What is a DSCR Mortgage Loan?

In the ever-evolving landscape of real estate financing, understanding the various types of mortgage loans available is crucial for investors and homeowners alike. Among the diverse options is the DSCR mortgage loan, a unique financial product tailored to meet the needs of income-generating properties. This article delves deep into the intricacies of DSCR mortgage loans, offering insights into their mechanics, benefits, and strategic advantages for real estate investors.

Understanding DSCR

The Debt Service Coverage Ratio (DSCR) is a fundamental concept for anyone involved in real estate investment. It serves as a key indicator of a property’s financial health and its ability to meet debt obligations. By exploring the components and calculations of DSCR, investors can gain a clearer picture of a property’s potential.

The Importance of DSCR in Real Estate

The DSCR is more than just a number; it’s a reflection of a property’s financial viability. Lenders rely heavily on this metric to assess the risk associated with lending. A strong DSCR signals financial stability, reassuring lenders that the property can generate enough income to cover its debts. For investors, a robust DSCR can enhance borrowing capacity and facilitate portfolio growth.

Calculating DSCR: A Step-by-Step Guide

The calculation of DSCR involves two critical financial figures: Net Operating Income (NOI) and Total Debt Service. The formula is straightforward: DSCR = NOI / Total Debt Service. To calculate NOI, subtract operating expenses like maintenance, taxes, and insurance from the property’s total revenue. Total Debt Service includes all loan payments, covering both principal and interest. By understanding these components, investors can accurately assess a property’s financial standing.

Interpreting DSCR Values

Interpreting DSCR values is pivotal for making informed investment decisions. A DSCR greater than 1 indicates that the property generates more income than is required to cover its debt, signifying a safe investment. Conversely, a DSCR less than 1 suggests financial strain, as the property fails to generate sufficient income to meet its obligations. Investors should aim for a DSCR of at least 1.25 to ensure a comfortable margin for covering debts and unforeseen expenses.

What is a DSCR Mortgage Loan?

A DSCR mortgage loan is a specialized financing option that shifts the focus from the borrower’s personal financial standing to the income-generating potential of the property. This approach is particularly advantageous for real estate investors seeking to leverage their assets without being constrained by personal income limitations.

The Core Principles of DSCR Mortgage Loans

DSCR mortgage loans are grounded in the principle of income-based qualification. Unlike traditional mortgages, which prioritize the borrower’s income and credit score, DSCR loans assess the property’s ability to generate revenue. This shift in focus enables investors with diverse financial backgrounds to access financing, provided the property demonstrates strong income potential.

Exploring the Flexibility of DSCR Loans

One of the standout features of DSCR mortgage loans is their flexibility. These loans often come with more lenient requirements compared to conventional mortgages, such as higher loan-to-value (LTV) ratios. This flexibility allows investors to borrow a larger percentage of the property’s value, facilitating portfolio expansion and investment diversification.

The Ideal Candidates for DSCR Loans

DSCR mortgage loans are tailored to meet the needs of real estate investors, particularly those managing multiple income-generating properties. Whether you’re acquiring rental properties, multi-family units, or commercial real estate, DSCR loans provide a financing solution that aligns with your investment strategy. By focusing on the property’s income, investors can overcome personal income constraints and unlock new opportunities.

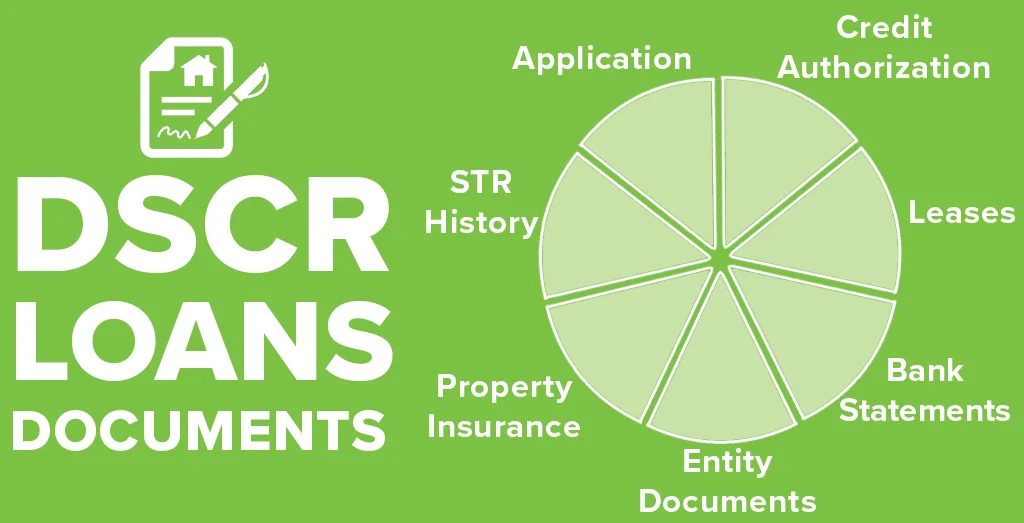

DSCR Loan Requirements

Qualifying for a DSCR mortgage loan involves meeting specific criteria that vary by lender. Understanding these requirements is essential for investors seeking to secure financing and capitalize on income-generating properties.

Evaluating Property Types for DSCR Loans

Lenders typically require that the property be income-generating, such as rental properties, multi-family housing, or commercial real estate. The property’s income potential, both current and projected, plays a crucial role in the lender’s assessment. Investors should ensure their properties meet these criteria to increase the likelihood of loan approval.

The Significance of a Strong DSCR Ratio

A robust DSCR ratio is a cornerstone of loan approval. Lenders generally look for a DSCR of at least 1.25, indicating that the property generates 25% more income than needed to cover its debt obligations. This margin provides a buffer against potential income fluctuations, enhancing the property’s appeal to lenders.

Understanding Credit Score Implications

While DSCR loans place less emphasis on personal credit scores, maintaining a decent credit score can still be beneficial. Most lenders prefer borrowers with a credit score of 620 or higher, as it reflects a level of financial responsibility. A strong credit score can also result in more favorable loan terms and interest rates.

The Role of Down Payments in DSCR Loans

Similar to traditional mortgage loans, DSCR loans typically require a down payment. This usually ranges from 20% to 30% of the property’s purchase price. A substantial down payment not only reduces the lender’s risk but also demonstrates the borrower’s commitment to the investment. Investors should be prepared to meet these requirements when pursuing DSCR financing.

Using a DSCR Loan Calculator

A DSCR loan calculator is a valuable tool for investors seeking to evaluate the feasibility of a DSCR mortgage loan. By inputting key financial data, investors can estimate loan amounts and assess the potential for securing financing.

Navigating the DSCR Loan Calculator

To effectively use a DSCR loan calculator, begin by inputting the property’s expected rental income or revenue. This figure serves as the basis for calculating Net Operating Income (NOI). Next, enter all operating expenses, including taxes, insurance, and maintenance costs. The calculator will then compute the DSCR, providing a clear picture of the property’s financial health.

Assessing Loan Eligibility with DSCR Calculators

Once the DSCR is calculated, investors can gauge whether the property meets the lender’s minimum requirements for loan approval. A DSCR that exceeds the lender’s threshold indicates a higher likelihood of securing financing. By understanding the property’s income potential, investors can make informed decisions about pursuing a DSCR mortgage loan.

Estimating Maximum Loan Amounts

With the DSCR calculated, the loan calculator can help determine the maximum loan amount an investor may qualify for. This estimation is based on the property’s income potential and the lender’s criteria. By having a clear understanding of borrowing capacity, investors can strategically plan their real estate investments and expansion efforts.

Benefits of DSCR Mortgage Loans

DSCR mortgage loans offer a range of benefits that make them an attractive option for real estate investors. From expanding investment opportunities to simplifying the approval process, these loans provide a pathway to financial growth and diversification.

Unlocking New Investment Opportunities

For real estate investors, DSCR loans open doors to new possibilities. By focusing on the income-generating potential of a property, investors can leverage their assets to acquire additional properties and grow their portfolios. This approach allows for strategic expansion without being limited by personal income constraints.

Streamlining the Approval Process

The approval process for DSCR loans is often quicker and more straightforward than traditional mortgage loans. Because lenders prioritize property income over personal financial details, investors can navigate the application process with ease. This streamlined approach is particularly advantageous in competitive real estate markets, where timely decisions are crucial.

Enhancing Portfolio Diversification

DSCR loans enable investors to diversify their holdings by acquiring various types of income-generating properties. This diversification enhances financial stability and reduces risk by spreading investments across different asset classes. By leveraging DSCR financing, investors can build a robust and resilient portfolio.

Considerations Before Applying

While DSCR loans offer numerous advantages, it’s important for investors to carefully consider their investment strategy and financial goals before proceeding. Thoughtful planning and research are essential for making informed decisions.

Conducting a Comprehensive Property Analysis

Before applying for a DSCR loan, conduct a thorough analysis of the property’s income potential, expenses, and market conditions. This evaluation ensures that the investment aligns with your financial objectives and risk tolerance. By understanding the property’s strengths and weaknesses, investors can make strategic decisions that support long-term success.

Selecting the Right Lender for DSCR Loans

Choosing a reputable lender experienced in DSCR mortgage loans is crucial for a successful borrowing experience. Compare loan terms, interest rates, and fees to find the best fit for your needs. Partnering with a knowledgeable lender can provide valuable insights and guidance throughout the financing process.

Aligning DSCR Loans with Long-Term Strategy

Consider how a DSCR loan fits into your long-term investment strategy. Evaluate whether the property will generate sufficient income to cover its debt and provide a return on investment. By aligning your financing decisions with your broader financial goals, you can maximize the benefits of DSCR loans and achieve sustainable growth.

Conclusion

DSCR mortgage loans offer a unique and powerful financing option for real estate investors seeking to capitalize on income-generating properties. By understanding the concept of DSCR and leveraging tools like DSCR loan calculators, investors can make informed decisions to expand their portfolios and achieve financial success in the real estate market. Whether you’re a seasoned investor or new to the real estate game, a DSCR mortgage loan could be the key to unlocking new investment opportunities and realizing your financial ambitions.