Table of Contents : Walpole Co‑operative Bank

- History & Institutional Profile

- Routing Number & Wire/ACH Details

- Deposit Products: Checking, Savings & Money Market

- Certificate of Deposit (CD) Rates & IRAs

- Loan Products & Business Services

- Fees, Penalties & Policies

- Digital Banking & Access

- Financial Strength & Performance Metrics

- Strategic Advice for Savers & Borrowers

- Local Branch & Customer Experience

- FAQs

- Conclusion

1. History & Institutional Profile

- Established in January 1912, originally without FDIC coverage, later becoming a state‑chartered member of the Federal Reserve in June 2011.

- Operates with a single branch in Walpole, MA, staffing around 42 employees, holding $630.44 million in assets, and $500.68 million in deposits as of March 31, 2025.

- Known for community-oriented service, commercial lending, and conservative asset management with strong capitalization (~18.15%) and low Texas Ratio (~2.17%).

2. Routing Number & Wire/ACH Details

- The official routing number for both ACH and wire transfers is 211373063, assigned to Walpole Co-operative Bank and effective as of March 25, 2024.

- Routing number details are confirmed across sources including Wise.com and LaneGuide, and it’s used for direct deposit, electronic payments, and Fedwire transfers.

- Fedwire eligibility, including book-entry securities transfers, is supported; servicing FRB routing is 011000015.

3. Deposit Products: Checking, Savings & Money Market

Checking Accounts

- Easy Checking: 0.00% APY, no monthly fee, minimum to open unspecified.

- Easy Interest Checking: 0.05% APY, minimum balance $500, $2.50 fee if below threshold.

- High Rate Checking: 0.10% APY, minimum $2,500, no fee.

Savings & Money Market

- Savings is a variable-rate tiered product; Money Market tiers offer:

- $1K–$9,999: 0.20%

- $10K–$24,999: 0.35%

- $25K–$99,999: 0.40%

- $100K–$249,999: 0.50%

- $250K+: 0.60% APY; $500 minimum deposit to open.

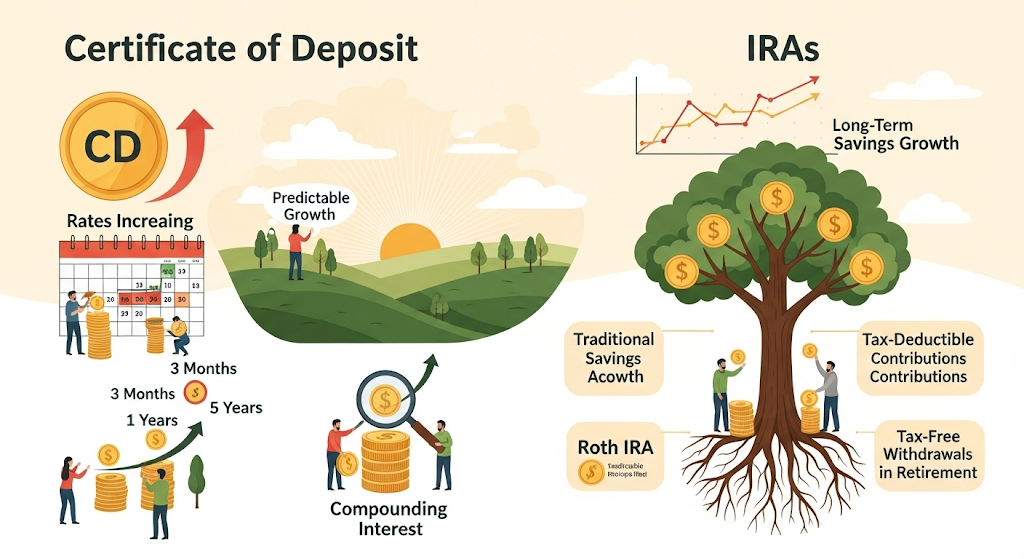

4. Certificate of Deposit (CD) Rates & IRAs

All CD product rates effective as of July 29, 2025, and require $500 minimum deposit:

| Term | Rate | APY |

|---|---|---|

| 3-Month CD | 0.10% | 0.10% |

| 6-Month CD | 3.93% | 4.00% |

| 1-Year CD | 3.69% | 3.75% |

| 18-Month CD | 2.96% | 3.00% |

| 2-Year CD | 0.30% | 0.30% |

| 3-Year CD | 0.40% | 0.40% |

| 5-Year CD | 0.45% | 0.45% |

- Notably, the 6-month CD at 4.00% APY is the stand-out competitive offering.

- Datatrac reports the bank’s 3-month CD rate outperforms local averages by ~10% for $10K deposits.

CD Terms & Penalty

- Automatic renewal at maturity for identical term; customers have a 10-day grace period to change or withdraw penalty-free.

- Early withdrawal penalties are “substantial”—contact bank for specifics, typical of community banks.

5. Loan Products & Business Services

- The bank provides consumer and small business lending, including personal loans, auto, home equity, and real estate lending.

- A typical product: Overdraft Protection Line of Credit connected to checking accounts (limits $100–$5,000 at ~15% interest).

- Commercial lending focuses on commercial real estate, 1–4 family residential, and construction/development loans, representing ~34% and ~17% respectively of its loan portfolio.

- No consumer auto or unsecured personal loan rates are publicly listed; interested customers are encouraged to contact the bank directly.

6. Fees, Penalties & Policies

- CD minimums set at $500; early withdrawal penalties may cut into earnings substantially.

- Savings and checking fees apply if account balances drop below threshold (e.g. $2.50 fee for Easy Interest Checking).

- Overdraft line interest and return item fees apply as applicable.

- No online loan rates are exposed—applicants must inquire through the bank

7. Digital Banking & Access

- The bank’s website provides rate boards, calculators not specified but implied.

- Based on size, full online banking features are limited; customers likely must visit branch for service. No mobile app mentioned.

- Contact and support details only list one physical location and a single phone number (508‑668‑1080) for assistance

8. Financial Strength & Performance Metrics

- As of March 31, 2025, Walpole Co‑operative Bank holds assets worth $630.44 million, deposits of $500.68 million, and loan portfolio of $516.31 million

- Key ratios highlight strong capitalization (18.15%), low non-performing assets (Texas Ratio 2.17%), and modest return on equity (2.76%) compared to national averages.

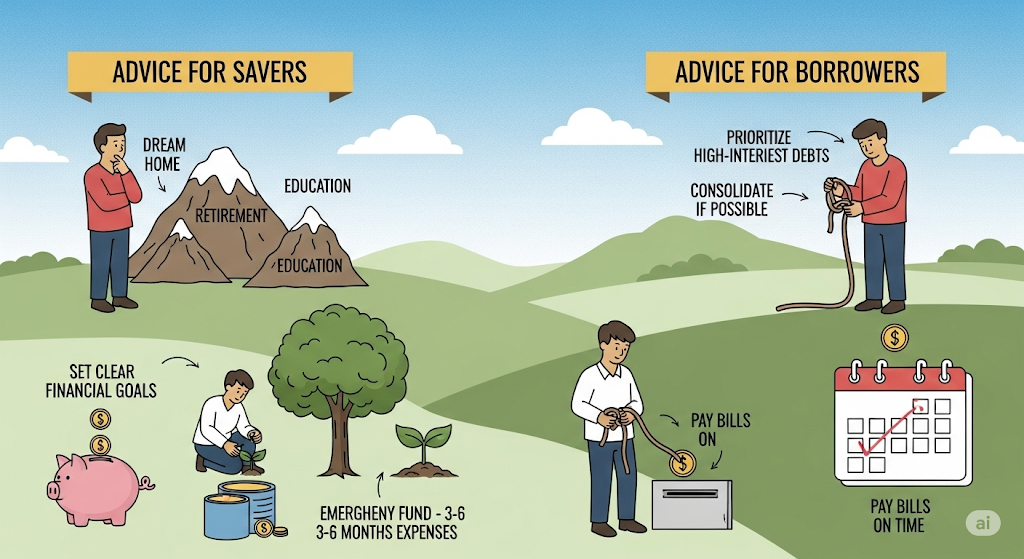

9. Strategic Advice for Savers & Borrowers

Savers:

- 6-month CD at 4% APY is an excellent short-term option.

- Laddering strategy: Combine 3-month, 6-month, and 1-year CDs for liquidity and rate protection.

- Money market yields up to 0.60% for balances over $250K—useful if flexibility matters over locking funds in CDs.

Borrowers:

- If you need small overdraft protection, a credit line up to $5K is available.

- For larger real estate or business loans, contact bank to review options—online rates not published.

- Compare with local credit unions or regional community banks to ensure competitive loan pricing and service availability.

10. Local Branch & Customer Experience

- Only one branch exists, located at 982 Main Street, Walpole, MA 02081.

- Online reviews are scarce; a Yelp mention notes security measures and CD/savings offerings, with limited details on customer service quality.

- A DepositAccounts review includes a complaint regarding ATM usage by non-customers, suggesting limited service to outsiders.

11. Frequently Asked Questions (FAQs)

Q1: What’s the routing number for Walpole Co‑operative Bank?

A: Use 211373063 for both wire and ACH transfers.

Q2: Is the bank FDIC-insured?

A: Yes—FDIC Certificate #26487, also maintains strong equity cushion and risk metrics

Q3: Can I open a CD online?

A: Rates suggest online quoting is possible, but actual CD opening likely requires branch visit.

Q4: What interest rates are available on CDs?

A: See table above; standout is 6-month at 4.00% APY.

Q5: Does the bank offer checking interest or rewards?

A: Yes—High Rate Checking offers 0.10% APY with $2.5K balance and no fee; Easy Interest Checking offers 0.05% with balance maintenance.

12. Conclusion

Walpole Co‑operative Bank is a small but stable community bank offering solid CD rates—especially the 4.00% APY on 6-month CDs—plus tiered money market accounts and deposit-linked overdraft lines. With a single branch and emphasis on local lending, it’s ideal for nearby residents and businesses in Walpole, MA.

With its routing number 211373063, customers can perform wire and ACH transactions confidently. While digital-only users may find the bank’s online capabilities limited, loyal local customers benefit from FDIC insurance, strong capitalization, and competitive short-term saving options.