Understanding No Teletrack Payday Loans

What are Teletrack and its impact on loan applications?

Teletrack is a consumer reporting agency. It provides lenders with detailed information about your credit history. This includes past loan applications, even those that were denied. Lenders use this data to assess your creditworthiness. A negative Teletrack report can significantly impact your chances of loan approval. Many borrowers find their applications rejected because of past financial difficulties reflected in their Teletrack report.

This impacts your ability to get payday loans and other types of short-term financing. “Lenders using Teletrack often view applicants with a history of missed payments or multiple loan applications more negatively.” This system aims to mitigate risk for lenders. However, it can create challenges for borrowers with less-than-perfect credit histories. No Teletrack payday loans offer an alternative for those who need quick financial help but worry about their Teletrack report. These loans bypass the Teletrack system, potentially increasing your approval chances.

How No Teletrack Payday Loans differ from Traditional Payday Loans

Traditional payday loans typically involve a hard credit check through Teletrack, a major credit reporting agency. This means lenders access your full credit history, potentially impacting your credit score, even if you’re approved. A lower credit score can make securing future loans more difficult. Denial is also more likely with a poor credit history.

In contrast, no Teletrack payday loans bypass this process. Lenders utilize alternative methods to assess your creditworthiness, often focusing on your current income and employment status. This can be a faster and more convenient option for individuals with less-than-perfect credit. “While this offers quicker access to funds, it’s crucial to remember that interest rates might be higher compared to traditional loans due to the increased risk for the lender.” Always compare loan offers carefully before committing to any agreement.

Benefits of choosing a No Teletrack Payday Loan

One key advantage is the faster application process. Traditional payday loans often involve extensive credit checks, delaying approval. No Teletrack loans bypass this step, leading to quicker funding. This is particularly beneficial for those facing urgent financial needs, such as unexpected medical bills or car repairs. You may receive your funds much faster than with a traditional lender.

Furthermore, a wider range of applicants qualify. Individuals with less-than-perfect credit histories, or even those with no credit history at all, often find it difficult to secure traditional loans. No Teletrack payday loans offer a more inclusive option, providing access to financial relief for a broader population. “This increased accessibility is a significant benefit for those who might otherwise be excluded from the lending market.” Remember to carefully compare interest rates and terms before selecting a lender.

Finding Reputable Lenders for No Teletrack Payday Loans

Identifying trustworthy lenders: red flags to avoid

Before applying for a no teletrack payday loan, carefully scrutinize potential lenders. Avoid lenders with vague websites lacking contact information, physical addresses, or licensing details. Be wary of sites promising guaranteed approval or incredibly low interest rates—these are often predatory tactics. Legitimate lenders will be transparent about fees and terms. “Always check reviews from multiple sources to gauge the lender’s reputation and customer service experience.” Many reputable review sites exist to aid your research.

Look for red flags like excessive upfront fees, hidden charges, or pressure to borrow more than you need. A trustworthy lender will clearly explain all costs associated with the loan. Be cautious of lenders who demand access to your bank account without proper authorization. No teletrack payday loans should be accessible, but responsible borrowing involves thorough due diligence. “Protect yourself by thoroughly researching and comparing lenders before committing to a loan.” Remember, a responsible lender prioritizes transparency and fair practices.

Checking lender credentials and licenses

Before applying for any no teletrack payday loan, meticulously verify the lender’s legitimacy. Check if they possess the necessary state licenses to operate legally in your area. Many states have online databases listing licensed lenders; utilize these resources. Beware of lenders operating without the proper licenses; this is a major red flag indicating potential scams. Always confirm their physical address and contact information; avoid lenders who only provide vague details.

Legitimate lenders are transparent about their fees and terms. They will clearly outline the interest rates, repayment schedules, and any additional charges. Avoid lenders who are evasive or refuse to provide detailed information upfront. Research online reviews and complaints; reputable websites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation and history. “Thorough due diligence is crucial when seeking fast financial relief through a no teletrack payday loan; protecting yourself from predatory lending practices is paramount.”

Comparing loan offers: interest rates and terms

Don’t just grab the first no teletrack payday loan offer you see. Carefully compare interest rates from multiple lenders. A seemingly small difference in percentage points can significantly impact your total repayment cost. For example, a 1% difference on a $500 loan could mean tens of dollars more in interest over the loan term. Always check the Annual Percentage Rate (APR), which includes all fees and interest. This gives you a complete picture of the loan’s true cost.

Consider the loan terms alongside the interest rate. Shorter repayment periods usually mean higher monthly payments but lower overall interest charges. Longer terms offer smaller monthly payments, but you’ll end up paying more in interest. Prioritize lenders who offer clear and transparent terms, including any potential late fees or penalties. “Read the fine print carefully before signing any agreement to avoid unexpected costs.” Choosing the right loan is about finding a balance between affordability and minimizing total repayment. Remember, responsible borrowing is key to managing your finances effectively.

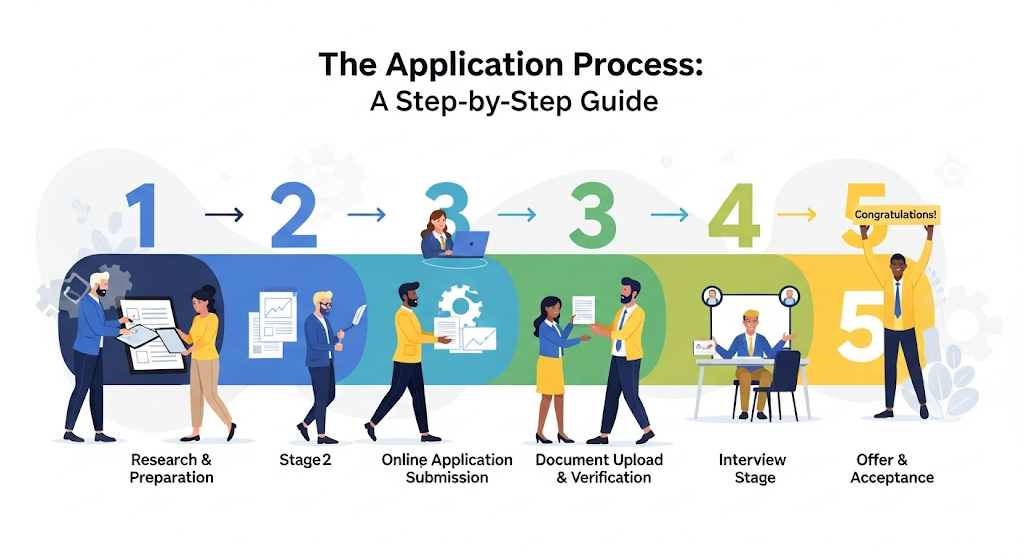

The Application Process: Steps to Secure Your Loan

Completing the application form accurately

Accuracy is paramount when applying for a no teletrack payday loan. Inaccurate information can delay your application or even lead to rejection. Double-check every detail, from your name and address to your employment history and bank account information. Providing false information is illegal and can have serious consequences. Take your time and carefully review each field before submitting your application.

Remember, lenders verify the information you provide. They may contact your employer or bank to confirm your details. “Providing correct information upfront streamlines the process and significantly increases your chances of approval.” Even small mistakes, like a typo in your social security number, can cause delays. Before submitting, proofread your application thoroughly. If you are unsure about any information, contact the lender directly for clarification. This proactive approach demonstrates responsibility and improves your chances of securing your no teletrack payday loan quickly.

Providing necessary documentation

Securing a no teletrack payday loan often requires providing some basic personal and financial information. Lenders will typically ask for valid identification, such as a driver’s license or state-issued ID. Proof of income is also crucial, which might include pay stubs, bank statements, or tax returns. This demonstrates your ability to repay the loan. Be prepared to provide contact information, including your current address and phone number. Accuracy is paramount; incorrect information can delay or even prevent approval.

Remember, lenders use this information to assess your creditworthiness and your ability to repay the loan on time. While no teletrack loans don’t involve a traditional credit check, providing accurate documentation builds trust and increases your chances of approval. “Providing complete and accurate information is vital for a smooth and efficient application process.” Failing to do so could result in delays or even rejection of your application. Always keep copies of everything you submit for your records.

Understanding the approval process timeline

Securing a no teletrack payday loan often involves a surprisingly swift approval process. Many lenders boast same-day funding, meaning you could have the money in your account within 24 hours of application. However, this speed depends on several factors. Your individual creditworthiness, the lender’s internal processing times, and even the time of day you apply can all influence the timeline. While some lenders provide instant decisions, others may take a few hours to review your application.

“It’s crucial to understand that the advertised processing speed is not a guarantee,” as various unforeseen circumstances can cause delays. Check the lender’s website for estimated processing times. Read reviews from other borrowers to gauge their experiences with approval speeds. Remember, responsible lenders will be transparent about their process. Always confirm the details before submitting your application. A quick approval doesn’t mean a quick repayment plan. Carefully review the loan terms before acceptance to avoid unexpected fees or repayment difficulties.

Responsible Borrowing: Managing Your Payday Loan

Creating a repayment plan

Before accepting a no teletrack payday loan, meticulously plan your repayment. Carefully review the loan agreement. Understand the total cost, including fees and interest. Then, create a realistic budget. Identify non-essential expenses you can cut. This might include dining out, entertainment, or subscriptions. Even small reductions can make a significant difference in your repayment capacity. Prioritize loan repayment to avoid accumulating further debt.

A written repayment plan is highly recommended. List your income sources. Account for all your regular expenses. Allocate a specific amount for your loan repayment each payday. This structured approach minimizes the risk of default. “Failing to plan is planning to fail,” and this is especially true with short-term loans like no teletrack payday loans. Consider using budgeting apps or spreadsheets to track your progress. Remember, responsible borrowing is key to managing your finances effectively and avoiding a debt cycle.

Budgeting effectively to prevent default

Creating a realistic budget is crucial to avoid defaulting on your no teletrack payday loan. Before applying, honestly assess your monthly income and expenses. List all your essential costs – rent, utilities, groceries, transportation – and compare them to your income. Identify areas where you can cut back. Even small savings can make a significant difference in your ability to repay the loan. Remember, accurate budgeting is the foundation of responsible borrowing.

Unexpected expenses often derail even the best-laid plans. Building an emergency fund, even a small one, can provide a buffer against unforeseen events that might otherwise force you to miss a payment. Consider setting aside a small amount each month, even $20 or $30, specifically for emergencies. This proactive approach greatly reduces the risk of defaulting on your no teletrack payday loan and protects your credit. “Failing to plan is planning to fail,” so careful budgeting is key to using these short-term loans responsibly.

Exploring alternative financial solutions

Before applying for any no teletrack payday loan, consider alternatives. Exploring these options might save you money and prevent a cycle of debt. Many credit unions offer small-dollar loans with more manageable repayment terms than payday lenders. These loans often come with lower interest rates, providing better financial protection for borrowers. Check with your local credit union or bank first; they could be a much better solution than a high-cost payday loan.

Consider also budgeting strategies and free financial counseling services. Organizations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost guidance. They can help you create a budget, explore debt management plans, and find other resources to manage your finances. “Prioritizing needs over wants, coupled with careful financial planning, can often eliminate the need for high-interest short-term borrowing like no teletrack payday loans altogether.” Remember, responsible financial management is key to long-term financial well-being.

Alternatives to No Teletrack Payday Loans

Personal loans

Personal loans offer a viable alternative to no teletrack payday loans, providing a potentially more manageable repayment structure. Unlike payday loans, which often involve high interest rates and short repayment periods, personal loans typically offer longer terms and lower interest rates, depending on your creditworthiness. This allows for smaller, more affordable monthly payments, reducing the risk of falling into a cycle of debt. Reputable lenders, such as banks and credit unions, offer personal loans with transparent terms and conditions, allowing for careful consideration before borrowing.

Consider exploring options from online lenders as well, but always prioritize reputable companies with positive customer reviews. Carefully compare interest rates and fees from multiple lenders to secure the most favorable terms. “Remember to check the loan’s APR (Annual Percentage Rate) to understand the true cost of borrowing.” Before applying for any personal loan, carefully review your budget to ensure you can comfortably manage the monthly repayments. This responsible approach minimizes the risk of financial hardship and helps you navigate your financial needs effectively.

Lines of credit

Lines of credit offer a flexible alternative to payday loans, providing access to funds as needed, up to a pre-approved limit. Unlike payday loans, which are typically one-time lump sums, a line of credit allows for repeated borrowing and repayment, making it a potentially more manageable option for ongoing financial needs. Many credit unions and banks offer lines of credit, often with more favorable terms than payday lenders. It’s crucial to compare interest rates and fees across different institutions. Consider a secured line of credit if you have difficulty qualifying for an unsecured one. This often involves pledging collateral, like a savings account, to reduce lender risk.

Secured lines of credit often come with lower interest rates than unsecured options, making them a more affordable solution for managing unexpected expenses. However, remember that defaulting on a secured line of credit could result in the loss of your collateral. Before applying, carefully review the terms and conditions. “Understanding the interest rates, fees, and repayment schedule is vital to making an informed decision.” Explore your options thoroughly; comparing offers from different lenders can save you money in the long run. Remember to budget carefully to avoid accumulating excessive debt. Responsible borrowing is key to successfully using any type of credit facility.

Credit union loans

Credit unions offer a viable alternative to payday loans, even without a Teletrack check. They are not-for-profit organizations, often serving specific communities or employee groups. This structure allows them to provide more favorable loan terms compared to traditional banks or payday lenders. They may offer small-dollar loans with lower interest rates and more flexible repayment options. Many credit unions prioritize member financial well-being, providing financial education resources alongside lending services.

Before applying, check your eligibility requirements. Membership often involves joining a specific credit union’s group, though this can be relatively easy to accomplish. Credit union loans typically require a credit check, but they may be more lenient than other financial institutions, particularly for members with a history of responsible financial behavior within the credit union. “Consider a credit union loan as a much safer and potentially cheaper way to borrow small amounts of money compared to high-interest payday loans.” Remember to compare interest rates and fees across several credit unions before committing to a loan.

Seeking financial assistance from non-profit organizations

Non-profit organizations offer a crucial alternative to no teletrack payday loans. Many provide financial assistance programs, including emergency funds and budgeting advice. These organizations often work with individuals facing unexpected hardships, such as medical bills or job loss. They understand the complexities of financial distress and aim to provide support without the high interest rates and fees associated with payday loans. Reputable charities like the Salvation Army and local food banks frequently offer such services, sometimes in conjunction with counseling to help prevent future financial crises. Check your local area for available resources.

Before applying for a no teletrack payday loan, thoroughly explore these nonprofit options. “These organizations prioritize long-term financial well-being over short-term fixes,” offering guidance and resources far beyond a simple loan. They can provide valuable tools and education to improve your financial literacy and help you develop a sustainable budget. This might include workshops, one-on-one counseling sessions, or access to resources like credit counseling services. Remember to verify the legitimacy of any organization before sharing personal financial information. The goal is to gain sustainable financial relief, not simply a quick loan with potentially devastating consequences.

Frequently Asked Questions (FAQs)

What is the maximum loan amount I can borrow?

The maximum loan amount for a no teletrack payday loan varies significantly depending on several factors. These include your state’s regulations, the lender’s policies, and your individual financial circumstances. Many lenders set limits between $100 and $1,000. However, some states may have stricter caps, limiting loans to much smaller amounts. It’s crucial to research your state’s specific regulations before applying. Always check the lender’s website for their stated maximum loan amount.

“Remember, borrowing more than you can comfortably repay within the short timeframe of a payday loan can lead to a cycle of debt.” Before you commit to a loan, carefully evaluate your budget and repayment capabilities. Consider using a loan calculator to estimate your total repayment cost, including fees and interest. Responsible borrowing is paramount when seeking fast financial relief with a no teletrack payday loan. Compare offers from several lenders to find the best terms for your situation. Don’t hesitate to seek financial guidance if needed.

What are the typical interest rates?

Interest rates for no teletrack payday loans vary significantly. Several factors influence the final rate, including the lender, your credit history (even without a full Teletrack report), the loan amount, and the repayment terms. Generally, expect rates to be higher than traditional loans. This is because these loans carry a higher risk for lenders. They often compensate for this increased risk with higher interest charges. Remember to always compare offers from multiple lenders.

“It’s crucial to carefully review the loan agreement before signing, paying close attention to all fees and charges.” While advertised rates might seem appealing, hidden fees can dramatically increase the overall cost. Some lenders might quote an Annual Percentage Rate (APR), which provides a clearer picture of the total borrowing cost. However, not all lenders provide this information upfront. Always ask for clarification if anything is unclear. Be aware that extremely high interest rates could signal a predatory lender. Consider exploring alternative financial solutions if the cost seems prohibitive.

How long does it take to receive funds?

The speed of receiving funds with a no teletrack payday loan varies depending on the lender and your specific circumstances. Most lenders aim for same-day funding if you apply and are approved before a certain cut-off time, typically midday. However, it’s crucial to understand that this is not always guaranteed. Weekend or holiday applications may result in a delay until the next business day. Always check the lender’s website for specific processing times and potential delays.

Factors affecting disbursement include the lender’s internal processing speed, your bank’s processing time for electronic transfers, and the verification of your information. While many lenders advertise “fast cash,” it’s essential to manage expectations. Instant approval doesn’t always equate to instant funding. “Always confirm the expected timeframe with your chosen lender before submitting your application to avoid disappointment.” Consider this a critical step in making an informed decision about no teletrack payday loans as a short-term financial solution.

What happens if I can’t repay the loan?

Missing loan payments on a no teletrack payday loan has serious consequences. Lenders will typically attempt to contact you repeatedly. They may also charge late fees, which can significantly increase your debt. These fees vary by lender, so it’s crucial to understand your loan agreement thoroughly before signing. Ignoring the debt is not an option. It will likely damage your credit score, even without teletrack reporting. Further action could include being sent to collections, impacting your ability to obtain credit in the future.

Dealing with potential repayment issues proactively is vital. Contact your lender immediately if you foresee difficulties. Explore options such as loan extensions or payment plans to avoid default. Many lenders are willing to work with borrowers facing temporary financial hardship. Consider seeking free credit counseling from a reputable organization to develop a budget and manage your finances more effectively. “Failing to communicate your situation could lead to far worse outcomes than seeking help early on.” Remember, responsible borrowing is key. Always borrow only what you can comfortably repay.