Do Debit Cards Need a PIN

Debit cards often come with a personal identification number (PIN), but a PIN is not always required for every transaction. Many purchases can be made by signing for the transaction or selecting “credit” instead of “debit” at the point of sale. However, using a PIN is usually necessary for withdrawing cash or getting cash back.

Depending on how the transaction processes, a PIN helps verify identity and secure the purchase. Advances in payment technology, like contactless and mobile wallets, sometimes reduce the need to enter a PIN. Understanding when and why a PIN is required can help users navigate daily transactions with their debit cards more confidently.

Understanding Debit Card PIN Requirements

Debit cards generally use a personal identification number (PIN) to authorize transactions, adding a security layer. However, the necessity of a PIN varies depending on the transaction type, card network, and merchant system. Some debit cards also allow purchases without a PIN, relying on signatures or online verification instead.

What Is a Debit Card PIN?

A debit card PIN is a secret numeric code assigned to the cardholder. It verifies the user’s identity during transactions, especially at ATMs and point-of-sale (POS) terminals. The PIN ensures that only the authorized cardholder can access funds directly from their bank account.

Typically, debit cards linked to electronic debit systems require a PIN to complete transactions. This process is standard with US debit cards and international cards such as the Bank of Bhutan’s international debit card. The PIN is vital whenever a chip malfunction occurs, as merchants may then request manual entry of the PIN or a signature. The PIN is distinct from the card’s magnetic stripe data or chip data, providing an extra security step.

Why Is a PIN Needed for Debit Cards?

PINs serve as a primary security feature that protects against unauthorized use. When a debit card transaction requires a PIN, the funds are withdrawn directly from the customer’s bank, minimizing fraud risks. It means fraudsters need both the physical card and the PIN to complete transactions.

Card networks such as Visa Debit or Shazam debit cards emphasize PIN use to meet security standards and reduce chargeback risks for merchants. PIN entry prevents unauthorized users from easily making purchases or withdrawing cash at ATMs. It also provides protection in case the card is lost or stolen. The PIN requirement contributes to one of the main advantages of debit cards: secure, immediate access to account funds.

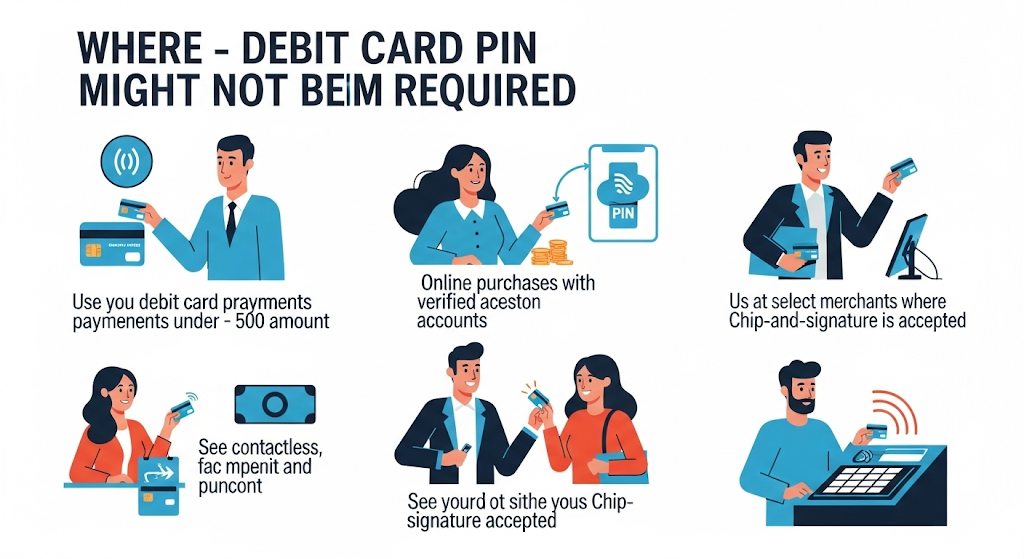

Instances Where a PIN Is Not Required

Debit cards can sometimes be used without entering a PIN. Certain transactions on credit networks allow a cardholder to sign for purchases instead of entering a PIN. This is common for online purchases or contactless payments. Some debit cards offer a “pinless” debit option, where verification relies on card details but no numeric code.

In addition, merchants may process debit transactions without a PIN, but these often come with higher fees or risk. For example, signature-based transactions involving US Visa debit cards typically don’t require a PIN. This option exists to provide convenience but generally offers less protection against fraud compared to PIN-protected transactions. Online, providing card number and expiration date usually suffices to complete debit purchases without a PIN.

Types of Debit Card Transactions and PIN Usage

Debit card transactions can involve different methods for authentication and processing. These include PIN-based transactions, signature or PINless transactions, and modern contactless or mobile payments. Each method affects security, costs, and user experience in distinct ways.

PIN-Based Versus Signature-Based Transactions

PIN-based transactions require the cardholder to enter a personal identification number at the point of sale or ATM. This method is common with US debit cards linked directly to the cardholder’s bank account. Entering a PIN typically authorizes immediate withdrawal of funds from the account.

Signature-based transactions allow the cardholder to sign instead of entering a PIN, often used with Visa debit cards for convenience or where PIN entry is not supported. These transactions usually process like credit card charges but still withdraw funds directly from the bank account.

Bypassing the PIN or choosing signature transactions may increase the cost for merchants due to higher interchange fees and greater fraud risk compared to PIN transactions. Therefore, PIN use is often recommended for larger purchases to reduce these fees.

Online Debit Card Payments and PIN Entry

Online debit payments generally do not require a PIN entry because the card is not physically present. Instead, these transactions use the card number, expiration date, CVV code, and sometimes additional authentication steps like 3D Secure.

Since PIN cannot be entered online, security relies heavily on these alternative verification methods. This also means online debit payments are not classified as PIN transactions and may carry higher processing fees.

For cardholders, this means online debit purchases are similar to signature debit transactions in processing, even though the funds still come directly from their bank accounts.

Contactless and Mobile Payments

Contactless debit card payments and mobile wallet transactions such as Apple Pay or Google Pay often do not require PIN entry for small amounts. These methods use encrypted communication between the device and terminal to authorize payments quickly.

For transactions exceeding a certain limit, a PIN or biometric verification (like fingerprint) may be required to confirm identity. Contactless payments are typically classified as PINless debit transactions, which carry different fee structures and risk profiles than PIN debit.

Many US debit cards support contactless technology alongside traditional PIN or signature options, allowing flexibility in how payments are processed and authorized.

Security Considerations for Debit Card PINs

Debit card PINs are a fundamental line of defense against unauthorized use. Their effectiveness depends on how well users protect their PINs and understand the risks of not using them. Both proper caution and knowledge about potential vulnerabilities are essential to minimizing fraud.

Proper Security Measures for Debit Cards

A strong, unique PIN helps prevent unauthorized access to debit accounts. It should not include easily guessed numbers like birthdates, phone numbers, or simple sequences.

Users must avoid sharing their PIN with anyone or writing it down where it can be found. Covering the keypad when entering the PIN reduces the risk of theft through shoulder surfing or hidden cameras.

Chip-enabled debit cards offer extra protection, but chip malfunctions can occur. If a chip fails, transactions may default to magnetic stripe swiping, which is less secure and might not always require a PIN, increasing fraud risk.

For security, many banks recommend monitoring account activity regularly to spot and report suspicious transactions promptly.

Risks of Not Using a PIN

Bypassing or not using a PIN significantly raises the chance of unauthorized access. Some payment methods, like contactless transactions under a certain limit, may not require a PIN, but this convenience increases vulnerability.

If a debit card is lost or stolen, anyone who can access the card without a PIN can quickly make purchases or withdraw cash. This risk is greater compared to credit cards, which often have better fraud protections.

Fraudsters might use stolen debit card data online or clone cards to bypass PIN requirements, exploiting weak points in systems that do not verify PINs consistently.

Without a PIN, the likelihood of financial loss rises, and recovering stolen funds can be more difficult for cardholders.

When You May Not Need a Debit Card PIN

Debit cards do not always require a PIN for every type of transaction. In some cases, cardholders can make purchases or payments without entering a PIN, depending on the method, location, or card features.

Card Not Present Transactions

In card not present (CNP) transactions, such as online shopping or phone orders, entering a PIN is typically not required. Instead, cardholders provide the card number, expiration date, and CVV code to authorize payments. Merchants rely on these details to verify the card and process the payment securely.

This method increases convenience but may carry a higher risk of fraud because the physical card and PIN are not needed. Cardholders should use trusted websites and secure payment methods to reduce risk during CNP transactions.

International Debit Card Usage

When traveling abroad, debit cards may not always require a PIN. For example, the Bank of Bhutan International Debit Card allows transactions that may be authorized with signatures or no PIN under some circumstances, depending on the country and merchant.

Some international ATMs or payment systems might only require a PIN for cash withdrawals or specific purchases. Others process debit card payments by signature. This flexibility depends on the network and local banking regulations. Customers should verify with their bank before traveling for details on PIN requirements abroad.

PINless Debit Card Features

A pinless debit card allows certain transactions without entering a PIN. These cards often use electronic signals or signature verification to approve payments. An electronic debit card is one example, where purchases can be authorized without a PIN if the card is swiped or used contactlessly.

Pinless transactions may include small purchases or certain in-store payments. They offer speed and ease but can carry added fees or security concerns. Users should confirm with their issuing bank which transactions are eligible for PINless use and understand potential risks.

Troubleshooting and Managing PIN Issues

Common PIN problems include forgetting the code or having it blocked after multiple incorrect attempts. Managing these issues promptly ensures continued access to funds and protects the account from unauthorized use.

Forgotten or Blocked PINs

If a user forgets their PIN, most banks allow a reset without needing the old PIN. The process usually requires verifying identity with details like the debit card number, linked phone number, and part of the Social Security number.

Entering the wrong PIN more than three times often locks the card to prevent fraud. Locked cards require contacting the bank’s customer service or visiting an ATM for reactivation or PIN reset.

In some cases, chip malfunctions on the debit card can trigger false PIN errors. When this happens, users should request a card replacement and reset their PIN through their bank.

What to Do if a PIN Is Compromised

If a user suspects their PIN has been compromised, they should immediately notify their bank to prevent unauthorized transactions. The bank can freeze the card or issue a new one with a new PIN.

Changing the PIN frequently enhances security. Some banks allow users to customize their PINs via phone, ATM, or online banking, though not all institutions support this.

Users are advised against sharing their PIN or writing it down in insecure places to reduce the risk of compromise.

Frequently Linked Payment and Credit Card Topics

Understanding how different payment and credit card issues interact can help users make informed choices and avoid common pitfalls. Topics range from specialized debit card uses to credit card security concerns and how businesses manage credit and debit cards.

Debit Cards for Special Situations

Debit cards are often linked directly to checking or specialized accounts, such as Health Savings Accounts (HSA). Users can generally withdraw cash from HSA debit cards, but the availability depends on the account terms and bank policies. Some debit cards also help individuals with lower credit scores, acting as alternatives to traditional credit cards, though searching for solutions like a debit card for bad credit crossword clue highlights the limited but available options.

It is crucial to note that using a business debit card for personal expenses is discouraged due to accounting and tax risks. Banks may flag irregular activity, and it can complicate record-keeping for business expenses.

Credit Card Related Charges and Security

Credit cards carry specific risks and fees, including overdraft-like charges when balances are not paid. First-time offenses for credit card theft may carry legal penalties but often depend on the nature and severity of the misuse.

Consumers asking, should you pay LASIK with a credit card? should consider benefits like extended warranties or fraud protection. Meanwhile, understanding the difference between soft declined and hard declined credit card sales is important for merchants, as soft declines do not impact credit scores, while hard declines may affect credit standing.

Credit card abuse charges typically relate to fraud or unauthorized use, requiring immediate attention and reporting to minimize damage.

Business and Line of Credit Considerations

Credit unions and banks offer business credit cards tailored for company expenses, often combining spending limits with rewards or cashback benefits useful for business purchases. These are distinct from debit cards and should be used wisely to maintain healthy credit.

Statutes like the statute of limitations for credit card debt in Georgia affect how long creditors can legally pursue unpaid debt. Understanding these timelines helps businesses and individuals manage liabilities.

Businesses should carefully separate personal and business finances to avoid problems with audits and compliance. Clear distinctions also protect credit lines and maintain accurate financial records.