Understanding Online Payday Loans Louisiana

What are online payday loans?

Online payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. These loans are accessed primarily online, offering convenience and speed. However, it’s crucial to understand that they come with high interest rates and fees, making them a costly borrowing option if not managed carefully. Consider them only for genuine emergencies and always explore alternative solutions first.

Think of them as a financial safety net for unexpected car repairs or medical bills, not for regular expenses. Louisiana residents seeking online payday loans should carefully research lenders and compare terms to find the best option. “Always read the fine print and fully understand the repayment terms and associated fees before agreeing to a loan,” as failing to do so can lead to a cycle of debt. Reputable lenders will provide clear and concise information about their fees and interest rates. Avoid lenders who are vague or pressure you into a quick decision.

How do online payday loans work in Louisiana?

Applying for an online payday loan in Louisiana is generally straightforward. You’ll need to complete an online application, providing personal information and financial details. Lenders will then review your application, checking your creditworthiness and employment history. The entire process, from application to potential approval, might be completed in minutes, although funding may take longer. Remember, instant approval is not guaranteed, and lenders will assess your ability to repay the loan. Louisiana’s regulations on payday loans are important to understand.

Once approved, the loan amount, typically a small sum, is usually deposited directly into your bank account. Repayment is due on your next payday, usually within two weeks. High interest rates are a characteristic of these loans. Before applying, carefully compare interest rates and fees from multiple lenders. “It’s crucial to only borrow what you can comfortably repay to avoid a debt cycle.” Failing to repay on time can result in hefty fees and further complications. Consider alternatives like credit counseling if you’re struggling financially.

Louisiana’s legal framework for payday loans

Louisiana regulates payday loans under the Louisiana Revised Statutes Title 6, Chapter 10. These laws govern crucial aspects like loan amounts, interest rates, and loan terms. Lenders must adhere strictly to these regulations to operate legally. Ignoring these rules can lead to severe penalties, including hefty fines and potential legal action. “Borrowers should always check the current state regulations before considering any payday loan.”

Understanding the specifics of Louisiana’s payday loan laws is vital for both borrowers and lenders. The maximum loan amount allowed is capped, preventing excessively high-risk loans. Furthermore, the law dictates the maximum finance charges a lender can impose. These limits aim to protect consumers from predatory lending practices. Always compare offers from multiple lenders to find the most favorable terms. “Remember to carefully read the loan agreement before signing, understanding all fees and repayment schedules to avoid unexpected charges.”

Instant Approval: Fact or Fiction?

The reality of ‘instant’ approval

The term “instant approval” for online payday loans in Louisiana is often misleading. While some lenders advertise this, the application process rarely results in immediate funding. Many factors influence processing times, including credit checks, verification of employment and income, and the lender’s internal procedures. Expect a delay, even if the initial application is quickly reviewed. Think of “instant” as referring to the speed of the initial application review, not the final disbursement of funds.

In reality, approval often takes several hours, or even a full business day. This is particularly true for borrowers with less-than-perfect credit histories. Lenders need time to assess risk and verify information. Louisiana payday loan regulations also contribute to processing times. “The speed of approval depends heavily on the lender and your individual circumstances.” Always be wary of lenders promising unrealistic turnaround times; they may be employing deceptive marketing tactics. Read the fine print carefully before committing to any loan.

Factors affecting approval speed

Several factors influence how quickly a Louisiana payday loan application is processed. The lender’s internal processes play a significant role. Some lenders are faster than others, employing streamlined technology and efficient staff. Your credit score also matters. A strong credit history often leads to quicker approvals. However, even with bad credit, some lenders may still process your application relatively fast, though possibly with higher interest rates. Finally, the completeness and accuracy of your application are crucial. Missing information or errors will cause delays. “Providing all required documents upfront significantly speeds up the process.”

The time of day and day of the week can surprisingly affect approval speed. Lenders often experience higher application volumes during peak times. Weekends and holidays may also result in slower processing. Therefore, submitting your application during off-peak hours on a weekday could lead to faster results. Remember that “instant approval” is largely a marketing term. While some lenders may offer quick decisions, the actual funding time will likely vary. Always check the lender’s stated processing times for a more realistic expectation. Understanding these factors will help manage your expectations and increase your chances of a smoother online payday loan experience in Louisiana.

What to expect during the application process

Applying for an online payday loan in Louisiana usually involves a straightforward process. Expect to provide personal information, including your full name, address, Social Security number, and bank account details. You’ll also need to verify your employment and income. Lenders will likely check your credit report, but this may not be a major factor in their decision. The entire process, from application to receiving a response, can take anywhere from a few minutes to a couple of hours, depending on the lender and your individual circumstances.

“While many lenders advertise ‘instant approval,’ this rarely means immediate access to funds.” Be prepared for a short review period. The lender needs to verify your information to prevent fraud and ensure you meet their eligibility criteria. Remember to carefully read all terms and conditions before accepting a loan. Understanding the interest rates, fees, and repayment schedule is crucial before proceeding. Choosing a reputable lender with transparent policies is key to a positive experience with online payday loans in Louisiana.

Eligibility Requirements for Louisiana Payday Loans

Credit score and history

Unlike traditional loans, Louisiana payday lenders generally don’t perform extensive credit checks. They prioritize your current income and ability to repay the loan. A poor credit history won’t automatically disqualify you. However, extremely poor credit, indicating a history of irresponsible borrowing, might raise red flags. Lenders assess your risk based on various factors, and your credit report is one piece of that puzzle. They’re more interested in your capacity to repay the loan within the short timeframe.

Remember, while a bad credit score isn’t a complete barrier to securing an online payday loan in Louisiana, it could impact the terms offered. Lenders may offer a smaller loan amount or charge a higher interest rate. Always compare offers from several lenders to find the best terms for your situation. “Before applying for any online payday loan, it’s crucial to understand the total cost and repayment implications to avoid falling into a debt cycle.” Carefully review the loan agreement before signing, paying close attention to the APR and any hidden fees.

Income and employment verification

Louisiana payday lenders require proof of regular income to assess your ability to repay the loan. This typically means providing pay stubs from your employer for the past few months, showing consistent earnings. Self-employment requires submitting tax returns or bank statements demonstrating a stable income stream. The specific documentation needed varies between lenders, so always check their individual requirements before applying. “Failing to provide sufficient proof of income will likely result in your application being rejected.”

Lenders also verify employment. This often involves a simple phone call to your employer to confirm your employment status and income. Some lenders may use third-party verification services for a more thorough check. Be prepared to provide your employer’s contact information when applying for an online payday loan in Louisiana. Remember, truthful and accurate information is crucial for a successful application. Providing false information is illegal and can have serious consequences.

Residential status in Louisiana

To qualify for an online payday loan in Louisiana, you must be a resident of the state. This means you’ll need to provide proof of your current address. Acceptable forms of proof often include a utility bill, bank statement, or lease agreement. The address you provide must be a physical address within Louisiana. Lenders verify this information to ensure compliance with state regulations and to mitigate risk. Failure to provide accurate residential information will likely result in your application being denied.

Furthermore, the length of your residency in Louisiana may also be a factor. While not all lenders have the same requirements, some may prefer applicants who have lived in the state for a certain minimum period. This timeframe varies widely depending on the lender’s internal policies and risk assessment. Always check the specific requirements of the online lender you choose before applying. “Confirming your residency is a crucial step in the application process, so gather your documents beforehand to streamline the process.” Contacting the lender directly to clarify their residency criteria can avoid potential delays or rejections.

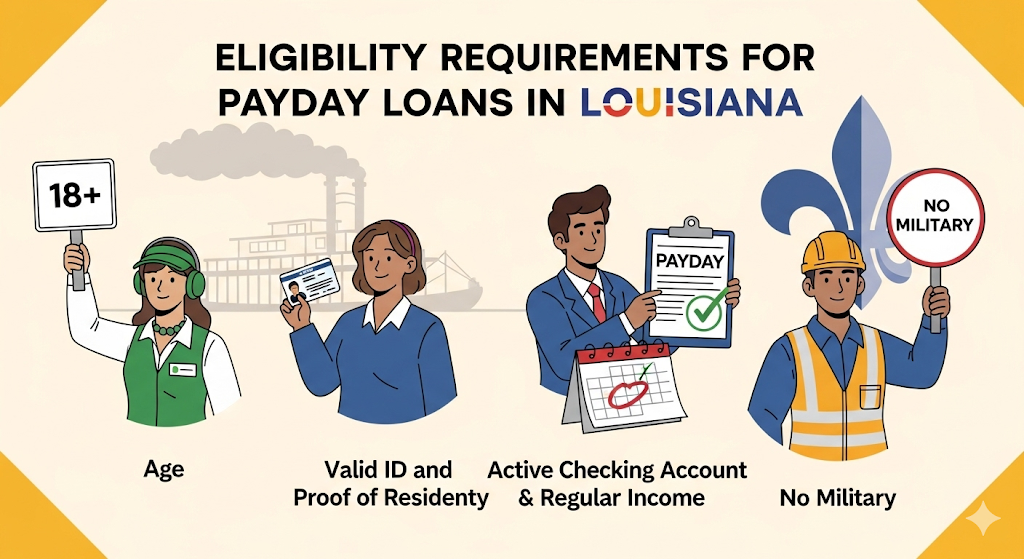

Other requirements

Beyond the basic income and employment criteria, Louisiana payday lenders often have additional stipulations. These may include minimum age requirements (typically 18 years or older), a valid Louisiana driver’s license or state-issued ID, and an active checking account in your name. The checking account is crucial for direct deposit of the loan and subsequent repayment. Failure to meet these seemingly minor requirements can lead to immediate loan application rejection.

Furthermore, some lenders might request proof of residency, such as a utility bill or rental agreement. This is to verify your Louisiana address and ensure you are a resident of the state, as payday loan regulations vary considerably by location. It’s also important to note that lenders may perform a credit check, though this isn’t always a deal-breaker for online payday loans in Louisiana. However, a poor credit history might lead to higher interest rates or a reduced loan amount. “Always carefully review the lender’s specific requirements before applying, as these can vary from institution to institution.” Contacting the lender directly with questions is always advisable to avoid unexpected rejection.

Finding Reputable Lenders in Louisiana

Identifying licensed and trustworthy lenders

Before applying for any online payday loans in Louisiana, verifying a lender’s legitimacy is crucial. Check the Louisiana Office of Financial Institutions (LOFI) website. This site maintains a registry of licensed lenders. Only borrow from firms listed there. Ignoring this step could lead to illegal lending practices and potential scams. Remember, a lender’s online presence doesn’t guarantee legitimacy. Always conduct thorough research.

Look for transparent fee structures and clear loan terms. Avoid lenders who pressure you into a loan or hide crucial information. “Legitimate lenders readily provide details about interest rates, repayment schedules, and any associated fees.” Compare multiple lenders before making a decision. Read online reviews and check the Better Business Bureau (BBB) website for any complaints filed against potential lenders. This due diligence protects you from predatory lending practices prevalent in the payday loan industry.

Comparing interest rates and fees

Interest rates on payday loans in Louisiana vary significantly. Don’t just focus on the advertised rate. Carefully examine the Annual Percentage Rate (APR), which includes all fees. This gives you a true picture of the loan’s overall cost. A lower APR is always better. Remember, these loans are designed for short-term use only, so even small differences in APR can dramatically impact your total repayment.

Compare fees across multiple lenders. Some lenders charge origination fees, late fees, or other hidden costs. These fees can quickly add up, making the loan far more expensive than initially anticipated. “Always read the loan agreement thoroughly before signing to avoid unexpected charges.” Look for transparent lenders who clearly outline all fees upfront. This helps you make an informed decision and choose the most affordable Louisiana payday loan option. Using an online comparison tool can streamline this process and save you considerable time and money.

Avoiding predatory lending practices

Louisiana residents seeking online payday loans must be vigilant against predatory lenders. These lenders often charge exorbitant fees and interest rates, trapping borrowers in a cycle of debt. Look for lenders transparent about their fees and terms, readily available contact information, and a clear explanation of the repayment process. Avoid lenders who pressure you into borrowing more than you need or who offer loans without properly assessing your ability to repay. Remember, reputable lenders prioritize responsible lending practices.

Legitimate lenders in Louisiana comply with state regulations, including those outlining maximum interest rates and fees. Check the Louisiana Office of Financial Institutions website for a list of licensed lenders. Before accepting any loan offer, carefully review all terms and conditions. Be wary of lenders who promise “guaranteed approval” or “instant cash” without a proper credit check. “Choosing a responsible lender is crucial for protecting your financial well-being.” Compare offers from several lenders to find the best terms. Consider exploring alternative borrowing options, such as credit unions or community-based financial assistance programs, if payday loans seem too risky.

Tips for safe online transactions

Securing a payday loan online in Louisiana requires caution. Always verify the lender’s legitimacy. Check for a physical address and licensing information from the Louisiana Office of Financial Institutions. Beware of lenders promising guaranteed approval, as this often indicates predatory practices. Legitimate lenders will perform a credit check and assess your ability to repay. Never share sensitive information unless you’re on a secure, HTTPS website. Look for a padlock icon in your browser’s address bar.

Before submitting any personal details or financial information, carefully review the loan terms and conditions. Understand the Annual Percentage Rate (APR), fees, and repayment schedule clearly. Compare offers from multiple lenders to find the best deal. Read online reviews and testimonials from previous borrowers. “Ignoring these steps can lead to unexpected fees, high interest rates, and potential scams.” Remember, a responsible lender will be transparent about all charges. Report any suspicious activity to the Louisiana Attorney General’s office or the Better Business Bureau.

Responsible Borrowing and Repayment

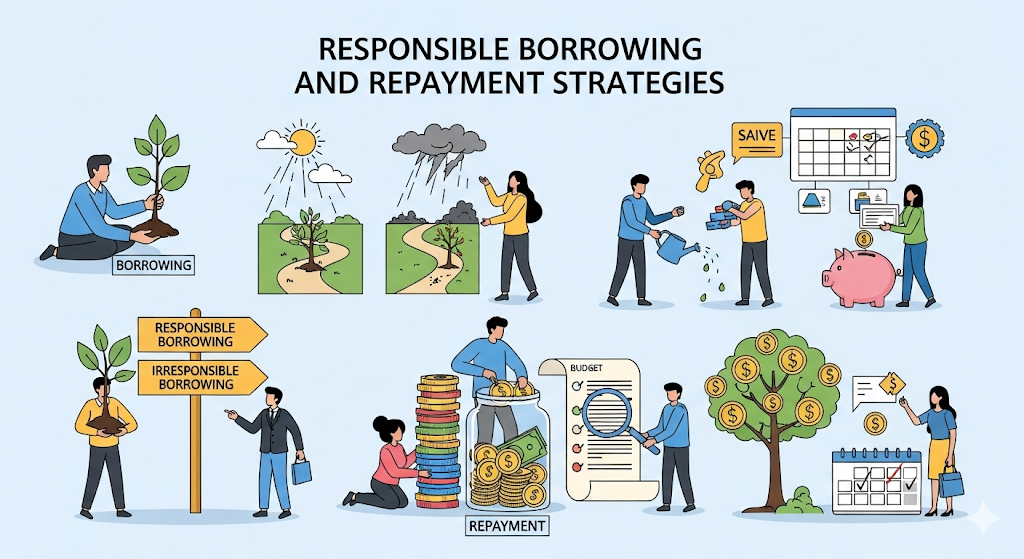

Creating a repayment plan

Before applying for an online payday loan in Louisiana, carefully plan how you will repay it. Unexpected expenses can derail even the best-laid plans. Thoroughly assess your monthly income and expenses. Identify areas where you can cut back to free up funds for loan repayment. Consider creating a detailed budget to visualize your cash flow. This will help you understand if a payday loan is truly feasible, given your current financial situation.

A realistic repayment plan is crucial for avoiding a debt cycle. Account for the loan’s total cost, including fees and interest, which can significantly increase the amount you owe. Explore different repayment options. Can you repay the loan in full on your next payday? Or, will you need to make partial payments? “Failing to plan for repayment can lead to serious financial consequences, including further borrowing to cover missed payments and damage to your credit score.” Prioritize paying off the loan promptly to minimize interest charges and avoid potential late fees. Remember, Louisiana payday loan regulations are in place to protect borrowers, but responsible planning is your best defense against financial hardship.

Understanding the total cost of the loan

Before you apply for an online payday loan in Louisiana, it’s crucial to understand the true cost. Payday loans are notorious for high interest rates and fees. These charges can quickly inflate the total amount you repay, far exceeding the initial loan amount. Always carefully review the loan agreement. Look for details on all fees, including origination fees, late payment penalties, and any other potential charges. Use a loan calculator to estimate the total repayment amount. This will give you a clear picture of your financial commitment.

Remember, the advertised loan amount isn’t the amount you’ll ultimately repay. “Failing to account for all associated costs can lead to unexpected debt and financial hardship.” Consider the Annual Percentage Rate (APR), a standardized measure reflecting the total cost of borrowing. A higher APR indicates a more expensive loan. Compare APRs from multiple lenders to find the most affordable option. Shop around and don’t rush into a decision. Taking the time to fully understand the total cost will help you make a responsible borrowing choice and avoid potential financial problems.

Managing debt and avoiding rollover

Successfully managing your online payday loan in Louisiana requires careful planning and discipline. Create a realistic budget that accounts for all your income and expenses, including the loan repayment. Prioritize the loan payment to avoid late fees and potential damage to your credit score. Consider setting up automatic payments to ensure on-time repayment. Remember, even a small amount of missed payments can snowball into larger debt. “Failing to plan is planning to fail,” and this is especially true when dealing with short-term, high-interest loans like payday loans.

Avoid the trap of loan rollovers at all costs. Rolling over a payday loan simply means extending the loan’s repayment period, usually with added fees. This practice can quickly lead to a cycle of debt that’s difficult to break. Instead of rolling over, explore options like speaking to your lender about a payment plan or seeking financial counseling from reputable organizations like the National Foundation for Credit Counseling (NFCC). Early intervention is key to preventing a spiraling debt situation. Proactive planning and responsible financial habits are your best defense against overwhelming debt.

Seeking help with financial difficulties

Facing financial hardship can be overwhelming. It’s crucial to remember you’re not alone. Many resources exist to help you navigate difficult times and avoid relying solely on online payday loans Louisiana or similar high-interest options. Consider exploring options like credit counseling agencies, which offer debt management plans and budgeting advice. These services can provide personalized strategies to address your unique financial situation. They can also help you negotiate with creditors for more manageable repayment terms.

Before taking out any loan, especially a short-term payday loan, carefully consider all alternatives. Explore options like negotiating payment plans directly with creditors, seeking assistance from local charities, or utilizing government assistance programs. “The Louisiana Department of Social Services offers various programs to aid residents facing financial difficulties.” Remember, responsible borrowing involves understanding your options and making informed decisions that minimize long-term financial burdens. Prioritizing your needs and creating a sustainable budget is crucial for long-term financial health. Don’t hesitate to seek professional help; it’s a sign of strength, not weakness.

Alternatives to Payday Loans in Louisiana

Community resources and financial assistance programs

Before considering an online payday loan in Louisiana, explore the wealth of community resources available. Many local charities and non-profit organizations offer financial assistance programs designed to help individuals facing temporary financial hardship. These programs often provide emergency funds, budget counseling, and assistance with bill negotiation. Contact your local United Way or search online for “financial assistance programs near me” to locate resources in your area. The Louisiana Department of Social Services also maintains a directory of relevant services.

These community resources often provide a more sustainable solution than a payday loan. They typically avoid the high interest rates and fees associated with short-term loans. “Instead of trapping yourself in a cycle of debt, seek help navigating your financial challenges through responsible and sustainable means.” Remember, exploring these options before resorting to online payday loans in Louisiana can significantly improve your long-term financial well-being and prevent further financial distress. Utilize available credit counseling to develop a sound budget and debt management plan.

Credit unions and small-loan options

Credit unions often provide more affordable small-loan options than payday lenders. They are not-for-profit organizations, meaning their focus is on member benefit, not maximizing profit. This often translates to lower interest rates and more flexible repayment terms. Many credit unions offer small loans specifically designed for situations where a quick cash injection is needed, sometimes even processing applications faster than traditional banks. Check with your local credit union to see what programs they offer. They may also provide financial counseling, assisting you in creating a budget and better managing your finances in the long run.

Exploring credit unions is a crucial step in finding a responsible alternative to Louisiana payday loans. “Before rushing into a high-interest payday loan, always check if a local credit union can provide a more sustainable and affordable loan.” These institutions frequently offer personal loans, share secured loans, or even small credit-builder loans. These options can help you avoid the debt trap many fall into with payday loans’ high fees and short repayment windows. Remember to compare interest rates and terms carefully before committing to any loan, regardless of the lender.

Budgeting and financial planning advice

Before considering any loan, thorough budgeting is crucial. Create a realistic budget that tracks your income and expenses. Identify areas where you can cut back. This will give you a clearer picture of your financial situation and help you determine if a loan is truly necessary. Many free budgeting apps and resources are available online, such as Mint or EveryDollar, to assist you in this process. Remember, understanding your spending habits is the first step towards financial stability.

Effective financial planning goes beyond simply budgeting. It involves setting both short-term and long-term financial goals. These might include paying off debt, saving for emergencies, or planning for retirement. Consider seeking guidance from a reputable financial advisor. They can offer personalized strategies to help you manage your money effectively. “Taking control of your finances now will prevent you from needing high-interest loans like payday loans in the future.” Prioritize building a strong financial foundation to avoid the high cost and potential debt cycle associated with payday loans in Louisiana.