How to Lease a Car with Bad Credit: A Complete 2025 Guide

Table of Contents

- Introduction

- Understanding Bad Credit

- Can You Lease a Car with Bad Credit?

- Challenges of Leasing with Poor Credit

- Step-by-Step Guide to Leasing with Bad Credit

- Best Cars to Lease with Bad Credit in 2025

- Tips to Improve Your Lease Approval Odds

- Alternatives to Leasing

- How Leasing Affects Your Credit Score

- FAQs

- Conclusion

Introduction

If you’re struggling with a low credit score but still need reliable transportation, you may be wondering if leasing a car with bad credit is even possible. The short answer? Yes—but with a few hurdles.

While many car leases are geared toward people with solid credit, there are practical workarounds for individuals with credit scores below 600. In this blog, we’ll guide you step-by-step through the leasing process, outline your options, and share expert-backed tips to help you get approved even with bad credit in 2025.

Understanding Bad Credit

What Is a Bad Credit Score?

Your FICO credit score is typically classified as:

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

Most auto lease companies prefer 670 or higher. If your score falls below 670, you’re considered a subprime lessee.

Why Does Credit Matter When Leasing?

Leasing companies want to ensure that you’ll make your monthly payments. A poor credit score signals risk—which may result in higher monthly payments, a larger down payment, or lease denial.

Can You Lease a Car with Bad Credit?

Yes, but it’s more difficult. Here’s how:

- Standard lease terms may not apply

- You might need to put more money down

- You may be required to add a cosigner

- You’ll likely pay higher interest (money factor)

Challenges of Leasing with Poor Credit

1. Higher Money Factor (Interest Rate Equivalent)

Lenders charge more interest to offset the perceived risk.

2. Increased Down Payment

You may be asked to put down $2,000–$5,000+ upfront.

3. Limited Vehicle Options

You may not qualify for luxury or high-demand models.

4. Strict Lease Terms

Fewer miles, stricter penalties, or non-negotiable buyout clauses.

5. Credit Checks

Multiple rejections can lower your credit score further.

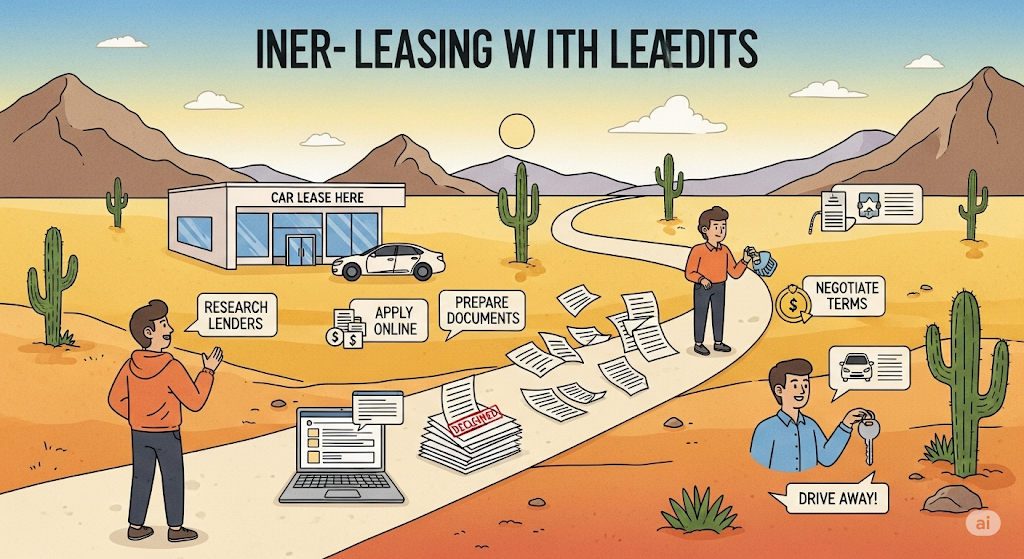

Step-by-Step Guide to Leasing with Bad Credit

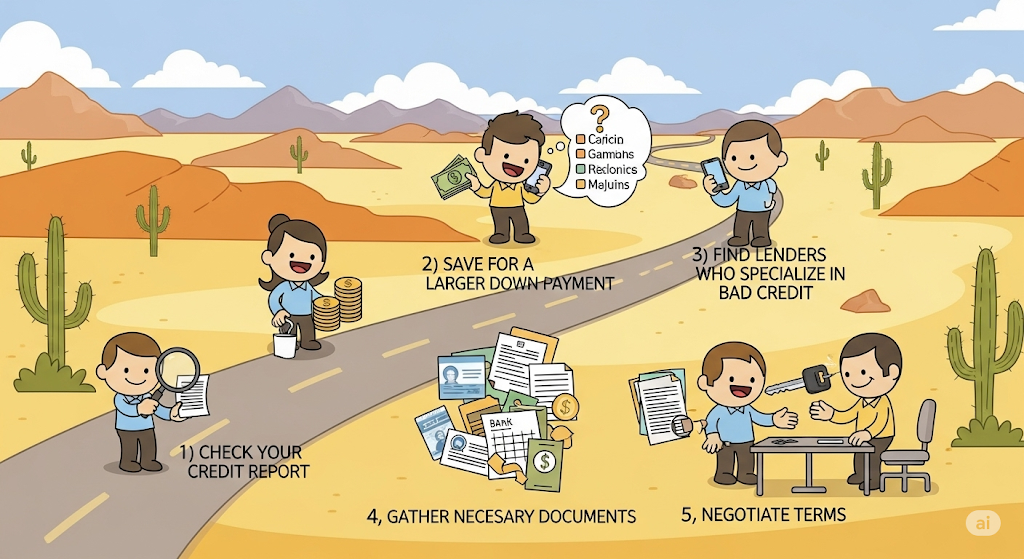

Step 1: Know Your Credit Score

Check your score through platforms like:

- Credit Karma

- Experian

- MyFICO

Step 2: Set a Realistic Budget

Factor in:

- Monthly payment

- Insurance

- Fuel

- Lease acquisition fees

- Maintenance

Use the 20/4/10 rule as a baseline:

- 20% down

- 4-year lease or less

- 10% of monthly income on total car expenses

Step 3: Save for a Larger Down Payment

A larger down payment lowers your:

- Monthly lease payment

- Risk to the leasing company

Step 4: Consider a Cosigner

A cosigner with excellent credit increases your approval odds.

Step 5: Shop Subprime-Friendly Dealerships

Look for dealers or automakers with programs tailored to bad credit (more on this below).

Step 6: Review the Lease Terms Carefully

Watch out for:

- Hidden fees

- Mileage limits

- Early termination clauses

Best Cars to Lease with Bad Credit in 2025

Some manufacturers offer subprime lease programs or second-chance financing:

🟢 Toyota

Known for reliability and flexible leasing, Toyota Financial Services is friendly toward credit scores above 580.

🟢 Hyundai

Offers some of the most affordable lease options with low upfront payments.

🟢 Kia

Similar to Hyundai, often works with subprime borrowers.

🟢 Nissan

Participates in NMAC SignaturePURCHASE program, great for rebuilding credit.

🟢 Chevrolet & Ford

Domestic manufacturers often run incentive programs for low-credit customers.

Tips to Improve Your Lease Approval Odds

✅ Check Your Credit Report

Dispute errors that could unfairly drag your score down.

✅ Get Pre-Approved

Credit unions and online lenders may pre-qualify you without affecting credit.

✅ Lower Your Debt-to-Income Ratio

Pay off credit cards or existing loans.

✅ Lease a Lower-Value Vehicle

A compact sedan or used certified lease can drastically improve approval chances.

✅ Time Your Lease Right

The end of the quarter or model year is when dealerships are more flexible.

✅ Improve Your Credit Score

Even a 20-point increase can help. Pay all bills on time and keep credit utilization low.

Alternatives to Leasing

If leasing doesn’t work out, here are options:

1. Buy a Used Car with a Subprime Auto Loan

- Higher interest rates

- But better long-term asset ownership

2. Rent-to-Own Programs

- No credit check

- Higher monthly cost, but flexible

3. Ride-Sharing or Subscription Services

- Temporary solution while improving credit

4. Buy Here, Pay Here Dealers

- Local dealerships that offer in-house financing

How Leasing Affects Your Credit Score

Leasing can help rebuild your credit if:

- You make on-time payments

- Keep inquiries limited

- Avoid early lease termination

Missing lease payments or defaulting can severely damage your credit for 7+ years.

FAQs

Q1: What credit score do I need to lease a car in 2025?

Typically 670+, but some dealerships lease to individuals with 580 or higher.

Q2: Will I need a cosigner?

If your credit is below 600, a cosigner significantly improves your approval odds.

Q3: Can I lease a luxury car with bad credit?

Unlikely. Luxury brands have stricter credit requirements. Consider starting with an economy model.

Q4: Does leasing affect my credit?

Yes. Leasing shows up as a line of credit on your credit report and affects utilization and payment history.

Q5: Is leasing better than buying with bad credit?

Leasing may have lower upfront costs, but buying helps build equity in the long term.

Q6: How do I find lease deals for bad credit?

Use filters on websites like:

- Autotrader

- Cars.com

- TrueCar

- Manufacturer sites

Q7: What documents do I need to lease a car?

- Proof of income (paystubs or bank statements)

- Valid driver’s license

- Proof of residence

- Insurance

Q8: What is the money factor?

It’s the lease equivalent of an interest rate. Multiply the money factor by 2,400 to get the APR.

Q9: Will pre-qualification hurt my credit?

No. Soft inquiries for pre-qualification won’t impact your score.

Q10: Can I negotiate lease terms even with bad credit?

Yes. Especially at month-end or quarter-end, dealers may be more flexible.

Conclusion

Leasing a car with bad credit in 2025 isn’t just a pipe dream—it’s entirely possible with the right preparation, research, and mindset. While you may face higher costs or more restrictions than someone with stellar credit, taking the right steps can get you approved—and even help rebuild your credit score over time.

Whether you’re rebuilding after financial hardship or just starting out with limited credit, be strategic, ask questions, and don’t settle for a bad deal. And always read the fine print.