Table of Contents

- Introduction

- What Are Third-Party Money Managers?

- How Third-Party Money Management Works

- Who Uses Third-Party Money Managers?

- Benefits of Hiring a Third-Party Money Manager

- Risks and Challenges

- Third-Party Managers vs. Financial Advisors

- How to Choose the Right Manager

- Regulation and Compliance in 2025

- Popular Third-Party Money Managers in the US

- Real-Life Case Studies

- Industry Trends in 2025

- Final Thoughts

- FAQs

1. Introduction

In today’s complex financial landscape, individual investors and institutions often rely on experts to manage their wealth. While many turn to traditional financial advisors or brokerage firms, others are increasingly using third-party money managers for professional portfolio oversight.

In this guide, we explore the role of third-party money managers in detail—from how they work to the benefits and potential risks. Whether you’re a retail investor or a high-net-worth individual, understanding this evolving financial service can help you make more informed investment decisions.

2. What Are Third-Party Money Managers?

Third-party money managers (TPMMs) are independent investment firms or individuals hired to manage assets on behalf of clients—usually through a financial intermediary like a broker, RIA (Registered Investment Advisor), or financial advisor.

Key Characteristics:

- They do not work directly for the investor but are hired by intermediaries.

- They specialize in portfolio management and are typically fee-based.

- They may have a specific investment philosophy (e.g., growth, value, income).

- Most are regulated by the SEC or FINRA in the US.

3. How Third-Party Money Management Works

When an investor works with a financial advisor or firm, that advisor may outsource the investment management to a TPMM. Here’s how the relationship typically flows:

- Investor engages a financial advisor.

- The advisor assesses the client’s goals, risk tolerance, and needs.

- The advisor then selects a third-party money manager with a suitable strategy.

- The TPMM actively manages the client’s portfolio, often through a managed account platform.

- The advisor monitors the relationship and reports performance to the client.

This delegation enables financial advisors to focus on client service and planning, while TPMMs handle day-to-day portfolio decisions.

4. Who Uses Third-Party Money Managers?

TPMMs cater to a diverse client base:

- Retail investors with managed accounts

- High-net-worth individuals (HNWIs)

- Trusts and family offices

- Corporate retirement plans (401(k), pension)

- Nonprofits and endowments

- Institutional investors

They’re especially popular among financial advisors who want to provide expert investment management without building in-house teams.

5. Benefits of Hiring a Third-Party Money Manager

✅ 1. Expertise and Specialization

TPMMs are usually experts in their chosen field—whether it’s large-cap growth stocks, fixed income, ESG investing, or alternatives.

✅ 2. Time Efficiency

For advisors and investors alike, delegating portfolio management frees up time for planning, education, or other financial tasks.

✅ 3. Objectivity

Independent money managers typically act as fiduciaries, reducing conflicts of interest and ensuring objective advice.

✅ 4. Risk Diversification

TPMMs often employ sophisticated risk-management strategies like rebalancing, tactical shifts, and hedging.

✅ 5. Customization

They offer separately managed accounts (SMAs) and model portfolios tailored to client goals.

6. Risks and Challenges

❌ 1. Higher Fees

Since TPMMs work through intermediaries, clients may pay layered fees (advisor + manager).

❌ 2. Performance Variability

Not all TPMMs outperform the market or even their benchmarks.

❌ 3. Lack of Transparency

Some managers do not clearly disclose holdings, methodologies, or risk metrics.

❌ 4. Limited Control

Clients typically can’t make individual decisions within the portfolio.

❌ 5. Due Diligence Required

Choosing the wrong TPMM can lead to poor outcomes. Due diligence is essential.

7. Third-Party Managers vs. Financial Advisors

| Feature | Third-Party Manager | Financial Advisor |

|---|---|---|

| Role | Portfolio management | Holistic planning, client service |

| Interaction with investor | Indirect (through advisor) | Direct |

| Fiduciary duty | Usually Yes | Varies (RIA vs. broker-dealer) |

| Strategy focus | Narrow (e.g., equity/fixed income) | Broad (retirement, estate, tax) |

| Customization | Investment-based | Life-goal based |

They complement each other—most advisors use TPMMs to offer more comprehensive service.

8. How to Choose the Right Manager

Here are the steps to finding a solid third-party money manager:

🔍 1. Verify Credentials

Ensure the TPMM is registered with the SEC or a state regulator. Check for designations like CFA, CFP.

📈 2. Analyze Track Record

Evaluate performance over 3, 5, and 10 years, risk-adjusted returns, and volatility.

🧠 3. Understand the Philosophy

Do they follow value investing? Tactical asset allocation? ESG? Make sure it aligns with your goals.

📝 4. Review Fees

Request full transparency about management fees, platform costs, and advisor compensation.

🧪 5. Ask for Sample Reports

Look at sample performance reports, holdings, and how they communicate with clients.

9. Regulation and Compliance in 2025

As of 2025, TPMMs fall under the purview of:

- SEC (for firms with AUM over $100M)

- State regulators (under $100M AUM)

- FINRA, if they use broker-dealer channels

- ERISA, if managing retirement plan assets

- DOL Fiduciary Rule (for retirement accounts)

Key compliance aspects:

- Annual ADV filing (Form ADV Part 2)

- Code of Ethics

- KYC (Know Your Customer) and AML checks

- Cybersecurity protocols

10. Popular Third-Party Money Managers in the US

Here are some TPMMs widely used by advisors in the U.S.:

| Name | Specialty | AUM (Approx.) |

|---|---|---|

| SEI Investments | Turnkey asset management | $1 trillion+ |

| Brinker Capital | Multi-strategy portfolios | $30 billion |

| AssetMark | Custom SMAs and TAMPs | $100+ billion |

| Envestnet | Technology + investment solutions | $5+ trillion |

| City National Rochdale | High-net-worth solutions | $60+ billion |

Note: Always check current AUM and registration status.

11. Real-Life Case Studies

✅ Case 1: An Advisor Scaling Up

Sarah, an independent financial advisor, uses AssetMark to offer custom portfolios. This allows her to scale without hiring in-house analysts.

✅ Case 2: Family Office Outsourcing

A family office in New York uses multiple TPMMs across different asset classes, improving diversification and minimizing internal headcount.

✅ Case 3: Retirement Plan Optimization

A 401(k) sponsor hires a TPMM to manage target-date funds and reduce plan fiduciary liability.

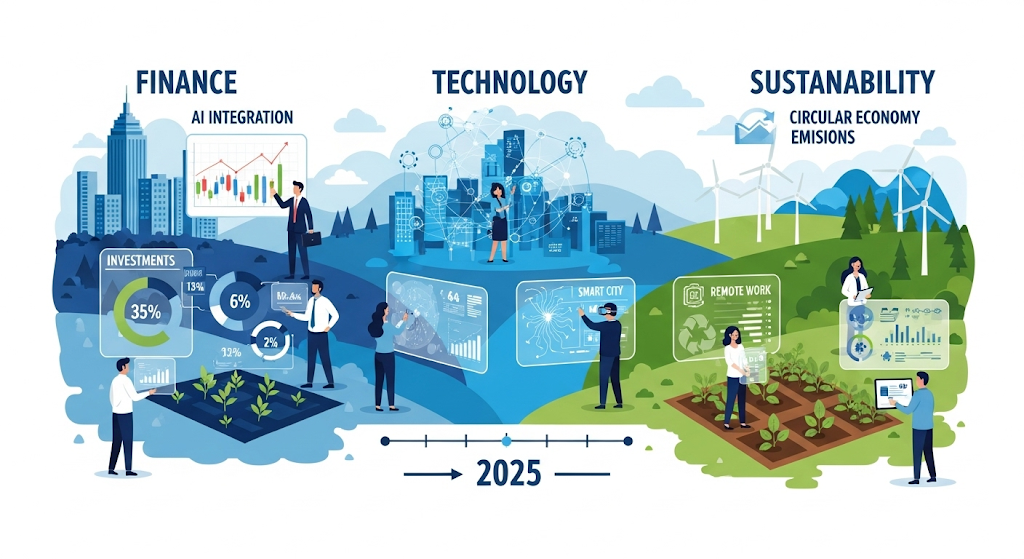

12. Industry Trends in 2025

🔮 1. AI-Driven Investment Models

Many TPMMs are integrating AI and machine learning for smarter portfolio decisions.

🔮 2. ESG and Impact Investing

Demand for sustainable investing has surged; TPMMs are launching ESG-focused strategies.

🔮 3. Direct Indexing

Instead of mutual funds, TPMMs offer personalized indexing for tax efficiency.

🔮 4. Unified Managed Accounts (UMAs)

Combining multiple strategies into one account is now standard practice.

🔮 5. TAMP Growth

Turnkey Asset Management Platforms (like Envestnet, Orion) are growing rapidly among RIAs.

13. Final Thoughts

Third-party money managers play a crucial role in modern wealth management. By bringing professional expertise and institutional-level strategies to individual investors, TPMMs allow advisors and clients to focus on bigger financial goals while maintaining investment discipline.

If you’re an investor or advisor, considering a third-party manager could be one of the smartest financial decisions—provided you do the proper research, understand the fee structure, and align with a manager that fits your needs.

14. FAQs

❓What is the difference between a TPMM and a mutual fund manager?

A TPMM customizes portfolios for individual clients, while a mutual fund manager runs pooled investments for many investors.

❓Are third-party managers fiduciaries?

Most are fiduciaries, especially those registered as RIAs. Always confirm before engagement.

❓How do they charge fees?

Fees are usually based on a percentage of assets under management (e.g., 0.50%–1.25% annually).

❓Can I access TPMMs as a retail investor?

Yes, typically through a financial advisor or RIA.

❓Do TPMMs guarantee returns?

No. Investments carry risk, and no manager can guarantee future performance.

❓Are TPMMs better than robo-advisors?

They offer more customization and human oversight, but at a higher cost.

❓Can I switch TPMMs?

Yes. Most platforms allow you to reassign portfolios if performance is lacking.

❓What is a TAMP?

TAMP stands for Turnkey Asset Management Platform, a service combining TPMMs, custodians, and technology.

❓Are there tax benefits to using TPMMs?

Yes. TPMMs may use tax-loss harvesting, asset location, and other tax strategies.

❓What platforms do they use?

Common platforms include Envestnet, Orion, SEI, AssetMark, and Morningstar.