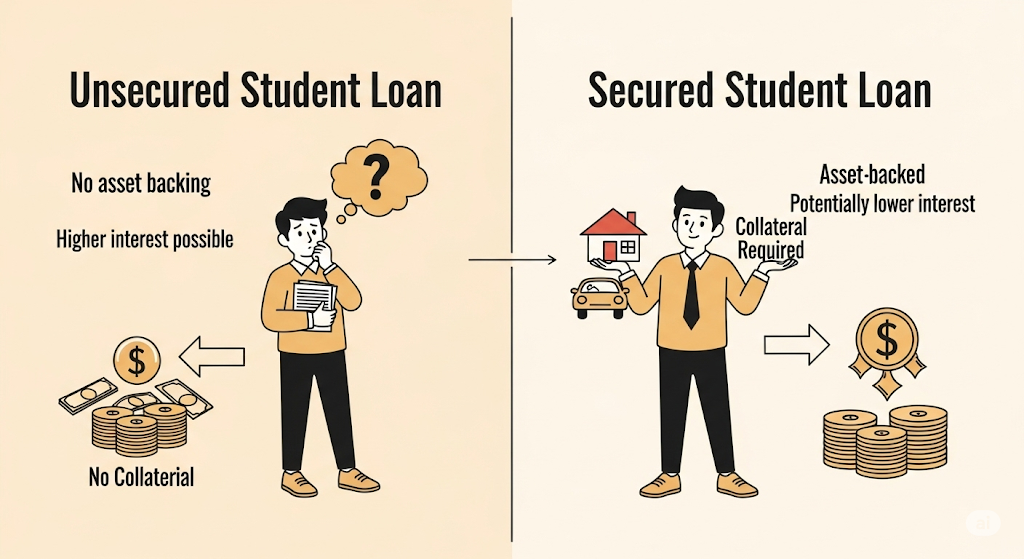

Is a Student Loan Secured or Unsecured?

Is a Student Loan Secured or Unsecured? Table of Contents 1. Introduction Student loans help millions of students pursue higher education. But one common question many borrowers ask is: Are student loans secured or unsecured? The answer can affect how lenders view risk, what happens if you default, and even your financial planning after graduation. […]

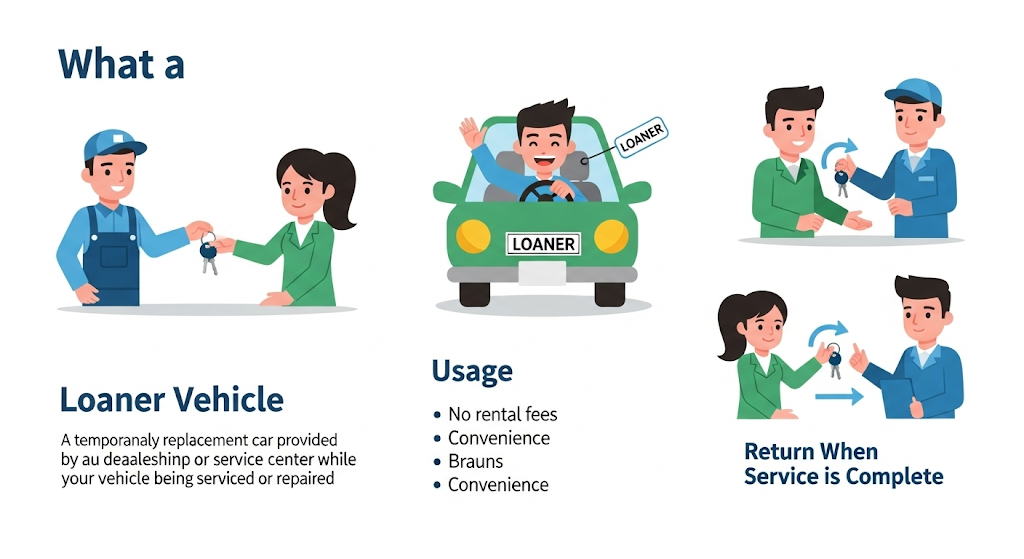

🚗 What Is a Loaner Vehicle? Everything You Need to Know

Table of Contents 1. Introduction Have you ever taken your car to the dealership for repairs and walked out with another car to drive for free? That’s likely a loaner vehicle. Whether your car is in the shop for a few hours or several days, having a temporary replacement can keep your life moving. In […]

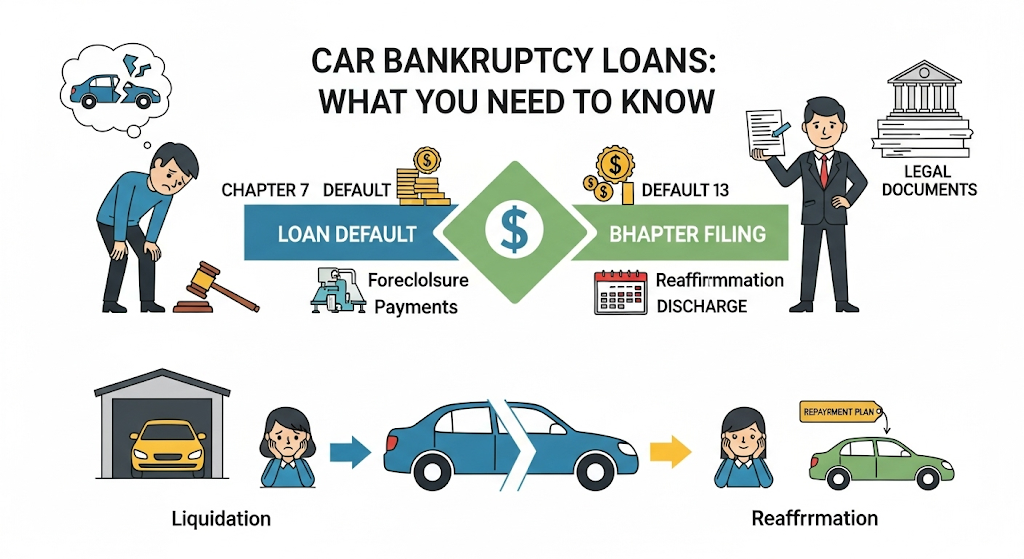

Car Bankruptcy Loans: How to Get an Auto Loan After Bankruptcy (2025 Guide)

Table of Contents 1. Introduction Filing for bankruptcy can be financially and emotionally overwhelming. Whether it’s Chapter 7 or Chapter 13, it impacts your credit and your ability to get future loans. But what if you need a car? The good news: you can get a car loan after bankruptcy. These are known as car […]

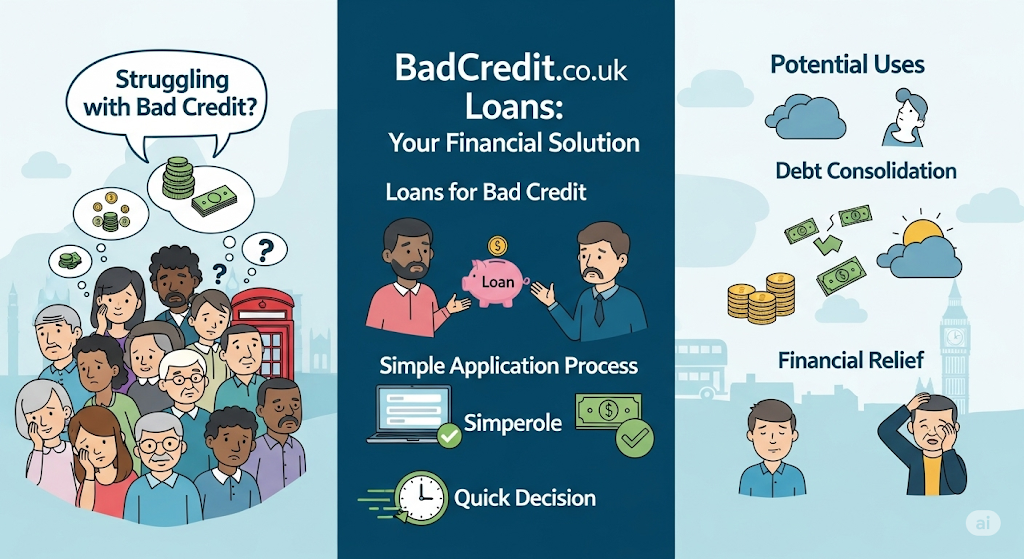

BadCredit.co.uk Loans: A Complete 2025 Guide for Borrowers with Poor Credit

BadCredit.co.uk Loans: A Complete 2025 📌 Table of Contents 1. Introduction If you’ve ever been denied a loan due to poor credit history, you’re not alone. In the UK, millions search for loan solutions each month—but for people with bad credit, traditional lenders often say no. That’s where platforms like BadCredit.co.uk come in: they offer […]

My Fast Broker Loan Brokers: Fast, Smart, and Reliable Lending Solutions in 2025

My Fast Broker Loan Brokers: Fast Table of Contents 1. Introduction When you need a personal or business loan, time and approval anxiety are your biggest enemies. That’s where loan brokers step in to streamline the process. In 2025, online platforms like MyFastBroker are gaining popularity as efficient, fast, and customer-focused alternatives to traditional lenders. […]

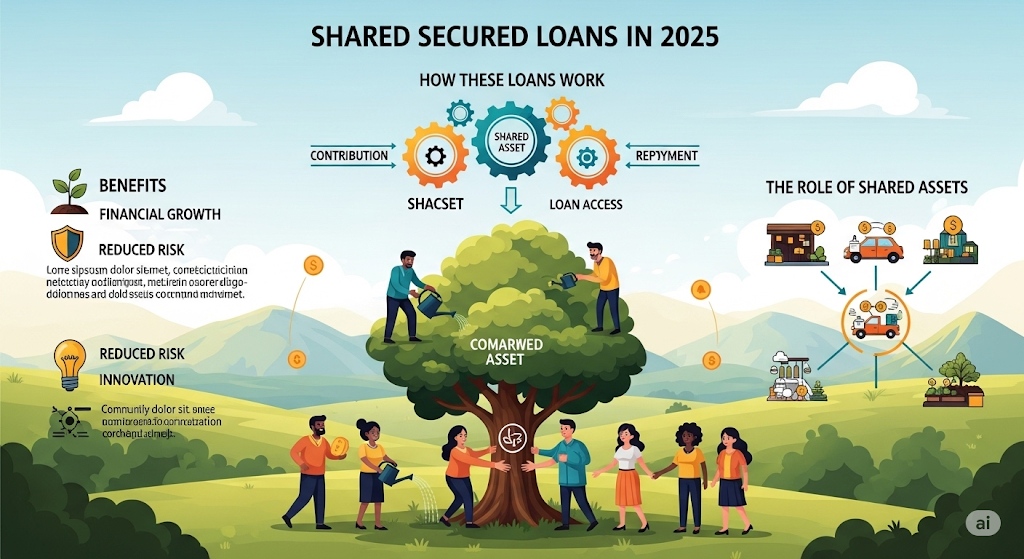

Shared Secured Loans in 2025: What They Are, How They Work, and When to Use One

Table of Contents 1. Introduction In today’s fast-paced financial world, having good credit can unlock low-interest loans, better insurance rates, and even job opportunities. For people with little or poor credit history, a traditional loan might be out of reach. Enter the shared secured loan—a smart, low-risk tool designed to build or rebuild credit while […]

Secured Personal Loans: Everything You Need to Know in 2025

Table of Contents 1. Introduction Personal loans have become one of the most common ways for individuals to handle urgent financial needs—be it consolidating debt, managing medical bills, or funding large purchases. Among the types available, secured personal loans offer an option that may provide better interest rates and approval odds, especially for borrowers with […]

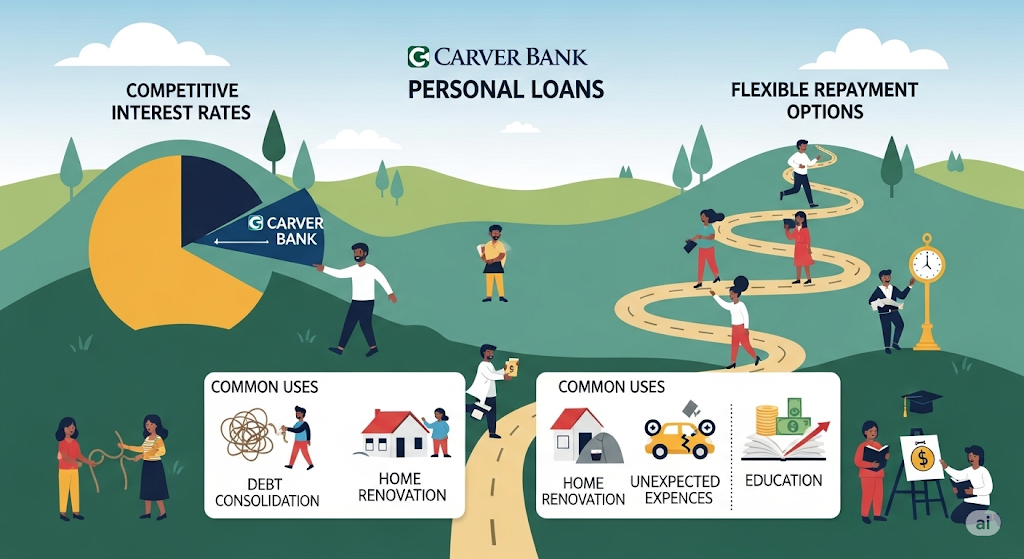

Carver Bank Personal Loans: A Complete Guide (2025)

Carver Bank Personal Loans Carver Federal Savings Bank, commonly known as Carver Bank, has a long history of serving underrepresented and minority communities. Established in 1948, Carver Bank continues to offer financial products tailored to meet the needs of everyday Americans. Among these offerings are personal loans, which help individuals cover a range of expenses […]

ITIN Personal Loans: A Complete 2025 Guide for Non-Citizens

Table of Contents 1. Introduction to ITIN Personal Loans For millions of immigrants in the U.S. without a Social Security Number (SSN), access to traditional credit can be limited. Fortunately, some lenders offer personal loans using an Individual Taxpayer Identification Number (ITIN). This guide walks you through everything you need to know about ITIN personal […]

GPO Personal Loans: Everything You Need to Know

Introduction GPO Federal Credit Union, headquartered in New York, provides a wide range of financial services to its members—including personal loans tailored to individual needs. Whether you’re consolidating debt, funding a major life event, or covering emergency expenses, a personal loan from GPO can be a practical and affordable option. This comprehensive guide explores everything […]