Table of Contents

- Introduction

- What Is a Shared Secured Loan?

- How Shared Secured Loans Work

- Shared Secured Loan vs. Traditional Secured Loan

- Benefits of Shared Secured Loans

- Risks and Considerations

- Credit Building with Shared Secured Loans

- Eligibility and Requirements

- Where to Get a Shared Secured Loan

- How to Apply

- Shared Secured Loans for Businesses

- FAQs

- Conclusion

1. Introduction

In today’s fast-paced financial world, having good credit can unlock low-interest loans, better insurance rates, and even job opportunities. For people with little or poor credit history, a traditional loan might be out of reach. Enter the shared secured loan—a smart, low-risk tool designed to build or rebuild credit while using your own savings as collateral.

Shared secured loans are gaining popularity in 2025 among students, young professionals, and anyone looking to boost their credit health. Let’s break down everything you need to know about them.

2. What Is a Shared Secured Loan?

A shared secured loan is a type of credit-builder loan backed by a savings account or certificate of deposit (CD) that you already own. Unlike a traditional loan that gives you money upfront, a shared secured loan locks your funds in a savings account while you make monthly payments to “pay off” the loan. When you complete the term, you get your money back—plus a better credit score.

Example:

You deposit $2,000 into a savings account. The bank “loans” you $2,000 and holds your deposit as collateral. You make monthly payments with interest, and when the loan is repaid, you get your $2,000 back.

3. How Shared Secured Loans Work

Step-by-Step Process:

- Deposit Funds: Open a savings or CD account and deposit an amount (e.g., $500–$10,000).

- Loan Setup: The lender issues a loan equal to or less than your deposit.

- Funds Frozen: The amount is frozen and cannot be accessed during the loan term.

- Monthly Payments: You repay the loan in fixed monthly installments, usually with a low interest rate.

- Credit Reporting: Each payment is reported to the credit bureaus.

- Funds Released: When the loan is paid off, your funds are unlocked.

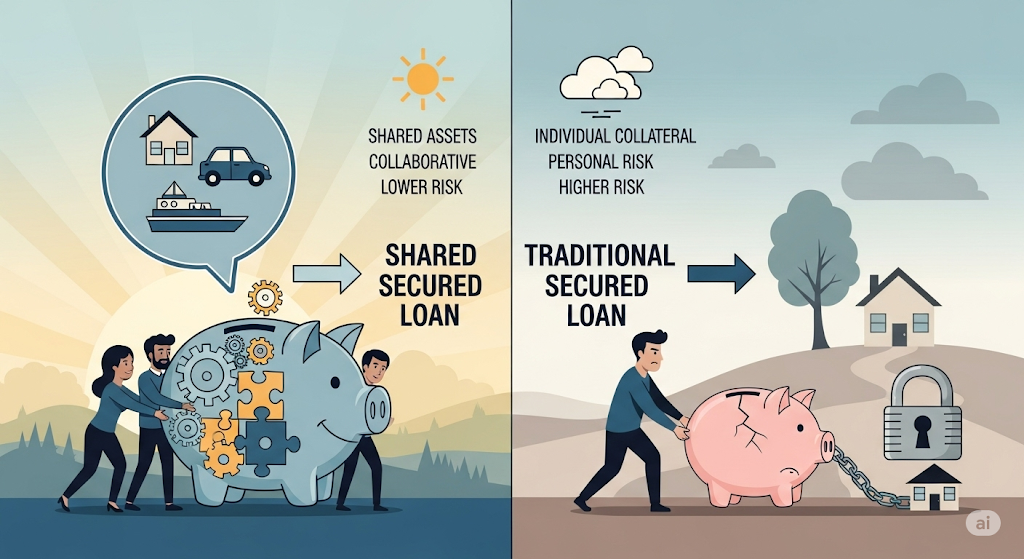

4. Shared Secured Loan vs. Traditional Secured Loan

| Feature | Shared Secured Loan | Traditional Secured Loan |

|---|---|---|

| Collateral | Your own savings or CD | Vehicle, property, etc. |

| Funds Received | Often restricted or held | Given upfront |

| Primary Purpose | Credit building | General borrowing |

| Interest Rates | Very low | Varies |

| Approval Odds | High | Moderate to high |

| Risk to Borrower | Very low | Higher (asset loss) |

5. Benefits of Shared Secured Loans

✅ Credit Building

- Every on-time payment helps build or repair your FICO and VantageScore.

- Reports to major credit bureaus: Experian, Equifax, and TransUnion.

✅ Low Interest Rates

- Typically lower than unsecured credit-builder loans since you’re using your own money.

✅ High Approval Rate

- Because it’s secured by your own deposit, nearly everyone qualifies.

✅ Savings + Discipline

- Encourages financial discipline by locking your money while building your credit.

✅ Safe for Lenders and Borrowers

- No risk of losing a home or vehicle.

- Lenders are protected, and you recover your money at the end.

6. Risks and Considerations

While shared secured loans are low-risk, here are a few points to keep in mind:

- Locked Funds: You won’t have access to the savings until the loan is fully repaid.

- Missed Payments: Late or missed payments can still hurt your credit score.

- Interest Paid: You pay interest on your own money (though minimal).

- Not Ideal for Emergencies: Because funds are frozen, they can’t be used for emergencies during the loan term.

7. Credit Building with Shared Secured Loans

Shared secured loans are specifically designed to build or rebuild credit. Here’s how they help:

- Payment history (35%): Timely payments boost your score.

- Credit mix (10%): Adds installment credit to your profile, improving your mix.

- Length of credit (15%): Great for young borrowers starting out.

Tip:

Set up auto-pay to ensure you never miss a payment.

8. Eligibility and Requirements

Most banks and credit unions have very simple eligibility criteria:

- Must be at least 18 years old

- Must have valid ID and Social Security Number (or Tax ID)

- Initial deposit in a savings or CD account (typically $300–$5,000)

- U.S. citizenship or permanent residency

No credit score requirement!

9. Where to Get a Shared Secured Loan

Shared secured loans are most commonly offered by:

- Credit unions (e.g., Navy Federal, Alliant, DCU)

- Community banks

- Online fintech lenders (like Self, MoneyLion)

- National banks (limited availability)

Credit Union Example:

Alliant Credit Union offers a shared secured loan starting at $500 with terms from 12 to 60 months.

10. How to Apply

Steps to Apply:

- Open a Savings Account or CD: Deposit the amount you want to use.

- Request a Shared Secured Loan: Choose a term (6 to 60 months is typical).

- Review Terms: Understand interest rates, monthly payments, and how your funds will be held.

- Sign the Agreement: A legally binding loan contract.

- Begin Repayment: Your payments start the following month.

Most institutions allow online applications and instant approval.

11. Shared Secured Loans for Businesses

Shared secured loans can also benefit small business owners in a few ways:

- Business Credit Building: Establish credit history for a new business.

- Low-Risk Capital Access: Use business savings to secure a working capital loan.

- Financial Planning: Great for managing cyclical cash flow without external debt.

Some banks offer shared secured business credit cards as well.

12. FAQs

Q1: Can I get denied for a shared secured loan?

A: Rarely. Unless you have legal issues or banking restrictions, approval is easy.

Q2: Will it affect my credit score negatively?

A: Only if you miss or make late payments. Otherwise, it boosts your score.

Q3: How much interest will I pay?

A: Typically 2–5% APR, much lower than unsecured credit-builder loans.

Q4: Can I access my money during the loan term?

A: No. The funds remain frozen until the loan is paid off.

Q5: How long should I take the loan for?

A: 12–24 months is ideal. Long enough to build credit, but not too burdensome.

Q6: Can I repay the loan early?

A: Yes, and usually with no penalty. This may reduce your interest costs.

Q7: Is this better than a secured credit card?

A: For credit-building, both are useful. A shared secured loan builds installment credit, while credit cards build revolving credit.

13. Conclusion

A shared secured loan is one of the safest, easiest, and smartest ways to build or repair your credit in 2025. It’s especially helpful for:

- Young adults with no credit history

- People recovering from bankruptcy or financial setbacks

- Immigrants and new residents in the U.S.

- Anyone looking for a low-risk way to improve credit health

You get your money back, improve your credit score, and show lenders you’re responsible—all without risking your car or home. As more people become financially literate and credit-conscious, shared secured loans will only continue to rise in popularity.