Table of Contents

- Introduction

- What Is a Secured Personal Loan?

- Secured vs. Unsecured Personal Loans

- Types of Assets Used as Collateral

- How Secured Personal Loans Work

- Pros and Cons

- Who Should Consider a Secured Personal Loan?

- How to Apply for a Secured Personal Loan

- Credit Score Requirements

- Secured Loans from Banks vs. Online Lenders

- Risks Involved

- Alternatives to Secured Personal Loans

- FAQs

- Conclusion

1. Introduction

Personal loans have become one of the most common ways for individuals to handle urgent financial needs—be it consolidating debt, managing medical bills, or funding large purchases. Among the types available, secured personal loans offer an option that may provide better interest rates and approval odds, especially for borrowers with limited or poor credit history.

This comprehensive guide explores secured personal loans in 2025—how they work, who should get them, their pros and cons, and how to apply for one with confidence.

2. What Is a Secured Personal Loan?

A secured personal loan is a loan that is backed by collateral. This means you pledge an asset (like a car, savings account, or property) to the lender as a form of security. If you fail to repay the loan, the lender has the legal right to seize the asset.

Example:

If you borrow $10,000 using your car as collateral and fail to make payments, the lender can repossess the vehicle.

3. Secured vs. Unsecured Personal Loans

| Feature | Secured Personal Loan | Unsecured Personal Loan |

|---|---|---|

| Collateral Required | Yes | No |

| Interest Rates | Lower | Higher |

| Risk to Borrower | Asset seizure possible | Legal action/credit damage |

| Loan Approval | Easier for bad credit | Harder for low credit |

| Loan Amounts | Higher (based on collateral value) | Lower |

4. Types of Assets Used as Collateral

Here are the most common assets used as collateral in 2025:

- Vehicles (Cars, trucks, motorcycles)

- Home equity or real estate

- Savings accounts or certificates of deposit (CDs)

- Investment accounts

- Gold or valuable jewelry

- Insurance policies (whole life insurance)

- Machinery or business equipment

Pro tip: The value of your collateral should ideally match or exceed the amount you’re borrowing.

5. How Secured Personal Loans Work

Step-by-Step Process:

- Apply for the Loan: Submit a loan application to a bank, credit union, or online lender.

- Submit Collateral Information: The lender appraises your asset.

- Loan Approval: If approved, you sign an agreement detailing repayment terms and collateral conditions.

- Receive Funds: Loan is disbursed, often within 1–3 business days.

- Repay in Installments: Monthly payments include principal and interest.

- Reclaim Collateral: Once the loan is paid off, the asset is released back to you.

6. Pros and Cons

✅ Advantages

- Lower interest rates: Due to reduced risk for the lender.

- Higher approval odds: Even for borrowers with bad credit.

- Larger loan amounts: Based on asset value.

- Builds credit: On-time payments improve credit score.

❌ Disadvantages

- Risk of asset loss: If you default, you may lose your home, car, or savings.

- More complex application: Valuation and legal documentation needed.

- Limited asset availability: Not everyone has valuable collateral.

- Possibly longer funding times: Due to appraisal and verification.

7. Who Should Consider a Secured Personal Loan?

You should consider a secured personal loan if:

- You have bad or fair credit and want better loan terms.

- You need to borrow a larger amount than unsecured loans allow.

- You own an asset and are confident in your ability to repay.

- You want to rebuild your credit and qualify for better future financing.

8. How to Apply for a Secured Personal Loan

1. Check Your Credit Report

Review your credit score and fix errors if needed.

2. Determine Collateral

Choose an asset that matches the loan value. Ensure it’s not already pledged.

3. Compare Lenders

Evaluate banks, credit unions, and online lenders based on:

- Interest rates

- Repayment terms

- Fees (origination, prepayment, late payment)

4. Gather Documentation

- Proof of income

- Asset documents

- Government ID

- Loan purpose (if required)

5. Apply and Get Appraisal

Submit your application and get your asset valued by the lender.

6. Sign Agreement and Receive Funds

Once approved, read the agreement carefully and receive funds.

9. Credit Score Requirements

There is no fixed credit score required for secured loans. However:

- Excellent Credit (720+): May qualify for both secured and unsecured loans at the best rates.

- Fair Credit (580–669): Secured loans are a smart choice here.

- Poor Credit (<580): Secured loans could be your only option with decent rates.

Remember: Collateral does not override the importance of credit history entirely.

10. Secured Loans from Banks vs. Online Lenders

| Feature | Traditional Banks | Online Lenders |

|---|---|---|

| Speed | Slower (3–10 days) | Faster (24–72 hours) |

| Interest Rates | Often lower | Slightly higher |

| Credit Requirements | Stricter | More flexible |

| Support | In-person and online | Online only |

| Appraisal Services | Usually in-house | Third-party or digital |

11. Risks Involved

- Asset Loss: Most critical risk.

- Overborrowing: You might take more than needed due to asset leverage.

- Misjudging Repayment Ability: Can lead to default and asset seizure.

- Market Value Drop: If asset value drops, refinancing or loan extensions may be denied.

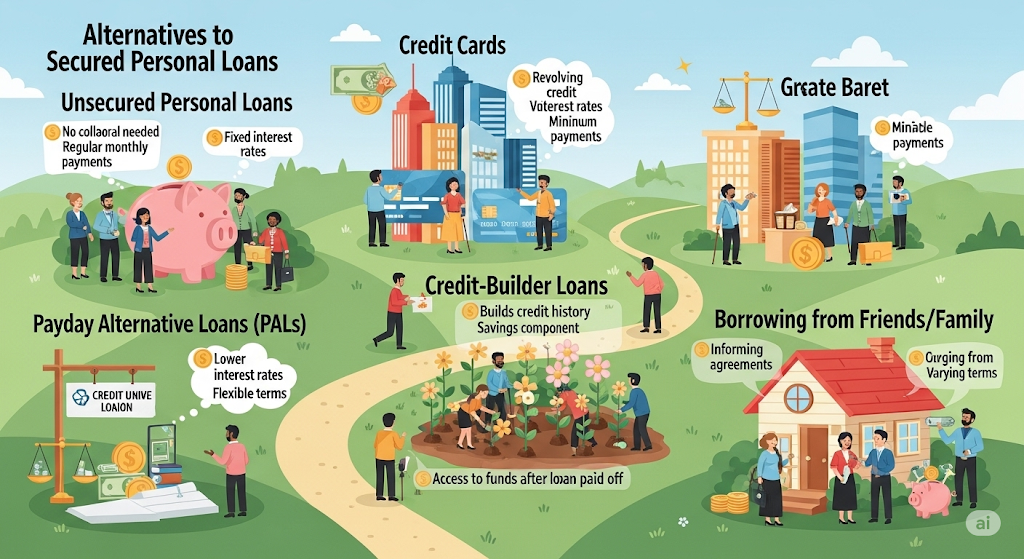

12. Alternatives to Secured Personal Loans

- Unsecured personal loans: Less risky but require better credit.

- Credit cards with 0% APR offers

- Home equity lines of credit (HELOC)

- Borrowing from friends/family

- Peer-to-peer lending platforms

- Payday alternative loans (PALs) from credit unions

13. FAQs

Q1: What’s the best collateral for a secured loan?

A: It depends on the lender, but vehicles and savings accounts are most common.

Q2: Can I use someone else’s asset as collateral?

A: Only if they co-sign or give legal consent and documentation.

Q3: Will I get my asset back after repaying?

A: Yes. Once fully repaid, the asset is released and ownership reverts to you.

Q4: Can I get a secured loan with no job?

A: If you have a strong asset and another income source (like rental income), some lenders may approve.

Q5: How fast can I get a secured loan?

A: 1–10 days depending on lender and asset type.

Q6: Will my credit score improve?

A: Yes, if payments are made on time regularly.

Q7: Can I pay off the loan early?

A: Yes, but check for prepayment penalties in the contract.

Q8: What happens if my asset loses value?

A: You may need to add more collateral or refinance under new terms.

Q9: Are secured loans good for debt consolidation?

A: Yes, especially if you need a large loan amount and lower interest.

Q10: Can I take a second loan using the same asset?

A: Typically not unless you fully repay the first or the lender allows partial re-collateralization.

14. Conclusion

A secured personal loan can be an excellent financial tool if you need money at a lower interest rate and have a valuable asset to pledge. Especially in 2025, with lending technologies evolving and more inclusive underwriting, borrowers with fair or poor credit are finding this route more accessible.

However, you must approach it with caution. Losing your home, car, or savings over missed payments can have long-term consequences. Evaluate your repayment ability, compare multiple lenders, and read the terms carefully.

If you play it smart, a secured personal loan could be your bridge to financial stability and credit growth.