Understanding Payday Loans in Chicago

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They are typically due on the borrower’s next payday, hence the name. These loans often come with high interest rates and fees, making them a costly borrowing option. Illinois, and specifically Chicago, has specific regulations governing payday loans to protect consumers from predatory lending practices, but awareness of these regulations is crucial for responsible borrowing.

Understanding the terms and conditions of a payday loan is vital before you sign. This includes thoroughly reviewing the Annual Percentage Rate (APR), which represents the total cost of borrowing, including interest and fees. “Failing to understand the APR can lead to unforeseen debt burdens,” significantly impacting your financial well-being. Compare offers from different lenders to find the most favorable terms, and always explore alternative financing options before resorting to a payday loan, such as borrowing from friends or family, or using a credit card. Remember, responsible borrowing practices are essential to avoid a cycle of debt.

How Payday Loans Work in Illinois

In Illinois, payday loans, also known as short-term loans, function as small, high-interest cash advances. Borrowers receive a lump sum, typically due on their next payday. The lender will usually require access to your bank account to automatically debit the repayment. This ease of access is a key attraction, but it also highlights the potential for rapid debt accumulation if repayment is missed. Interest rates are capped by state law, but they remain significantly higher than traditional loan options. It’s crucial to understand these rates before committing.

Before taking out a Chicago payday loan, carefully consider all fees and charges. These added costs can quickly inflate the total amount owed. Illinois law limits the amount a lender can charge in fees, but these still represent a substantial portion of the loan amount. Always compare offers from multiple lenders to find the most favorable terms. “Failing to do your research can lead to unexpected and crippling debt.” Remember, payday loans should be viewed as a last resort due to their high cost and potential for financial hardship. Explore alternative financial solutions whenever possible, such as credit counseling or negotiating with creditors.

Interest Rates and Fees in Chicago

Payday loans in Chicago are notorious for their high costs. Illinois law caps the annual percentage rate (APR), but the effective cost can still be significantly higher than other forms of borrowing. Fees, often disguised as charges for application processing or other services, add substantially to the total amount repaid. These additional costs can quickly push the effective interest rate far above the stated APR, making it crucial to carefully review all terms before signing any agreement. Always calculate the total amount you will owe, including all fees, to avoid unexpected financial burdens.

Remember to compare offers from multiple lenders before committing to a payday loan. This will allow you to assess the true cost across different providers. Avoid lenders advertising extremely low rates without clearly stating all associated fees. “Hidden fees are a common tactic used by predatory lenders, so be vigilant in your research.” The Illinois Attorney General’s office offers resources to help consumers understand their rights and avoid exploitative lending practices. Using their resources, and understanding the full implications of short-term loan agreements, are vital for navigating the Chicago payday loan landscape safely.

Alternatives to Payday Loans in Chicago

Before considering a payday loan in Chicago, explore better options. Many resources offer financial assistance without the crippling interest rates associated with payday loans. Credit unions, for example, often provide small-dollar loans with far more manageable terms. They frequently offer financial literacy programs to help borrowers build better financial habits. These programs can equip you with the knowledge and skills to avoid high-interest debt in the future.

Consider exploring government assistance programs as well. Organizations like the Chicago Coalition for the Homeless and the city’s Department of Family and Support Services offer various resources, including emergency financial aid and rent assistance. “These programs can provide a crucial safety net during difficult times, helping you avoid the predatory practices often associated with payday lenders.” Always investigate all available options before resorting to a high-cost, short-term loan. Remember, responsible financial planning is key to long-term stability.

Eligibility Requirements and the Application Process

Credit Score Requirements

Unlike traditional loans, many payday loan providers in Chicago don’t heavily rely on credit scores for approval. This is because they often focus on your ability to repay the loan from your next paycheck. However, a poor credit history might influence the interest rate offered or even the loan amount approved. Some lenders might still perform a credit check, albeit a soft one, to assess your overall financial responsibility. Always check the specific requirements with the lender before applying.

“While a stellar credit score isn’t always a necessity, a history of missed payments or bankruptcies could negatively impact your chances of securing a loan, or result in higher interest rates.” Consider this: Lenders prioritize repayment potential. Therefore, providing proof of steady employment and income is crucial. Transparency about your financial situation, even if imperfect, can be more beneficial than concealing information. Remember to compare offers from different payday loan providers to find the best terms.

Income Verification

Most payday lenders in Chicago require proof of regular income to assess your ability to repay the loan. This typically involves providing pay stubs from your employer for the past few months. Some lenders might accept bank statements showing consistent deposits, but this is less common. Always confirm the specific requirements with the lender beforehand, as policies vary. Failure to provide sufficient proof of income will likely result in your application being rejected. Consider gathering your documentation in advance to streamline the process.

Accurate and verifiable income information is crucial. Lenders use this data to determine the loan amount they’re willing to offer. They’ll assess your debt-to-income ratio to gauge your capacity for repayment. “Providing falsified income information is illegal and can have serious consequences,” including damage to your credit score and potential legal action. Be transparent and honest to ensure a smooth and ethical application. Remember to keep copies of all documents you submit for your records.

Required Documentation

Securing a payday loan in Chicago typically requires providing specific documentation to verify your identity and financial stability. Lenders will almost always ask for a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is crucial; this could be your recent pay stubs, bank statements showing direct deposit, or proof of self-employment income. Some lenders may also request proof of residency, such as a utility bill or lease agreement. Failure to provide the necessary documentation will likely result in your application being rejected. “Always keep copies of all documents you submit to the lender for your records.”

Payday loan applications often involve providing additional financial information beyond basic identification and income verification. This may include providing your bank account details for direct deposit of the loan and repayment. Be aware that lenders will carefully review this information to assess your ability to repay the loan on time. “Providing inaccurate or incomplete information can lead to application denial and potential legal repercussions.” Transparency is key; be honest and upfront about your financial situation to increase your chances of approval. Remember to thoroughly read and understand the loan agreement before signing. Comparing interest rates and fees across multiple lenders is also highly recommended to find the most suitable option.

Step-by-Step Application Guide

Applying for a payday loan in Chicago typically involves a straightforward process. First, you’ll need to locate a reputable lender. Many operate online, offering convenience. However, be wary of predatory lenders; always check reviews and licensing information before proceeding. Next, gather the necessary documentation. This usually includes a valid government-issued ID, proof of income (pay stubs or bank statements), and proof of a Chicago address. You’ll also need to provide your bank account details for direct deposit of the loan, and for repayment.

Once you’ve selected a lender and collected your documents, you can begin the online or in-person application. Carefully fill out all forms completely and accurately. Any discrepancies may delay processing or lead to rejection. “Submit your application and wait for a response; this can range from minutes to a few business days, depending on the lender and their verification process.” After approval, you’ll receive the funds, usually via direct deposit. Remember to review the loan agreement thoroughly before signing, paying close attention to the interest rates and repayment terms to avoid unexpected fees or difficulties. Always prioritize responsible borrowing; payday loans are a short-term solution, not a long-term financial strategy.

Responsible Borrowing Practices: Avoiding the Payday Loan Trap

Budgeting and Financial Planning

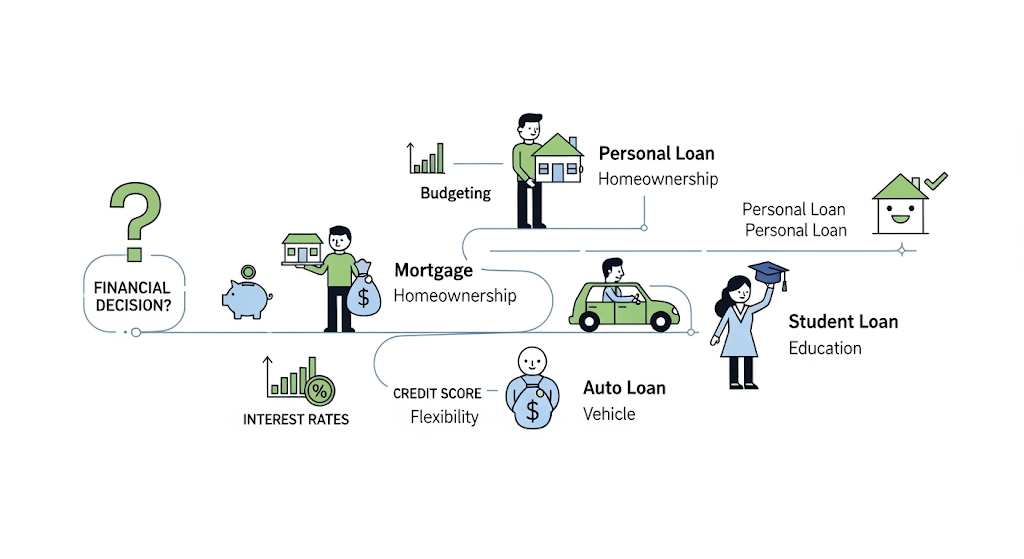

Before considering a payday loan in Chicago, thorough budgeting is crucial. Carefully track your income and expenses for at least a month. Identify areas where you can cut back. This process helps you understand your current financial situation and pinpoint areas needing improvement. Many free budgeting apps and online resources can assist you. A realistic budget highlights where your money goes, revealing potential savings. This is essential for responsible financial management and helps avoid future reliance on high-interest loans like payday loans.

Effective financial planning goes beyond simple budgeting. It involves setting short-term and long-term financial goals. Consider creating a plan to pay down existing debt, even small amounts each month makes a difference. Explore alternative solutions to immediate financial needs. Resources like credit counseling agencies and non-profit organizations in Chicago can offer free guidance. “Remember, tackling the root causes of your financial difficulties is far more effective than simply masking them with a short-term, high-cost payday loan.” Building a solid financial foundation protects you from the predatory nature of the payday loan cycle.

Understanding the Risks of Payday Loans

Payday loans in Chicago, like elsewhere, carry significant risks. The high interest rates are the most obvious danger. These rates can easily exceed 400% annually, making it incredibly difficult to repay the loan on time. Missed payments lead to escalating fees and debt, quickly trapping borrowers in a cycle of borrowing. This can severely impact your credit score, making it harder to access credit in the future for essential needs like housing or a car loan. The consequences extend beyond finances; the stress of managing overwhelming debt can negatively affect your mental and physical health.

Remember, payday lenders often target vulnerable individuals. They may use aggressive marketing tactics or deceptive practices. Always thoroughly research any lender before borrowing. “Before you consider a payday loan, explore all other options, such as negotiating with creditors, seeking help from non-profit credit counseling agencies, or utilizing emergency funds.” The Illinois Attorney General’s office offers resources for consumers facing financial hardship and can help you navigate these difficult situations responsibly. Be aware; choosing a payday loan is often a costly and risky choice with potentially devastating consequences.

Exploring Alternative Financial Resources

Before considering a payday loan in Chicago, explore readily available alternatives. Many free or low-cost resources can help manage unexpected expenses. The city offers various financial literacy programs and credit counseling services, often partnering with non-profit organizations like the Chicago Coalition for the Homeless or the Neighborhood Housing Services of Chicago. These programs provide valuable guidance on budgeting, debt management, and finding suitable financial solutions. They can help you create a personalized financial plan to avoid the high-interest rates and potentially harmful cycle of payday loans.

Consider exploring community resources as well. Local churches, community centers, and charities frequently offer emergency financial assistance programs. These programs may provide small grants or loans with far more favorable terms than payday lenders. Remember to always thoroughly research any organization offering financial aid to ensure legitimacy and avoid scams. “Taking advantage of these free resources is often the smartest first step in tackling financial challenges, preventing the need for a high-cost payday loan.” Checking your eligibility for government assistance programs, such as SNAP or unemployment benefits, could also significantly ease your financial burden.

Seeking Professional Financial Advice

Before considering a payday loan in Chicago, seek professional financial guidance. A certified financial planner (CFP) or credit counselor can offer unbiased advice tailored to your specific situation. They can help you explore alternative solutions, such as budgeting strategies, debt consolidation, or negotiating with creditors. These professionals possess the expertise to navigate complex financial matters and guide you toward responsible debt management. They understand the high-interest rates and potential pitfalls associated with payday loans. Their input can be invaluable in preventing long-term financial hardship.

Consider contacting non-profit credit counseling agencies. These organizations often provide free or low-cost financial guidance. They can offer practical tools and resources for improving your financial health. “Many reputable agencies in Chicago offer workshops and individual counseling sessions focused on responsible money management and debt reduction strategies.” This proactive approach is significantly more beneficial than relying on short-term, high-interest payday loans. Remember, responsible financial planning is key to avoiding the payday loan trap.

Finding Reputable Lenders in Chicago

How to Spot a Reputable Lender

Identifying trustworthy payday loan providers in Chicago requires diligence. Look for lenders licensed by the Illinois Department of Financial and Professional Regulation. This ensures they operate legally and are subject to state regulations designed to protect consumers. Check online reviews from reputable sources like the Better Business Bureau to gauge the experiences of other borrowers. Avoid lenders with overwhelmingly negative feedback or those lacking transparency about their fees and terms. “A lender’s willingness to clearly explain all charges is a crucial indicator of trustworthiness.”

Scrutinize the lender’s website carefully. Legitimate lenders provide detailed information about their interest rates, fees, and repayment terms upfront. Be wary of lenders who pressure you into a loan or who are vague about their lending practices. Compare interest rates and fees across multiple lenders before making a decision. Remember, high fees and exorbitant interest rates are red flags. “Always read the fine print before signing any agreement, and don’t hesitate to seek independent financial advice if needed.” This due diligence will help you secure a payday loan in Chicago safely and responsibly.

Online vs. Brick-and-Mortar Lenders

Choosing between online and brick-and-mortar payday lenders in Chicago requires careful consideration. Online lenders offer convenience and often a wider range of options, allowing you to compare interest rates and terms from multiple sources simultaneously. However, thorough vetting is crucial. Look for lenders licensed in Illinois and check online reviews carefully. Beware of scams; legitimate lenders will be transparent about fees and repayment terms.

Brick-and-mortar lenders provide a face-to-face interaction, which can be beneficial for some borrowers. You can ask questions directly and receive immediate feedback. However, this convenience may come at a cost; in-person lenders sometimes charge higher fees than their online counterparts. “Before committing to any lender, whether online or in person, always read the fine print and understand the total cost of borrowing.” Consider visiting the Illinois Department of Financial and Professional Regulation website for a list of licensed lenders in your area to help ensure you’re dealing with a reputable source.

Checking Licenses and Compliance

Before considering any payday loan lender in Chicago, verifying their licensing and compliance is crucial. Illinois has strict regulations governing payday lenders. The Illinois Department of Financial and Professional Regulation (IDFPR) maintains a database of licensed lenders. Always check this database to ensure the lender is operating legally. Avoid any lender that cannot readily provide their license information. Scammers often operate without the necessary permits, posing significant risks to borrowers. You can find the IDFPR’s database online; searching “IDFPR licensed lenders” will yield the right results.

Remember, a valid license is just one piece of the puzzle. Look for lenders with a history of fair practices. Read online reviews and check with the Better Business Bureau (BBB) for complaints. Consider lenders who clearly display their fees and terms upfront, avoiding hidden costs. “Choosing a licensed and reputable lender significantly reduces your risk of encountering predatory lending practices and illegal fees.” Don’t hesitate to compare multiple lenders before making a decision. Taking the time to verify licensing and check reputations can save you significant financial stress in the long run.

Comparing Interest Rates and Fees

Interest rates on payday loans in Chicago vary significantly. Shop around and compare offers from multiple lenders. Don’t just focus on the advertised rate. Consider all associated fees, including origination fees, late payment penalties, and any other charges. These fees can dramatically increase the overall cost of the loan. Remember, a slightly higher interest rate with fewer fees might be a better deal than a lower rate with hefty additional charges. “Always calculate the annual percentage rate (APR) to get a true picture of the loan’s cost.”

Check the lender’s licensing and reputation before borrowing. The Illinois Department of Financial and Professional Regulation (IDFPR) website is a valuable resource. Use online review sites to see what past borrowers have said about their experiences. Be wary of lenders promising incredibly low rates or requiring upfront payments. These practices can be red flags of predatory lending. “Transparency is key; choose a lender that clearly outlines all terms and conditions upfront.” Prioritize lenders with a proven track record of fair and ethical practices in Chicago’s financial landscape.

Legal Protections and Consumer Rights

Illinois Payday Loan Laws

Illinois has specific regulations governing payday loans, designed to protect consumers from predatory lending practices. These laws cap the amount a lender can charge in fees. The maximum fee is typically a percentage of the loan amount. This helps prevent borrowers from falling into a cycle of debt. Interest rates are also strictly regulated, preventing exorbitant charges that can quickly overwhelm borrowers. The Illinois Department of Financial and Professional Regulation (IDFPR) oversees these regulations and provides resources for consumers. Understanding these limits is crucial before considering a payday loan in Chicago.

Crucially, Illinois law mandates that lenders provide borrowers with clear and concise information about loan terms and associated fees. This includes the total cost of the loan and the repayment schedule. Transparency is key to informed decision-making. “Borrowers have a right to understand exactly what they are agreeing to before signing any loan documents.” Failure to provide this information is a violation of state law. If you suspect a lender has violated these regulations, you should contact the IDFPR to file a complaint. This ensures fair treatment and helps protect consumers from deceptive payday loan practices.

Protecting Yourself from Predatory Lenders

Chicago residents seeking payday loans must be vigilant against predatory lending practices. Illinois has laws designed to protect consumers, but awareness is key. Always compare interest rates and fees across multiple lenders. Avoid lenders who pressure you into quick decisions or obscure crucial information within lengthy contracts. “Understand the total cost of borrowing, including all fees and interest, before agreeing to any loan.” Check the lender’s reputation with the Illinois Attorney General’s office and the Better Business Bureau. Don’t hesitate to walk away from a loan if anything feels wrong or unclear.

Scrutinize the loan agreement meticulously. Look for hidden fees, excessive interest rates exceeding Illinois’ legal limits, and automatic renewal clauses that can trap borrowers in a cycle of debt. Remember, payday loans are meant for short-term emergencies, not long-term financial solutions. Consider alternatives like credit counseling or borrowing from friends and family before resorting to a payday loan. “If you’re struggling to repay, contact a credit counselor immediately to explore options for debt management or consolidation.” Proactive steps will significantly reduce your risk of falling prey to predatory lenders in Chicago’s payday loan market.

Knowing Your Rights as a Borrower

In Illinois, including Chicago, you have significant protections against predatory lending practices. The Illinois Consumer Finance Act regulates payday loans, setting limits on fees and interest rates. Payday lenders cannot charge more than a certain percentage of the loan amount. This helps prevent borrowers from falling into a cycle of debt. Always review the loan agreement carefully before signing. Understand all fees and charges upfront. Know the total cost of borrowing before you commit.

If a payday lender violates these regulations, you have legal recourse. You can file a complaint with the Illinois Attorney General’s office. The Illinois Department of Financial and Professional Regulation also handles complaints. Document all interactions with your lender, including loan agreements and payment records. “These records are crucial if you need to dispute charges or pursue legal action.” Consider seeking advice from a consumer protection agency or a legal professional. They can guide you through the process and help you understand your options.

Reporting Unfair Lending Practices

In Chicago, as elsewhere, you have legal recourse if you face unfair lending practices from payday lenders. If a lender violates Illinois’s Payday Loan Act, or engages in deceptive or abusive practices, you have several options. You can file a complaint with the Illinois Attorney General’s office. Their website provides detailed instructions and forms. They actively investigate complaints about predatory lending.

Additionally, you can contact the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency with authority over payday lenders nationwide. They can investigate complaints and pursue enforcement actions against lenders who violate federal consumer financial laws. Document everything, including loan agreements, communication with the lender, and any evidence of harassment or deceptive practices. “Keeping detailed records is crucial for building a strong case.” Remember, you are not alone, and seeking help is a sign of strength, not weakness.

Long-Term Financial Wellness: Beyond Payday Loans

Building a Strong Credit History

A crucial step towards long-term financial health is establishing a positive credit history. This involves consistently making on-time payments on all your debts, including credit cards, loans, and even utility bills. These payments are reported to credit bureaus, like Experian, Equifax, and TransUnion, building your credit score over time. A higher credit score opens doors to better interest rates on future loans, potentially saving you thousands of dollars in the long run. Remember, even small, consistent payments contribute significantly to a healthy credit profile.

Consider using secured credit cards or credit-builder loans if you’re starting with a limited or damaged credit history. These products often require a security deposit, minimizing risk for lenders and giving you the opportunity to demonstrate responsible repayment. “Regularly checking your credit report for accuracy is also essential,” as errors can negatively impact your score. Free credit reports are available annually from AnnualCreditReport.com. By proactively building your credit, you significantly reduce your reliance on high-interest payday loans and gain access to more affordable financial products in the future.

Creating a Realistic Budget

Building a solid budget is crucial for long-term financial health, especially after navigating the short-term relief of a payday loan. Start by tracking your income and expenses for at least a month. Use budgeting apps or spreadsheets to categorize everything. This detailed picture reveals where your money goes. Identifying areas of overspending becomes easier. You can then make informed decisions about necessary adjustments.

Prioritize essential expenses like rent, utilities, and groceries. Allocate funds for debt repayment, even small amounts. Consider creating a realistic savings plan, even if it’s just a small amount each month. “Saving, even a little, helps build a financial safety net and reduces reliance on payday loans in the future.” Remember to factor in unexpected expenses. Having a small emergency fund can prevent future borrowing. This proactive approach fosters a more stable financial future and avoids the cycle of high-interest debt. Seek professional advice if needed. Many free resources exist in Chicago to help you.

Exploring Debt Consolidation Options

Facing overwhelming debt can feel crippling, but solutions exist beyond payday loans in Chicago. Debt consolidation can be a powerful tool. It involves combining multiple debts into a single, more manageable payment. This often results in a lower monthly payment and potentially a lower interest rate, saving you money over time. Consider exploring options like balance transfer credit cards with introductory 0% APR periods or personal loans from reputable lenders. Remember to carefully compare terms and fees before committing.

Before pursuing debt consolidation, it’s crucial to understand your entire financial picture. Create a budget to track your income and expenses. Identify areas where you can cut back. This will help you determine how much you can realistically afford to pay each month. Many reputable non-profit credit counseling agencies in Chicago offer free or low-cost debt management plans (DMPs). These plans negotiate with creditors on your behalf to reduce interest rates and create a more manageable repayment schedule. “Seeking professional guidance is vital to avoid further financial hardship and navigate the complexities of debt consolidation effectively.”

Seeking Credit Counseling Services

Facing financial hardship can feel overwhelming, but seeking help is a sign of strength, not weakness. In Chicago, numerous reputable credit counseling agencies offer free or low-cost services. These agencies can provide valuable guidance on budgeting, debt management, and exploring alternative financial solutions beyond payday loans. They can help you create a realistic budget and develop a plan to tackle your debt strategically.

Consider contacting agencies like the National Foundation for Credit Counseling (NFCC) or Debtor Relief Services. These organizations can connect you with certified credit counselors who can assess your financial situation and help you build a long-term plan for financial stability. “Remember, responsible financial management is key to avoiding the high-interest trap of payday loans and building a secure future.” By actively seeking professional guidance, you can gain control of your finances and escape the cycle of debt. Finding the right credit counselor is a vital step towards achieving long-term financial wellness.