Understanding Payday Loans Modesto CA

What are Payday Loans and How Do They Work?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They’re typically due on your next payday, hence the name. These loans are characterized by their quick approval process and ease of access, often requiring minimal documentation. However, it’s crucial to understand that they come with high interest rates and fees, making them a costly borrowing option if not repaid promptly. Borrowers should carefully consider the total cost before applying. Many Modesto, CA residents use them for emergencies, such as car repairs or unexpected medical bills.

Before applying for a payday loan in Modesto, it’s essential to understand how they work. The process usually involves applying online or in person at a lender’s location, providing personal and financial information, and undergoing a credit check (though often not a thorough one). If approved, the funds are typically deposited into your bank account within 24 hours. Repayment is typically due on your next payday. Failure to repay on time can lead to additional fees and potentially damage your credit score, significantly impacting your future borrowing options. “Always prioritize responsible borrowing practices and explore alternative solutions before resorting to payday loans.”

Defining the Terms: APR, Fees, and Loan Amounts

Understanding the financial terms associated with payday loans in Modesto, CA, is crucial before considering this borrowing option. Annual Percentage Rate (APR) represents the total cost of the loan, including fees, expressed as a yearly percentage. Unlike traditional loans, payday loans often have extremely high APRs, sometimes exceeding 400%. This high cost reflects the short repayment period and inherent risk for lenders. Remember to carefully compare APRs from different lenders before making a decision. Failing to do so could lead to unexpected and substantial debt.

Payday loan fees in Modesto can significantly impact the overall cost. These fees, often presented as a percentage of the loan amount or a flat fee, are added to the principal. Loan amounts typically range from $100 to $500 in California, though this can vary by lender. “It’s vital to borrow only the amount you absolutely need and realistically expect to repay on your next payday to avoid a debt cycle.” Always explore all available options, considering potential alternatives to payday loans before committing. Carefully review the loan agreement to fully understand all associated costs and repayment terms.

Legal Aspects of Payday Lending in California

California has strict regulations governing payday loans, designed to protect consumers from predatory lending practices. The California Department of Financial Protection and Innovation (DFPI) oversees these regulations. These laws limit the amount a lender can charge in fees and interest. They also place caps on the loan amount. Knowing these limits is crucial before considering a payday loan in Modesto. Failure to comply with these regulations can result in significant penalties for lenders.

For example, California law prohibits lenders from rolling over or renewing a payday loan indefinitely. This prevents borrowers from falling into a cycle of debt. It’s important to fully understand the repayment terms before signing any agreement. Researching reputable lenders is vital to avoid illegal practices. Always review the loan contract carefully. “Don’t hesitate to seek legal advice if you have questions or concerns about the terms of a payday loan.” The DFPI website offers valuable resources and information for consumers in California.

Finding Reputable Lenders in Modesto, CA

Identifying Licensed and Regulated Lenders

In Modesto, California, as in all states, it’s crucial to only borrow from licensed and regulated payday lenders. The California Department of Financial Protection and Innovation (DFPI) maintains a registry of licensed lenders. Always check this registry before applying for a payday loan. Failing to do so could expose you to predatory lending practices and illegal interest rates. This simple step is your first line of defense against potential financial harm.

Verify a lender’s license number directly with the DFPI. Don’t rely solely on information displayed on a website. Look for clear contact information, including a physical address in Modesto or California. Be wary of lenders who operate solely online with vague or untraceable contact details. “Choosing a licensed lender dramatically reduces your risk of encountering scams or exorbitant fees.” Remember, responsible borrowing begins with thorough due diligence. A licensed lender will provide you with all the necessary paperwork clearly outlining loan terms and fees upfront.

Checking Online Reviews and Testimonials

Before applying for a payday loan in Modesto, CA, thoroughly research potential lenders online. Don’t rely solely on a company’s website. Instead, check independent review platforms like Google Reviews, Yelp, and the Better Business Bureau (BBB). Look for patterns in customer feedback. Positive reviews should detail positive experiences with loan applications, approval processes, and repayment terms. Negative reviews, while less desirable, can highlight potential red flags, such as hidden fees or aggressive collection practices. Pay close attention to the lender’s responses to negative comments; a responsible lender will address concerns promptly and professionally.

“Ignoring online reviews can be a costly mistake when dealing with payday loans.” Consider the quantity and quality of reviews. A few glowing reviews on a new company’s website might not be representative. A lender with hundreds or thousands of reviews, even with some negative ones, might suggest a more established and accountable operation. Remember that reviews offer valuable insights into the customer service and overall experience of potential lenders. Use this information to compare options and ultimately make an informed decision when selecting a reputable payday loan lender in Modesto, CA. Checking reviews is a critical step in protecting yourself from predatory lending practices.

Comparing Interest Rates and Loan Terms

Before committing to a payday loan in Modesto, CA, meticulously compare interest rates from different lenders. Payday loans are notoriously expensive, so even a small percentage difference can significantly impact your total repayment amount. Don’t just focus on the advertised APR; inquire about all fees and charges, including origination fees and late payment penalties. These can quickly add up, potentially making one seemingly cheaper loan far more expensive than another. Remember to factor these hidden costs into your comparison.

Consider the loan term as well. Shorter loan terms mean quicker repayment, but also higher weekly or bi-weekly payments. Longer terms lower individual payments but increase the total interest paid. “Carefully weigh the pros and cons of each repayment schedule based on your budget and ability to manage repayments.” Choose a term you’re confident you can comfortably manage to avoid accumulating additional fees and harming your credit score. A reputable lender will clearly outline all terms and conditions, offering transparent information to help you make an informed decision.

The Application Process: A Step-by-Step Guide

Gathering Required Documents

Securing a payday loan in Modesto, CA, often requires providing specific documentation. Lenders typically need proof of income, such as recent pay stubs or bank statements showing consistent deposits. This verifies your ability to repay the loan. They’ll also want to see a valid government-issued photo ID, confirming your identity and residency. Failure to provide these crucial documents will likely delay or prevent loan approval. Don’t hesitate to contact the lender directly if you have questions about specific requirements, as policies can vary slightly.

Beyond income verification and ID, be prepared to provide additional documents. This could include your current address verification (utility bill, lease agreement), and possibly your bank account information, allowing for direct deposit and repayment. Some lenders may require a completed application form, often available online or in their office. “Remember to carefully review all forms and ensure the accuracy of the information you provide to avoid delays and potential complications.” Being organized and prepared significantly streamlines the application process for a payday loan in Modesto, CA.

Completing the Online Application

Most payday loan providers in Modesto, CA, offer online applications for convenience. This usually involves completing a simple form requesting basic personal information. Expect to provide your full name, address, Social Security number, and employment details, including income verification. Be sure to double-check all information for accuracy before submitting. Inaccurate information can delay your application or lead to rejection.

After submitting your application, you’ll typically receive an almost immediate response indicating whether your request is approved, pending further review, or denied. If approved, you’ll see the terms and conditions of the loan, including the APR and total repayment amount. Carefully review this information. “Understanding the total cost before acceptance is crucial to avoiding unexpected fees and ensuring the loan suits your budget.” Remember, payday loans are designed for short-term financial relief and should be used responsibly. If you have questions, contact the lender directly for clarification *before* signing any documents.

Understanding Loan Approval and Disbursement

Once you’ve submitted your application for a payday loan in Modesto, CA, the lender will review your information. This usually involves a credit check, verification of employment and income, and confirmation of your identity. The speed of the approval process varies by lender, but many offer same-day decisions. Factors like your credit score and debt-to-income ratio heavily influence approval. Remember to carefully review all terms and conditions before accepting a loan offer.

Approval doesn’t automatically mean instant funds. After approval, the lender will initiate the disbursement process. This typically involves depositing the funds directly into your bank account. The timeframe for disbursement can range from a few minutes to a couple of business days, depending on the lender’s procedures and your bank’s processing times. Always confirm the expected disbursement date with your lender to avoid unnecessary worry. “Understanding these steps will help you better manage your expectations and prepare for the arrival of your funds.”

Responsible Borrowing and Avoiding Predatory Lending

Creating a Realistic Budget

Before considering a payday loan in Modesto, CA, honestly assess your finances. Create a detailed budget, listing all your monthly income and expenses. This includes necessities like rent, utilities, and groceries, as well as non-essential spending like entertainment and dining out. Identify areas where you can cut back to free up cash flow. Consider using budgeting apps or spreadsheets to track your spending effectively. “Failing to plan is planning to fail,” and a realistic budget is the cornerstone of responsible financial management, especially when considering high-interest loans.

Prioritize essential expenses. Ensure you can comfortably meet these obligations before allocating funds to discretionary spending or loan repayments. Unexpected expenses often arise; build an emergency fund to handle these situations. Even a small emergency fund can prevent you from needing a payday loan altogether. Consider setting aside a small amount each month, even $25, to build this crucial safety net. “A well-structured budget helps you see the bigger picture and makes informed borrowing decisions.” Remember, responsible borrowing means understanding your financial capacity before seeking any type of loan.

Understanding the Total Cost of the Loan

Before taking out a payday loan in Modesto, CA, carefully examine the total cost. This goes beyond the initial amount borrowed. Payday lenders in California are regulated, but fees can still be substantial. Always ask for a clear breakdown of all fees and charges, including interest rates (expressed as an Annual Percentage Rate or APR), origination fees, and any potential penalties for late payments. “Understanding these costs upfront is crucial to making an informed decision.”

Consider the loan repayment schedule. These loans often demand repayment within a short timeframe, usually your next payday. Failing to repay on time results in additional fees, rapidly increasing the overall cost of borrowing. A seemingly small loan can quickly become unaffordable if you don’t fully understand the potential consequences of missed payments. Research and compare offers from multiple lenders to find the most reasonable terms. “Never borrow more than you can comfortably repay on time to avoid a debt spiral.”

Recognizing and Avoiding Predatory Lending Practices

Predatory lenders often target individuals facing financial hardship. They use deceptive tactics to trap borrowers in cycles of debt. Be wary of extremely high interest rates, far exceeding California’s legal limits. These rates can quickly spiral your debt out of control. Always carefully review the loan agreement before signing. Look for hidden fees and unclear terms. Consider using a reputable credit union or bank for a more transparent loan process. They typically offer fairer terms and lower interest rates.

Avoid lenders who pressure you into a quick decision. Legitimate lenders will give you time to consider your options. “Never feel pressured to borrow more than you need or can comfortably repay.” Watch out for lenders who ask for access to your bank account without clear explanation. This is a major red flag. Check the lender’s reputation with the California Department of Financial Protection and Innovation (DFPI). The DFPI helps protect consumers from predatory lending practices. Researching your options and understanding the terms thoroughly is crucial for responsible borrowing of payday loans in Modesto, CA.

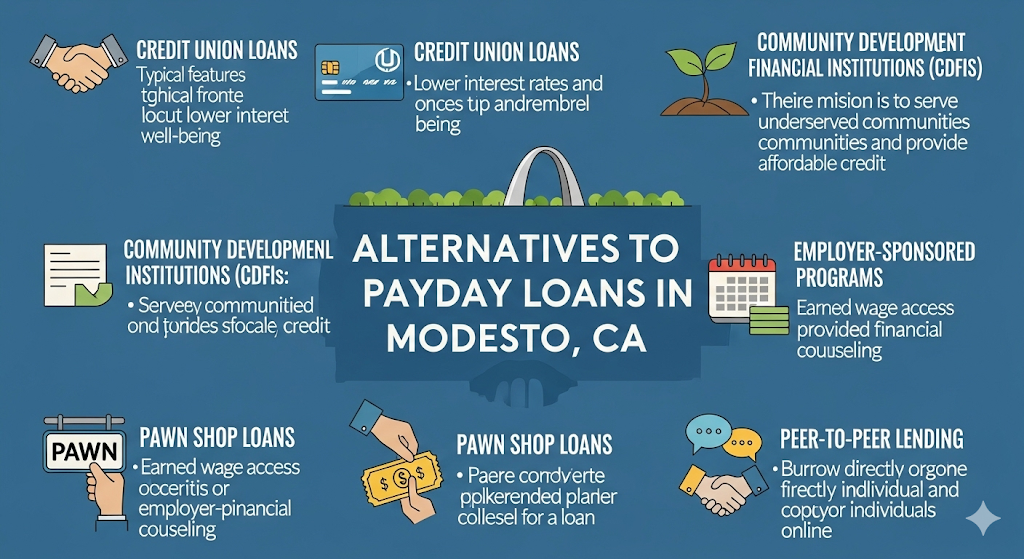

Alternatives to Payday Loans in Modesto, CA

Exploring Small Loans from Credit Unions

Credit unions often offer small loans with more favorable terms than payday lenders. They are not-for-profit organizations, meaning their primary goal is to serve their members, not maximize profits. This often translates to lower interest rates and more flexible repayment options. Many credit unions in Modesto, CA, provide small-dollar loans specifically designed to help members cover unexpected expenses. Research local credit unions to see what options are available to you.

Before applying, check your credit score and gather necessary financial documents. This will streamline the application process. “Credit unions often consider factors beyond credit scores,” allowing for more inclusive lending practices. They might offer financial counseling or budgeting assistance, helping you manage your finances better in the long term and avoid needing high-interest loans in the future. Consider this valuable support as you explore this viable alternative to payday loans in Modesto.

Considering Personal Loans from Banks

Banks offer personal loans as a viable alternative to payday loans in Modesto, CA. These loans typically have lower interest rates than payday loans. They also offer longer repayment periods, making them more manageable. Before applying, carefully compare interest rates and fees from several banks. Consider your credit score, as this significantly impacts loan approval and interest rates. Many local banks in Modesto, such as Bank of America and Chase, offer personal loan options.

Researching different loan products is crucial. Look for loans with fixed interest rates to avoid unexpected increases. Understand the terms and conditions thoroughly before signing any agreement. “Always prioritize a loan you can comfortably repay to avoid further financial strain.” Check if the bank offers financial literacy resources. These resources can help you better manage your finances in the future, preventing the need for high-cost short-term borrowing like payday loans.

Utilizing Community Resources and Financial Counseling

Modesto, CA offers a network of valuable community resources designed to help residents avoid the high-cost trap of payday loans. Organizations like the Modesto Gospel Mission and St. Mary’s Interfaith Community Services often provide emergency financial assistance programs. These programs might offer short-term grants or connect you with other local charities offering similar aid. Remember to explore all avenues; eligibility requirements vary. “Don’t hesitate to reach out; many are equipped to offer guidance and support during financial hardship.”

Financial counseling can be incredibly beneficial. Certified credit counselors can help you create a budget, develop a debt management plan, and explore options like debt consolidation or negotiating with creditors. Agencies such as the Consumer Credit Counseling Service (CCCS) have local branches or offer online services. A counselor can provide personalized advice tailored to your unique financial situation, offering a long-term strategy to build financial stability and avoid future reliance on payday loans. “Seeking professional help is a proactive step towards achieving lasting financial well-being.”

Managing Your Finances After a Payday Loan

Developing a Repayment Plan

Creating a repayment plan is crucial after securing a payday loan in Modesto, CA. Don’t just rely on hoping your next paycheck covers it. Instead, meticulously track your income and expenses. Identify areas where you can cut back. This might involve temporarily reducing entertainment spending or dining out less frequently. Consider using budgeting apps to help visualize your cash flow and allocate funds specifically for loan repayment. Remember, prompt repayment minimizes the risk of accumulating high interest charges. “Failing to plan is planning to fail,” so take the time to strategize.

Prioritize your debt repayment. List all your debts, including the payday loan, and arrange them from highest interest rate to lowest. This is a common debt management strategy (like the debt snowball method) that can provide mental satisfaction as you quickly tackle high-interest debts. Once you have a clear overview, allocate as much of your disposable income as possible to the payday loan. This dedicated approach, coupled with careful budgeting, will significantly accelerate your repayment journey and reduce the overall cost of the loan. “Consistent, even small, repayments demonstrate financial responsibility and build creditworthiness.”

Building Good Credit Habits

Escaping the cycle of payday loans in Modesto, CA, requires establishing strong credit habits. This means consistently paying all bills on time. Even small, seemingly insignificant late payments can negatively impact your credit score. Consider setting up automatic payments to avoid missed deadlines. Monitoring your credit report regularly through services like AnnualCreditReport.com is crucial. This allows you to catch and address any errors promptly. Paying down existing debts, even gradually, will show lenders you’re responsible. “Consistent, on-time payments are the foundation of good credit.”

Beyond timely payments, focus on responsible credit card usage. Keep your credit utilization low – ideally under 30% of your available credit. This demonstrates financial discipline. Avoid opening multiple accounts simultaneously. Apply for new credit sparingly. Building a positive credit history takes time and effort. But, it’s a critical step in securing better financial options in the future. “By consistently practicing these habits, you’ll lay a strong foundation for a brighter financial future, one free from the need for high-interest payday loans.”

Seeking Professional Financial Advice

Facing financial hardship can be overwhelming, especially after using a payday loan in Modesto, CA. Don’t hesitate to seek help from a qualified professional. A financial advisor can provide a personalized plan to get back on track. They can help you budget effectively, manage debt, and explore options like debt consolidation or credit counseling. Their expertise can make a significant difference in navigating your financial situation.

Consider contacting non-profit credit counseling agencies like the National Foundation for Credit Counseling (NFCC). They offer free or low-cost services, including budgeting workshops and debt management plans. “Remember, seeking professional help is a sign of strength, not weakness, and can prevent further financial difficulties.” These agencies have experience working with individuals struggling with high-interest debt, such as that incurred from payday loans. They’ll offer objective guidance and support to help you regain control of your finances.