Are EIDL Loans Personally Guaranteed? Everything

Are EIDL Loans Personally Guaranteed Economic Injury Disaster Loans (EIDL) have been a lifeline for millions of small businesses during times of crisis, particularly during the COVID-19 pandemic. While many business owners welcomed the financial relief, confusion still surrounds several aspects of the program, especially when it comes to personal guarantees. Let us explore what personal guarantees mean in the context of EIDL loans, when they are required, the implications for borrowers, and how you can manage your loan responsibly.

Table of Contents

- What is an EIDL Loan?

- Key Features of the EIDL Loan

- What is a Personal Guarantee?

- Do EIDL Loans Require a Personal Guarantee?

- Thresholds for Personal Guarantees in EIDL

- Why Personal Guarantees Matter

- Risks of Personal Guarantees

- How the SBA Enforces Personal Guarantees

- How to Mitigate Risk if You’ve Signed a Personal Guarantee

- Alternatives to Personal Guarantees

- The EIDL and Bankruptcy Implications

- Common Misconceptions

- Real-Life Case Studies

- Expert Opinions on Personal Guarantees

- Conclusion and Key Takeaways

1. What is an EIDL Loan?

An EIDL (Economic Injury Disaster Loan) is a financial assistance program provided by the U.S. Small Business Administration (SBA) for small businesses, agricultural enterprises, and non-profits that suffer substantial economic injury due to a declared disaster.

Purpose

- To meet working capital needs

- Cover payroll, rent, utilities, and other bills

- Ensure business continuity

2. Key Features of the EIDL Loan

- Loan Amount: Up to $2 million (varies depending on the disaster)

- Interest Rate: 3.75% for businesses; 2.75% for non-profits

- Repayment Term: Up to 30 years

- Collateral Requirement: Required for loans over $25,000

- No Forgiveness: Unlike PPP loans, EIDL loans must be repaid

3. What is a Personal Guarantee?

A personal guarantee is a legally binding agreement in which an individual agrees to be personally responsible for repaying a loan if the business fails to do so.

Types

- Unlimited: Full liability

- Limited: Liability up to a specific amount

Legal Implications

If your business defaults on the loan, the lender (in this case, the SBA) can go after your personal assets — such as your home, car, and savings — to recover the amount.

4. Do EIDL Loans Require a Personal Guarantee?

Yes, but with conditions.

SBA Rules:

- Loans under $200,000: No personal guarantee required

- Loans of $200,000 or more: Personal guarantee required

This rule was particularly enforced during the COVID-19 pandemic. The SBA updated the requirements to allow streamlined access for smaller loans.

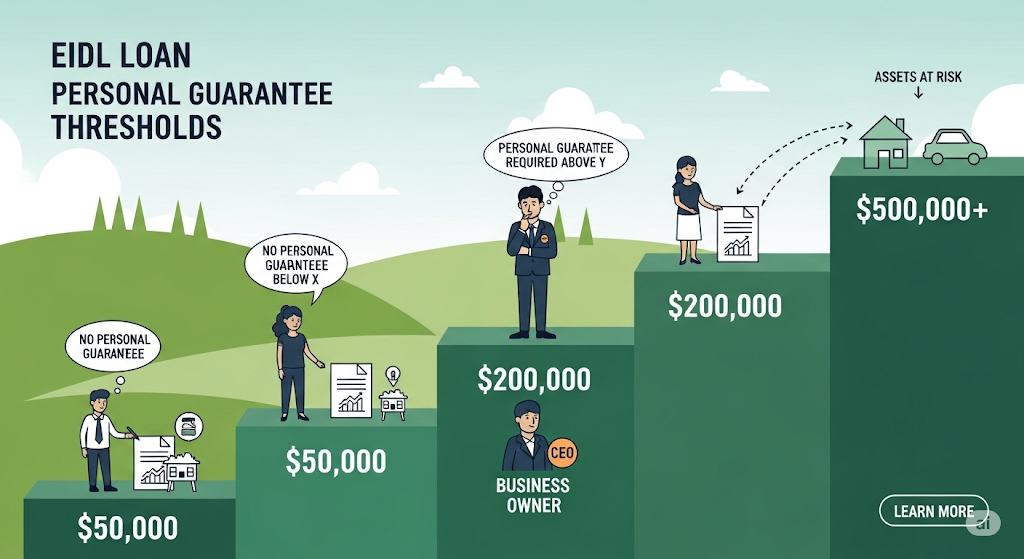

5. Thresholds for Personal Guarantees in EIDL

| Loan Amount | Personal Guarantee Required? |

|---|---|

| $25,000 or less | No (and no collateral) |

| $25,001 to $199,999 | No personal guarantee, but collateral may be required |

| $200,000 or more | Yes |

6. Why Personal Guarantees Matter

- They serve as a risk management tool for lenders

- Help ensure responsible borrowing

- Prevent fraud or reckless spending

Personal guarantees align borrower incentives with the lender’s expectations by increasing accountability.

7. Risks of Personal Guarantees

- Loss of Personal Assets: The most severe risk

- Credit Score Impact: Defaults can damage your personal credit

- Legal Action: Potential lawsuits and wage garnishments

- Bankruptcy Exposure: Personal bankruptcy may be needed if unable to repay

8. How the SBA Enforces Personal Guarantees

When borrowers default:

- The SBA may refer the debt to the U.S. Treasury

- Initiate collection proceedings

- Report the default to credit bureaus

The SBA is not just a lender — it’s a government agency. Its enforcement powers are significant.

9. How to Mitigate Risk if You’ve Signed a Personal Guarantee

a. Maintain Financial Transparency

Keep accurate and updated financial records

b. Budget for Repayment

Avoid late payments to maintain good standing

c. Create a Contingency Plan

Have backup funding strategies in case of revenue disruptions

d. Communicate With the SBA

If hardship occurs, request deferment or modification

10. Alternatives to Personal Guarantees

Although EIDL loans follow SBA regulations, alternative business loans or grants may not require a personal guarantee:

- PPP Loans (forgiven if criteria met)

- SBA 7(a) Loans (lower guarantee thresholds)

- Grants: State and federal-level grants

- Equity funding: Give up shares instead of taking on debt

11. The EIDL and Bankruptcy Implications

If your business goes bankrupt:

- Loan is still owed unless discharged

- Personal guarantee remains enforceable

- Chapter 7 or 13 bankruptcy may impact liability, but legal advice is crucial

12. Common Misconceptions

- “EIDL loans are forgivable like PPP” — False

- “Personal assets are never at risk” — False if you signed a guarantee

- “EIDL loans are grants” — False, they must be repaid

13. Real-Life Case Studies

Case 1: A Retail Owner with a $250,000 Loan

- Signed personal guarantee

- Business closed in 2023

- SBA pursued personal repayment

Case 2: A Café Owner with $150,000 Loan

- No personal guarantee required

- Defaulted but protected from personal asset seizure

14. Expert Opinions on Personal Guarantees

- Lenders’ View: Guarantees are critical for loan security

- Legal Experts: Carefully review all loan documents

- Financial Advisors: Only borrow what you can safely repay

15. Conclusion and Key Takeaway

EIDL loans have served as an essential resource for small businesses. However, the inclusion of a personal guarantee can have serious implications for business owners — particularly for loans exceeding $200,000. Understanding when a personal guarantee is required, the risks involved, and your options can help you make informed financial decisions.

Summary Points:

- Personal guarantees apply only to EIDL loans over $200,000

- Defaulting on such loans can put personal assets at risk

- Responsible planning, legal advice, and communication with the SBA are key

Disclaimer: This guide is for informational purposes only and does not constitute financial or legal advice. Please consult a licensed professional before making loan decisions.