Introduction – Why Payday Loans Are Popular in Shreveport

Shreveport, Louisiana, is no stranger to financial ups and downs. From rising utility bills to unexpected car repairs, residents often find themselves in need of quick cash. Payday loans in Shreveport offer a fast solution—often providing funds within hours—but they also come with high costs and strict repayment timelines. For some, these short-term loans bridge the gap between paychecks; for others, they create long-term debt challenges. This guide breaks down everything you need to know before walking into a payday lender or applying online.

Understanding Payday Loans in Shreveport

A payday loan is a small, short-term cash advance—typically $100 to $500—meant to be repaid in full on your next payday. In Louisiana, state law allows lenders to charge up to $45 in fees for a $300 loan, which translates into an annual percentage rate (APR) that can exceed 400%.

Payday loans are easy to obtain because they require minimal documentation: proof of income, a valid ID, and a bank account. But the simplicity comes at a cost—if you can’t repay on time, fees pile up fast.

Example:

Sarah, a Shreveport resident, borrowed $300 to cover a medical bill. When she couldn’t pay it back in two weeks, the loan rolled over with an additional $45 fee, quickly making her $300 debt a $390 burden in just one month.

Payday Loan Laws in Louisiana

Louisiana has specific payday lending regulations that directly impact Shreveport borrowers.

Key Legal Points:

- Loan Amount Cap: Maximum $350 per loan

- Term Limit: Minimum 10 days, maximum 30 days

- Fee Cap: Up to $45 for $300 borrowed

- No Rollovers Allowed: Borrowers can’t renew the same loan, but they can take another loan after paying off the first one.

Data Insight: According to the Louisiana Office of Financial Institutions, over 60% of payday loan borrowers in the state take out more than one loan per year, showing how common repeat borrowing is.

Pros and Cons of Payday Loans in Shreveport

Payday loans can be both a lifeline and a financial trap. Here’s the balance:

Advantages:

- Speed: Same-day cash for emergencies

- Accessibility: Available to those with poor credit

- Simplicity: Minimal paperwork and instant approvals

Disadvantages:

- High APR: Often over 400% annually

- Short Repayment Terms: Usually due within 14–30 days

- Risk of Debt Cycle: Repeat borrowing can lead to financial strain

Example:

James took a $200 payday loan for car repairs. The short repayment window and $30 fee didn’t seem like much, but when his paycheck was already stretched thin, he had to borrow again—doubling his debt in two months.

Online vs. Storefront Payday Loans in Shreveport

Shreveport borrowers can choose between physical payday loan stores and online lenders.

Storefront Loans:

- Pros: Face-to-face interaction, cash in hand immediately, easier to ask questions

- Cons: Limited business hours, need to travel to the location

Online Loans:

- Pros: Apply 24/7, convenient from home, faster deposits for some lenders

- Cons: Risk of scams, possible hidden fees, no in-person verification

Tip: Always verify that an online lender is licensed in Louisiana via the Office of Financial Institutions database before applying.

Eligibility Criteria for Payday Loans in Shreveport

While payday loans in Shreveport are easier to qualify for than traditional bank loans, there are still basic requirements you must meet. These criteria ensure lenders reduce their risk while keeping the process simple for borrowers.

Basic Requirements:

- Minimum age of 18 years

- Proof of steady income (pay stubs, benefits letter, or bank statements)

- Valid government-issued photo ID

- Active checking account in your name

Example:

Denise, who works part-time at a Shreveport diner, was approved for a $250 payday loan despite her poor credit score. Because she could show three months of consistent income deposits, the lender processed her loan the same day.

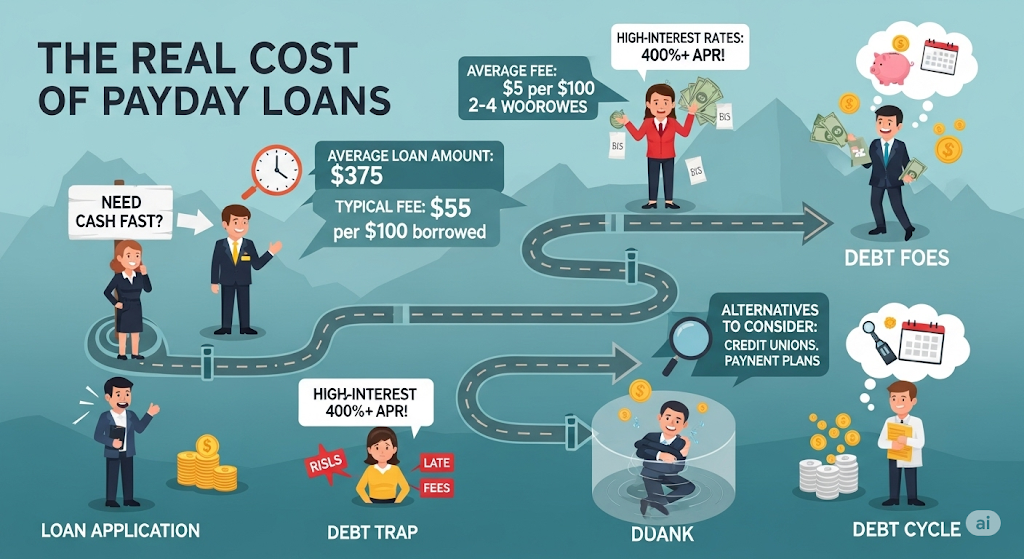

Cost of Payday Loans – The Real Numbers

Payday loans are often marketed as small, short-term solutions, but the costs can be surprisingly high when calculated annually.

In Louisiana, for a $300 loan, a $45 fee is typical. While $45 might not seem like much, when you annualize that over a 14-day term, the APR exceeds 391%.

Example Calculation:

- Loan amount: $300

- Fee: $45

- Term: 14 days

- Effective APR: ~391%

If you roll over the loan or take out another right after repaying the first, the costs multiply quickly—trapping borrowers in a debt cycle.

Common Reasons People in Shreveport Use Payday Loans

Payday loans are almost always tied to urgent, unplanned expenses. In Shreveport, the most common reasons borrowers turn to these loans include:

- Emergency Car Repairs: Essential for those commuting to work in areas with limited public transport.

- Medical Bills: Especially for uninsured or underinsured residents facing sudden health costs.

- Utility Bills: To avoid disconnection during high-usage months like summer or winter.

- Rent Payments: Preventing eviction when paychecks fall short.

Example:

Brandon’s car broke down two days before payday. Without the $220 he borrowed from a payday lender, he couldn’t have repaired it in time to keep his job.

Risks of Payday Loans in Shreveport

While payday loans offer quick relief, they also carry significant risks—particularly for low-income borrowers who already live paycheck to paycheck.

Main Risks:

- Debt Cycle: Borrowers often take out new loans to repay existing ones.

- High Fees: Can exceed the original loan amount in a matter of months.

- Bank Account Seizures: Lenders can withdraw directly from your bank account, leading to overdraft fees.

- Credit Damage: Unpaid loans sent to collections can tank your credit score.

Data Insight:

A report by the Center for Responsible Lending found that 80% of payday loans are renewed or rolled over, indicating how common repeat borrowing is.

Legal Protections for Borrowers in Shreveport

Louisiana law provides some safeguards for payday loan customers, although they may not be as strict as in other states.

Borrower Protections Include:

- No more than one loan at a time per borrower with a single lender

- Written disclosure of all fees and repayment terms

- Right to repay early without penalty

Pro Tip:

Always request a copy of the loan agreement and keep it for your records. In case of disputes, you can contact the Louisiana Office of Financial Institutions for assistance.

Online Payday Loans in Shreveport – Convenience at Your Fingertips

In recent years, online payday loans have become a go-to option for Shreveport residents who need quick cash without visiting a physical store. The biggest advantage is convenience — you can apply 24/7 from your home or even on your phone during a lunch break.

Most online lenders in Louisiana offer same-day or next-day funding if you meet their eligibility criteria and submit your application early in the day. However, this convenience comes with a warning: online scams are more common in the payday lending space.

Many unlicensed lenders operate outside state regulations, charging hidden fees or misrepresenting repayment terms. Before applying, borrowers should verify that the lender is licensed by the Louisiana Office of Financial Institutions to ensure they are protected under state law.

Storefront Payday Lenders – Face-to-Face Service in Shreveport

Despite the growth of online lending, many Shreveport residents still prefer traditional storefront payday lenders. Visiting a physical location allows for personal interaction, immediate cash disbursement, and the opportunity to ask questions directly to a representative. This face-to-face approach can be reassuring for borrowers who are unfamiliar with the process or concerned about sharing personal details online.

However, storefront lenders have limited operating hours and require travel, which may be inconvenient for people with busy schedules or limited transportation. Additionally, while they provide in-person service, the costs and APRs are often identical to those of online lenders, meaning the convenience of immediate cash may still come at a steep price.

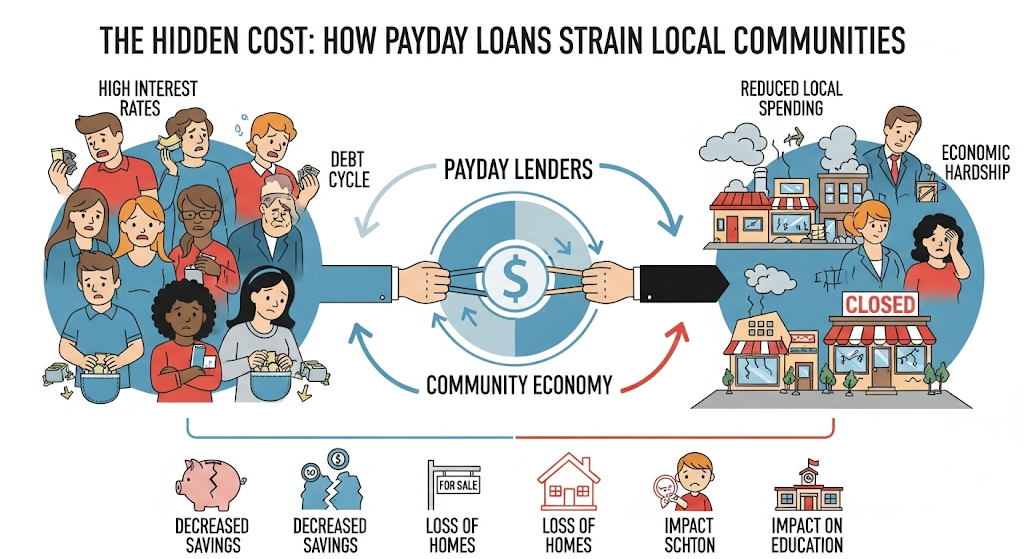

The Impact of Payday Loans on Local Communities

Payday loans in Shreveport don’t just affect individual borrowers — they also impact the broader community. Because these loans often carry high fees and short repayment terms, they can drain disposable income from neighborhoods, reducing spending in local businesses.

Studies from the Pew Charitable Trusts show that in states like Louisiana, millions of dollars leave the local economy each year due to payday loan fees. This loss of capital could otherwise support small businesses, fund local projects, and strengthen community growth.

The concentration of payday lenders in lower-income areas also raises concerns about financial inequality, as residents in these neighborhoods may have fewer affordable credit options and face more aggressive marketing from lenders.

Financial Alternatives to Payday Loans in Shreveport

While payday loans might seem like the fastest solution to a financial emergency, there are alternative options available in Shreveport that can be less costly and more sustainable. Local credit unions offer Payday Alternative Loans (PALs) with lower interest rates and more flexible repayment terms. Nonprofit organizations and community assistance programs may also provide short-term aid for rent, utilities, or medical expenses.

Additionally, some employers in Shreveport partner with earned wage access platforms, allowing employees to receive a portion of their paycheck early without paying high fees. Choosing these alternatives can help break the cycle of debt and keep more money in the borrower’s pocket over time.

How to Borrow Responsibly in Shreveport

Responsible borrowing starts with a clear understanding of your financial situation and a realistic repayment plan. Before taking out a payday loan, borrowers should calculate whether they can repay the full amount plus fees with their next paycheck without falling short on essential expenses like rent, utilities, and groceries.

It’s also wise to borrow only the minimum amount needed to cover the emergency, rather than the maximum allowed by the lender. Avoid back-to-back loans, as this is one of the fastest ways to get trapped in a debt cycle. Keeping detailed records of each loan, payment date, and total fees can also help maintain control over borrowing habits.

By approaching payday loans as a last-resort, short-term solution rather than a recurring source of credit, borrowers can protect their financial stability and reduce long-term risk.

Payday Loan Regulations in Shreveport and Louisiana

Louisiana has specific laws that govern payday lending, designed to offer some protections to borrowers while still allowing lenders to operate. In Shreveport, payday loan amounts are capped at $350, with a maximum loan term of 30 days. Lenders can charge up to $45 in fees for loans up to $220, plus an additional $20 for every $100 borrowed beyond that amount.

While this might seem reasonable at first glance, when translated into APR, these fees can result in interest rates well over 400% annually. Importantly, Louisiana law allows borrowers to request an extended payment plan once every 12 months without additional fees, provided the request is made before the loan is due. This regulation aims to reduce rollover cycles that trap borrowers in long-term debt, but many people are unaware of this right.

Example:

Tanya from Shreveport borrowed $300 to cover urgent car repairs. She didn’t know she could request an extended payment plan and ended up rolling over her loan twice, paying $180 in fees on top of the original amount.

Common Myths About Payday Loans in Shreveport

Payday loans often carry a lot of misconceptions, and these myths can influence how borrowers approach the decision. One common myth is that payday loans improve credit scores — in reality, most lenders in Shreveport don’t report on-time payments to credit bureaus.

Another myth is that “guaranteed approval” loans truly exist; legitimate lenders will always verify income, identification, and banking details before funding. Many also believe that payday loans are the cheapest way to handle emergencies, but in truth, their high fees can make them one of the most expensive forms of borrowing.

Quick Points:

- Myth: Payday loans are a long-term solution — Fact: They are designed for short-term use only.

- Myth: Only people with bad credit use payday loans — Fact: Many borrowers have fair or even good credit but lack immediate cash.

- Myth: Payday lenders don’t care about repayment ability — Fact: They assess income and bank activity before lending.

Seasonal Payday Loan Trends in Shreveport

In Shreveport, payday loan usage spikes at certain times of the year, often linked to predictable financial pressures.

Peak Times Include:

- December–January: Increased borrowing to cover holiday spending and higher winter utility bills.

- August–September: Back-to-school expenses for families with children.

- April: Tax season obligations, including IRS payments.

Data from local lenders suggests applications can rise by 25% during December alone.

Example:

Marcus took a $250 payday loan in December to buy gifts for his two children. By January, he faced high electric bills due to cold weather, forcing him to roll over the loan twice. This turned the original $250 loan into a $400 repayment obligation, highlighting how seasonal borrowing can spiral into long-term debt.

Payday Loan Scams Targeting Shreveport Residents

With the rise of online payday lending, scams have become more prevalent. Fraudulent lenders often operate without licenses, promising “instant guaranteed approval” to lure in desperate borrowers. Once they collect sensitive personal information, they may withdraw unauthorized funds, sell the data, or charge “processing fees” without ever providing the loan.

Warning Signs Include:

- Requests for upfront fees before loan approval.

- Lenders unwilling to provide a physical address or license details.

- Aggressive sales tactics and threats of legal action for nonpayment before the loan is due.

- Example:

Linda applied for a payday loan online and was told she had been “approved instantly.” The lender asked for a $60 “wire transfer fee” to release the funds. She paid it — but the money never came, and the lender stopped responding.

Conclusion – Borrowing Smarter in Shreveport

Payday loans in Shreveport can be a financial lifeline for residents facing unexpected expenses, but they are far from risk-free. Understanding local regulations, knowing your rights as a borrower, and recognizing the warning signs of scams are crucial for making informed decisions.

Whenever possible, explore alternatives like credit union loans, employer cash advances, or community assistance programs. If you do choose to use a payday loan, borrow the smallest amount necessary, create a repayment plan before you sign, and avoid back-to-back borrowing.

In the end, smart borrowing is about maintaining control over your finances — not letting high-interest debt control you.

Frequently Asked Questions (FAQs) About Payday Loans in Shreveport

1. Are payday loans legal in Shreveport, Louisiana?

Yes, payday loans are legal in Shreveport under Louisiana state law. Loan amounts are capped at $350, with a maximum term of 30 days. Fees are regulated, but the effective APR can still exceed 400%, so borrowers should proceed with caution.

2. How much can I borrow with a payday loan in Shreveport?

In Louisiana, the maximum payday loan amount is $350. This includes the principal and any fees. If you need more than this, you may have to look for other short-term lending options, such as installment loans or personal loans from a credit union.

3. Can payday loans in Shreveport help build my credit?

Typically, no. Most payday lenders in Shreveport do not report repayment activity to major credit bureaus unless the account goes to collections. If you’re aiming to build credit, consider secured credit cards or credit-builder loans instead.

4. How quickly can I get funds from a payday loan?

In most cases, you can receive funds within 24 hours — sometimes the same day. Online lenders may deposit directly into your bank account, while storefront lenders can provide cash immediately upon approval.

5. What happens if I can’t repay my payday loan on time?

If you can’t repay by the due date, you may roll over the loan for an additional fee or enter an extended payment plan (available once every 12 months by law). However, repeated rollovers can quickly increase your total debt.

6. Can active-duty military members get payday loans in Shreveport?

Yes, but they are protected under the Military Lending Act, which caps the APR at 36% and prohibits certain lender practices. Many military families opt for low-interest loans from credit unions or military aid organizations instead.

7. Are there online payday loan scams in Shreveport?

Yes, scams are common. Beware of lenders requesting upfront fees, lacking a physical address, or pressuring you into quick decisions. Always verify that the lender is licensed in Louisiana before applying.

8. What alternatives exist to payday loans in Shreveport?

Alternatives include credit union Payday Alternative Loans (PALs), employer paycheck advances, community assistance programs, and borrowing from friends or family. These options often have lower costs and fewer risks.

9. Is there a limit on how many payday loans I can have at once in Shreveport?

Louisiana law does not allow multiple outstanding payday loans from the same lender. However, you could technically take loans from different lenders, though this is strongly discouraged due to high repayment burdens.

10. How can I find a licensed payday lender in Shreveport?

You can check the Louisiana Office of Financial Institutions website for a list of licensed payday lenders. This helps ensure you are dealing with a legitimate business that complies with state regulations.