Understanding Payday Loans Topeka, KS

What are Payday Loans?

Payday loans Topeka KS are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They are typically due on your next payday, hence the name. In Topeka, KS, as in other states, these loans come with high interest rates and fees. Understanding these costs is crucial before considering this type of borrowing. Borrowers should carefully weigh the potential benefits against the significant financial risks involved. “Failing to repay on time can lead to a cycle of debt that is difficult to escape.”

Before applying for a payday loan in Topeka, Kansas, thoroughly research the lender’s terms and conditions. Look for licensing information; ensure the lender is legally operating within the state. Compare interest rates and fees across multiple lenders to find the most favorable terms possible. Remember, while convenience is a factor, responsible borrowing requires a clear understanding of the total cost of the loan. “Always prioritize repayment to avoid further financial hardship.” Consider alternatives like credit counseling or borrowing from family and friends before resorting to a payday loan.

Eligibility Requirements for Payday Loans in Topeka

To qualify for a payday loan in Topeka, Kansas, you’ll generally need to meet specific criteria. These typically include being at least 18 years old, possessing a valid government-issued ID, and having a verifiable source of regular income. Lenders will want to see proof of income, such as pay stubs or bank statements, to ensure you can repay the loan. Having an active checking account in your name is also a crucial requirement. Many lenders use direct deposit for both loan disbursement and repayment. Remember, each lender sets its own specific requirements, so it is vital to check directly with the lender for their detailed list of criteria.

Beyond the basic requirements, lenders often consider your credit history, though it’s not always a deal-breaker for payday loans. However, a poor credit score might result in higher interest rates or stricter loan terms. Important factors lenders assess include your debt-to-income ratio and employment history. “Understanding your financial standing and honestly presenting your financial information is crucial for a successful application.” Don’t over-borrow; only request the amount you absolutely need. Failure to repay on time can lead to significant financial consequences, including further debt accumulation and damage to your credit report. Always borrow responsibly.

Interest Rates and Fees: A Clear Explanation

Payday loans in Topeka, KS, are notorious for their high costs. These costs aren’t always transparent. Interest rates can range significantly, often exceeding 400% APR. This means borrowing $100 might cost you significantly more than $100 to repay. Always clarify the Annual Percentage Rate (APR) before signing any agreement. Don’t hesitate to ask questions if anything is unclear. Understanding these charges is crucial to responsible borrowing.

Beyond the APR, expect additional fees. These can include origination fees, late payment penalties, and rollover charges. These fees quickly accumulate, escalating the total cost of the loan. Kansas state regulations cap some fees, but it’s vital to review all loan documents carefully. “Failing to understand these fees can lead to a debt trap, making repayment incredibly difficult.” Shop around and compare offers from different lenders to find the most reasonable terms before committing to a payday loan in Topeka.

The Application Process: A Step-by-Step Guide

Securing a payday loan in Topeka, KS, typically involves a straightforward application process. Most lenders require you to be at least 18 years old, have a valid bank account, and provide proof of regular income. You’ll usually fill out an online or in-person application. This application will ask for personal information, including your Social Security number, address, and employment details. Be prepared to provide pay stubs or bank statements verifying your income. Carefully review all terms and conditions before signing any agreement. Transparency is key. Don’t hesitate to ask questions if anything is unclear.

After submitting your application, lenders will usually process it quickly. Approval times vary depending on the lender and your financial situation. If approved, the funds are typically deposited directly into your bank account within one business day. However, remember that payday loans come with high interest rates and fees. Borrow only what you absolutely need and have a clear repayment plan in place before you proceed. “Failing to repay on time can lead to severe financial consequences, including damage to your credit score and further debt.” Always compare offers from multiple lenders to find the best terms.

Finding Reputable Lenders in Topeka, KS

Identifying Licensed and Regulated Lenders

Before considering any payday loan in Topeka, KS, verify the lender’s licensing status. The Kansas Office of the State Bank Commissioner regulates payday lenders. Their website is a crucial resource for checking licenses and verifying the legitimacy of potential lenders. Avoid any lender that isn’t clearly and readily identifiable as licensed within the state. “Using unlicensed lenders puts you at significant risk of predatory lending practices and illegal fees.”

Confirm the lender’s adherence to all state regulations regarding interest rates, fees, and loan terms. Look for transparent fee schedules and clear explanations of all loan costs. Compare multiple licensed lenders before deciding. Don’t hesitate to contact the Kansas Attorney General’s office if you suspect fraudulent or illegal activity. Remember, a reputable lender will readily provide this information and answer all your questions honestly and openly.

Checking Online Reviews and Ratings

Before applying for a payday loan in Topeka, KS, thoroughly research potential lenders online. Websites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation. Look for ratings and reviews from previous borrowers. Pay close attention to comments about customer service, transparency regarding fees, and the loan repayment process. A high BBB rating and numerous positive reviews indicate a trustworthy lender. Conversely, a low rating or a significant number of negative comments should raise red flags.

Don’t just focus on star ratings. Read the actual reviews carefully. Look for recurring themes or common complaints. Are borrowers consistently reporting issues with hidden fees? Do many complain about aggressive collection practices? Such details reveal a lender’s true character. “Remember, negative reviews can be just as informative as positive ones, helping you avoid potential problems.” Cross-reference information from multiple review sites to gain a comprehensive understanding of the lender’s reputation before proceeding with your application for a Topeka, KS payday loan.

Comparing Interest Rates and Loan Terms

Interest rates are the cornerstone of any payday loan. They vary significantly between lenders in Topeka, KS. Shop around! Compare offers from several reputable lenders before committing. Don’t just focus on the lowest rate; consider the total cost, including fees. A slightly higher rate with fewer fees might be a better deal. Check the Annual Percentage Rate (APR) for a complete picture of the loan’s cost.

Loan terms are equally crucial. Payday loans in Kansas are typically short-term, often due on your next payday. However, some lenders may offer slightly longer repayment periods. Understand the repayment schedule clearly. Missing payments can lead to significant penalties and damage your credit score. “Always confirm the due date and the exact amount you’ll need to repay to avoid unexpected fees or late payment charges.” Read the fine print carefully, and don’t hesitate to ask questions if anything is unclear. Understanding these details is essential for responsible borrowing and financial planning.

Avoiding Predatory Lending Practices

In Topeka, Kansas, as elsewhere, beware of lenders who pressure you into borrowing more than you need. High-interest rates and excessive fees are hallmarks of predatory payday loans. Legitimate lenders will clearly explain all terms and conditions. They will not use aggressive tactics. Always compare offers from multiple lenders.

Scrutinize the loan agreement carefully. Watch out for hidden fees or unclear language. The Kansas Office of the State Bank Commissioner offers resources for consumers to report suspicious lending activity. Transparency is key. “If a lender is unwilling to fully explain the terms of the loan, or if something feels off, it’s best to walk away and explore other options.” Remember, responsible borrowing involves understanding your rights and protecting yourself from exploitation. Don’t hesitate to seek help from consumer protection agencies if needed.

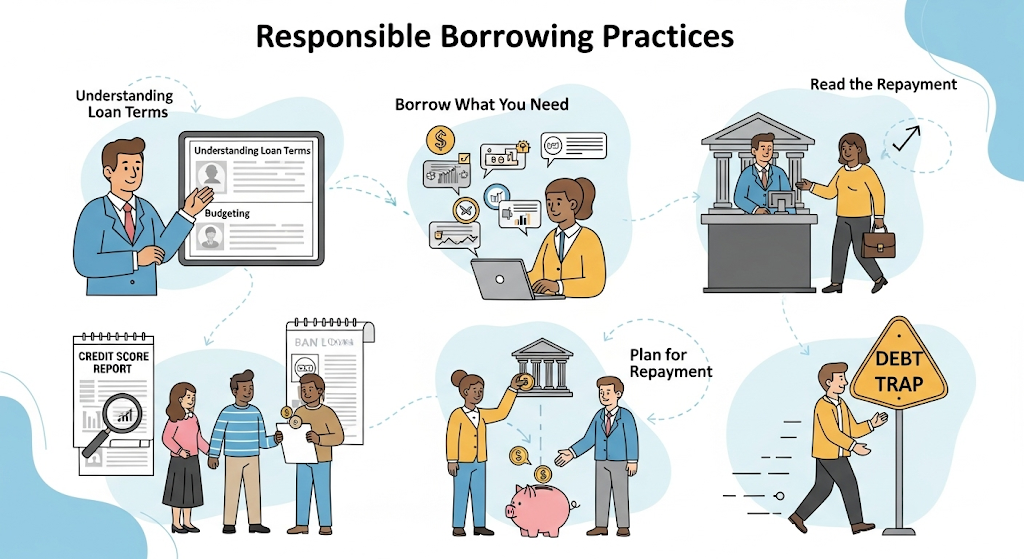

Responsible Borrowing Practices

Creating a Realistic Budget

Before considering a payday loan in Topeka, Kansas, meticulously track your income and expenses for at least a month. This provides a clear picture of your financial situation. Use budgeting apps or spreadsheets to categorize spending, identifying areas where you can cut back. Prioritizing essential expenses like housing, utilities, and food is crucial. Remember, accurate budgeting is the cornerstone of responsible borrowing.

Once you have a realistic budget, honestly assess your ability to repay the loan. Factor in the loan’s total cost, including fees and interest. “Never borrow more than you can comfortably repay by your next payday,” as overspending can lead to a debt cycle. Explore alternative solutions first, such as negotiating with creditors or seeking free financial counseling services available in Topeka. These resources can help you develop long-term financial strategies and avoid the high costs associated with payday loans. Remember, responsible borrowing starts with a realistic budget and a clear repayment plan.

Understanding the Loan Repayment Terms

Before accepting a payday loan in Topeka, KS, meticulously review the repayment terms. This includes the loan amount, the total fees, and crucially, the due date. Payday loans typically require repayment within a short timeframe, often your next payday. Failing to repay on time incurs hefty penalties, potentially leading to a cycle of debt. Understand the APR (Annual Percentage Rate), which reflects the true cost of borrowing. Compare APRs across different lenders to find the most favorable option. Remember, seemingly small fees accumulate quickly.

Always clarify the repayment method. Some lenders accept online payments, while others may require in-person visits. Confirm whether partial payments are allowed, as this can offer flexibility in managing repayments. “Failing to understand the repayment terms can lead to serious financial consequences, impacting your credit score and overall financial health.” Develop a realistic budget to ensure you can comfortably repay the loan on the agreed-upon date, avoiding further debt. If you anticipate difficulties, contact the lender immediately to explore potential solutions, such as an extended repayment plan.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Topeka, Kansas, explore alternative financing options. These alternatives often offer more manageable repayment terms and lower overall costs. Credit unions, for example, frequently provide small-dollar loans with more favorable interest rates than payday lenders. They often prioritize member financial well-being, offering financial literacy resources alongside lending services. Check with local credit unions like the Capitol Federal Savings Bank or First National Bank of Topeka to see what options are available to you.

Consider tapping into your existing resources first. This could include discussing a temporary payment plan with creditors or seeking help from local charities like the Salvation Army or Catholic Charities. Budgeting apps and financial counseling services can also be invaluable in managing your finances and avoiding high-interest debt. “Remember, carefully evaluating your options before taking out any loan, especially a high-cost payday loan, is crucial for responsible financial management.” Exploring these alternatives will provide a clearer picture of your financial situation and may help you avoid the debt cycle often associated with payday loans.

Seeking Help with Financial Difficulties

Before considering a payday loan in Topeka, Kansas, explore all other avenues for financial assistance. Many resources exist to help you manage unexpected expenses or temporary income shortfalls. Contacting your creditors directly to discuss payment arrangements is a crucial first step. They may offer extensions or payment plans to avoid late fees and damage to your credit score. The Consumer Credit Counseling Service (CCCS) provides free or low-cost budgeting and debt management advice. They can help you create a realistic budget and explore debt consolidation options, potentially eliminating the need for high-interest payday loans altogether.

Exploring local non-profit organizations and government assistance programs is also highly recommended. The United Way of Greater Topeka offers a 211 helpline connecting individuals to local resources. They can direct you toward programs offering financial assistance, food banks, and utility assistance. Remember, “seeking help is a sign of strength, not weakness.” Prioritizing your financial well-being and exploring alternatives before resorting to payday loans can save you from a cycle of debt and its associated high fees. Careful planning and proactive financial management are key to long-term financial stability.

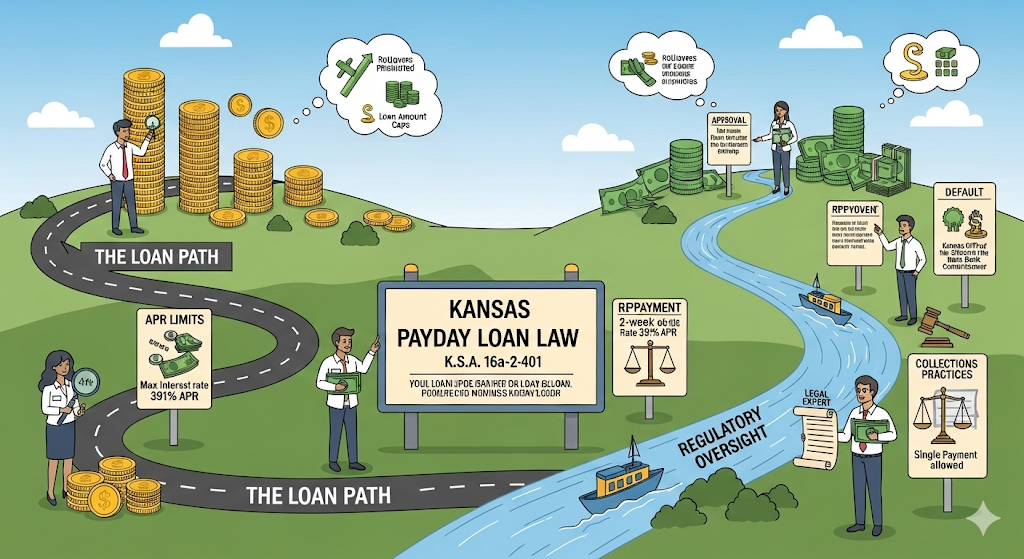

The Legal Landscape of Payday Loans in Kansas

Kansas State Regulations on Payday Lending

Kansas has specific regulations governing payday lending, designed to protect consumers. These regulations, found in the Kansas Consumer Credit Code, limit the amount a lender can charge in fees. The maximum finance charge is capped at 15% of the principal amount of the loan. This means that the total cost of borrowing should be clearly stated upfront and should not exceed this legal limit. Borrowers should carefully review all loan documents to ensure compliance. Ignoring this limit could leave you vulnerable to predatory lending practices.

Critically, Kansas law also restricts the number of outstanding payday loans a single borrower can have at any given time. This prevents borrowers from falling into a cycle of debt by taking out multiple loans simultaneously to repay previous ones. It’s crucial to understand these limitations before considering a payday loan in Topeka, KS. “Failing to adhere to these regulations can lead to serious financial consequences, so thorough research is vital before signing any loan agreement.” Always seek clarification from the lender regarding fees and repayment terms. Understanding Kansas’s payday lending laws is a crucial step in responsible borrowing.

Understanding Your Rights as a Borrower

In Kansas, including Topeka, you possess crucial rights when dealing with payday loans. The Kansas Consumer Protection Act offers significant safeguards. These laws set limits on fees and interest rates lenders can charge. They also mandate clear disclosure of all loan terms. Failing to provide this information is a violation of state law. Before signing any agreement, carefully review every detail. Understand the total cost, including fees and interest, to avoid unexpected expenses. Don’t hesitate to ask questions if anything is unclear.

Your right to a fair and transparent lending process is paramount. Kansas law requires lenders to provide you with a written copy of the loan agreement. This agreement must clearly detail repayment terms, including the amount due, due date and penalties for late payments. Should a lender violate these regulations, you can file a complaint with the Kansas Attorney General’s office. “Remember, responsible borrowing involves understanding your rights and protections under Kansas law.” Research lenders thoroughly before committing to a loan. Look for reviews and compare interest rates. This ensures you obtain the best possible terms for your financial situation.

Common Misconceptions and Myths Debunked

Many believe payday loans are a quick fix for any financial emergency. This is a dangerous misconception. While convenient, they carry extremely high interest rates, making them a costly solution unless repaid immediately. Choosing a payday loan should only be a last resort after exploring all other options, such as negotiating with creditors or seeking assistance from local charities.

Another myth is that all payday lenders in Topeka, KS are created equal. This is false. Lenders’ fees and interest rates vary significantly. Careful comparison shopping is essential before committing to a loan. Don’t just look at the advertised APR; thoroughly examine all fees and repayment terms. “Failing to understand the true cost of a payday loan can lead to a cycle of debt that is difficult to escape.” Always prioritize responsible borrowing and research reputable lenders with transparent fee structures to mitigate risks.

Where to Find Additional Information and Resources

Understanding Kansas payday loan regulations is crucial for responsible borrowing. The Kansas Office of the State Bank Commissioner oversees payday lending. Their website offers valuable information on licensing, interest rate caps, and consumer protections. You can find detailed explanations of state laws and regulations there, ensuring you’re aware of your rights and the lender’s obligations. Always check their site for the most up-to-date information before entering into any payday loan agreement.

For broader financial guidance and assistance, consider contacting the Consumer Financial Protection Bureau (CFPB). The CFPB provides resources for navigating various financial products, including payday loans. They offer educational materials and tools to help you make informed decisions. Their website includes detailed information on avoiding predatory lending practices and managing debt effectively. Remember to always compare offers from multiple lenders before committing to a loan. “Thorough research can save you money and prevent financial hardship.” Don’t hesitate to seek help from reputable, non-profit credit counseling agencies if you are struggling with debt.

Case Studies: Real-Life Scenarios and Outcomes

Example 1: Successful Payday Loan Usage

Maria, a Topeka resident, faced an unexpected car repair bill of $500. She lacked the funds in her checking account and feared a late fee impacting her credit score. Instead of resorting to high-interest credit cards, she researched payday loans in Topeka, KS, carefully comparing interest rates and terms from several reputable lenders. She chose a lender with transparent fees and a manageable repayment plan. Maria diligently budgeted, ensuring she could repay the loan within the agreed-upon timeframe. This allowed her to avoid the debt trap often associated with short-term borrowing.

By carefully planning and adhering to her repayment schedule, Maria successfully repaid her payday loan without incurring additional fees or impacting her credit negatively. “This example highlights the importance of responsible borrowing and thorough research when considering a payday loan,” emphasizing the need for careful budgeting and a clear repayment strategy. Understanding the terms and conditions and selecting a lender with a positive reputation are critical for a successful outcome. Failing to do so can lead to a cycle of debt. Maria’s success story showcases that responsible use of short-term loans in Topeka can be a valuable tool in navigating unexpected financial emergencies.

Example 2: Avoiding Payday Loan Traps

Sarah, a single mother in Topeka, needed $500 for unexpected car repairs. Instead of rushing into a payday loan, she explored alternatives. She contacted a local credit union, which offered a small personal loan with a significantly lower interest rate and manageable monthly payments. This allowed her to address the car issue without falling into the cycle of high-interest debt often associated with payday lenders. By taking time to compare options, she avoided the potential for debt traps and saved considerable money in the long run.

This contrasts sharply with Mark’s experience. He took out multiple short-term loans from different payday lenders in Topeka to cover various expenses. He quickly found himself overwhelmed by the accumulating interest and fees. “The quick cash seemed appealing at first, but it rapidly spiraled into a financial crisis,” Mark admitted. He eventually had to seek help from a credit counselor to consolidate his debt and navigate the complexities of his financial situation. His story highlights the importance of thorough research and careful planning before considering any payday loan in Topeka, KS, especially emphasizing the need to understand the total cost and potential long-term consequences.

Example 3: Alternative Solutions to a Financial Crisis

Sarah, a single mother in Topeka, faced an unexpected car repair bill. She considered a payday loan but paused. Remembering a recent workshop on financial literacy offered by the Topeka Community Action Project, she explored alternatives. Instead of a high-interest payday loan, she contacted her local credit union. They offered a small personal loan with a manageable interest rate and payment plan. This avoided the debt trap often associated with short-term, high-cost payday loans.

The credit union also connected Sarah with a budgeting counselor. This helped her create a realistic budget to manage her expenses. “By seeking help early and exploring responsible options, Sarah prevented a spiraling debt cycle,” explains financial advisor, Mark Johnson, CFP. This demonstrates that proactive steps and available community resources can be more effective, and far less risky, than relying on a payday loan to solve a financial emergency. Responsible borrowing hinges on exploring all viable options before resorting to high-interest lenders.

Frequently Asked Questions (FAQs)

What if I can’t repay my loan?

Falling behind on a payday loan in Topeka, KS, is a serious situation. Contact your lender immediately. Explain your circumstances. Explore options like extending the repayment period or creating a payment plan. Ignoring the problem will only worsen it, leading to late fees and potential damage to your credit score. Remember, many lenders in Kansas are willing to work with borrowers facing temporary hardship; proactive communication is key.

Don’t hesitate to seek outside help. Credit counseling agencies can provide guidance and support in managing your debt. These agencies can help you budget effectively and negotiate with lenders. In Topeka, resources like the Consumer Credit Counseling Service (CCCS) often offer free or low-cost services. “Failing to act promptly can result in significant financial consequences, including wage garnishment or legal action.” Exploring all available options before reaching a crisis point is crucial for responsible payday loan management in Topeka.

Can I roll over my payday loan?

Rolling over a payday loan in Topeka, Kansas, is generally not advisable. Kansas law doesn’t explicitly prohibit rollovers, but lenders often structure their agreements to discourage this practice. Attempting a rollover frequently leads to accumulating more fees and interest, quickly escalating the total debt owed. This can create a cycle of debt that is difficult to escape. Instead of rolling over, consider exploring alternative solutions, such as speaking to your lender about an extended repayment plan or seeking help from a credit counselor. Remember that repeated rollovers significantly increase the cost of your loan and can lead to serious financial hardship.

Many lenders in Topeka will refuse a rollover request. They may perceive it as a sign of financial instability. This could negatively impact your future ability to obtain credit. Before considering any rollover, carefully examine the loan agreement’s terms and fees. “Understanding the true cost of extending your debt is crucial to making a responsible financial decision.” Seek professional financial advice if you are struggling to manage your payday loan. Resources such as the Kansas Consumer Credit Counseling Service can provide valuable support and guidance. Prioritizing clear communication with your lender is also essential.

What are the consequences of defaulting on a payday loan?

Defaulting on a payday loan in Topeka, KS, has serious repercussions. Your credit score will suffer significantly, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Collection agencies may aggressively pursue repayment, potentially leading to wage garnishment or lawsuits. These legal actions can result in additional fees and court costs, dramatically increasing your debt. “Failing to repay can severely damage your financial well-being.”

Furthermore, repeated defaults can lead to a cycle of debt, trapping you in a continuous need for payday loans to cover previous debts. This is a common problem, and the Kansas Attorney General’s office provides resources to help consumers understand their rights and avoid predatory lending practices. Consider exploring credit counseling services if you’re struggling with debt repayment. Careful budgeting and exploring alternative financial solutions are crucial to prevent defaulting on payday loans. Remember, responsible borrowing is key to avoiding these negative consequences.

Are there any hidden fees I should be aware of?

Payday loans in Topeka, KS, often include fees beyond the initial loan amount. These can significantly impact your total cost. Always carefully review the loan agreement before signing. Look for details on things like origination fees, which are common charges for processing your application. Late payment fees are another significant concern. These can be substantial and quickly add up, potentially making it harder to repay the loan. Understanding these hidden costs is crucial for responsible borrowing.

In Kansas, lenders are required to disclose all fees upfront. However, “it’s vital to read the fine print and understand exactly what you’re agreeing to.” Don’t hesitate to ask the lender for clarification on any unclear fees or charges. Compare offers from multiple lenders to find the best terms. Remember, the lowest advertised interest rate doesn’t always mean the lowest overall cost. Consider the total amount you will repay, including all fees, to make an informed decision. Ignoring hidden fees can lead to unexpected debt and financial hardship.