sites rely on multiple technical strategies to operate and distribute stolen card data. These methods ensure the anonymity of both sellers and buyers while continuously sourcing new compromised credit card information.

Carding and Dump Creation

Carding refers to the process of testing stolen credit card data by making small transactions to verify validity. Fraudsters often use “soft declined” transactions to gauge if a card will eventually be approved without triggering immediate fraud alerts.

Once verified, the information becomes part of a credit card dump. Dumps contain data like the card number, expiration date, and security code. Sometimes, “fullz” include detailed personal information that can facilitate identity theft or more targeted fraud.

Dump creation can also involve cloning physical cards using data from dumps or exploiting online payment systems. Reproducing physical cards allows unauthorized in-person transactions in retail environments.

Use of Proxies and Anonymity

Credit card dump sites employ proxies and VPNs to mask IP addresses. This prevents law enforcement and cybersecurity firms from tracking their servers or users.

Proxies also enable sellers to “buy proxy with credit card” services, using stolen card data to fund anonymity tools. This adds layers of obfuscation, complicating efforts to trace the source of dumps.

Users on these sites often rely on cryptocurrencies or wire transfers for payment. These untraceable methods maintain anonymity for both buyers and sellers, reducing the risk of detection.

Data Sources and Methods of Acquisition

Thieves acquire credit card information through physical and digital means. Skimming devices capture card data from ATMs or point-of-sale terminals. Hackers breach company databases to download large volumes of credit card information.

Phishing attacks and malware infections target individual users to steal debit or credit card details. This explains how someone might use a debit card without physically having the card.

Dump sites aggregate stolen card information from various sources and categorize it by brand, expiration date, and other factors. Prices on these sites vary depending on the quality and completeness of the data involved.

Types of Information Traded

Credit card dump sites offer various kinds of stolen data that cater to different criminal needs. This includes distinct formats of card information, the differences between debit and credit card data, and additional personal details that enhance the value of the stolen information.

Credit Card Data Formats

The primary types of card data sold on these sites are dumps and CVVs. Dumps are raw data copied from the magnetic stripe or chip of a card, allowing criminals to clone the physical card. CVVs, on the other hand, often refer to the card number, expiration date, and the security code, used for online transactions.

Markets typically allow filtering by card type (Visa, MasterCard, AMEX), country of origin, and sometimes the card brand. This lets buyers select data suited to their fraud approach. Some dump sites even separate data by card type to increase ease of use.

Debit Versus Credit Card Dumps

Debit card dumps differ from credit card dumps in several important ways. Debit card data provides direct access to funds in the cardholder’s bank account, often making it riskier for the thief to use without detection. In contrast, credit card dumps allow spending on borrowed money, often with more lenient fraud protection.

Specific cards, like the US debit vs. Visa debit, show that Visa debit cards may offer broader online use. However, dumps from these cards might carry different security features or banking protections, impacting how criminals exploit them. Cards like the Bank of Bhutan international debit card represent niche targets due to regional banking practices.

Associated Data Sold

Beyond basic card details, dump sites trade additional personal information known as “fullz.” This can include the cardholder’s full name, address, date of birth, Social Security number, and phone number.

This associated data enhances the usability of card dumps, enabling criminals to bypass verification processes. It also fuels identity theft and account takeover schemes. Methods like skimming or hacking into company databases often yield both card and personal information, making these bundles more valuable.

These details can help with targeted fraud on specialized cards, such as the Shazam debit card, or assist those with poor credit histories, like users searching debit card for bad credit crossword clue, by exploiting vulnerabilities in verification systems.

Prevention and Security Measures

Preventing credit card dumps requires targeted actions by both cardholders and businesses. Strong security involves safeguarding card data, following strict operational guidelines, and adhering to industry standards to reduce vulnerabilities.

Protecting Your Card Information

Individuals should monitor their card statements regularly to spot unauthorized transactions quickly. Using credit cards with EMV chips enhances security by making cloning more difficult than traditional magnetic stripes.

Secure payment methods, such as contactless payments and tokenization, reduce exposure of the actual card details during transactions. Avoid sharing card information over unsecured or public Wi-Fi networks to prevent data interception.

If a chip malfunction occurs on a debit or credit card, the cardholder should notify the issuer promptly and use alternative secure payment options until a replacement arrives. Proper PIN usage and setting strong account passwords also limit unauthorized access.

Best Practices for Merchants

Merchants must implement end-to-end encryption to protect card data during transactions. They should employ point-to-point encryption (P2PE) solutions to prevent card data from being intercepted in-store or online.

Regularly updating payment and reconciliation software decreases the risk of security breaches. Merchants should perform periodic audits of transaction data to identify potential fraud patterns early.

Training staff to recognize signs of card tampering and phishing attempts is critical. A layered security approach combining physical safeguards, digital protections, and robust reconciliation practices minimizes exposure to card dump attacks.

Industry Security Standards

The Payment Card Industry Data Security Standard (PCI DSS) sets guidelines merchants and payment processors must follow to protect cardholder data. Compliance involves maintaining secure networks, encrypting stored card information, and conducting vulnerability assessments.

Industry-wide adoption of EMV technology and tokenization methods limits the risks associated with stolen magnetic stripe data. Payment networks encourage continuous innovation in hardware and software to enhance transaction security.

Collaboration among banks, merchants, and technology providers supports rapid detection and response to emerging threats, helping maintain customer trust and reducing financial losses related to credit card dumping.

Recognizing and Responding to Fraud

Detecting unauthorized credit card use early reduces financial loss and identity theft. Knowing how to spot unusual charges, report fraud correctly, and act quickly after a compromise is critical for protecting personal finances.

How to Identify Compromised Accounts

Unrecognized or suspicious charges such as Blossom UP or Acqra showing up on billing statements can indicate fraud. Legitimate charges like JPMCB Card Services on a credit report typically relate to payment processing but should still be reviewed for accuracy.

Unexpected fees from unfamiliar vendors, or multiple small transactions, often signal that a card dump has occurred. Monitoring statements for repeated declined transactions or bypassed PIN attempts on debit cards helps catch misuse quickly.

Using transaction alerts via bank apps or text notifications can aid in spotting fraudulent activity immediately. Cardholders should regularly review all credit card activity, especially if they have account access through multiple vendors or services, such as Modern Leasing MI or Good Sportsman.

Reporting Credit Card Fraud

Once fraud is suspected, the cardholder must contact the issuing bank or card provider immediately. Reporting should include a description of suspicious charges, such as unexplained vendor names, and any phishing attempts.

Using government resources like IdentityTheft.gov, overseen by the FTC, helps victims report the fraud comprehensively. Early reporting initiates the cancellation of compromised cards and can limit liability for unauthorized charges.

It is important to keep a record of all communications with the bank, including dates and names of representatives. Banks often require completing fraud affidavits or forms about disputed charges to process claims efficiently.

Steps After a Security Breach

After confirming unauthorized activity, the card should be canceled or replaced immediately. Reviewing credit reports for multiple or new fraudulent accounts is critical, especially monitoring mentions of unfamiliar creditors or leases.

Changing passwords on financial accounts and enabling two-factor authentication reduces further risk. If a PIN was bypassed in a debit transaction, the cardholder should inform the bank, as this indicates more advanced fraud tactics.

Follow-up steps include filing a police report if large sums were involved and alerting major credit bureaus. Consistent monitoring post-breach ensures no new fraudulent activity occurs under the same identity or card information.

Associated Payment and Banking Trends

Payment and banking methods tied to credit card dump sites have evolved sharply. New tools and services facilitate the quick movement of stolen funds and obscure their trails, complicating detection and recovery efforts.

Automatic Payment Pools and Security

Automatic payment pools are networks that aggregate stolen card data for rapid, bulk spending. These pools use scripts to test multiple cards simultaneously, automating fraudulent purchases or fund transfers. This tactic maximizes the exploitation of compromised accounts before banks can respond.

Security measures, like transaction monitoring and real-time fraud alerts, face challenges from these pools. While banks deploy AI-based systems to flag unusual patterns, fraudsters routinely adapt by spreading transactions across various accounts and merchants to evade detection.

Supernova payment platforms have emerged as specialized intermediaries, reportedly optimized for handling payments derived from dump sites. Their infrastructure supports faster dispensing of illicit proceeds, intensifying the battle between cybersecurity teams and cybercriminals.

Proxy and Electronic Payment Methods

Proxies serve as critical tools for criminals to mask their geographic locations during transactions. Many dump site operators recommend or bundle proxy services purchasable with stolen credit cards, helping obfuscate IP addresses linked to fraudulent activity.

Electronic payment methods, such as electronic debit cards, are frequently abused to launder stolen funds. Unlike traditional cards, electronic debit cards can be instantly loaded with digital currency or wire transfers, accelerating money movement while limiting paper trails.

Buyers on dump sites also favor crypto-based payment options, but some platforms have integrated electronic debit cards for easier cashing out. These cards often bypass stringent banking protocols, providing criminals with quicker access to liquid assets while complicating regulatory oversight.

Related Credit and Debit Card Issues

Credit and debit cards come with various features and risks that affect consumers and businesses differently. Understanding distinctions between secured and unsecured credit lines, as well as the differences in card types, helps users manage their finances better and stay alert to potential fraud or misuse.

Unsecured and Secured Credit Lines

Unsecured credit lines do not require collateral and are based on the borrower’s creditworthiness. They typically have higher interest rates due to increased risk to lenders. For instance, unsecured business lines of credit, such as those offered by TN Bank or Coast Hill, provide flexible access to funds without tying up assets.

Secured credit lines are backed by collateral like property or savings. This reduces lender risk, often resulting in lower interest rates and higher borrowing limits. Businesses using secured lines, including options through credit unions, may find it easier to qualify, especially if they lack strong credit histories. The Guidance line of credit is an example where collateral supports borrowing power.

Both types require careful management. Unauthorized access or data breaches involving credit card dump sites can severely impact these credit lines, particularly when linked directly to business accounts or consumer cards.

Business and Consumer Card Types

Business credit cards differ from consumer cards mainly in features tailored for company expenses and financial tracking. Business cards, including those issued by credit unions, often offer higher limits, expense management tools, and rewards suited to business purchases.

Consumer cards focus on personal spending with features like cashback or travel rewards. However, both card types face risks from credit card dumps, as stolen data can enable online or in-store fraud, resulting in financial loss and potential liability.

Some specialized cards, like the Aamco credit card, may cater to specific industries or services, emphasizing the diversity within business credit offerings. Awareness of card type-specific protections and risks is essential to prevent fraud stemming from compromised card information on dump sites.

Financial Services and Payment Plans

Financial services and payment structures often involve tailored programs to meet specific borrower needs. These include specialty loan arrangements, secured home equity products, and solutions designed to handle real estate and construction-related payments efficiently.

Specialty Loan and Payment Programs

Specialty loan programs cover unique financing options, such as orthodontist payment plans and automobile down payment assistance. Orthodontist plans typically allow patients to pay over time with minimal or no interest, making high-cost dental treatments more accessible.

Automobile down payment assistance programs help buyers reduce upfront costs, often through lender partnerships or local assistance programs. Similarly, payment options like the root canal dentist Seattle payment plan provide tailored financing to cover dental procedures, offering manageable monthly installments.

These programs focus on flexibility, clear terms, and credit considerations, enabling borrowers to access specialized services without financial strain.

Home Equity and HELOC Security

Home equity products like home equity loans and home equity lines of credit (HELOCs) come with varying rates based on geography and loan conditions. For example, home equity loan rates in Virginia and HELOC rates in Wichita, KS reflect regional market factors.

Loans secured in a second position, such as the home equity loan 2nd position Daly City, involve secondary claims on property, often with slightly higher interest rates due to increased risk. Borrowers should compare options like closed-end home equity loans and revolving credit lines to fit their repayment preferences.

Understanding the security features and rate differences is crucial when considering options for accessing home equity as a financial resource.

Real Estate and Construction Payments

Real estate and construction financing includes tools such as construction lines of credit and real estate lines of credit. These credit products provide flexible funding during building projects or property purchases.

For investors and builders, knowing how to open credit lines for home auctions or everyday construction expenses helps maintain cash flow. Additionally, understanding Oregon estimated tax payment obligations and integrating them into financial planning supports compliance and budgeting.

Managing construction funds through dedicated credit lines reduces the need for repeated loan applications and streamlines payment processes throughout project phases.