Table of Contents

- Introduction

- Overview of Heritage Bank

- What Is a Personal Loan?

- Types of Heritage Bank Personal Loans

- Features and Benefits

- Interest Rates in 2025

- Eligibility Criteria

- Documentation Requirements

- Step-by-Step Application Process

- Fees and Charges

- How to Choose the Right Loan Type

- Use Cases for Heritage Bank Personal Loans

- Pros and Cons

- Tips to Increase Your Loan Approval Odds

- Alternatives to Heritage Bank Personal Loans

- Real Customer Experiences

- FAQs

- Conclusion

1. Introduction

If you’re considering a personal loan to fund major expenses, consolidate debt, or cover emergencies, Heritage Bank could be an ideal financial partner. In 2025, Heritage Bank personal loans continue to gain popularity for their transparent terms, fixed and variable rate options, and flexible repayment structures. This in-depth guide explores everything you need to know about Heritage Bank’s personal loan offerings—from eligibility and application to fees, rates, and use cases.

2. Overview of Heritage Bank

Heritage Bank is one of Australia’s longest-running mutual banks, serving customers since 1875. Unlike shareholder-owned banks, Heritage Bank is owned by its members, and its mission is to deliver superior value through lower fees, better service, and fair lending practices.

With over 60 branches and a digital presence, Heritage serves tens of thousands of Australians. Known for customer-first values and responsible lending, it remains a trusted choice for personal loans, home loans, and everyday banking.

3. What Is a Personal Loan?

A personal loan is a fixed amount of money borrowed from a lender that is repaid over a set term with interest. Personal loans are typically unsecured, meaning they don’t require collateral, though secured versions are available for lower interest rates.

You can use personal loans for:

- Home renovations

- Wedding expenses

- Debt consolidation

- Travel or medical emergencies

- Car purchases (especially used cars)

- Education expenses

4. Types of Heritage Bank Personal Loans

Heritage Bank offers a variety of personal loan options to suit different needs and financial profiles:

✅ Fixed Rate Personal Loan

- Stable interest over the loan term

- Ideal for borrowers who want predictable repayments

✅ Variable Rate Personal Loan

- Flexible with the ability to make extra repayments

- Rates can fluctuate with the market

✅ Secured Low Rate Loan

- Requires collateral (e.g., term deposit)

- Offers lower interest rates than unsecured options

✅ Green Loans (for eco-friendly purchases)

- Designed for environmentally conscious consumers

- Can be used for solar panels, water tanks, etc.

5. Features and Benefits

Here are the standout features that make Heritage Bank personal loans attractive:

| Feature | Benefit |

|---|---|

| Loan amount | $5,000 to $50,000 unsecured |

| Term length | 1 to 7 years (up to 10 for secured) |

| Redraw facility | Available on variable loans |

| Extra repayments | Allowed at no penalty |

| Repayment frequency | Weekly, fortnightly, or monthly |

| Loan purpose flexibility | Use funds for any personal need |

6. Interest Rates in 2025

Heritage Bank offers competitive interest rates that vary based on loan type and creditworthiness.

| Loan Type | Interest Rate (Starting from) | Comparison Rate* |

|---|---|---|

| Fixed Rate Personal Loan | 8.99% p.a. | 9.35% p.a. |

| Variable Rate Loan | 11.99% p.a. | 12.61% p.a. |

| Secured Low-Rate Loan | 5.14% p.a. | 7.61% p.a. |

*Comparison rates include standard fees and help you compare true borrowing cost.

7. Eligibility Criteria

To qualify for a Heritage Bank personal loan in 2025, you must meet the following:

- Be 18 years or older

- Be a permanent resident or hold an eligible visa

- Have a regular income

- Maintain a good credit score

- Provide verifiable employment and identity documents

8. Documentation Requirements

To complete your loan application, you’ll need:

- Valid photo ID (driver’s license, passport)

- Proof of income (payslips, bank statements, tax returns)

- Employer details

- Details of current debts and liabilities

- Purpose of the loan (optional but recommended)

9. Step-by-Step Application Process

📝 Step 1: Use the Loan Calculator

Start by estimating repayments using Heritage Bank’s online calculator.

📤 Step 2: Begin Online Application

Visit Heritage Bank’s official website and complete the application form.

📎 Step 3: Upload Documents

Submit all supporting documents securely.

📞 Step 4: Await Verification

A lending specialist may contact you for additional details.

✅ Step 5: Approval and Funding

If approved, funds are disbursed to your account—usually within 24–48 hours.

10. Fees and Charges

Here’s a summary of common fees:

| Fee Type | Amount |

|---|---|

| Application fee | $200–$250 |

| Monthly service fee | $0 |

| Redraw fee | $0 |

| Early repayment fee | $0 |

| Late payment fee | Variable |

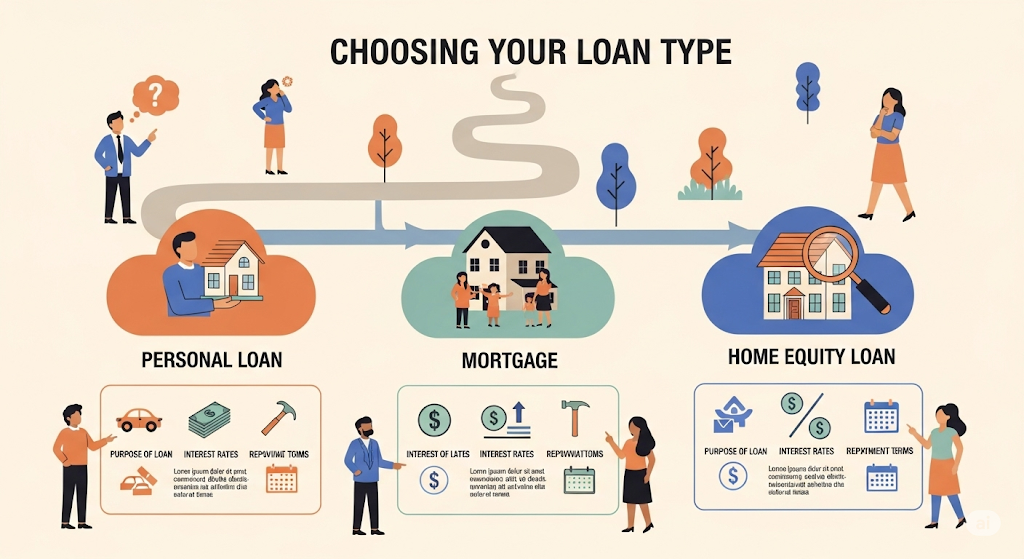

11. How to Choose the Right Loan Type

- If you prefer predictable payments → Choose a fixed rate loan

- If you want flexibility and extra repayment ability → Go for a variable rate

- If you have a term deposit to secure the loan → Opt for the low-rate secured loan

- If purchasing eco-friendly upgrades → Consider the green loan

12. Use Cases for Heritage Bank Personal Loans

🏡 Home Renovation

Upgrade your kitchen, build an outdoor deck, or add solar panels.

💍 Wedding Expenses

Pay for venue, catering, attire, and honeymoon with one lump sum.

🚗 Car Purchase

Buy a used car without needing a secured vehicle loan.

💳 Debt Consolidation

Combine credit cards and high-interest debts into one manageable loan.

🏥 Medical Bills

Finance surgery or treatments not covered by insurance.

🎓 Education

Bridge tuition or study expenses without relying on student loans.

13. Pros and Cons

✅ Pros

- No ongoing monthly fees

- Transparent comparison rates

- Flexible repayment and redraw options

- Pre-approval available

- Competitive interest on secured loans

❌ Cons

- Application fees

- Loan caps ($50k for unsecured)

- Variable rates can rise unexpectedly

- Not available to non-residents

14. Tips to Increase Your Loan Approval Odds

- Check your credit score before applying

- Reduce existing debt to lower your DTI (debt-to-income) ratio

- Have all documents ready to speed up approval

- Apply for only what you need—smaller amounts are approved faster

- Avoid multiple applications across different lenders

15. Alternatives to Heritage Bank Personal Loans

| Lender | Fixed Rate (from) | Max Loan Amount | Notes |

|---|---|---|---|

| NAB | 6.99% p.a. | $55,000 | No monthly fees |

| CommBank | 7.50% p.a. | $50,000 | Fast digital approval |

| ANZ | 6.89% p.a. | $50,000 | Flexible features |

| Latitude Finance | 7.99% p.a. | $70,000 | Competitive for travel loans |

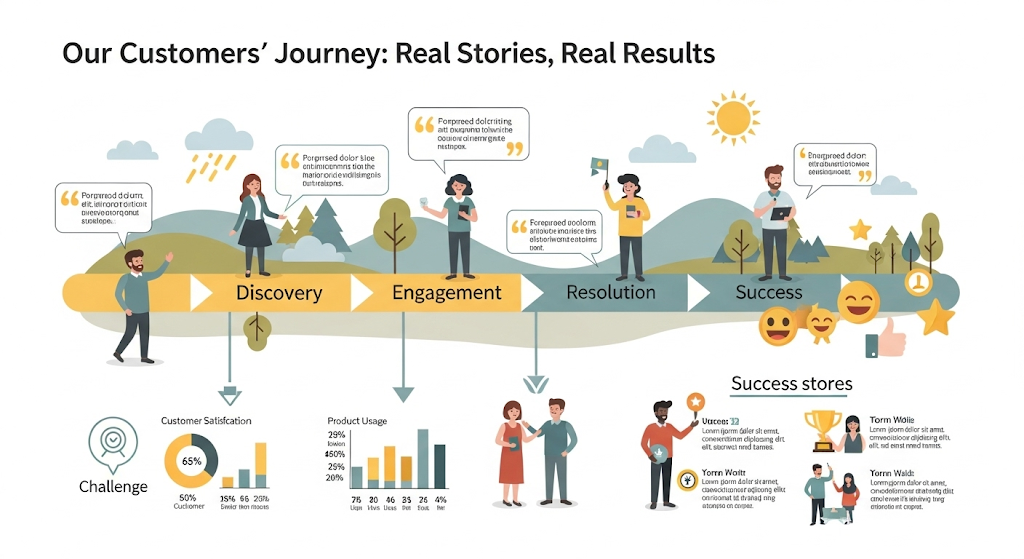

16. Real Customer Experiences

⭐ “Smooth process and quick turnaround”

“I applied for a $15k fixed rate loan for renovations. It was approved within 24 hours and no hidden charges. Great experience.” — Anna S., Brisbane

⭐ “Helpful staff and no hassles”

“The bank manager personally walked me through the documents. Very customer-centric compared to the big 4.” — Jordan M., Toowoomba

⭐ “Saved money with secured option”

“I used my term deposit as security and got a 5.2% rate—much lower than my credit card interest!” — Naomi P., Sydney

17. FAQs

❓ Can I repay my loan early without penalty?

Yes. Heritage Bank allows early repayments without fees.

❓ Is a redraw facility available?

Yes—on variable rate loans.

❓ What happens if I miss a payment?

A late fee may apply, and your credit score could be affected.

❓ Can I apply jointly?

Yes—joint applications are accepted for spouses, family, or partners.

❓ How long does approval take?

Most loans are approved within 1–2 business days if documentation is complete.

❓ Will applying affect my credit score?

Submitting a formal application triggers a credit inquiry, which can impact your score.

18. Conclusion

Heritage Bank personal loans offer a blend of flexibility, transparency, and competitive pricing—especially for borrowers who value customer service and ethical banking practices. Whether you’re looking to consolidate debt, fund a wedding, or renovate your home, Heritage has an option suited for your needs.

By understanding the types of loans, comparing rates, and preparing your application properly, you’ll be in a strong position to get approved and use your funds wisely in 2025.