Understanding Payday Loans in Texas

Texas Payday Lending Laws and Regulations

Texas has specific laws governing payday loans, aiming to protect consumers from predatory lending practices. These laws, primarily found in the Texas Finance Code, set limits on the amount a lender can charge in fees and interest. The state also mandates a clear disclosure of all loan terms before a borrower signs any agreement. Failure to comply with these regulations can result in significant penalties for lenders. “Ignoring these laws can lead to severe consequences for both borrowers and lenders alike.”

Crucially, Texas law does *not* prohibit No Denial Payday Loans in Texas. While some lenders might advertise this, it’s essential to understand that no legitimate lender can guarantee approval without a credit check. Any lender claiming a “guaranteed approval” should raise a red flag. Be wary of such promises; thoroughly research any lender before applying for a no credit check payday loan in Texas. Remember to always compare interest rates and fees to secure the best possible terms. “Always prioritize reputable lenders who openly comply with all state regulations.”

Interest Rates and Fees: What to Expect

Texas payday loans are notorious for their high costs. Borrowers should expect substantial interest rates and various fees. These charges can quickly escalate the total amount owed, far exceeding the initial loan amount. The state doesn’t cap interest rates on payday loans, leading to significant variation among lenders. Always carefully review the loan agreement before signing. “Understanding the true cost of borrowing is crucial to avoid a debt trap.”

Look beyond the advertised interest rate. Many lenders also charge origination fees, late fees, and other hidden charges. These additional costs can dramatically increase the effective annual percentage rate (APR). Researching multiple lenders and comparing their total costs, including all fees, is vital before committing to a loan. Failing to do so can result in unexpectedly high repayment amounts. “Transparency is key; choose a lender who openly discloses all charges upfront.”

The Risks and Downsides of Payday Loans

Payday loans, while seemingly offering quick financial relief, often carry significant risks. The high interest rates are a major concern. These rates can easily exceed 400% annually, quickly transforming a small loan into a substantial debt burden. Missed payments lead to escalating fees and charges, creating a cycle of debt that is difficult to escape. Many borrowers find themselves trapped in this cycle, repeatedly taking out new loans to cover previous ones. This can have a devastating impact on personal finances.

Beyond the immediate financial strain, payday loans can damage your credit score. Late or missed payments are reported to credit bureaus, negatively affecting your ability to secure loans, credit cards, or even rent an apartment in the future. Furthermore, the stress associated with managing high-interest debt can impact your overall well-being. “Repeated reliance on payday loans can lead to serious financial hardship and even legal issues.” Consider exploring alternative financial solutions before resorting to payday loans, such as credit counseling or negotiating with creditors.

The Truth About “No Denial” Payday Loans

Misleading Marketing and Predatory Practices

Many payday loan advertisements employ deceptive marketing tactics. They promise “guaranteed approval” or “no denial” loans to lure in desperate borrowers. This is misleading. No legitimate lender can truly guarantee approval, as each application undergoes a credit and financial assessment. These claims are designed to attract those with poor credit, who are often the most vulnerable to predatory practices.

The reality is that these “no denial” loans usually come with extremely high interest rates and fees, often far exceeding legal limits in Texas. Hidden fees and complicated terms are common, making it difficult to understand the true cost of borrowing. Borrowers should be wary of lenders who prioritize speed and convenience over transparency and fair lending practices. “These unscrupulous businesses prey on individuals facing financial hardship, trapping them in a cycle of debt.” Always research a lender thoroughly before applying for any type of loan, including payday loans in Texas. Consider alternatives, such as credit counseling or seeking assistance from local charities.

The Importance of Lender Reputation and Licensing

Choosing a lender for a payday loan, even one advertised as “no denial,” requires careful vetting. Reputation is key. Look for lenders with positive online reviews and a history of fair lending practices. Check independent review sites and the Better Business Bureau for complaints or warnings. Avoid lenders with overwhelmingly negative feedback or a lack of transparency.

Licensing is equally crucial. Texas, like many states, strictly regulates payday lenders. Verify the lender’s license with the Texas Department of Banking. Operating without a license is illegal and puts borrowers at significant risk. “Using an unlicensed lender exposes you to predatory practices and potentially illegal fees, making it more difficult to resolve any issues.” Always prioritize licensed and reputable lenders, even if it means slightly less convenient application processes. Your financial well-being depends on it.

Financial Health Check: Assessing Your Needs

Before considering any loan, including a payday loan in Texas, honestly assess your financial situation. This means looking beyond your immediate need. Consider your monthly income, all expenses, and existing debts. A realistic budget is crucial. Don’t just focus on the potential quick fix; understand the long-term implications of borrowing. Tools like budgeting apps or free financial counseling services can help you create a clear picture.

“No lender, especially those offering payday loans, can truly guarantee approval without any assessment of your creditworthiness.” Remember, responsible lenders evaluate your ability to repay. This isn’t about denial; it’s about responsible lending practices designed to protect both you and the lender. Explore alternative solutions, such as negotiating with creditors or seeking help from non-profit credit counseling agencies, before resorting to high-interest loans. These options may offer better long-term financial health and avoid the potential pitfalls of high-cost payday loans.

Finding Reputable Direct Lenders in Texas

Verification of Licensed Lenders in Texas

Verifying a lender’s license in Texas is crucial before considering any no denial payday loan. The Texas Office of Consumer Credit Commissioner (OCCC) maintains a public database of licensed lenders. You can easily search this database using the lender’s name or license number. Always check this before applying, ensuring they’re legally operating and authorized to offer loans in Texas. Ignoring this step leaves you vulnerable to scams.

Don’t rely solely on a website’s claims. Many illegitimate lenders create convincing websites. “Always independently verify a lender’s license through the official OCCC website,” this is your best protection. If a lender refuses to provide their license information, consider it a major red flag and avoid them entirely. Remember, protecting yourself from fraudulent activities is paramount when seeking financial assistance. Choosing a licensed lender minimizes your risks significantly.

Checking Lender Reviews and Ratings

Before applying for a no denial payday loan in Texas, thoroughly research potential lenders. Don’t rely solely on advertising. Check independent review sites like the Better Business Bureau (BBB) and Trustpilot. Look for patterns in customer feedback. Positive reviews mentioning fast and easy applications, clear terms, and helpful customer service are good signs. Conversely, numerous complaints about hidden fees, aggressive collection practices, or loan rollovers should raise red flags. “Ignoring negative reviews can lead to serious financial problems.”

Pay close attention to the rating scores provided. A consistently high rating across multiple platforms suggests a reputable lender. Remember that a single negative review doesn’t automatically disqualify a lender. However, a large number of negative reviews, especially those detailing similar issues, warrants further investigation. Consider lenders with transparent fee structures and readily available contact information. Direct lenders often offer more favorable terms than third-party brokers. Always verify the lender’s license with the Texas Office of Consumer Credit Commissioner before proceeding with an application.

Understanding Loan Terms and Conditions

Before committing to any no denial payday loan in Texas, meticulously review the loan agreement. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing. Understand all fees, including origination fees, late payment penalties, and any potential rollover charges. These fees can significantly impact the overall cost, potentially making the loan more expensive than initially anticipated. Compare APRs from multiple lenders to find the most favorable terms.

Remember that even no denial payday loans come with conditions. These conditions are not always transparent, so thorough research is critical. Look for clear explanations of repayment schedules, grace periods (if any), and the consequences of default. “Consider using a reputable online loan comparison tool to simplify the process and ensure you are comparing apples to apples.” Don’t hesitate to ask questions and clarify any uncertainties with the lender before signing the contract. A trustworthy lender will readily provide transparent information.

Alternatives to Payday Loans in Texas

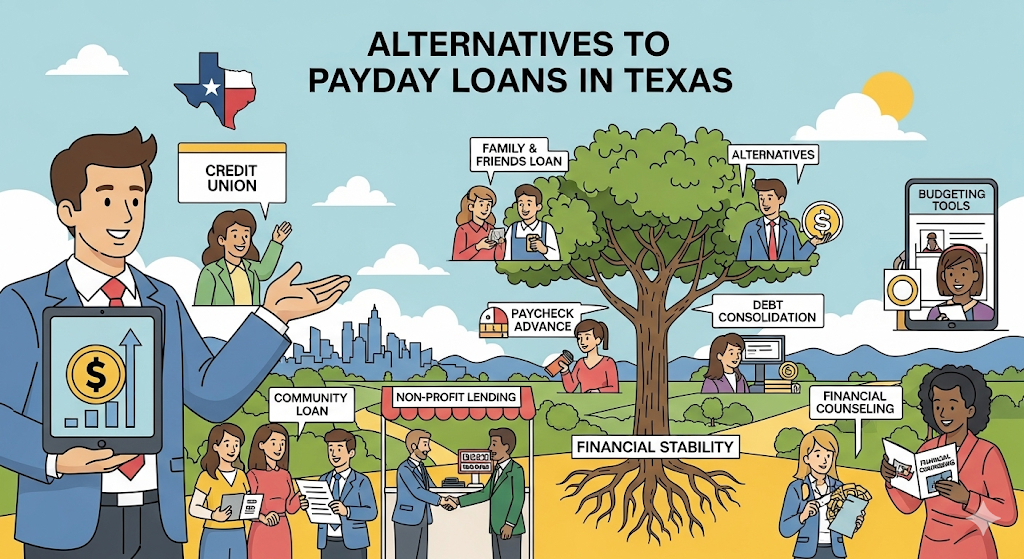

Credit Unions and Small-Dollar Loans

Credit unions offer a viable alternative to payday loans in Texas. They often provide small-dollar loans with more manageable interest rates and repayment terms than payday lenders. Unlike payday loans, credit unions typically consider your credit history but also focus on your overall financial situation. This makes them a more accessible option for borrowers with less-than-perfect credit. Membership requirements may apply, but many credit unions have open or community charters, broadening accessibility.

Consider exploring your local credit union‘s offerings. They may have small loan programs specifically designed for members facing temporary financial hardship. These programs often include financial literacy resources and counseling to help you manage your finances effectively. “Choosing a credit union can provide a much more responsible and sustainable borrowing experience compared to the potentially predatory practices of some payday lenders.” Remember to compare interest rates, fees, and repayment terms before committing to any loan. Always prioritize responsible borrowing practices.

Community Financial Assistance Programs

Many Texas residents facing financial hardship can access vital support through community financial assistance programs. These programs often offer emergency financial assistance, budget counseling, and assistance with utility bills or rent. The United Way and local churches frequently operate such initiatives, providing crucial short-term relief to prevent reliance on predatory no denial payday loans. Finding these resources might require some searching online using keywords like “[your city/county] financial assistance,” or contacting your local 211 helpline.

“These community-based solutions offer a far more sustainable and ethical alternative to high-interest payday loans, often providing personalized support beyond a simple loan.” They frequently work with individuals to create a long-term financial plan, addressing the root causes of debt, rather than simply providing temporary fixes. Remember to explore all available options before considering any loan, especially those advertising “no denial” policies which often carry hidden fees and unsustainable interest rates. Investigate your eligibility for programs based on income and household size.

Budgeting and Financial Literacy Resources

Taking control of your finances is the best way to avoid needing a payday loan, even a no denial one. Many free resources can help you build a budget and improve your financial literacy. The Consumer Financial Protection Bureau (CFPB) website offers numerous free budgeting tools and educational materials. They provide practical advice on creating a realistic budget, tracking your spending, and understanding your credit score. These resources empower you to make informed financial decisions.

Furthermore, consider utilizing the services of non-profit credit counseling agencies. These organizations often offer free or low-cost financial literacy workshops and individual counseling sessions. They can assist with developing a personalized debt management plan and teach you valuable skills for long-term financial stability. Remember, “building strong financial habits is key to avoiding the high-cost cycle of payday loans.” Look for local agencies or those affiliated with reputable national organizations to ensure credibility and trustworthiness. Investing time in learning these skills is an investment in your future financial well-being.

Responsible Borrowing Practices

Creating a Realistic Budget and Financial Plan

Before considering any loan, including a no denial payday loan in Texas, creating a solid budget is crucial. Track your income and expenses meticulously for at least a month. This reveals spending habits and areas for potential savings. Identify non-essential expenses you can cut back on to free up funds. Consider using budgeting apps or spreadsheets to streamline the process. Remember, even small savings add up over time.

A realistic financial plan goes beyond simple budgeting. It involves setting short-term and long-term financial goals. For example, aim to build an emergency fund to cover unexpected expenses, avoiding the need for high-interest loans in the future. “A well-defined plan reduces reliance on short-term solutions like payday loans, ultimately promoting financial stability.” Prioritize paying down high-interest debt before taking on new debt. This proactive approach to personal finance protects your financial future and reduces the temptation of payday loans.

Exploring Debt Management Options

Before considering any loan, especially a no denial payday loan in Texas, explore alternative solutions. Consider budgeting carefully to identify areas where you can cut expenses. This simple step can often free up funds to cover immediate needs. Many free budgeting apps and resources are available online to help you create a realistic and manageable budget. Remember, responsible financial planning is key to avoiding a cycle of debt.

If you’re already struggling with debt, reach out for help. Credit counseling agencies offer debt management plans (DMPs) that can consolidate your debts and create a more manageable repayment schedule. These agencies often negotiate lower interest rates with your creditors. Additionally, consider contacting the Texas Attorney General’s office or a reputable non-profit organization for information on debt relief programs. “Taking proactive steps to manage your finances can prevent the need for high-interest loans like payday loans.” Remember, exploring these options before resorting to high-cost loans is crucial for your long-term financial well-being.

Seeking Professional Financial Advice

Before considering any loan, especially a no denial payday loan in Texas, seeking professional financial advice is crucial. A certified financial planner or credit counselor can provide a personalized assessment of your financial situation. They can help you understand your options beyond payday loans, exploring alternatives like budgeting strategies or debt management plans. Their unbiased perspective helps you make informed decisions, avoiding the potential high costs and debt cycles associated with these types of loans.

Remember, responsible borrowing means understanding your financial capabilities. A financial advisor can help you create a realistic budget and explore debt consolidation strategies. They can also guide you through the application process for other loan options with potentially lower interest rates, if needed. “Ignoring professional advice can lead to worsening financial problems, so it’s always best to seek guidance before taking on any debt.” Consider this crucial step as a form of financial self-care, preventing potential harm from predatory lending practices.

Disclaimer and Legal Information

We are not a lender; this is for informational purposes only

This blog post provides information about no denial payday loans in Texas. We strive to offer accurate and up-to-date details. However, the lending landscape is complex and regulations change. Always verify information with official sources before making financial decisions. This information is for educational purposes only and shouldn’t be considered financial advice. We are not affiliated with any lenders. We do not endorse specific lenders or loan products.

Remember, finding a reputable lender is crucial. Thoroughly research any lender before applying for a loan. Check their licensing and reviews. Look for transparency in their fees and terms. “Never provide sensitive personal information to an unverified source.” Understanding the risks associated with payday loans is vital. High interest rates and potential debt cycles are significant factors to consider. This blog helps you navigate this complex area, but ultimately, you are responsible for your financial choices.

Always verify lender credentials independently

Finding a trustworthy lender is crucial when seeking no denial payday loans in Texas. Don’t rely solely on online advertising or flashy websites. Many illegitimate lenders operate, preying on individuals facing financial hardship. Always check the lender’s license and registration with the Texas Office of Consumer Credit Commissioner (OCCC). You can verify this information directly on their official website. Look for reviews and testimonials from actual customers, but be wary of fake or overly positive ones.

Cross-referencing information from multiple sources is vital for a thorough investigation. Check the Better Business Bureau (BBB) website for complaints or ratings. Websites like the Consumer Financial Protection Bureau (CFPB) also provide valuable resources and information on identifying predatory lending practices. “Failing to independently verify a lender’s credentials can lead to scams, high fees, and significant financial harm,” so take the time for due diligence. Remember, a legitimate lender will be transparent and readily provide their licensing information.

Seek legal advice if necessary

The information provided in this article about no denial payday loans in Texas is for educational purposes only. It is not intended as legal advice. Texas law regarding payday lending is complex and frequently changes. Therefore, relying solely on this blog post for financial decisions could be risky. We strongly encourage you to research further and consult multiple reputable sources before making any borrowing choices. Consider the potential consequences of various lending options carefully. Remember that interest rates and fees can significantly impact your financial well-being.

“This blog post cannot replace professional legal counsel.” If you are facing difficulties with debt, including payday loans, or if you are unsure about your rights and obligations under Texas law concerning payday loans or “no denial” loan claims, it is crucial to seek advice from a qualified Texas attorney specializing in consumer finance or debt. They can assess your specific circumstances and provide guidance tailored to your situation. Don’t hesitate to seek help; it’s a proactive step towards financial stability. Exploring options like credit counseling or debt management plans might also prove beneficial.