Understanding payday loans tucson az

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They are typically due on your next payday, hence the name. These loans are often characterized by high interest rates and fees, making them a costly borrowing option. Consider the total cost before you borrow. In Arizona, including Tucson, specific regulations govern payday lending. Understanding these regulations is crucial to avoid predatory lending practices.

Before taking out a payday loan in Tucson, carefully weigh the pros and cons. High interest rates and fees can quickly spiral into a cycle of debt if you cannot repay the loan on time. Explore alternative financial solutions first, such as borrowing from family, friends, or credit unions. Credit unions often offer lower interest rates and more flexible repayment plans than payday lenders. “Always explore all available options before resorting to a payday loan, as the high costs can outweigh the benefits.” Understand the terms completely before signing any agreement.

How Payday Loans Work in Arizona

In Arizona, payday loans are short-term, small-dollar loans. They are designed to bridge the gap until your next paycheck. Borrowers typically write a post-dated check to the lender for the loan amount plus fees. The lender holds the check until the agreed-upon repayment date. Arizona law regulates these loans, setting limits on fees and interest. Understanding these regulations is crucial before you borrow. Failure to repay on time can lead to significant additional fees and impact your credit score.

Arizona’s payday lending laws aim to protect consumers from predatory practices. However, high fees remain a significant concern. These fees can quickly make the loan unaffordable, leading to a cycle of debt. Before applying for a payday loan in Tucson, explore all available options. Consider alternatives such as credit counseling, borrowing from friends or family, or negotiating with creditors. “Always carefully compare loan offers and understand the total cost before signing any agreement.” Remember that responsible borrowing practices are key to avoiding financial hardship.

Key Differences from Other Loan Types

Payday loans in Tucson, AZ, differ significantly from traditional loans like personal loans or credit cards. The most crucial difference lies in their short repayment terms, typically two to four weeks. This contrasts sharply with personal loans, which offer repayment periods spanning months or even years. Furthermore, payday loans usually involve smaller loan amounts, often designed to cover immediate expenses until your next paycheck. This makes them unsuitable for larger purchases or long-term financial solutions. Interest rates also vary dramatically. While personal loans often have lower interest rates, payday loans carry significantly higher rates and fees, making them a costly option if not repaid promptly.

Another key distinction is the application process. Payday loans often require minimal documentation, focusing primarily on proof of income and identification. This streamlined process makes them accessible to individuals who might not qualify for traditional loans. However, this ease of access also means less stringent credit checks, potentially leading borrowers into a cycle of debt if not managed responsibly. Remember, while convenient, the high cost of these loans should be carefully weighed against their benefits. Always explore other financing options before resorting to a payday loan in Tucson.

Eligibility Criteria and Requirements

Credit Score and History Impact

Payday loan lenders in Tucson, AZ, typically assess your creditworthiness. A good credit score isn’t always mandatory for approval. However, a higher score often leads to better terms and lower interest rates. Lenders understand that many people seeking payday loans have less-than-perfect credit histories. They might consider alternative factors such as your income stability and employment history. “A strong income, verifiable employment, and a positive banking history can significantly offset a lower credit score.”

Remember that even with a poor credit history, you may still qualify. Many payday loan providers utilize alternative credit scoring models. These models consider factors beyond traditional credit reports. This approach allows for a broader evaluation of your financial responsibility. It is crucial to compare offers from multiple lenders. This ensures you find the most suitable terms for your financial situation. “Always check the APR (Annual Percentage Rate) to compare the true cost of borrowing across different lenders.” Ignoring this step could lead to unexpectedly high fees.

Income and Employment Verification

Lenders in Tucson, AZ, typically require proof of regular income to approve a payday loan application. This is because consistent income demonstrates your ability to repay the loan on your agreed-upon due date. You’ll need to provide documentation such as recent pay stubs, bank statements showing direct deposit, or tax returns, depending on the lender’s specific requirements. Some lenders may accept proof of other regular income sources, such as Social Security benefits or retirement income. Always clarify acceptable documentation directly with the lender beforehand to avoid delays.

The amount of income needed varies widely between lenders. However, most lenders will want to see proof that you earn enough to cover your living expenses and the payday loan repayment without causing financial hardship. Be prepared to provide details on your monthly expenses, as some lenders may request this information as part of their assessment. “Failing to provide sufficient income verification is a common reason for payday loan applications being rejected,” so ensure your documentation is clear, complete, and accurate. Remember to compare offers from multiple lenders to find the best terms and interest rates.

Residency Requirements in Tucson

To qualify for a payday loan in Tucson, Arizona, you must generally be a resident of the state. This usually means providing proof of your current address, such as a utility bill or rental agreement. The specific documentation needed varies by lender, so it’s crucial to check with each institution directly. Failing to meet this requirement will automatically disqualify you from loan consideration. Remember, lenders are required to verify your residency to comply with state and federal regulations.

Many lenders use services to verify addresses, which can speed up the application process. However, providing inaccurate information is risky and can lead to application denial, or even legal consequences. Ensure all information you provide is completely accurate. “Always double-check your application before submitting it to avoid delays or rejection.” For example, an outdated address on your driver’s license could cause issues. You might need to show additional documentation, like a bank statement reflecting your current Tucson address, to satisfy the lender’s requirements for a payday loan in Tucson, Arizona.

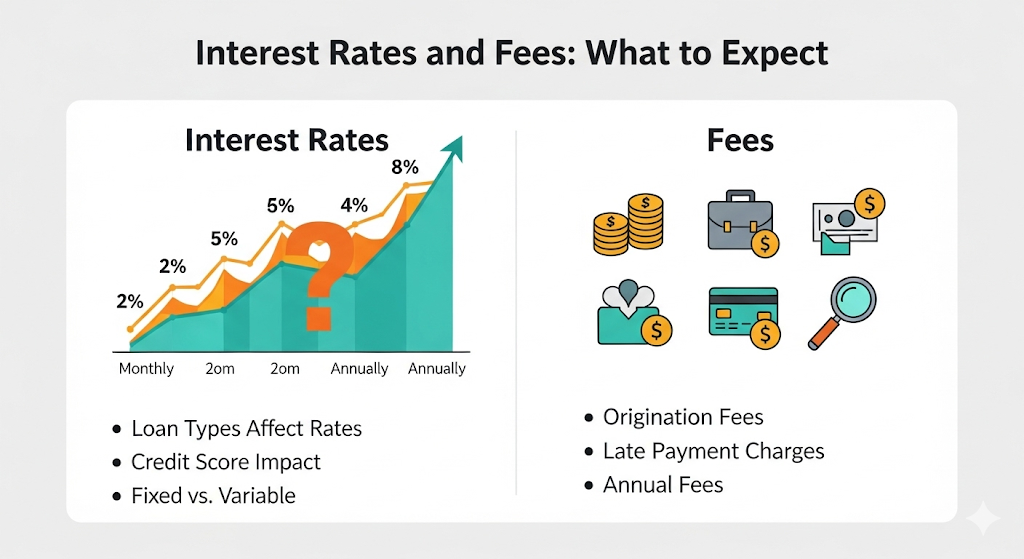

Interest Rates and Fees: Transparency is Key

Arizona’s Regulations on Payday Loan Interest

Arizona, like many states, regulates payday loans to protect consumers from predatory lending practices. The state caps the maximum interest rate a payday lender can charge. However, this seemingly straightforward regulation can be complex. Fees are often structured in ways that effectively increase the annual percentage rate (APR) far beyond the stated interest. Understanding the total cost, including all fees, is crucial before borrowing. Always request a clear breakdown of all charges.

Payday lenders in Tucson must comply with Arizona Revised Statutes, Title 6, Chapter 6, Article 1, which governs small loans. It’s vital to carefully review the loan agreement for all details. “Failing to understand the fine print can lead to unexpected and potentially crippling debt.” For example, some lenders might charge a seemingly low interest rate but add substantial origination or processing fees, dramatically increasing the overall cost. Research different lenders and compare their total fees and interest to find the most affordable option. Remember, transparency is paramount when dealing with payday loans.

Breaking Down the Total Cost of Borrowing

Understanding the true cost of a payday loan in Tucson, AZ goes beyond the advertised interest rate. Payday lenders often present a low APR, but this can be misleading. Crucially, fees significantly impact the total amount you repay. These fees, often expressed as a percentage of the loan amount or a flat fee, quickly inflate the overall cost. Always request a detailed breakdown showing all charges before signing any agreement.

For example, a $300 payday loan with a stated 15% interest rate might seem manageable. However, with added fees for origination, processing, or late payments, the actual cost could easily exceed $50. This significantly increases the effective annual percentage rate (APR), often exceeding 400%. “Before committing to a payday loan, carefully calculate the total repayment amount including all associated fees to make an informed financial decision.” This will help you avoid unexpected debt burdens and choose the most cost-effective option, if one even exists. Remember, researching several lenders is vital to comparing total costs.

APR and Other Associated Charges

Understanding the Annual Percentage Rate (APR) is crucial when considering a payday loan in Tucson, AZ. The APR reflects the total cost of borrowing, including interest and all fees. This isn’t just the stated interest rate; it encompasses everything, giving you a complete picture of the loan’s expense. Always ask for the APR in writing before agreeing to any loan terms. Compare APRs from multiple lenders to find the most affordable option. “Ignoring this critical figure can lead to unexpected and substantial financial burdens.”

Beyond the APR, be aware of other potential charges. These might include origination fees, late payment penalties, and even rollover fees if you need to extend the loan term. These additional costs can significantly increase the overall cost of borrowing. Read the loan agreement meticulously to understand all associated charges. Arizona state regulations govern payday loans; familiarize yourself with these regulations for consumer protection. “Transparency from the lender is paramount; if anything is unclear, seek clarification before signing.”

Responsible Borrowing Practices: Avoiding the Debt Trap

Creating a Realistic Budget and Repayment Plan

Before taking out a payday loan in Tucson, AZ, honestly assess your financial situation. Create a detailed budget, tracking all income and expenses. Identify areas where you can cut back to free up funds for repayment. This crucial step prevents further financial stress. Many free budgeting apps and online resources can assist you. Consider the Consumer Financial Protection Bureau’s website for helpful budgeting tools.

Next, develop a realistic repayment plan. Carefully consider your income and expenses, ensuring your repayment schedule aligns perfectly with your capabilities. Avoid borrowing more than you can comfortably repay by your next payday. “Failing to do so can lead to a cycle of debt, requiring further loans to cover previous ones, ultimately trapping you in a high-interest debt spiral.” Contact a credit counselor for personalized guidance if you struggle to create a manageable plan. Remember, responsible borrowing is key to avoiding financial hardship.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Tucson, Arizona, explore other options. Credit unions often offer small-dollar loans with more manageable interest rates than payday lenders. Check with local credit unions like Tucson Electric Power Federal Credit Union or Desert Schools Federal Credit Union for potential alternatives. These institutions frequently prioritize member well-being, offering financial counseling and education alongside lending services.

Consider budgeting apps and credit counseling. These resources can help you identify areas to cut expenses and develop a plan to manage your finances. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services nationwide. “Prioritizing responsible financial management is key to avoiding the high-cost cycle of payday loans.” Explore all available resources before resorting to high-interest, short-term borrowing. Remember, responsible borrowing is crucial to maintaining your financial health.

Seeking Financial Counseling when Needed

Facing financial hardship can be overwhelming, especially when considering a payday loan in Tucson, AZ. Don’t hesitate to seek professional guidance. Many free or low-cost financial counseling services are available in the Tucson area. These services can offer budgeting advice, help you create a debt management plan, and explore alternatives to high-interest payday loans. They can also help you understand your rights and responsibilities as a borrower. Finding a reputable counselor is crucial; look for certified credit counselors or those affiliated with well-established non-profit organizations.

The Consumer Financial Protection Bureau (CFPB) is an excellent resource to locate qualified counselors. They can provide unbiased advice and help you navigate the complexities of debt. Remember, early intervention is key. “Seeking help early can prevent a small financial problem from snowballing into a significant debt crisis,” impacting your credit score and overall financial well-being. Taking proactive steps like contacting a financial counselor demonstrates responsibility and can significantly improve your long-term financial health. Don’t struggle alone; utilize the resources available to make informed decisions about your finances.

Finding Reputable Lenders in Tucson, AZ

How to Spot and Avoid Predatory Lenders

Predatory lenders often employ deceptive tactics. They might advertise incredibly low initial interest rates, masking exorbitant fees and hidden charges. Be wary of lenders who pressure you into a loan immediately or fail to clearly explain the terms and conditions. Always read the fine print thoroughly before signing anything. “Don’t hesitate to walk away if something feels wrong; a reputable lender will be transparent and patient.”

Look for red flags like aggressive sales pitches, unclear repayment schedules, and a lack of information about licensing and registration. In Arizona, lenders must be licensed by the Arizona Department of Financial Institutions. Verify this independently. Consider using online resources like the Better Business Bureau (BBB) to check a lender’s reputation. “Checking reviews and complaints before applying for a payday loan can save you from a potentially devastating financial situation.” Remember, responsible borrowing involves careful comparison shopping and thorough due diligence.

Verifying Lender Licenses and Accreditation

Before considering any payday loan in Tucson, Arizona, meticulously verify the lender’s licensing status. The Arizona Department of Financial Institutions (ADFI) maintains a public database of licensed lenders. Check this database to confirm the lender’s legitimacy and avoid fraudulent operations. Always look for a current license number and ensure it matches the lender’s stated information. Failure to verify licensing can lead to severe financial consequences.

Beyond licensing, explore whether the lender holds any relevant accreditations. While not mandatory for payday lending in Arizona, affiliations with reputable organizations like the Community Financial Services Association of America (CFSA) can indicate a commitment to ethical lending practices. Review online reviews and complaints to get a sense of the lender’s reputation. “Choosing a licensed and potentially accredited lender significantly reduces your risk of encountering predatory lending practices.” Remember to compare interest rates and fees across several licensed lenders before making a decision.

Comparing Interest Rates and Terms from Multiple Lenders

Before committing to a payday loan in Tucson, AZ, thoroughly compare offers from several lenders. Don’t just focus on the advertised rate. Examine the Annual Percentage Rate (APR), which includes all fees and interest. A lower APR usually indicates a better deal. Also, carefully review the loan terms, including the repayment schedule and any prepayment penalties. Consider the total cost of the loan, not just the initial amount borrowed. This will allow for a complete comparison of loan options.

Remember, payday loans are expensive. High interest rates and short repayment periods can quickly lead to a debt cycle. Therefore, only borrow what you can confidently repay on time. Compare loan amounts, repayment periods, and fees to determine which lender offers the most manageable repayment plan for your circumstances. “Use online comparison tools or check with the Arizona Department of Financial Institutions for resources to help you find reputable lenders and understand the associated costs.” This will empower you to make an informed decision and avoid financial hardship.

Legal Protections and Consumer Rights

Arizona’s Laws Protecting Borrowers

Arizona has specific laws designed to protect consumers from predatory lending practices associated with payday loans. These laws regulate the maximum loan amount, the maximum finance charge, and the loan term, preventing excessively high interest rates and fees that can trap borrowers in a cycle of debt. The Arizona Department of Financial Institutions oversees payday lenders and enforces these regulations. You can find detailed information on their website regarding current limits and restrictions on payday loans in Tucson and throughout the state.

Crucially, Arizona law mandates clear disclosure of all fees and charges before you sign a loan agreement. Lenders must clearly explain the total cost of borrowing, including interest, fees, and any potential rollover charges. “Failing to provide this crucial information is a violation of Arizona law, and borrowers have legal recourse if misled.” Understanding these protections is your first step towards responsibly navigating the payday loan landscape in Tucson. Always carefully review the loan contract before signing. Contact the Arizona Attorney General’s office if you suspect illegal activity by a lender.

Understanding Your Rights and Responsibilities

In Arizona, including Tucson, you have significant protections when dealing with payday loans. The Arizona Department of Financial Institutions (ADFI) regulates lenders. They ensure compliance with state laws designed to protect consumers from predatory lending practices. Familiarize yourself with these laws. Understanding them is crucial before you consider a payday loan. “Knowing your rights empowers you to negotiate better terms or avoid exploitative loans altogether.”

Always carefully review the loan agreement. Understand the annual percentage rate (APR) and all fees. These fees can quickly escalate the total cost. Don’t hesitate to ask questions if anything is unclear. If you believe a lender has violated Arizona’s lending laws, contact the ADFI immediately. They can investigate complaints and take action against unethical lenders. “Remember, responsible borrowing is key to managing your finances and avoiding a cycle of debt.”

Where to Report Unfair Lending Practices

In Tucson, Arizona, several agencies protect consumers from unfair payday loan practices. If you believe a lender has violated Arizona’s lending laws, your first step should be to file a complaint with the Arizona Attorney General’s Office. Their website provides detailed instructions and forms for submitting complaints. They investigate allegations of predatory lending, including violations of interest rate caps and deceptive advertising related to payday loans in Tucson. You can also contact them by phone or mail.

Beyond the Attorney General, the Consumer Financial Protection Bureau (CFPB) is a crucial resource. The CFPB is a federal agency with broad authority over financial institutions, including payday lenders. They handle complaints about a wide range of issues, from illegal fees to harassment by debt collectors. “Filing a complaint with the CFPB is vital for building a record of the lender’s misconduct and potentially triggering an investigation.” Remember to document all interactions with the lender, including loan agreements, payment records, and communication logs. This documentation will strengthen your case.