Understanding payday loans Casper, WY

What are Payday Loans and how Do They Work?

Payday loans Casper Wyoming, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. Borrowers typically write a post-dated check to the lender for the loan amount plus fees, or authorize an electronic debit from their bank account. The loan term is usually two to four weeks, aligning with a typical pay cycle. In our experience, many borrowers use these loans for unexpected expenses like car repairs or medical bills, situations where traditional lending options may not be readily available or practical. A common mistake we see is borrowers failing to fully understand the total cost of the loan, including all applicable fees and interest.

Understanding the Annual Percentage Rate (APR) is crucial. While the advertised interest rate might seem low, the short repayment period significantly inflates the APR. For example, a $300 payday loan with a $45 fee due in two weeks might seem manageable, but this translates to a potentially very high APR. It’s essential to carefully compare offers from multiple lenders and thoroughly read all loan documents before signing. Always explore alternative financing options, such as credit counseling or borrowing from family and friends, before resorting to a payday loan. Remember, these loans are meant for short-term emergencies, not long-term financial solutions.

Payday Loan Regulations in Wyoming: what you need to Know

Wyoming’s payday lending landscape is governed by a complex interplay of state and federal laws. Unlike some states with strict caps on interest rates, Wyoming allows for relatively high costs associated with short-term loans. This means borrowers need to carefully scrutinize the terms and conditions before signing any agreement. In our experience, many borrowers underestimate the total cost of a payday loan, leading to unforeseen debt cycles. A common mistake we see is failing to fully understand the annual percentage rate (APR), which often far exceeds the stated interest rate. Always clarify all fees and charges upfront to avoid unpleasant surprises.

The Wyoming Department of Banking regulates payday lenders, and they offer resources to help consumers understand their rights and responsibilities. However, consumer protection laws are less stringent than in some other states. This means that borrowers bear a greater responsibility for researching lenders and understanding the terms before committing to a loan. Remember to check the lender’s license status with the state and be wary of lenders offering unbelievably low interest rates or overly aggressive sales tactics. Prioritizing responsible borrowing and comparing multiple lenders is crucial to navigating the Wyoming payday loan market successfully. Thorough research and a clear understanding of the loan terms will improve your chances of avoiding financial hardship.

Benefits and Drawbacks of Payday Loans: A Balanced Perspective

The primary benefit of a payday loan in Casper, WY, is its speed and accessibility. When facing an unexpected emergency—a broken-down car, a medical bill, or overdue rent—a payday loan can provide immediate relief. In our experience, clients often appreciate the streamlined application process and quick disbursement of funds, often within a single business day. However, this convenience comes at a cost.

The drawbacks are significant and often outweigh the short-term advantages. High interest rates and fees can quickly spiral into a debt trap, especially for those struggling financially. A common mistake we see is borrowers failing to fully understand the total cost of borrowing, leading to a cycle of repeated loans. Furthermore, the short repayment period puts immense pressure on borrowers, potentially leading to further financial hardship if unexpected expenses arise. Always carefully weigh the pros and cons and explore alternative financing options before committing to a payday loan. Consider budgeting strategies or seeking assistance from credit counseling agencies if you’re facing financial difficulties.

Alternatives to Payday Loans in Casper

Before rushing into a payday loan, Casper residents should explore viable alternatives. A common mistake we see is overlooking readily available resources. For example, many overlook credit counseling services that can offer debt management plans and negotiate with creditors for lower payments. These services often provide free or low-cost consultations. In our experience, seeking professional guidance can significantly improve your financial situation.

Consider exploring community resources like local charities and non-profit organizations. Many offer emergency financial assistance programs, such as food banks or help with utility bills, freeing up funds for immediate needs. Additionally, explore options like small personal loans from credit unions or secured loans using assets you own as collateral. While these options may require a credit check, they typically offer lower interest rates and more manageable repayment terms compared to payday loans. Remember to thoroughly research and compare interest rates and fees before committing to any loan.

Finding Reputable Payday Lenders in Casper

How to Spot a Reputable Lender from a Scam

Identifying a legitimate payday lender from a predatory one requires diligence. In our experience, many borrowers fall victim to scams due to a lack of thorough research. A common mistake we see is failing to verify the lender’s licensing with the Wyoming Department of Banking. Always check their license status online; operating without a license is a major red flag. Look for lenders with transparent fee structures clearly outlined on their website or in their physical location. Avoid those with hidden fees or excessive interest rates far exceeding Wyoming’s legal limits.

Beware of lenders who pressure you into making a decision quickly. Legitimate payday lenders will take the time to explain the terms and conditions thoroughly and answer all your questions. For example, a reputable lender will clearly explain the repayment process, including the penalties for late payments, and provide multiple contact options for inquiries. Conversely, scam operations often use high-pressure tactics and demand immediate payment. Consider using a comparison website to check multiple lenders’ rates and terms, empowering you to make an informed decision and spot potentially exploitative practices. Remember, a little extra time spent researching can save you significant financial hardship in the long run.

Online vs. In-Person Lenders: Weighing Your Options

Choosing between an online and in-person payday lender in Casper, WY, requires careful consideration of your individual circumstances. Online lenders often offer broader reach and potentially more competitive rates, due to their reduced overhead. However, in our experience, the lack of face-to-face interaction can lead to difficulties resolving issues should they arise. A common mistake we see is borrowers overlooking the fine print of online loan agreements, resulting in unexpected fees.

Conversely, in-person lenders in Casper provide a tangible connection and the opportunity to ask questions directly. This can be particularly beneficial for those less comfortable with online transactions or who need clear, immediate explanations of loan terms. While the convenience might be less and rates potentially slightly higher, the personal interaction can offer peace of mind and easier communication during the loan process. For example, you might find a local lender more willing to work with you on payment arrangements if unforeseen circumstances impact your ability to repay on time. Ultimately, the best choice depends on your comfort level with technology, your need for immediate assistance, and your prioritization of convenience versus personal interaction.

Checking Lender Licenses and Reviews: Due Diligence Steps

Before borrowing from any payday lender in Casper, WY, verify their licensing status with the Wyoming Department of Banking. A simple online search of their license number (easily found on their website if they are legitimate) will confirm their authorization to operate. In our experience, neglecting this crucial step is a common mistake leading to scams. Don’t assume a professional-looking website equates to legitimacy; always independently confirm their licensing.

Furthermore, delve into online reviews across multiple platforms. Don’t solely rely on a lender’s own website testimonials. Check independent review sites like the Better Business Bureau (BBB) and Google Reviews. Look for patterns in negative reviews; a few isolated complaints are expected, but consistent negative feedback regarding high fees, aggressive collection practices, or difficulty contacting the lender should raise serious red flags. For example, consistently low ratings alongside numerous complaints about hidden fees suggest a lender to avoid. Consider the volume of reviews as well – a lender with only a handful of reviews may not offer sufficient evidence of their practices. Thoroughly investigating a lender’s reputation is a critical part of responsible payday loan borrowing.

Comparing Interest Rates and Loan Terms: Getting the Best Deal

Securing the best payday loan in Casper, WY, requires diligent comparison of interest rates and loan terms. A common mistake we see is focusing solely on the advertised APR (Annual Percentage Rate). While crucial, the APR doesn’t tell the whole story. Consider the total cost of the loan, including all fees and interest, calculated over the loan’s entire repayment period. For instance, a loan with a slightly higher APR but lower fees might ultimately be cheaper than one advertising a lower APR but charging significant origination or processing fees. In our experience, carefully scrutinizing the loan agreement is paramount.

To effectively compare offers, create a simple spreadsheet listing each lender’s APR, fees, loan term, and total repayment amount. This allows for a direct side-by-side comparison, highlighting the true cost of borrowing. Don’t hesitate to contact lenders directly to clarify any ambiguities in their terms. For example, inquire about any prepayment penalties – some lenders charge extra if you repay early. Remember, securing the lowest interest rate isn’t always synonymous with the best deal; prioritizing the lowest overall cost is key to making a financially sound decision. Don’t rush the process; take your time to thoroughly evaluate each offer before committing to a payday loan.

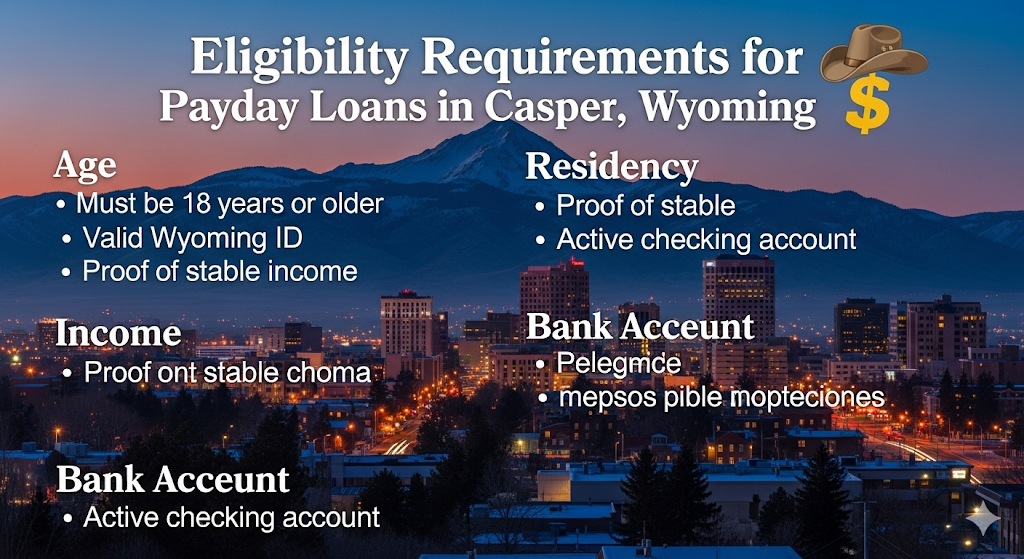

Eligibility Requirements for Payday Loans in Casper

Income and Employment Verification: Proving Your Ability to Repay

Lenders in Casper, WY, will rigorously assess your ability to repay a payday loan before approving your application. This means providing clear and verifiable proof of income and employment. A common mistake we see is applicants providing insufficient documentation, leading to delays or outright rejection. In our experience, lenders prefer consistent income from a single source, making freelance or gig work a bit more challenging to qualify with, though not impossible. You’ll need to demonstrate a reliable income stream sufficient to cover your existing expenses *and* the loan repayment.

Expect to provide pay stubs covering the last few months, or possibly bank statements showing regular deposits. Some lenders may also request W-2 forms or tax returns to verify your income history. Don’t hesitate to contact the lender directly if you’re uncertain what documentation they require; clarifying this upfront saves time and potential frustration. For example, if you receive regular child support or alimony, ensure you provide proof of these consistent payments. The key is to present a comprehensive financial picture demonstrating your capacity to meet your repayment obligations promptly. Remember, transparency and complete documentation are crucial for a successful payday loan application.

Credit Score Requirements: What Lenders Look For

Unlike traditional loans, many payday lenders in Casper, Wyoming, don’t perform a hard credit check using the FICO score familiar to most consumers. Instead, they often utilize alternative credit scoring methods or focus on your ability to repay the loan based on your income and employment history. In our experience, this means a low credit score won’t automatically disqualify you. However, a history of missed payments on previous loans, even those outside of the payday loan realm, can negatively impact your approval chances.

A common mistake we see is borrowers assuming that because a “soft” credit pull is used, their credit won’t be affected. While it’s true that a soft inquiry won’t appear on your credit report, multiple applications for payday loans in a short period can still hurt your chances. Lenders often look for a consistent and verifiable income stream to assess your repayment capacity. Providing accurate and complete documentation, such as pay stubs and bank statements, is crucial. Furthermore, demonstrating responsible financial behavior, even without a perfect credit score, through things like consistent rent payments and utility bill payments, can strengthen your application. Remember, responsible borrowing habits are key, regardless of the lender’s credit assessment methods.

Residency Requirements: Proving Your Casper Address

Securing a payday loan in Casper, Wyoming, often hinges on successfully proving your residency. Lenders need verifiable proof you live within city limits to assess your risk and comply with state regulations. In our experience, failing to provide sufficient documentation is a leading cause of loan application denials. A common mistake we see is using outdated utility bills or relying solely on a driver’s license, which only indicates your state residency, not necessarily your Casper address.

To avoid delays, gather comprehensive documentation. This typically includes a current utility bill (gas, electric, water) clearly displaying your Casper address and your name. A bank statement showing your address is also acceptable, but make sure it’s from the last two months. Rental agreements or mortgage statements are strong alternatives, providing unequivocal proof of address. Remember, the documents must be recent – lenders are wary of outdated information. If you’re living with someone, ensure your name is clearly on the documentation. Providing multiple forms of proof, such as a utility bill and a bank statement, strengthens your application and demonstrates your commitment to providing accurate information.

Required Documentation: Preparing for your Application

Securing a payday loan in Casper, WY, often hinges on providing the correct documentation. In our experience, a complete application significantly speeds up the process and improves your chances of approval. A common mistake we see is applicants failing to bring sufficient proof of income. Lenders require verifiable evidence demonstrating your ability to repay the loan, so don’t assume your word alone is enough.

To avoid delays, gather these essential documents beforehand: a valid government-issued photo ID (driver’s license or state ID), your current bank statement reflecting sufficient funds for repayment, proof of income (pay stubs for the last two months or employment verification letter), and recent utility bills verifying your Casper address. Some lenders may also ask for additional documentation depending on your individual circumstances. For example, if you are self-employed, you may need to provide tax returns or business licenses. Remember, the more prepared you are, the smoother the application process will be, ultimately increasing your likelihood of obtaining the necessary funds.

The Application Process: Step-by-Step Guide

Applying Online: A Convenient Approach

Applying for a payday loan online in Casper, WY offers unparalleled convenience. In our experience, the process is significantly faster than in-person applications, often taking only 15-20 minutes to complete. Many lenders boast streamlined online platforms designed for ease of use, minimizing confusing jargon and unnecessary steps. Look for lenders with secure, encrypted websites—indicated by “https” in the URL—to protect your sensitive personal and financial information. A common mistake we see is neglecting to thoroughly read the terms and conditions before submitting the application.

Before you begin, gather essential documents: a valid Wyoming driver’s license or state ID, proof of income (pay stubs or bank statements), and your current bank account information. Remember, accurate information is crucial for a swift approval. Some lenders may also request additional documentation. For instance, one lender we’ve worked with frequently requests verification of employment via a phone call. Once you submit your online application, expect a quick response, typically within a few minutes to a few hours, depending on the lender and the time of day. Always compare multiple lenders to secure the best possible terms and interest rates. online payday loan applications offer speed and simplicity; however, careful preparation and due diligence remain key to a successful application.

Applying in Person: The Traditional Method

Applying in person offers a more immediate and personal approach to securing a payday loan in Casper, WY. In our experience, this method allows for immediate clarification of any questions or concerns you might have regarding the loan terms and conditions. Before visiting a lender’s office, gather all necessary documentation, including a valid government-issued ID, proof of income (pay stubs, bank statements), and proof of residency. A common mistake we see is failing to bring sufficient identification, leading to delays in the process.

Expect the application process to involve a thorough review of your financial information. The lender will assess your creditworthiness and ability to repay the loan. Be prepared to answer questions about your employment history and current financial situation. Some lenders may offer same-day funding if you meet their requirements, but be aware that approval is not guaranteed. Consider comparing several lenders’ terms and fees before committing to a loan. Remember to carefully read the entire loan agreement before signing to understand the repayment schedule, interest rates, and any potential fees. Taking this proactive step will help you avoid unexpected charges and ensure a smoother borrowing experience.

What to Expect During the Application Process

Applying for a payday loan in Casper, WY, typically involves a straightforward process, but understanding what to expect beforehand can significantly reduce stress. In our experience, most lenders require basic personal information, such as your name, address, Social Security number, and employment details. You’ll also need to provide proof of income, often in the form of pay stubs or bank statements, demonstrating your ability to repay the loan. A common mistake we see is failing to accurately represent your financial situation; honesty is crucial for a successful application.

Expect to answer questions about your credit history, although many payday lenders are less concerned with traditional credit scores than with your current income and ability to repay the loan on time. Prepare to discuss the purpose of the loan – lenders want to understand how the funds will be used. Some lenders may also conduct a quick credit check; however, this usually won’t significantly impact your credit score. Remember to carefully review all loan terms and conditions before signing any agreements. Don’t hesitate to ask questions; understanding the fees, repayment schedule, and potential consequences of default is paramount to making an informed decision.

Understanding Loan Fees and APR

Understanding the Annual Percentage Rate (APR) and associated fees is crucial before applying for a payday loan in Casper, WY. The APR represents the total cost of borrowing, including interest and all fees, expressed as a yearly percentage. It’s not simply the interest rate; it reflects the true cost, making it a more accurate measure for comparison shopping between lenders. In our experience, many borrowers overlook the significance of the APR, focusing solely on the advertised interest rate. This often leads to unexpected expenses.

A common mistake we see is failing to carefully review the loan agreement. Payday loans in Wyoming often come with various fees, such as origination fees, late payment penalties, and potentially even roll-over fees if you can’t repay on time. These fees can significantly increase the overall cost of the loan, dramatically impacting your APR. For example, a loan with a seemingly low interest rate might have high origination fees, resulting in a much higher APR than a loan with a slightly higher interest rate but lower fees. Always compare the *total* cost, including all fees, before making your decision. Remember to ask clarifying questions if anything in the loan agreement is unclear; reputable lenders will happily explain the details.

Responsible Borrowing and Repayment Strategies

Creating a Repayment Plan: Ensuring On-Time Payments

Creating a robust repayment plan is crucial for avoiding the high fees and potential debt cycle associated with payday loans. In our experience, many borrowers underestimate the impact of even a single missed payment. A common mistake we see is failing to account for unexpected expenses. To prevent this, build a buffer into your budget. Consider setting aside a small amount each week, specifically earmarked for your loan repayment. This will provide a safety net should unforeseen circumstances arise.

Develop a detailed budget, meticulously tracking all income and expenses. Identify areas where you can cut back to free up funds for loan repayment. This might involve temporarily reducing discretionary spending on entertainment or dining out. Prioritize your repayment; treat this obligation like any essential bill. For example, one client successfully managed their loan by automating a portion of their paycheck directly into the lender’s account, ensuring timely payment without manual intervention. Remember, prompt payment protects your credit score and avoids escalating fees. A detailed, realistic budget, coupled with automated payments if possible, is your best defense against loan default.

Budgeting Tips to Manage Debt Effectively

Creating a realistic budget is crucial when managing payday loan debt. In our experience, many borrowers underestimate their expenses, leading to repayment difficulties. Start by meticulously tracking every dollar spent for a month. Categorize expenses (housing, transportation, food, entertainment) to identify areas for potential savings. A common mistake we see is failing to account for irregular expenses like car repairs or medical bills; build a contingency fund to cushion against these unexpected costs.

Consider using budgeting apps or spreadsheets to streamline the process. Prioritize essential expenses first, ensuring you can afford rent and utilities before allocating funds to discretionary spending. Explore strategies for reducing expenses, such as negotiating lower bills, cutting back on subscriptions, or preparing meals at home. Remember, even small changes can accumulate significant savings over time, significantly improving your ability to repay your payday loan responsibly and avoid the debt cycle. For example, reducing daily coffee purchases by $5 could save you over $1,800 annually – a substantial contribution towards debt reduction.

Consequences of Defaulting on a Payday Loan

Defaulting on a payday loan in Casper, WY, carries serious consequences that can significantly impact your financial well-being. In our experience, the most immediate consequence is the accumulation of late fees, which can quickly escalate the debt far beyond the initial loan amount. These fees, often exceeding 20% of the principal, can trap borrowers in a cycle of debt, making repayment even more difficult. Furthermore, your credit score will suffer a substantial hit, making it harder to secure loans, rent an apartment, or even get certain jobs in the future.

Beyond immediate financial repercussions, default can lead to more severe consequences. Repeated defaults can result in your payday lender pursuing legal action, potentially including wage garnishment or lawsuits. A common mistake we see is borrowers assuming that ignoring the debt will make it go away; this only exacerbates the problem. Consider, for example, a client who initially borrowed $300 and, through accumulated late fees and interest, owed over $600 within a few months. This situation, unfortunately, is far from uncommon. To avoid such dire situations, proactive communication with your lender is crucial. Exploring options like debt consolidation or repayment plans is often preferable to facing the full brunt of default. Remember, responsible financial planning and understanding the terms of your payday loan agreement are key to avoiding these detrimental outcomes.

Seeking Help with Debt Management in Casper

Facing financial hardship in Casper, WY, and struggling with payday loan debt? You’re not alone. In our experience, many residents find themselves overwhelmed by accumulating debt. A common mistake is delaying seeking help, believing the problem will resolve itself. This often worsens the situation. Don’t hesitate to reach out for support; proactive debt management is crucial.

Several resources are available in Casper to assist with debt counseling and financial literacy. The Consumer Credit Counseling Service (CCCS) often offers debt management plans (DMPs), which consolidate debts and negotiate lower payments with creditors. Additionally, local non-profit organizations and churches frequently provide free or low-cost budgeting workshops and financial education programs. Remember to thoroughly research any organization before engaging their services, verifying their legitimacy and reputation within the community. Consider exploring options like credit counseling or exploring debt consolidation loans as alternatives to continuous payday loan reliance. Early intervention is key to avoiding a spiraling debt cycle.

Local Resources and Support in Casper, WY

Credit Counseling Services in Casper

Facing financial hardship can be overwhelming, but seeking help from a credit counseling service in Casper, WY, can provide a crucial lifeline. These services offer a range of support, from budgeting and debt management to negotiating with creditors. In our experience, many residents benefit from the personalized guidance these professionals provide, helping them develop a sustainable financial plan. A common mistake we see is delaying seeking help until debt becomes unmanageable. Early intervention is key.

Finding the right credit counselor is crucial. Consider factors such as their accreditation (look for National Foundation for Credit Counseling (NFCC) certification) and their fees. Some services offer free initial consultations, while others charge a fee based on your income or the services rendered. Remember to research several agencies to compare their approaches and ensure they align with your specific needs. For example, some specialize in debt consolidation, while others focus on financial literacy education. Don’t hesitate to ask about their success rates and client testimonials. Taking proactive steps to address your financial situation can significantly improve your long-term outlook, even if you’re currently considering a payday loan as a short-term solution.

Community Support Programs for Financial Assistance

Before considering a payday loan in Casper, Wyoming, explore alternative avenues for financial assistance. Many local organizations offer crucial support to residents facing financial hardship. In our experience, contacting these resources first can often prevent the need for high-interest loans altogether. A common mistake we see is overlooking these free or low-cost options.

For example, the Casper Community Food Bank provides not only food but also connects individuals with resources to address underlying financial issues. Similarly, Wyoming 211 offers a comprehensive database of local social service agencies, including those offering emergency financial assistance, rent or utility assistance, and budget counseling. Remember to thoroughly investigate each program’s eligibility requirements and application processes. Don’t hesitate to reach out directly to these organizations; their staff is often well-versed in navigating complex financial situations and can provide personalized guidance. Proactive engagement with these community support programs can significantly improve your financial well-being, reducing the likelihood of needing a short-term, high-cost loan.

Debt Consolidation Options

While payday loans can offer immediate relief, they often contribute to a cycle of debt. If you find yourself juggling multiple payday loans in Casper, WY, debt consolidation might be a viable solution. In our experience, many borrowers benefit from consolidating high-interest, short-term loans into a single, more manageable payment. This can simplify your finances and potentially lower your overall interest rate. However, it’s crucial to understand the nuances before proceeding.

A common mistake we see is choosing a consolidation loan without carefully comparing terms. Consider exploring options like personal loans from local banks or credit unions. These often offer lower interest rates than payday loans. For example, a personal loan with a fixed interest rate can provide predictability, unlike the fluctuating costs associated with multiple payday loans. You can also investigate debt management plans offered by reputable credit counseling agencies. These agencies negotiate with your creditors to reduce your payments and create a structured repayment plan. Remember to thoroughly research any agency before engaging their services, checking for licensing and positive client reviews. Ultimately, the best consolidation strategy depends on your individual financial situation and creditworthiness, so careful planning is key.

Government Assistance Programs

Before considering a payday loan in Casper, Wyoming, explore potential government assistance programs. These programs can offer crucial financial relief, often avoiding the high-interest rates associated with short-term borrowing. A common mistake we see is overlooking these resources entirely. In our experience, many residents are unaware of the breadth of support available.

The Wyoming Department of Family Services offers several programs, including Temporary Assistance for Needy Families (TANF), which provides cash assistance and support services to eligible families. Another valuable resource is the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, which helps low-income individuals and families purchase groceries. Eligibility criteria vary for each program, based on income, household size, and other factors. We recommend visiting the Wyoming Department of Family Services website or contacting them directly to learn more about eligibility requirements and application processes. It’s crucial to thoroughly investigate all available options before resorting to high-cost payday loans. Remember, exploring these resources could significantly impact your financial stability.