Introduction

Low-Cost Roofing Loans in Washington State Is your roof aged, damaged, or leaking—but your wallet can’t handle a full cash payment? Good news: Washington State offers multiple low-cost loan and grant solutions to help homeowners finance roof repairs or replacements affordably, even if you have limited savings or poor credit.

In this all‑inclusive 2025 guide, we’ll explore state and federal programs, credit union offers, contractor financing options, eligibility criteria, interest rates, real-life examples, and step-by-step strategies to land the best deal and keep your home safe and dry—without financial strain.

Why Roofing Loans Matter in Washington

- The average roof replacement in Washington costs between $10,000–$15,000.

- Delaying repairs can lead to mold, structural damage, and insurance issues.

- Many qualifying homeowners can access 1% USDA loans, 0% contractor promotions, or flexible CU financing for up to 15 years.

- These finance plans help protect home equity, preserve savings, and allow manageable monthly payments.

Section 1: Government & Grant Programs You Should Know

USDA Section 504 Single Family Housing Repair Loan & Grant

- Available statewide for very low-income homeowners in eligible rural areas.

- Max loan: $40,000 at 1% interest, fixed for 20 years.

- Max grant: $10,000 for homeowners aged 62+ (combined aid up to $50K)

- Ideal for homeowners on fixed incomes needing essential repairs like roofing or electrical fix.

Washington State Home Rehabilitation Grant Program (HRGP)

- For low-income residents in rural Washington areas.

- Supports health, safety, durability improvements—including roof repairs and replacements

- Grants don’t need to be repaid unless the home is sold within 3 years.

Section 2: Credit Union and Home Improvement Loans

Local Credit Unions (e.g. Salal, BECU)

- Salal Credit Union offers financing in partnership with local roofers:

- Rates as low as 7.99% APR, loan amounts from $1,000–$75,000 over up to 12 years

- BECU Home Improvement Loan:

- Unsecured, no equity needed

- Fixed rate ~9.49% APR, borrow up to $35,000

- Can be used for roofing, siding, gutters, etc.

Why go this route?

- Faster approval than mortgage refinance

- No equity needed

- Often no prepayment penalties

Section 3: Contractor Financing Options

Many roofing companies in Washington now partner with finance providers like Hearth, Greensky, or Salal Credit Union to offer special loan packages:

- Washington Roofing partners:

- 0% interest for 6–12 months (on approved credit)

- Long‑term financing up to 10–15 years

- No money down options available for qualified homeowners

- Specialty Exteriors:

- Financing rates starting as low as 9.99% APR (credit-dependent)

- Example monthly payments for $12,895–$14,212 roof:

- 1-year plan: ~$1,075–$1,184/mo

- 5-year plan: ~$215–$237/mo

Section 4: Which Financing Option Fits You Best?

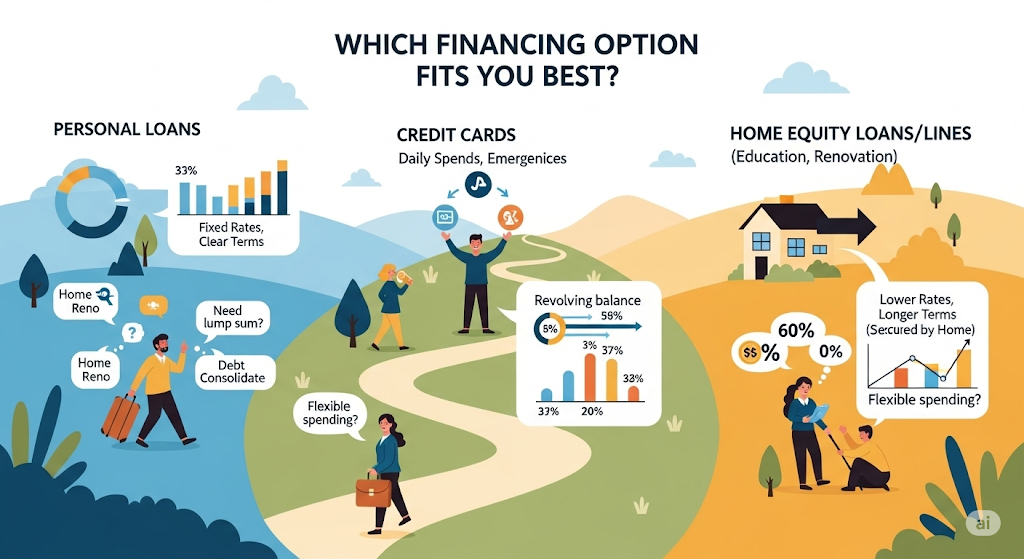

| Financing Option | Interest / Terms | Best For |

|---|---|---|

| USDA 504 Loan (rural, low-income) | 1% interest, up to $40K loan | Elderly or low-income rural homeowners |

| HRGP Grant | No repayment (if resident ≥3 yrs) | Disabled or seniors needing repairs |

| Credit Union Loans (Salal, BECU etc.) | ~8–10% APR, 5–12 yrs | Moderate credit and income homeowners |

| Contractor Financing (Hearth, etc.) | 0% (6–12 mo promo), ~10%+ after | Fast approvals, flexible plans |

| HELOC or Home Equity Loan | Variable or fixed, equity required | If you prefer lower interest over shorter term |

Section 5: How to Qualify & Apply

Step 1: Determine eligibility

- Are you in a rural area for USDA or HRGP? Try address lookup.

- Does your income fall under low-income limits (200% FPL or 80% AMI)? Check program guides.

Step 2: Gather documentation

- Proof of income, home ownership, identity, insurance

- Estimates from licensed WA roofing contractors

Step 3: Compare terms carefully

- Watch for prepayment penalties, variable vs. fixed APRs

- Confirm loan origination fees, title costs, or escrow charges

Step 4: Timing matters

- Contractor loans with 0% promo: pay within 6–12 months to avoid interest.

- Federal/Grant programs: may take 4–12 weeks for approval—plan accordingly.

Section 6: Real Borrower Insights (Reddit & Real-world Examples)

- Reddit user: Used a HELOC at 5.99% interest to finance roof replacement; praised flexibility and tax deductibility

- Another homeowner: Used a contractor’s 0% financing offer and paid balance early without penalty

- Mortgage market advice: Always check rate and early payoff terms—most lender programs can be accessed directly, even if offered through contractors

Section 7: Key Statistics & Why It Matters

- Roof replacements in WA cost average ~$12K–$15K (Specialty Exteriors pricing)

- USDA loans offer 1% interest, dramatically lower than conventional rates for eligible homeowners

- HRGP and repair grants target incomes up to 200% FPL (~$64K for 4-person household)

Section 8: Mistakes to Avoid

- Accepting first loan offer without comparing

- Ignoring prepayment penalties

- Using high‑interest credit card instead of structured financing

- Failing to verify contractor credentials, licensing, and insurance

- Thinking HELOC is always best—only if you have equity and plan future remodels

Conclusion

Washington State homeowners can access multiple low-cost roofing loans and grant programs to keep their homes safe and structurally sound—even on a tight budget or limited equity. Whether you’re eligible for USDA’s 504 or HRGP, want a fixed-rate credit union loan, or prefer 0% short-term contractor financing, there’s a solution tailored to your circumstances.

Key takeaways:

- Act early to avoid further damage

- Compare multiple options before choosing

- Read the fine print before signing

- Keep documentation for tax purposes (some interest is deductible)

🔟 FAQs

- Can I qualify if I don’t live in a rural area?

USDA repair loans require rural designation. For urban areas, credit unions or contractor financing may be better. - Is there a prepayment penalty on most loans?

Credit union and USDA loans typically allow early payoff without penalty; verify for contractor credit. - Can I use a roofing grant if I only need minor repairs?

Some programs require full replacement or significant health‑safety work to qualify. - How long do approvals take?

Government programs: 4–12 weeks; credit unions or contractor loans: days to a couple weeks. - Do I need homeowners insurance?

Most lenders require proof of active homeowners insurance before funding. - Does my credit score matter?

Yes—credit unions and contractors will check credit, though USDA considers inability to access other affordable credit. - Is it better to use a HELOC?

Only if you have sufficient equity and need flexible funding for future projects—but it risks your home if unpaid. - Are there energy-efficiency incentives if I install a reflective or solar roof?

Potentially yes—explore PACE programs or solar rebates, though roofing alone may not qualify unless tied to efficiency upgrades. - Will roofing loans increase my property taxes?

Not unless using a PACE assessment, which attaches as a property tax line item. - Can I refinance these loans later if my credit improves?

Yes. Refinancing through credit unions or FHA Title I lenders can reduce interest and monthly payments.

By understanding and leveraging available roofing financing options in Washington State—especially USDA, HRGP, credit unions, and contractor plans—you can secure a safe, durable roof without draining your savings or delaying essential repairs. Thinking ahead and comparing offers pays off in peace of mind, savings, and lasting home protection.