Online Payday Loans in Missouri: A Comprehensive Guide

Understanding Missouri Payday Loan Laws Legal Framework for Online Payday Loans in Missouri Missouri’s legal framework for online payday loans largely mirrors its regulations for brick-and-mortar lenders. The state’s Payday Loan Act dictates crucial aspects, including maximum loan amounts, finance charges, and loan terms. These regulations are designed to protect borrowers from predatory lending practices. […]

Your Complete Guide to Online Payday Loans in Alabama: Fast Cash Solutions & State Laws

Understanding Online Payday Loans in Alabama What Exactly is an Online Payday Loan? online payday loans alabama An online payday loan provides a fast, short-term financial solution designed to bridge unexpected cash shortages until your next paycheck. “It’s a small, unsecured loan meant for immediate needs, not long-term financial problems.” These loans typically range from […]

Your Complete Guide to Payday Loans in Portland, Oregon

Understanding Payday Loans in Portland What are Payday Loans? Payday loans are short-term, small-dollar loans designed to help people cover unexpected expenses until their next payday. They’re typically due on your next pay date, usually within two to four weeks. Borrowers write a post-dated check or authorize electronic withdrawal for the loan amount plus fees. […]

Payday Loans in Mobile, Alabama: A Comprehensive Guide

Understanding Payday Loans in Mobile, AL What are Payday Loans? Navigating Payday Loans in Mobile, Alabama Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically due on your next pay date, hence the name. Think of them as a bridge to get you through a […]

Payday Loans in Tulsa: Complete Guide to Fast Cash Solutions

Understanding Payday Loans in Tulsa: Your Fast Cash Option What Exactly is a Payday Loan? Navigating Payday Loans in TulsaA payday loan is a small, short-term, high-interest unsecured loan. It’s specifically designed to help individuals cover unexpected expenses or bridge a financial gap between paychecks. Essentially, you borrow a modest amount of money – typically […]

What Is the $1800 Social Security Payment Explained: Eligibility and Details

The $1,800 Social Security payment is a monthly benefit provided to eligible retirees, widows, and individuals with disabilities who have contributed to the Social Security system through their work history. This payment serves as a key financial support for many, helping to cover daily expenses and maintain stability during retirement. Eligibility depends on factors like […]

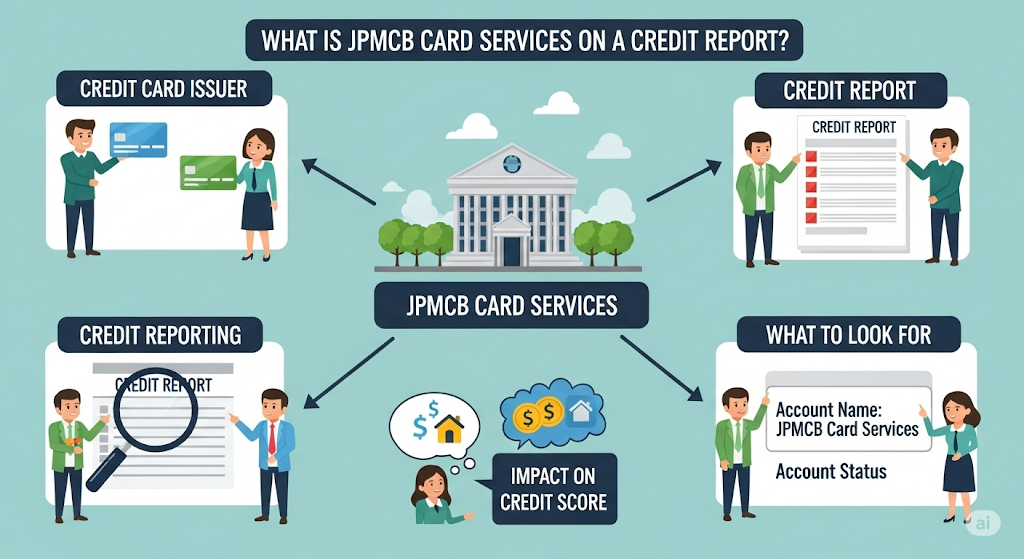

What Is JPMCB Card Services on My Credit Report Explained Clearly and Simply

When someone sees JPMCB Card Services on their credit report, it can raise questions about what it means and why it’s there. JPMCB stands for JPMorgan Chase Bank, and this entry typically appears due to credit card activity linked to Chase, such as applying for a card, having an existing Chase credit card, or being […]

What Is Felony Level Credit Card Theft Explained: Legal Consequences and Definitions

Felony level credit card theft occurs when the value of the stolen goods or services exceeds a certain threshold, often $1,000 or more, depending on state or federal laws. This type of crime involves knowingly using counterfeit, stolen, or fraudulently obtained credit cards to acquire money or property. It is classified as a felony because […]

What Is Felony Credit Card Abuse Explained: Legal Implications and Consequences

Felony credit card abuse involves the illegal use or possession of credit cards with fraudulent intent, often resulting in significant financial harm. It is a serious crime typically charged when the value involved exceeds a certain amount or when the act involves repeated offenses, leading to severe penalties such as hefty fines and long prison […]

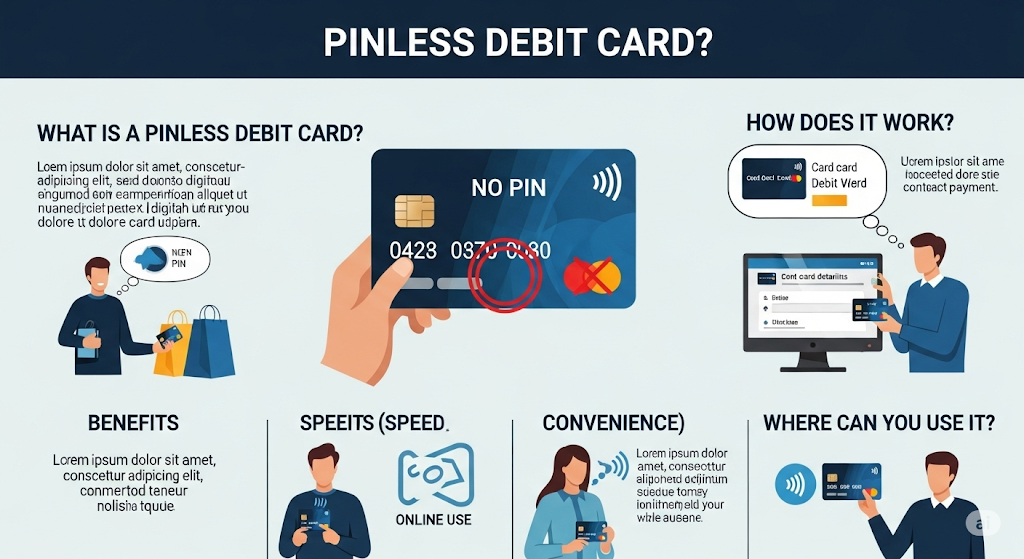

What is a Pinless Debit Card Explained: Benefits and Usage Guide

What is a Pinless Debit Card Explained: What is a Pinless Debit Card allows consumers to make debit transactions without entering a personal identification number (PIN) at the point of sale. This type of payment functions similarly to a credit card transaction, enabling quicker and more convenient checkouts while still using funds directly from a […]