Home equity line of credit rates in Connecticut vary depending on factors such as credit score, loan-to-value ratio, and lender offers. Typically, rates are variable and currently range around competitive figures for Connecticut homeowners, often influenced by automatic payment discounts or existing banking relationships.

Borrowers in Connecticut can access funds using their home’s equity with flexible repayment terms, making HELOCs a practical option for home improvements or debt consolidation. Many local credit unions and banks, including specialized Connecticut institutions, provide competitive rates tailored to the regional market.

Understanding how rates fluctuate and what impacts eligibility can help homeowners make informed choices. This article explores the current Connecticut HELOC rates and what borrowers should consider before applying.

Understanding Home Equity Lines of Credit in Connecticut

Home equity lines of credit (HELOCs) in Connecticut offer homeowners flexible borrowing tied to the equity in their homes. They typically feature variable interest rates and revolving credit, allowing funds to be drawn as needed. The application involves specific eligibility criteria unique to CT lenders, including loan-to-value limits and creditworthiness.

Definition and Key Features

A HELOC is a revolving line of credit secured by the equity in a homeowner’s property. It operates much like a credit card, with a preset borrowing limit based on the home’s value and outstanding mortgage balance.

Key features include:

- Variable interest rates that often depend on the prime rate plus a margin.

- A draw period, usually 5-10 years, during which the borrower can access funds.

- A repayment period following the draw phase, where principal and interest payments must be made.

- Often located in the second lien position after the primary mortgage, affecting risk and rates.

- Potential for tax-deductible interest under certain IRS rules.

HELOCs differ from closed-end home equity loans, which provide a lump sum at a fixed interest rate and fixed repayment schedule.

How HELOCs Work in CT

In Connecticut, HELOC rates vary by lender but typically adjust with market conditions and the borrower’s credit profile. For owner-occupied residences, lenders often set a maximum loan-to-value (LTV) ratio near 80%, meaning the combined mortgage and HELOC balance must not exceed 80% of the home’s appraised value.

Borrowers draw funds via checks, credit cards, or online transfers during the draw period. Monthly payments may initially cover only interest, increasing later during repayment.

Connecticut-specific offerings include products like cash value lines of credit and construction lines of credit, which function similarly but are used for targeted purposes such as home improvements.

Rates can be discounted by maintaining automatic payments or additional accounts with the lender, common among local credit unions and banks.

Overview of the Application Process

Applying for a HELOC in CT typically requires:

- Proof of income and employment stability.

- A satisfactory credit score, often above 620.

- An appraisal to determine current home value.

- Verification of existing mortgage and debts.

After submission, lenders assess the loan-to-value ratio, creditworthiness, and property eligibility. Some lenders in Fairfield County and elsewhere may offer fast-track or online application options.

Borrowers should compare home equity loan rates in Virginia or other states for regional differences but focus primarily on Connecticut terms, including terms specific to second position loans and local market trends.

Lenders may require documentation such as:

- Recent tax returns

- Bank statements

- Mortgage disclosures

Approval timelines vary but typically range from a few days to several weeks depending on lender requirements and appraisal scheduling.

Current Home Equity Line of Credit Rates in Connecticut

Home equity line of credit (HELOC) rates in Connecticut reflect a mix of national trends and state-specific factors. Borrowers face varying options between fixed and variable rates, with influences like credit score, loan-to-value ratio, and market conditions shaping the terms available.

Overview of Rate Trends in 2025

In 2025, Connecticut’s HELOC rates generally range from around 7% to 9% for variable-rate products. Rates have climbed alongside broader interest rate increases set by the Federal Reserve in prior years. Many lenders offer discounted rates for automatic payments or maintaining multiple accounts.

Rates remain competitive compared to other states but are slightly higher than in regions like Wichita, KS, where local economic conditions and market competition differ. Variable rates remain more common but are subject to adjustment with market fluctuations.

Comparison of Fixed vs. Variable Rates

Connecticut borrowers can choose between variable and fixed HELOC rates. Variable rates typically start lower, around 7%, but can increase or decrease with benchmark rate changes. This option suits those who want initial affordability and expect stable or declining rates.

Fixed-rate HELOC products provide consistent monthly payments, often ranging between 8% and 9% in Connecticut. They offer budget certainty but may have higher starting rates compared to variable ones. Some lenders allow converting part or all of a variable balance to a fixed rate during the loan term.

Factors Influencing HELOC Rates in CT

Several factors influence HELOC rates in Connecticut:

- Credit Score: Higher credit scores secure lower interest rates.

- Loan-to-Value Ratio (LTV): Rates are better with an LTV below 80%.

- Repayment Terms: Longer draw and repayment periods can affect the rate.

- Relationship with Lender: Discounts may apply for customers with existing accounts or automatic payment setups.

- Market Conditions: Federal Reserve policies and local housing market trends impact rates.

Lenders in Connecticut also consider regional economic stability, which can differ from areas like Wichita, KS, affecting the risk and pricing of loans.

Eligibility and Requirements for CT HELOCs\

Homeowners seeking a HELOC in Connecticut must meet specific financial and documentation criteria. Key factors include creditworthiness, the amount of equity they hold in their property, and the paperwork required to verify income, property value, and legal ownership.

Credit Score and Income Considerations

Lenders in Connecticut typically require a credit score of at least 620 to qualify for a HELOC. A higher score improves the chances of securing lower interest rates. Borrowers should also demonstrate stable income to ensure their ability to repay.

Income sources may include wages, self-employment earnings, or other verifiable revenue. Some lenders might accept alternative proof of income, which can be helpful for self-employed individuals or those involved in business lines of credit, especially unsecured ones like those offered by Coast Hill.

Debt-to-income ratio (DTI) usually must stay below 43%, balancing monthly debt payments against monthly income. This ensures the borrower can manage new debt alongside existing financial obligations.

Loan-to-Value Ratio (LTV) Guidelines

Connecticut lenders commonly allow HELOCs with a maximum combined loan-to-value ratio of 80% to 90%. This means the total mortgage debt plus the HELOC should not exceed this percentage of the home’s appraised value.

For example, if a home is valued at $400,000, the borrower might be allowed to borrow up to $320,000 to $360,000 combined. Lenders factor in this ratio to reduce their risk, especially for properties recently purchased at auction, which may need precise valuation.

The exact LTV limit can vary depending on lender policies, the applicant’s credit profile, and whether the HELOC has a fixed or variable rate.

Documentation Needed

Applicants must provide several key documents during the HELOC application process. Standard requirements include:

- Recent pay stubs or tax returns to verify income

- Property deed or mortgage statement proving ownership

- Home appraisal or valuation report

- Credit authorization form for credit score review

Additional paperwork may be required for special cases such as unsecured business lines of credit or properties obtained through auctions. In these cases, lenders may request business financials or detailed auction sale documents to assess collateral and repayment ability.

Proper and complete documentation speeds up approval and ensures compliance with state and lender regulations.

Application and Approval Process for Connecticut HELOCs

Applying for a HELOC in Connecticut involves gathering specific documents and meeting lender requirements. Borrowers should compare offers based on rates, fees, and terms to select the best fit. Understanding the process helps prevent delays and ensures clear communication throughout approval.

Step-by-Step Guide to Applying

Applicants typically start by submitting a formal application with proof of income, credit history, and homeownership documents. Lenders require a recent home appraisal to determine the available equity and set the credit limit.

The lender reviews the credit score, debt-to-income ratio, and financial stability before pre-approval. Once approved, the borrower receives an offer outlining terms, including interest rate type—fixed or variable—and any fees.

Setting up automatic payment plans is often available to ensure timely payments and avoid penalties. This also reduces the risk of lender action, such as foreclosure, if payments are missed.

Evaluating Lenders and Offers

Comparing HELOC offers involves examining interest rates, closing costs, annual fees, and any early termination penalties. Lenders in Connecticut vary in their fee structures; some waive application and annual fees, which can reduce overall costs.

Borrowers should also clarify how variable rates may change and assess the lender’s flexibility on repayment terms. Some credit unions and banks offer fixed-rate options, providing payment stability.

Contractors working on home improvements with funds from a HELOC should ensure contracts cover payment terms clearly. Without a contract, contractors may have legal grounds to sue for nonpayment, which complicates the borrower’s financial planning.

Using this information, CT homeowners can better choose the right credit line, balancing cost, risk, and repayment flexibility.

Repayment Terms and Payment Strategies

Home equity line of credit (HELOC) repayments require understanding the timing and types of payments. Borrowers should plan for both the draw and repayment phases and decide between interest-only or combined principal and interest payments to manage their finances effectively.

Understanding Draw and Repayment Periods

A HELOC typically includes two distinct phases: the draw period and the repayment period.

During the draw period, which usually lasts 5 to 10 years, borrowers can access funds up to their credit limit. Payments are often interest-only during this time, keeping monthly costs lower. However, some lenders, including in Connecticut, may require minimum principal payments even during the draw phase.

The repayment period follows, usually lasting 10 to 20 years, when no additional draws are allowed. Borrowers must start paying back both principal and interest. Understanding these periods helps avoid payment surprises.

For example, someone using a HELOC to supplement an automobile down payment assistance fund needs to be ready for higher payments once the repayment phase begins. Similarly, orthodontist payment plans structured with HELOC funds require clear timing on draw and repayment to avoid stress.

Interest-Only vs. Principal and Interest Payments

Interest-only payments cover just the interest charged on the outstanding balance. This option is common during the draw period but does not reduce the principal.

Paying only interest keeps monthly costs low but can result in a large balance moving into the repayment period, increasing future payments significantly.

Principal and interest payments reduce the loan balance gradually. While monthly payments are higher, this approach lowers total interest paid over the life of the loan.

Careful consideration is essential. For example, a borrower using HELOC funds to cover a root canal dentist Seattle payment plan may opt for interest-only payments at first but must be prepared to shift to full payments later.

Some lenders, like those offering Supernova payment options, encourage borrowers to pay principal early to build equity faster and reduce interest costs. Borrowers should balance their current cash flow with long-term repayment goals, especially when managing multiple financial commitments like Oregon estimated tax payments alongside HELOC expenses.

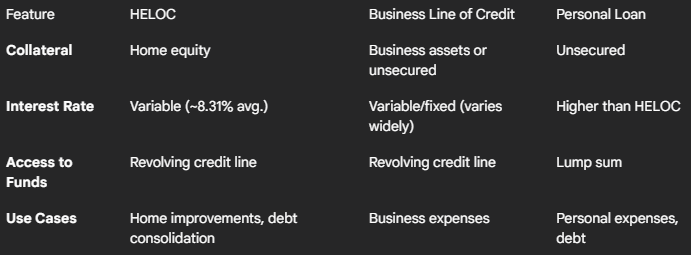

Comparing HELOCs With Other Financing Options

In Connecticut, borrowers evaluating financing alternatives should consider factors like interest rates, repayment structures, and access to funds. Each option provides distinct benefits and drawbacks, especially when comparing home-backed and unsecured credit sources.

HELOC vs. Home Equity Loan

A HELOC typically offers a variable interest rate averaging around 8.31% in 2025, while home equity loans usually have a slightly lower fixed rate near 8.14%. HELOCs function as revolving credit lines, allowing multiple withdrawals during the draw period. In contrast, home equity loans provide a lump sum with fixed monthly payments.

Borrowers seeking flexibility in borrowing and repayment may prefer a HELOC. However, those wanting predictable payments and interest stability often choose home equity loans. Both options use home equity as collateral, so default risks include potential foreclosure.

HELOC vs. Personal Loan

Personal loans generally have higher interest rates than HELOCs since they are unsecured. Unlike HELOCs, personal loans provide a fixed amount with fixed monthly payments, without requiring home equity as collateral.

Borrowers with limited home equity or those who want to avoid putting their home at risk may select a personal loan. However, HELOCs often offer larger credit limits and potentially lower rates due to secured status. Personal loans can be easier to obtain quickly but usually come with shorter repayment terms.

HELOC vs. Business Lines of Credit

Business lines of credit, such as those offered by Tennessee banks, often target entrepreneurs needing working capital without leveraging personal assets. These lines might offer credit cards or revolving credit but typically require business financial documentation rather than home collateral.

HELOCs can finance both personal and some business-related expenses but tie repayment to home equity. Credit union business credit cards provide convenience but may carry higher interest rates and lower limits compared to a HELOC or a dedicated business line of credit.

Comparing HELOCs With Other Financing Options

In Connecticut, borrowers evaluating financing alternatives should consider factors like interest rates, repayment structures, and access to funds. Each option provides distinct benefits and drawbacks, especially when comparing home-backed and unsecured credit sources.

HELOC vs. Home Equity Loan

A HELOC typically offers a variable interest rate averaging around 8.31% in 2025, while home equity loans usually have a slightly lower fixed rate near 8.14%. HELOCs function as revolving credit lines, allowing multiple withdrawals during the draw period. In contrast, home equity loans provide a lump sum with fixed monthly payments.

Borrowers seeking flexibility in borrowing and repayment may prefer a HELOC. However, those wanting predictable payments and interest stability often choose home equity loans. Both options use home equity as collateral, so default risks include potential foreclosure.

HELOC vs. Personal Loan

Personal loans generally have higher interest rates than HELOCs since they are unsecured. Unlike HELOCs, personal loans provide a fixed amount with fixed monthly payments, without requiring home equity as collateral.

Borrowers with limited home equity or those who want to avoid putting their home at risk may select a personal loan. However, HELOCs often offer larger credit limits and potentially lower rates due to secured status. Personal loans can be easier to obtain quickly but usually come with shorter repayment terms.

HELOC vs. Business Lines of Credit

Business lines of credit, such as those offered by Tennessee banks, often target entrepreneurs needing working capital without leveraging personal assets. These lines might offer credit cards or revolving credit but typically require business financial documentation rather than home collateral.

HELOCs can finance both personal and some business-related expenses but tie repayment to home equity. Credit union business credit cards provide convenience but may carry higher interest rates and lower limits compared to a HELOC or a dedicated business line of credit.

Benefits and Drawbacks of Connecticut HELOCs

Connecticut homeowners can access funds through HELOCs with varying interest rates and terms. Understanding the key advantages and risks helps identify when this option fits financial goals and how to manage potential downsides effectively.

Advantages for Homeowners

HELOCs in Connecticut offer flexibility by allowing borrowers to withdraw funds as needed, rather than receiving a lump sum. Variable interest rates are typically lower than credit cards or personal loans, which can reduce borrowing costs.

Interest-only payment options during the draw period can ease monthly expenses. Additionally, some interest paid on HELOCs may be tax-deductible, depending on IRS rules and how the loan proceeds are used.

Homeowners benefit from the ability to tap into increased home equity without refinancing the entire mortgage. Monthly payments can also decrease if rates drop, providing potential savings.

Common Risks and How to Minimize Them

Variable rates mean HELOC payments can rise significantly, potentially becoming unaffordable. Borrowers should budget for rate increases and avoid using the HELOC for non-essential expenses.

Failure to repay can lead to foreclosure since the home serves as collateral. Credit card companies cannot place a lien on a home, but HELOC lenders can, heightening risk if debts are unpaid.

In Connecticut, statute of limitations for credit card debt does not apply to secured loans like HELOCs, which means lenders can pursue repayment longer. Homeowners must stay informed and communicate with lenders if financial trouble arises.

Using automatic payments and monitoring loan terms can help minimize default risk and reduce the HELOC interest rate through available discounts.

Local Lender Options and HELOC Offers in Connecticut

Connecticut homeowners have access to a variety of lenders offering competitive Home Equity Line of Credit (HELOC) rates and flexible terms. These lenders include both well-established local banks and credit unions, as well as online and regional institutions that cater to diverse borrower needs.

Major Banks and Credit Unions

Local banks and credit unions in Connecticut often provide HELOCs with competitive variable rates based on an 80% loan-to-value ratio. Institutions like Sikorsky Credit Union offer loans tailored to home improvement projects with perks such as automatic payment discounts and no application fees. Nutmeg State Financial Credit Union highlights fee-free applications, including no annual fees or points, making their HELOCs appealing to cost-conscious borrowers.

These lenders usually require standard documentation, but many provide fast approval processes and flexible draw periods. Some also offer relationship discounts, reducing rates for clients who maintain multiple accounts. Torrington Savings Bank allows borrowing up to 100% of home equity, which is notable for those seeking larger credit lines.

Online and Regional Lenders

Online and regional lenders in Connecticut compete by streamlining the application process and offering competitive rates. These lenders use credit score, home value, and equity levels as critical factors for qualification. SoFi, for example, provides detailed rate information and calculators to help borrowers estimate monthly payments.

Compared with local institutions, online lenders often provide faster approvals and less stringent underwriting but may lack personalized service. Regional banks tend to balance regional knowledge with operational efficiency. Many online platforms allow homeowners to compare multiple offers quickly, helping them find the lowest interest rate or best loan terms based on their financial profile.

Tax Implications and Financial Considerations

Homeowners using a HELOC in Connecticut must carefully evaluate how interest deductions apply and how the line of credit may affect their property tax situation. These financial factors can influence the overall cost and benefit of leveraging home equity.

Interest Deductibility Under IRS Rules

Interest on a HELOC is generally tax deductible only if the borrowed funds are used to buy, build, or substantially improve the home securing the loan. The IRS restricts deductibility for expenses unrelated to these qualified uses.

The Tax Cuts and Jobs Act capped the amount of home equity debt eligible for interest deductions to $750,000 combined with primary mortgage debt. Homeowners should keep detailed records proving that HELOC funds were used appropriately to meet IRS guidelines.

In Connecticut, taxpayers should also consider how these federal rules interact with state tax filings. Although Oregon estimated tax payments are unrelated, taxpayers moving between states may face complexities in claiming deductions across jurisdictions.

Impact on Property Taxes and Assessments

Using a HELOC usually does not directly affect property tax rates or assessments in Connecticut. Property taxes are primarily based on the assessed home value, which is independent of outstanding loan balances.

However, if HELOC funds are used for home improvements, the increased property value could lead to higher assessments, resulting in increased property tax bills. Homeowners should weigh the potential tax cost of improvements funded by a HELOC.

It is important to note that refinancing or adding liens against the property does not change the property tax liability directly but may influence financial planning or credit assessments tied to property ownership.

Security, Fraud, and Account Management for HELOCs

Managing and securing a Home Equity Line of Credit requires vigilance and regular monitoring. Users must implement strong security measures and respond quickly if suspicious activity is detected. Effective account management includes safeguarding login information and understanding the steps to take when disputes or fraud occur.

Protecting Your HELOC Account

To protect a HELOC account, users should use strong, unique passwords and enable two-factor authentication when available. Regularly reviewing account statements and credit reports helps identify unauthorized transactions early. Using credit card reconciliation software or similar financial management tools can assist in tracking all HELOC-related activity accurately.

Avoid sharing login credentials or personal information over email or phone. Secure online accounts by using encrypted connections and logging out after each session. Homeowners should also notify their lender immediately of any suspicious emails or calls requesting account details.

Physical documents related to the HELOC, like statements or checks, should be stored securely to prevent theft or forgery. Keeping software and devices updated reduces vulnerabilities to hacking attempts.

What to Do in Cases of Disputes or Fraud

If fraud is suspected, contacting the lender promptly is crucial to halt unauthorized transactions or new account openings. The lender will typically freeze the account and start an investigation. Homeowners should report fraud to credit bureaus to place fraud alerts on reports.

Documenting all communication with the lender and maintaining records of disputed transactions supports faster resolution. A formal written dispute may be required by some lenders.

In cases where financial loss occurs, filing a police report may be necessary. Additionally, monitoring credit reports regularly for unexpected changes helps detect ongoing fraudulent activity. He or she should also inquire about any available fraud protection services from their financial institution.

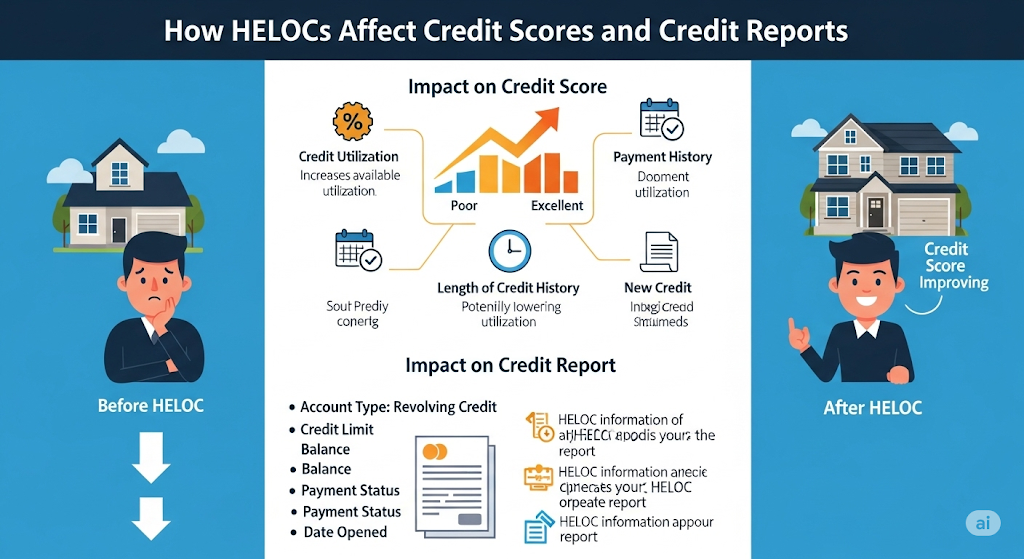

How HELOCs Affect Credit Scores and Credit Reports

A HELOC influences credit scores through both the reporting practices of lenders and how the borrower manages their credit usage. Proper handling of a HELOC can improve credit, while mismanagement may lower it. Specific details on reporting and utilization determine the impact on credit reports and scores.

Reporting to Credit Bureaus

Lenders reporting HELOC activity to major credit bureaus affect credit files similarly to credit cards or other open lines of credit. When a HELOC is opened, a hard inquiry appears, which can temporarily lower the credit score by a few points.

Ongoing reporting includes the HELOC balance, credit limit, and payment history. Timely payments reported by providers like JPMCB Card Services help build positive credit history. Conversely, missed or late payments damage the score.

Some HELOCs appear as installment loans or revolving accounts on credit reports. This classification affects how scoring models weigh the account. Borrowers should check their credit reports regularly to confirm how lenders, such as JPMCB Card Services, are reporting their HELOC.

Managing Credit Utilization

Credit utilization measures how much of the available HELOC credit is used compared to the total limit. High utilization negatively impacts credit scores, as it indicates increased risk to lenders. Experts recommend keeping utilization below 30%.

For example, if a borrower has a $50,000 HELOC and uses $20,000, their utilization rate is 40%, which could lower their score. Managing utilization involves paying down balances efficiently and avoiding maxing out the credit line.

Accounts like the Christell White Paterson credit card show similar utilization effects, underscoring the importance of balancing use and payments. Maintaining low balances and making payments on time maximizes the positive credit impact a HELOC can have.

Special Situations and Alternatives for Connecticut Borrowers

Connecticut borrowers may face unique circumstances when applying for a HELOC. Factors such as the property type and credit profile can influence eligibility and rates. Exploring alternative lending options can help those with unconventional financial backgrounds or lower credit scores.

HELOCs for Investment and Second Homes

Home equity lines of credit for investment properties or second homes in Connecticut typically have higher interest rates than primary residences. Lenders consider these loans riskier due to the potential for less stable income and market fluctuations in these properties.

Borrowers should expect:

- Loan-to-value (LTV) limits lower than 80%.

- Variable rates generally above primary residence HELOCs.

- Stricter underwriting standards, including higher credit score requirements.

Using a HELOC on an investment property or second home is less common but available through select Connecticut lenders. It is advisable to verify terms and evaluate all costs upfront.

Alternatives for Lower Credit or Unique Financial Needs

Borrowers with lower credit scores or those recovering from offenses like first-time credit card theft may not qualify for standard HELOC rates in Connecticut. Alternatives include:

- Home Equity Loans with fixed rates and predictable payments.

- Personal loans that don’t require home equity but have higher interest rates.

- Credit Union products that may offer more flexible underwriting based on member history.

Additionally, some lenders accept us debit vs visa debit cards for payments but this usually does not affect loan approval.

Exploring these options ensures access to funds while managing the constraints posed by credit issues or unique financial needs.

Glossary of Key Terms in Home Equity Lending

A Home Equity Line of Credit (HELOC) is a loan that allows borrowers to access cash up to a set limit based on the equity in their home. The loan is usually secondary to the primary mortgage.

The credit limit represents the maximum amount a borrower can draw from the HELOC. It is typically a percentage of the home’s appraised value minus the remaining mortgage balance.

Draw period is the time frame during which the borrower can withdraw funds. After this period, the loan enters the repayment phase, where no additional draws are allowed.

Interest rate on a HELOC is often variable, meaning it can change over time based on market conditions. Some lenders offer fixed-rate options for portions of the balance.

The minimum payment is the least amount a borrower must pay monthly. It can vary depending on usage and the balance owed.

Loan-to-Value Ratio (LTV) calculates the loan amount as a percentage of the home’s value. Lenders often cap HELOCs at a specific LTV, such as 80%.

Equity is the difference between the home’s market value and the outstanding mortgage balance. This value determines how much credit a borrower can receive.

Borrowers should also understand fees that may apply, including application, appraisal, and annual fees, which vary by lender and impact the overall cost of borrowing.