Bank Fraud Jail Time :

Table of Contents

- Introduction

- What Is Bank Fraud?

- Common Types of Bank Fraud

- Is Bank Fraud a Federal Crime?

- What Laws Govern Bank Fraud in the U.S.?

- Jail Time for Bank Fraud – A Quick Overview

- Sentencing Guidelines and Factors That Impact Jail Time

- First-Time Offenders: Will You Go to Jail?

- State vs. Federal Charges

- Real-Life Sentencing Examples

- How Much Jail Time for Attempted Bank Fraud?

- What Happens After Conviction?

- Can You Get Probation for Bank Fraud?

- Defenses Against Bank Fraud Charges

- Tips to Avoid Being Accused of Bank Fraud

- Conclusion

- FAQs

1. Introduction

Bank fraud is a serious offense in the United States, with penalties that can include decades behind bars and fines reaching into the millions. But not every fraud case leads to a 30-year sentence—actual jail time depends on various factors such as the amount of money involved, the type of fraud, prior criminal history, and whether the accused cooperates with authorities.

If you’re curious about how long you can go to jail for bank fraud, or want to protect yourself from being charged, this in-depth guide will explain everything you need to know.

2. What Is Bank Fraud?

Bank fraud is defined as using deception to obtain money, credit, or assets from a financial institution. It’s a white-collar crime that includes acts committed to unlawfully gain access to or control of bank accounts, funds, or credit lines.

The legal definition is broad and includes intentional misrepresentation, concealment, forgery, and identity theft—all aimed at defrauding a bank or other financial entity.

3. Common Types of Bank Fraud

Bank fraud can take many forms. Here are some of the most common:

| Type of Bank Fraud | Description |

|---|---|

| Check Fraud | Altering or forging checks to withdraw unauthorized funds |

| Loan Fraud | Submitting fake documents to qualify for personal or business loans |

| Wire Transfer Fraud | Unauthorized electronic fund transfers |

| Credit Card Fraud | Using stolen credit card numbers for transactions |

| Identity Theft | Stealing personal data to open or access bank accounts |

| ATM Skimming | Using devices to capture card and PIN info at ATMs |

| Phishing Scams | Pretending to be a bank to trick users into revealing sensitive info |

| Forged Signatures | Signing someone else’s name to financial documents |

4. Is Bank Fraud a Federal Crime?

Yes. Bank fraud is most commonly prosecuted as a federal offense under 18 U.S. Code § 1344. Since banks are federally insured, any fraud involving them falls under the jurisdiction of the federal government. State laws can also apply, but federal charges usually carry heavier penalties.

5. What Laws Govern Bank Fraud in the U.S.?

The primary federal law is:

18 U.S. Code § 1344 – Bank Fraud

“Whoever knowingly executes, or attempts to execute, a scheme or artifice to defraud a financial institution… shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.”

Other related statutes include:

- 18 U.S. Code § 1028 – Identity Theft

- 18 U.S. Code § 1029 – Access Device Fraud

- 18 U.S. Code § 1343 – Wire Fraud

These may add additional penalties on top of the bank fraud sentence.

6. Jail Time for Bank Fraud – A Quick Overview

| Offense | Potential Jail Time | Fines |

|---|---|---|

| Basic bank fraud (single count) | Up to 30 years | Up to $1 million |

| Multiple counts of fraud | Up to 30 years per count | Stacked fines |

| Small-scale fraud under $10,000 | Often probation or <2 years | $10k–$50k |

| Aggravated identity theft | +2 years minimum (mandatory) | Additional penalties |

7. Sentencing Guidelines and Factors That Impact Jail Time

Federal courts follow United States Sentencing Guidelines (USSG) to calculate sentences. The actual jail time depends on several enhancement factors:

Factors That Can Increase Sentence Length:

- Amount of money involved

- Number of victims

- Use of fake identities or documents

- Organized scheme with co-conspirators

- Obstruction of justice

- Prior convictions

- Lack of remorse or cooperation

Factors That Can Reduce Sentence Length:

- Plea bargain agreement

- First-time offender status

- Cooperation with authorities

- Willingness to pay restitution

8. First-Time Offenders: Will You Go to Jail?

Not always. First-time offenders often receive lesser sentences—especially if:

- The fraud involved small sums

- No identity theft was used

- The defendant cooperated with investigators

- Restitution was paid to the victim(s)

Some first-time fraudsters may get probation, community service, or home detention, especially in cases under $10,000.

However, serious or organized fraud schemes can still lead to federal prison time, even for a first offense.

9. State vs. Federal Charges

While most large-scale fraud is prosecuted federally, states can also pursue fraud charges, particularly if:

- The bank is a state-chartered institution

- The fraud was localized (e.g., check fraud at a local bank)

- The total amount is under a certain threshold

Example:

In California, check fraud over $950 is a felony punishable by up to 3 years in state prison. In Texas, bank fraud can carry up to 20 years depending on the amount defrauded.

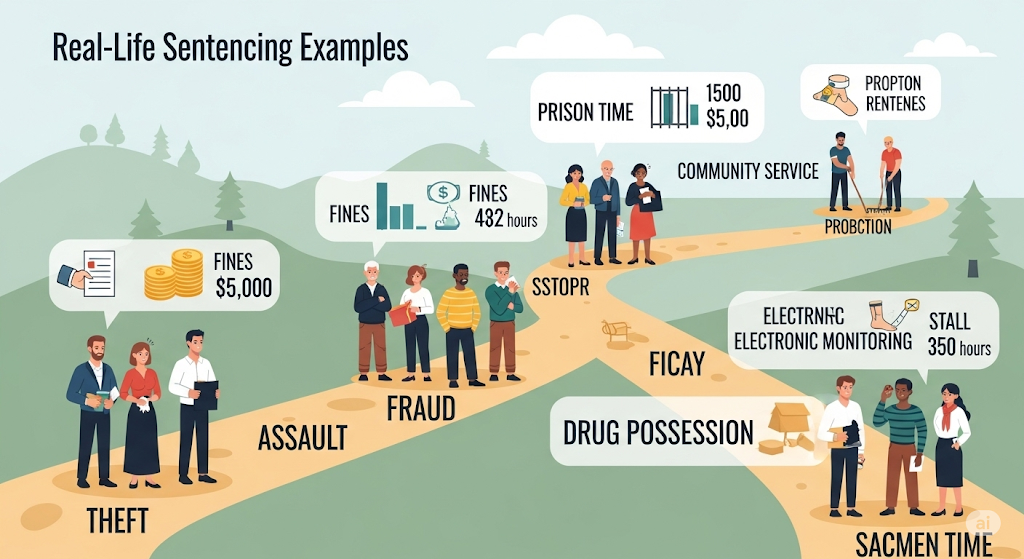

10. Real-Life Sentencing Examples

Example 1:

A New York businessman submitted false invoices to banks to secure loans. He defrauded $4.5 million and was sentenced to 12 years in federal prison.

Example 2:

A woman in Florida committed bank fraud and identity theft to claim COVID relief loans. She got 5 years in prison and was ordered to repay $500,000.

Example 3:

A college student in Oregon deposited fake checks worth $1,800 into his account. As a first-time offender, he received 3 years probation.

11. How Much Jail Time for Attempted Bank Fraud?

Even if the fraud wasn’t successful, attempting bank fraud is still punishable under federal law.

Maximum sentence: 30 years per attempt

Example: Writing a forged check, even if rejected, can lead to a felony charge.

Intent matters more than the outcome in many fraud cases.

12. What Happens After Conviction?

If convicted of bank fraud, you may face:

- Incarceration (federal or state prison)

- Restitution payments to victims

- Fines up to $1 million

- Supervised release (probation) after jail

- Loss of civil rights (e.g., voting, owning firearms)

A criminal record for bank fraud can also impact:

- Employment prospects

- Credit score

- Licensing (medical, law, finance)

- Immigration status (for non-citizens)

13. Can You Get Probation for Bank Fraud?

Yes—probation is possible, especially for:

- First-time offenders

- Amounts under $10,000

- Cases where restitution is paid

- Plea agreements in lower court

Probation terms may include:

- Regular check-ins with a probation officer

- Restrictions on employment or travel

- Mandatory financial counseling

- Drug testing or electronic monitoring

14. Defenses Against Bank Fraud Charges

Common legal defenses include:

| Defense | How It Helps |

|---|---|

| Lack of intent | You must have knowingly attempted to defraud |

| Mistaken identity | Especially in phishing or wire fraud cases |

| No financial gain | Not always enough to avoid conviction, but may reduce sentence |

| Duress or coercion | Forced into committing the act |

| Insufficient evidence | Prosecution must prove fraud beyond a reasonable doubt |

An experienced criminal defense attorney can also negotiate plea deals or argue for alternative sentencing.

15. Tips to Avoid Being Accused of Bank Fraud

Whether you’re a business owner, employee, or just managing personal finances:

- Keep personal and business finances separate

- Double-check documents before submitting to banks

- Don’t sign or endorse checks you didn’t verify

- Avoid using fake or borrowed information to access funds

- Use secure methods for online banking and avoid phishing traps

- Train staff on banking compliance if you run a business

16. Conclusion

Bank fraud is not just a “white-collar” slap on the wrist—it carries serious jail time, especially under federal law. While the maximum penalty is 30 years and $1 million in fines, the actual sentence depends on many factors, such as the size of the fraud, intent, cooperation with law enforcement, and whether it’s a first-time offense.

If you’re facing accusations, the best step is to seek legal counsel immediately. For everyone else, transparency, compliance, and ethical banking practices are the safest ways to stay clear of these harsh consequences.

17. FAQs

Q1. What is the minimum sentence for bank fraud?

There is no official minimum, but first-time offenders with minor fraud can receive probation or 6–12 months. Larger cases almost always involve prison time.

Q2. Will a felony fraud conviction stay on my record forever?

Yes—unless it’s expunged or sealed by court order. Fraud convictions permanently affect background checks, jobs, and housing.

Q3. Can I be charged with bank fraud for making a mistake?

If it was a genuine mistake, not intentional, you may not be charged. However, authorities will investigate intent carefully.

Q4. Can I go to jail for depositing a fake check?

Yes—especially if you knew it was fake. Even if you didn’t withdraw the money, the act of depositing it is considered bank fraud or attempted fraud.

Q5. Is bank fraud a felony?

Almost always, yes—both state and federal bank fraud charges are usually felonies.