A guidance line of credit is an uncommitted credit arrangement that provides a borrower with access to funds up to a pre-approved limit, granted at the bank’s discretion. It offers flexibility by allowing access to credit without a guaranteed commitment, making it useful for projects or financial needs that require variable funding over time.

This type of credit is often used by municipalities, developers, and investors who need a flexible source of financing for multiple projects or ongoing capital needs. Access to funds depends on the lender’s approval, which distinguishes it from traditional committed lines of credit with fixed borrowing limits.

By understanding how a guidance line of credit functions, borrowers can better manage cash flow and funding strategies without locking themselves into immediate debt. This makes it a practical option when project scopes or financing needs might change during the borrowing period.

Understanding Guidance Line of Credit

A guidance line of credit offers a flexible, pre-approved borrowing option tailored to specific financial needs, especially in business, construction, and real estate. It involves set limits, usage conditions, and approval processes that differ from conventional credit arrangements.

Definition and Purpose

A guidance line of credit is a pre-approved credit facility that allows borrowers to draw funds up to an agreed limit over a set period. It often targets entities like businesses, municipalities, or developers for capital projects or property acquisition.

Its primary purpose is to provide ready access to funds without requiring a new loan application each time, streamlining cash flow management. For example, a construction line of credit helps contractors draw funds as project needs arise, while a real estate line of credit supports buying and rehabbing properties.

This credit line can be either committed or uncommitted. TN bank business line of credit offerings sometimes use this product to meet small and mid-size company funding demands.

Key Features

Guidance lines of credit usually have pre-set limits, sometimes linked to project budgets or borrower creditworthiness. They often include a draw period where funds can be accessed and a repayment schedule that may be flexible or fixed.

Unlike some unsecured business lines of credit, such as those offered by Coast Hill, guidance lines often require collateral or ties to specific projects. Interest rates and fees vary but are generally competitive due to the pre-approval process.

Master financing agreements sometimes consolidate multiple borrowing events under one umbrella, reducing administrative burden. Timing, conditions for draw approval, and lender discretion are key elements borrowers must understand before use.

Comparison with Traditional Lines of Credit

Traditional lines of credit allow continuous borrowing and repayment without lender approval for each draw, often revolving over time. In contrast, a guidance line typically has stricter conditions, requiring lender approval before each draw.

A construction line of credit, under a traditional model, may offer more immediate access but less pre-defined structure. Guidance lines focus on borrowers with specific, forecasted capital needs, limiting risk for lenders and borrowers alike.

Additionally, guidance lines often cover larger sums with a temporary, project-focused term, whereas conventional lines may serve ongoing operational needs. This makes guidance lines more suitable for planned, phased spending rather than general business expenses.

How Guidance Lines of Credit Work

A guidance line of credit offers borrowers pre-approved access to funds with flexible terms. It involves an application and approval process based on specific criteria. Drawdowns are made within agreed limits, and repayment terms vary based on the lender’s conditions and the borrower’s purpose.

Application Process

The borrower submits a formal request to the lender, often including detailed financial information and the intended use of funds, such as capital projects or home auctions. For municipalities or developers, department heads or project leads may submit funding requests through an administrator.

Lenders assess submitted documentation and conduct due diligence, reviewing creditworthiness and project feasibility. The process may differ for individual uses like automobile down payment assistance or home equity loans, but the core requirement remains proof of ability to repay and the purpose of the credit.

Approval Criteria

Approval depends on credit history, existing debt, and the borrower’s financial stability. Lenders consider the project’s nature—whether it involves real estate development, home equity in Daly City in second lien position, or other wrapped uses like automatic payment pools.

The size of the guidance line is determined by projected borrowing needs and risk assessments aligned with Basel risk weights. Approval remains at the bank’s discretion, and some guidance lines are revocable without notice if conditions change.

Drawdown Procedures

Borrowers access the approved credit incrementally, typically through draws that require prior approval from the lender. For example, a developer drawing funds for phases of a home auction project must submit requests adhering to terms set in the credit agreement.

Drawdowns are monitored to ensure total outstanding amounts do not exceed the established limit. Some loans linked to automobile down payment assistance or other specialized funding may include additional documentation or conditions with each draw request.

Repayment Terms

Repayment terms vary but generally include scheduled principal and interest payments tied to the project timeline. Loans like home equity in second position in Daly City may have specific repayment conditions influenced by local regulations.

Some guidance lines do not require commitment fees, allowing cancellations without penalties. Repayments may align with milestones in capital projects or alternative financing needs, with flexibility to address changes in the borrower’s circumstances while maintaining bank oversight.

Types of Guidance Lines of Credit

Guidance lines of credit vary based on the nature of collateral, purpose, and borrower type. The distinctions influence risk levels, approval processes, and terms. Understanding these differences is crucial when selecting the appropriate credit facility.

Secured Guidance Lines

Secured guidance lines of credit require collateral, which could be assets such as real estate, equipment, or inventory. This collateral reduces the lender’s risk, often resulting in lower interest rates and higher credit limits.

These lines are common in business contexts, especially for companies with valuable fixed assets. For example, a manufacturer might use its machinery as security to access funds for operational needs.

Institutions like Coast Hill offer secured business lines of credit tailored to companies needing predictable capital access with tangible asset backing. Approval tends to be faster given the reduced lender risk.

Unsecured Guidance Lines

Unsecured guidance lines do not require collateral. Approval depends primarily on the borrower’s creditworthiness and financial history.

Unsecured lines often carry higher interest rates and lower credit limits due to increased risk for lenders. They suit businesses or individuals lacking specific assets to pledge but with strong credit profiles.

For businesses, unsecured lines might come through institutions such as TN Bank, which provides unsecured business lines of credit for operational flexibility without tying up assets.

Credit unions also offer unsecured business credit cards or lines, focusing on members with solid credit, offering competitive rates despite the lack of collateral.

Business vs. Personal Guidance Lines

Business guidance lines of credit are designed to support operational expenses, equipment purchases, or capital projects. They often come with higher credit limits and tailored terms based on the business’s financial health and revenue.

Personal guidance lines, while less common, serve individual borrowers for large expenses or liquidity management. They typically have lower limits and stricter credit requirements due to the lack of business revenue.

Business lines may be secured or unsecured, with products from banks or credit unions suited for commercial activities. Personal lines focus more on creditworthiness and debt-to-income ratios rather than asset backing.

Understanding these distinctions helps borrowers match their needs with available products and lender expectations.

Benefits of a Guidance Line of Credit

A guidance line of credit provides important tools for managing funds, making capital more accessible and flexible. It helps businesses and municipalities control liquidity with ease and ensures quick access to pre-approved funds when needed.

Financial Flexibility

A guidance line of credit offers flexibility by providing a pre-approved borrowing limit for specific projects or business needs over a set period, typically twelve months. Borrowers only draw funds as required, avoiding the need to secure full financing upfront.

This structure supports varied financial demands, such as capital expenditures or rehabilitation projects. It is especially useful for developers or businesses managing fluctuating expenses, allowing better alignment of borrowing with actual cash flow needs.

Borrowers maintain control over how and when they use the credit, which can reduce unnecessary interest costs compared to traditional loans. This approach is efficient in managing both planned and unexpected expenditures within the approved credit limit.

Liquidity Management

The guidance line of credit helps optimize liquidity by offering quick access to funds without repeated loan applications. It supports maintaining working capital levels and covering short-term cash flow gaps, which is critical for sustained operations.

By having committed but flexible funding available, entities can better manage payment schedules and financial commitments. Platforms like Supernova payment can integrate with these lines to facilitate smooth transaction flows and timely disbursements.

Furthermore, this line of credit can be linked to assets like cash value policies, offering additional collateral support. This linkage can enhance borrowing capacity or terms while preserving liquidity for daily operations.

Streamlined Access to Capital

This credit product simplifies the borrowing process by providing a pre-approved credit window, reducing delays in securing funds. Borrowers benefit from a streamlined approval process tailored to their anticipated borrowing needs.

A dedicated lending team often works closely with the borrower to approve and monitor credit usage, helping maintain alignment with financial goals. It minimizes administrative steps for repeated financing requests during the credit period.

For developers or investors, particularly those handling multiple projects, this ease of access facilitates timely acquisitions and expenditures. The guidance line of credit reduces dependence on traditional loan cycles, enabling more agile financial management.

Comparing Guidance Lines to Alternative Credit Solutions

Guidance lines of credit offer flexible, pre-approved funding for specific purposes like municipal capital projects or real estate investments. When compared to other credit products, their structure, approval process, and usage terms differ significantly, influencing cost, access, and risk.

Home Equity Lines vs. Guidance Lines

Home equity lines of credit (HELOCs) are secured by the borrower’s property and typically involve variable interest rates tied to market benchmarks. For example, rates like those in Virginia or Connecticut fluctuate based on regional lending markets.

Guidance lines, by contrast, are often unsecured or backed by project-specific agreements, not residential property. Their approval focuses on standardized borrowing needs over a fixed term, usually a year.

HELOCs offer borrowers revolving credit with ongoing access but require property valuation and often stricter credit criteria. Guidance lines emphasize predictability and managing borrowing capacity for institutional or business borrowers, making them less personal but more structured than HELOCs.

Closed-End Loans vs. Guidance Lines

Closed-end home equity loans provide a lump sum with fixed interest rates and repayment schedules. Borrowers in Wichita or other markets often select these loans when they need predictable monthly payments.

In contrast, guidance lines provide flexible, revolving credit amounts without fixed repayment immediately due. They allow multiple draws up to a limit, adapting to evolving project costs or investment needs.

Closed-end loans are suited for one-time funding needs with clear payback terms. Guidance lines accommodate ongoing financial requirements, often seen in municipal or investment contexts.

Credit Cards vs. Guidance Lines

Credit cards offer unsecured, revolving credit with typically higher interest rates and the risk of credit card abuse charges if mismanaged. Their convenience suits daily expenses but is expensive for large or long-term borrowing.

Guidance lines carry lower interest rates and structured terms tailored to creditworthy borrowers or specific projects. They avoid the variable fees and risks prevalent with credit cards, focusing on larger-scale financing.

While credit cards provide instant access, guidance lines ensure controlled borrowing with administrative oversight and pre-set limits to prevent overextension or abuse.

Industry Applications of Guidance Lines

Guidance lines of credit serve distinct roles across several industries, offering targeted financial support. They help businesses manage cash flow, facilitate real estate transactions, and support specialized payment plans in healthcare sectors. These credit lines adapt to the unique financial cycles or project-based needs of each industry.

Business and Commercial Uses

Businesses often use guidance lines of credit to cover short-term cash flow gaps or planned expenses like fixed asset purchases. This credit type enables companies to access funds up to a preapproved limit without repeated loan applications.

It is common for businesses to use them for working capital, equipment purchases, and seasonal inventory spikes. For automobile dealerships or buyers, guidance lines can assist with down payment assistance, allowing for smoother vehicle acquisitions.

These lines provide flexibility, as funds can be drawn and repaid according to changing operational needs. Annual loan reviews ensure that the approved credit limits accurately reflect the company’s current financial position.

Real Estate Investment Applications

In real estate, guidance lines of credit support developers and investors by pre-approving borrowing up to a certain amount. This allows them to act quickly on property acquisitions or construction projects without seeking new financing each time.

Banks often require borrower approval before releasing funds for specific purchases or stages of development. These lines streamline financing during fluctuating market conditions by offering predictable access to capital.

Real estate investors benefit from the credit line’s ability to cover multiple property deals within a set timeframe, commonly around twelve months. This reduces delays associated with traditional loans and helps maintain momentum in project development.

Healthcare and Dental Payment Support

Guidance lines of credit are increasingly used in healthcare to assist patients with complex treatment costs. Orthodontists and root canal dentists, including practices in areas like Seattle, offer payment plan options powered by these lines.

Patients can cover large procedures in affordable installments without immediate full payment. Clinics use these credit arrangements to manage patient accounts receivable while improving access to care.

This approach also extends to dental specialty procedures where cost may be a barrier. By offering flexible payment support, healthcare providers maintain steady cash flow and reduce patient drop-off due to financial constraints.

Risks and Considerations

A guidance line of credit involves specific financial and legal risks that borrowers must carefully evaluate. These risks primarily revolve around how interest is structured, the borrower’s credit profile, and potential limitations tied to contract terms or regulatory factors.

Interest Rate Structures

Interest rates on guidance lines of credit often exceed those of standard loans due to the flexibility and on-demand access they provide. Typically, rates are variable, tied to benchmarks such as the prime rate or LIBOR, which can lead to fluctuating borrowing costs.

Borrowers should carefully review the terms to identify fees, penalties for late payments, and how interest compounds. Higher interest rates can significantly increase total repayment amounts, especially if the line is drawn upon extensively or repaid slowly.

Understanding the exact formula for rate adjustments and any caps on interest increases is crucial. Unlike fixed-rate loans, the variable nature can cause unexpected financial strain during periods of rising interest rates.

Creditworthiness Requirements

Lenders require thorough assessment of a borrower’s financial health before approving a guidance line of credit. This includes analyzing credit scores, debt-to-income ratios, and sometimes detailed financial statements.

The approval process is stringent due to the lender’s risk exposure linked to on-demand funds. Poor creditworthiness can either lead to denial or result in higher interest rates and more restrictive covenants.

Moreover, ongoing monitoring of the borrower’s credit situation is common. A decline in credit quality may trigger penalties or reductions in the credit limit.

For borrowers in jurisdictions like Georgia, awareness of the statute of limitations for credit card debt (generally six years) can influence repayment strategies and negotiations tied to credit lines.

Potential Drawbacks

One notable drawback is the possibility of over-reliance on this flexible credit, which may lead to cash flow issues if the borrower does not manage repayments responsibly. Since guidance lines often carry higher interest and fees, long-term borrowing can be costly.

In addition, failure to adhere to agreement terms, including covenants, risks triggering penalties, increased interest rates, or even immediate loan recall. Legal complications such as credit card theft offenses, especially first-time incidents, might impact access to or terms of credit if they affect the borrower’s credit profile.

Finally, borrowers should be aware of potential liquidity risks. A lender can reduce or freeze access to funds if financial market conditions deteriorate or the borrower’s financial situation worsens.

Managing and Maximizing Your Guidance Line of Credit

Effective management of a guidance line of credit requires clear tracking, disciplined use, and proactive communication with lenders. Regular monitoring of payments and drawdowns helps avoid surprises, while maintaining a good credit profile ensures continued access to funds. Utilizing tools and strategies can streamline these tasks.

Best Practices for Utilization

Borrowers should treat the guidance line of credit with a clear plan aligned to project needs. Drawing funds only when necessary helps control interest costs and preserves borrowing capacity. Scheduling drawdowns to match project milestones avoids idle credit balances.

Using credit card reconciliation software can simplify the tracking of expenses paid through the credit line, ensuring all transactions are accounted for accurately. This prevents overuse and helps maintain financial clarity.

Additionally, setting up automatic payment pools for scheduled payments can reduce missed or late payments. This automation supports consistent utilization and demonstrates financial reliability to lenders.

Maintaining a Positive Credit Profile

Maintaining timely payments on the guidance line is critical for sustaining a positive credit profile. Late or missed payments may impact the borrower’s ability to renew or increase the credit line.

Regularly reviewing financial statements helps detect discrepancies early. Borrowers should also monitor any impacts to their overall debt-to-income ratio, especially if other obligations like Oregon estimated tax payments are due.

Communicating proactively with the lender during financial fluctuations can preserve trust. Updating the lender with accurate project and financial information facilitates smoother annual loan reviews and potential credit line adjustments.

Monitoring Payments and Drawdowns

Tracking payment schedules and drawdowns is essential to avoid penalties and overdrawing the line. Borrowers should maintain a calendar of payment due dates and planned drawdowns.

Using software tools to automate notifications can help prevent missed deadlines. Reconciling monthly statements with project budgets can uncover inconsistencies before they escalate.

Borrowers should verify that all transactions align with the approved uses under the guidance line agreement. This vigilance supports compliance and avoids funding disruptions from the lender.

Legal and Regulatory Aspects

Lines of credit are subject to specific legal frameworks that govern compliance, contract terms, and consequences of default. Borrowers and lenders must understand these factors to navigate agreements effectively and avoid disputes or regulatory penalties.

Compliance Requirements

Financial institutions issuing lines of credit must adhere to laws such as the Truth in Lending Act (TILA), which mandates clear disclosure of terms, fees, and interest rates. Regulatory agencies require lenders to notify borrowers about changes in credit limits or terms promptly.

Creditors must also ensure that the line of credit complies with lending limits and capital requirements, especially for regulated entities. Consumer protection laws generally apply to personal lines of credit but may not cover commercial loans to the same extent.

Moreover, some states regulate fees related to credit card transactions, impacting whether attorneys or service providers can pass these costs to clients. Understanding regional regulation helps prevent unlawful charges.

Contractual Obligations

A line of credit agreement legally binds both parties to specific obligations, including borrowing limits, repayment schedules, and interest terms. It typically defines the lender’s right to demand repayment or adjust the credit limit under certain conditions.

For contractors, having a written contract is crucial when extending credit or credit-like payment terms. Without a contract, pursuing legal action for nonpayment becomes more complex, though some jurisdictions allow recovery based on implied agreements or work performed.

The agreement should clarify whether fees, such as late payments or transaction costs, can be charged and under what circumstances. It also specifies consequences if the borrower violates terms, such as suspending credit access.

Handling Defaults and Legal Actions

When a borrower defaults on a line of credit, the lender may pursue several remedies, including demand for full payment, foreclosure on secured assets, or legal action. Lines of credit secured by collateral may lead to liens against property, including a home if the credit is tied to real estate.

Credit card companies generally cannot place liens on a borrower’s home without a court judgment following unpaid debts. Legal procedures vary, but a lien typically requires a formal legal process.

In the absence of a formal contract, creditors or contractors may still sue for nonpayment based on services rendered or materials supplied. However, enforcement becomes more challenging without a binding agreement.

Legal costs and processing fees related to collections or credit card payments are often subject to regulatory constraints, which can impact how and if lenders recover these expenses from borrowers.

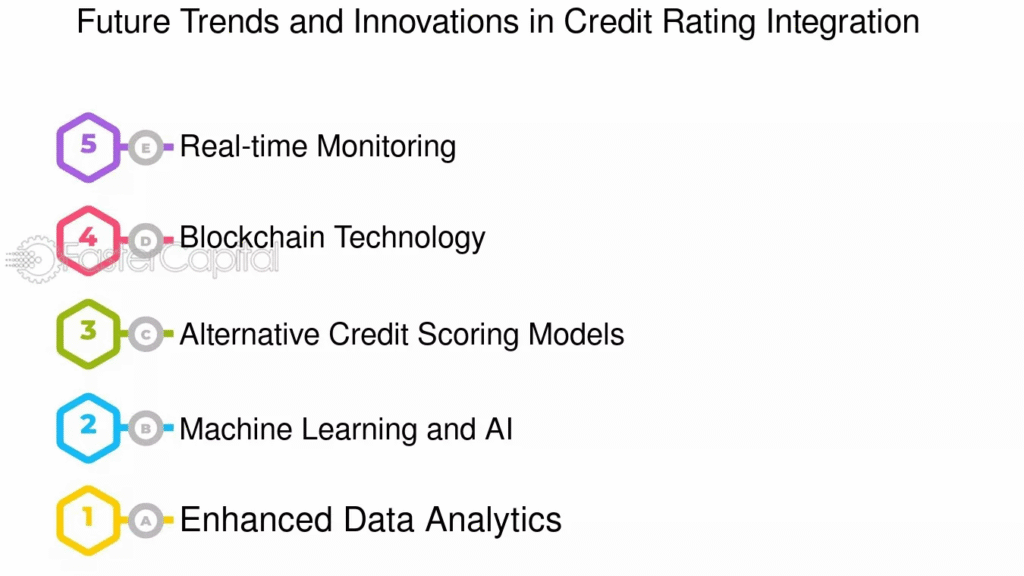

Recent Trends and Innovations in Lines of Credit

Lines of credit have increasingly adapted to technological advancements and evolving business needs. There is a strong focus on streamlined digital processes, seamless integration with payment systems, and the introduction of new financial products designed to enhance flexibility and control for businesses.

Digital Application Platforms

Digital platforms dominate the application and management of lines of credit today. Many lenders offer fully online application processes that reduce approval times and simplify documentation requirements. This shift allows businesses to access credit faster, often within days or hours.

These platforms incorporate automated credit assessments and AI-driven risk analysis. It improves accuracy and customizes credit limits based on real-time business data. Digital tools also provide ongoing account management, enabling users to track balances, repayments, and available credit conveniently.

Platforms supporting electronic debit cards further facilitate instant fund access. This digital-first approach is especially beneficial for small businesses and startups that require quick and flexible financing.

Integration With Payment Tools

The growing trend towards embedded finance places lines of credit directly into payment and operational platforms. Integration with systems like Supernova payment services and accounting software enables real-time fund access and repayment.

For example, combining a business credit line with a credit union business credit card or electronic debit card allows seamless spending aligned with cash flow needs. This integration reduces transactional friction and supports smarter cash flow management.

Such tools also enable businesses to automate payments, balance sheet entries, and inventory purchases directly from their credit lines, improving financial control and operational efficiency.

Emerging Financial Products

Innovations in credit products continue to diversify options available to businesses. Guidance lines of credit represent one such product, offering tailored credit based on specific acquisition or growth goals.

Credit unions increasingly offer bundled solutions combining credit lines with business credit cards, providing layered financing options. These products often feature variable interest rates tied to business performance or alternative credit scoring methods.

New offerings also include hybrid products that combine revolving credit with fixed loan components, improving predictability while maintaining flexibility. This allows businesses to better match financing structures to their cash flow cycles and growth plans.