✅ Table of Contents

- Introduction & Why CD Rates Matter

- What Is a Certificate of Deposit (CD)?

- First State Bank: Texas Presence & Overview

- Current CD Rates Snapshot (as of July 2025)

- How FSB Compares to Jumbo CD Market Rates

- CD Terms & APY by Term Length and Deposit Tier

- Flex-Rate & Special CDs at FSB

- Opening Requirements & Account Minimums

- Compounding, Maturity, and Early Withdrawal Penalties

- How to Choose the Best CD Term

- Tax & Fees Considerations

- Example Scenarios: What You’d Earn

- Jumbo CDs vs Regular CDs

- CD Laddering Strategy Explained

- Alternatives: IRAs, Money Markets & Savings

- Risks & Things to Watch

- FAQs

- Conclusion

1. Introduction: Why First State Bank CD Rates Matter in 2025

With interest rates stabilizing in 2025 following rate cuts in 2024, high-yield savings and CDs continue to attract savers. Community banks like First State Bank (FSB) in Texas offer competitive fixed‑rate CDs that are FDIC‑insured and ideal for secure short‑ or mid‑term savings. These CDs help lock in returns while minimizing risk.

2. What Is a Certificate of Deposit (CD)?

- A CD is a time-deposit account where you lock in funds for a fixed term—such as 3, 6, 12, or 24 months—in return for a guaranteed interest rate (APY).

- Once deposited, funds typically can’t be withdrawn without a penalty until maturity.

- They are FDIC-insured up to $250,000 per depositor, per institution—offering principal safety and predictable returns.

3. First State Bank: Texas Footprint & Presence

FSB operates several community branches in Texas, including at Uvalde, Graham, Athens, and others—each offering tailored CD products and localized service. While each branch may vary slightly, their CD offerings generally follow the same structure, opening thresholds, and penalty policies

4. Current FSB CD Rates Snapshot

As of late July 2025, CD rates at First State Bank in Texas include:

- 4‑Month CD Special: 3.64% APY (minimum $30,000)

- 7‑Month CD Special: 3.12% APY (minimum $30,000)

- Standard CD (12 to 60 months): ~2.77% APY on $1,000 minimum; and 2.68% APY for shorter 6‑ and 12‑month terms

These are featured prominently on FSB comparison sites and vary slightly by branch, but broadly align with the rates published on July 30, 2025

5. Comparing FSB Rates to Current Jumbo CD Market

According to recent jumbo CD listings, top-tier providers in 2025 offer:

- Finworth: 4.46% APY on 6‑month $50k min

- My eBanc: 4.45% APY on 12‑month $50k min

- NexBank & State Bank of Texas: ~4.35–4.40% APY.

While FSB’s jumbo‑level specials (3.64% on $30k) are competitive for local depositors, they are modest relative to high‑yield online or jumbo CD platforms—but may offer added convenience and account flexibility.

6. CD Terms & APYs by Duration and Deposit Tier

📋 Summary Table

| Term Length | Min Deposit | Interest Rate | APY |

|---|---|---|---|

| 4‑Month Special | $30,000 | — | 3.64% |

| 7‑Month Special | $30,000 | — | 3.12% |

| 6‑Month (std) | $1,000 | 2.75–2.77% | ~2.77% |

| 12‑Month | $1,000 | 3.00% | ~3.02% |

| 18‑/24‑/36‑/48‑/60‑Month | $1,000 | 3.00% | ~3.02% |

Terms of 2 years or longer generally carry the same base rate. These APYs are compounded semi‑annually or monthly depending on term and branch policies.

7. Flex-Rate & Special Feature CDs at FSB

- 4-Month & 7-Month Specials: Higher APY with a $30,000 deposit floor—ideal for savers wanting flexibility with short horizons.

- Flex‑Rate 24‑Month CD: Some branches (e.g., Uvalde) offer a change‑rate option once during the term, allowing a one-time rate update if market moves favorably.

8. Opening Requirements & Minimums

- Standard CDs typically require $1,000 minimum deposit.

- Special higher‑rate CD promotions often require $30,000 minimum.

- Early withdrawal penalties apply: less than 12‑month term → 90‑day interest penalty, longer terms → 180‑day penalty.

9. Interest Compounding, Renewal & Early Penalties

- FSB CDs typically compound interest monthly or semi-annually, crediting to the CD or linked account.

- Automatic renewal occurs at maturity unless the depositor withdraws within a 10‑day grace period.

- Penalties for early withdrawal:

- Terms under 12 months: 90 days’ interest

- Terms 12 months+. . .: 180 days’ interest.

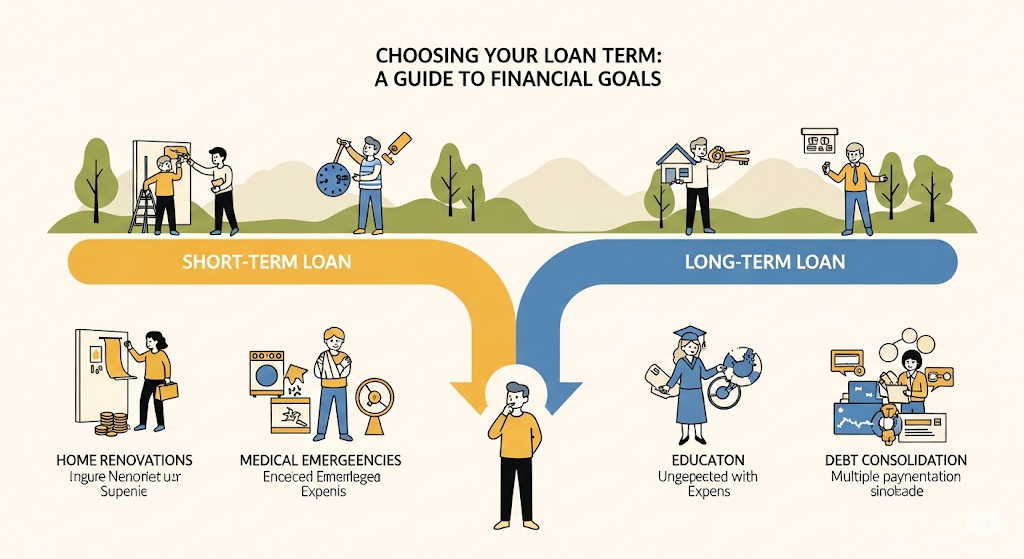

10. Choosing the Best Term for Your Goals

To select a CD:

- Define your time horizon: short (3–6 mo), medium (12–24 mo), long (36–60 mo).

- Assess interest rates versus liquidity risk.

- Consider special promos if you can deposit $30k and want higher APY.

- Think about a ladder strategy to stagger maturity dates and manage rate risk.

11. Tax & Fees Considerations

- Interest earned is tax‑able in the year credited. Consult a tax advisor for strategies.

- There may be maintenance fees on linked accounts if low balances or no e‑statements.

- Penalty on early withdrawal reduces yield—evaluate opportunity cost carefully.

12. Example Earnings Scenarios

💡 Scenario A: 4‑Month Special, $30,000

- APY: 3.64%

- Earned interest after 4 months: ~$364 × (4/12) ≈ $1,092

Scenario B: 12‑Month Std CD, $10,000

- APY: 3.02%

- Interest in 1 year: ≈ $302

Scenario C: Laddering five $20k CDs (6‑,12‑,18‑,24‑,36‑mo)

Combines short‑term flexibility with long‑term higher average yield. Estimated blended APY ~3.2–3.3%.

13. Jumbo CDs vs Regular FSB CDs

- Jumbo “special” CDs require $30k deposit and offer ~3.64% APY on short terms.

- Market jumbo CDs from other banks (like Finworth, NexBank) often exceed ~4.4% APY but require $50k+ and online setups.

- FSB’s advantage: local branch access, flexibility, trust in personal/local bank.

14. CD Laddering: Strategy & Examples

CD laddering means buying multiple CDs with staggered maturities—say, at 6, 12, 18, 24, 36 months.

- Provides periodic liquidity

- Allows reinvestment at potentially higher rates in future

- Helps manage interest‑rate risk

FSB’s tiered rate structure (e.g. standard vs special) makes laddering flexible for both $1k‑level savers and $30k tier.

15. Alternatives to CDs at FSB

FSB also offers:

- Money Market accounts (e.g. Vision Savings ~4.11% APY on $100 min; tiered business rates higher around ~1–2%)

- IRAs & CD‑IRAs with similar rates and CD functionality

- Savings & Checking products with variable, lower yields but more liquidity.

16. Risks & What to Watch

- Interest-rate shifts: Your locked-in rate may be lower than future market rate.

- Liquidity risk: Early withdrawal penalty reduces returns.

- Auto-renewal: Make sure to adjust or withdraw within grace period to avoid being locked-in again.

- Bank-specific promotions may vary: Always confirm with local branch before opening.

17. FAQs

Q1. Are FSB CD rates the same across all Texas branches?

Mostly yes, but customers should confirm specific specials by branch (Graham, Uvalde, Athens, etc.) Deposit Accounts FSB Uvalde.

Q2. Can I use multiple branches to open more CDs?

Yes, but FDIC insurance aggregate limit applies per depositor, per bank entity.

Q3. Can I increase my rate mid-term?

Only with specific products (like 24‑Month Flex CD). Most others lock rate until maturity.

Q4. What happens if I withdraw early?

Penalty is either 90 or 180 days of interest depending on term.

Q5. What’s the best CD term?

It depends on liquidity needs and rate outlook—short-term for flexibility, long-term for max yield.

18. Conclusion

In summary:

- First State Bank in Texas offers solid, fixed-rate CD options with APYs ranging from ~2.68% to 3.64%, depending on term and deposit size.

- Higher-yield specials are available for larger balances ($30k+), while standard CDs cater to smaller savers ($1,000+).

- Though not the absolute highest in national rates, FSB stands out for local access, service, trust, and FDIC insurance.

- With strategic laddering and term choices, FSB CDs can play a key role in a conservative savings plan.