Can You Get a Mortgage Loan without a Job?

In today’s fluctuating economic landscape, the traditional notion of employment is rapidly evolving. Many individuals find themselves without conventional jobs for various reasons, ranging from job loss and career transitions to personal choices such as entrepreneurship or gig work. The pressing question remains: can you secure a mortgage loan without a job? The answer is affirmative, yet it requires a nuanced understanding of the mortgage landscape and the strategic options available to those without traditional employment.

Understanding No Income Mortgages

The financial world offers diverse solutions for those who don’t fit into the standard mold of employment. One such solution is the no income mortgage, sometimes known as a no-doc mortgage. This type of loan doesn’t necessitate the usual income verification documents like pay stubs or tax returns.

What Are No Income Mortgages?

No income mortgages allow lenders to assess a borrower’s capability to repay a loan without requiring the standard proof of income. Instead, lenders evaluate other aspects of financial stability such as assets, credit history, and alternative income streams. These loans are designed to accommodate individuals who may not have a regular paycheck but possess other forms of financial credibility.

The Appeal of No Income Mortgages

Individuals who are self-employed, freelancers, or those whose income comes from non-traditional sources often face challenges in providing proof of income. For these individuals, no income mortgages offer a viable path to homeownership, bypassing the conventional hurdles of income verification. However, borrowers should be aware that these types of mortgages might come with steeper interest rates and might require a heftier down payment as a way for lenders to mitigate perceived risk.

Risks and Rewards

While no income mortgages open doors for non-traditional earners, they also carry certain risks. The higher interest rates can lead to significantly larger payments over the life of the loan. Additionally, the larger down payment requirements can strain financial resources upfront. Nevertheless, for many, the opportunity to own a home outweighs these challenges, making it a worthwhile endeavor.

Qualifying for a Mortgage Loan without a Job

Securing a mortgage without a traditional job may seem daunting, yet it’s entirely feasible for those who can demonstrate financial stability through alternative means. The key lies in presenting a robust financial picture to potential lenders.

Leveraging Your Assets

Your assets can serve as a powerful bargaining chip when applying for a mortgage without a job. Savings accounts, retirement funds, and other investments can be leveraged to show financial stability. Lenders often view these assets as a buffer against financial instability, potentially offering a loan based on their value. By presenting a comprehensive list of assets and their worth, you enhance your credibility in the eyes of the lender.

Exploring Alternative Income Sources

Steady income from non-traditional sources can also strengthen your mortgage application. This might include rental income, alimony, or social security benefits. Lenders look favorably upon documented and reliable income streams, even if they don’t come from a traditional job. Ensuring these income sources are well-documented and verifiable is crucial to convincing lenders of your repayment capability.

The Power of a Strong Credit Score

A high credit score can significantly tip the scales in your favor when applying for a mortgage without a job. It serves as an indicator of your financial responsibility and repayment reliability. Before applying, it’s wise to obtain a copy of your credit report to identify and rectify any errors that could hinder your application. Demonstrating a consistent history of managing credit responsibly can reassure lenders of your trustworthiness.

Utilizing a Co-Signer

Involving a co-signer can be a strategic move. A co-signer with a stable income and strong credit history can provide additional assurance to lenders about the loan’s repayment. However, this arrangement requires careful consideration and mutual understanding, as the co-signer assumes equal responsibility for the mortgage debt.

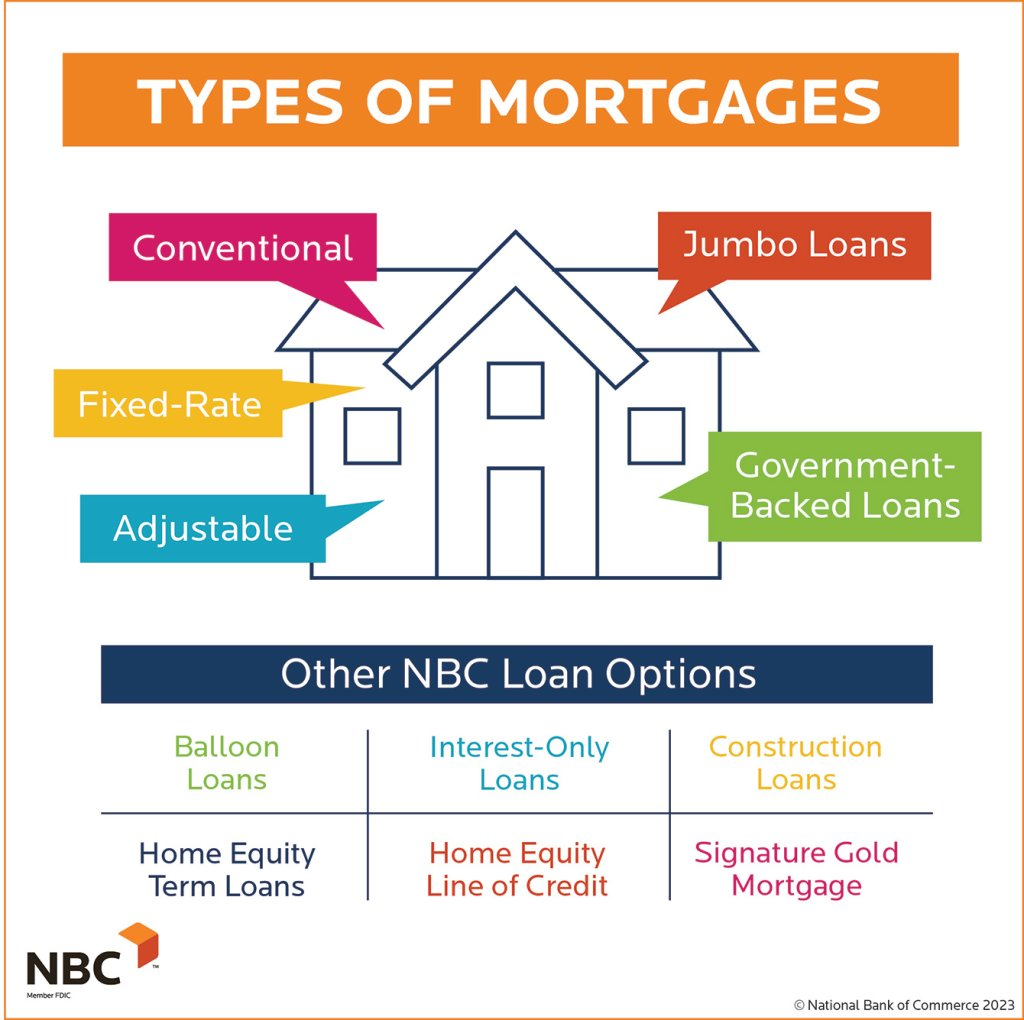

Types of Mortgages Available

When navigating the mortgage landscape without a job, you’ll encounter various loan types tailored to meet your unique circumstances. Each comes with its own set of requirements and considerations.

Asset-Based Mortgages

Asset-based mortgages focus on the borrower’s net worth rather than income. These loans are particularly advantageous for individuals with substantial savings or investment portfolios. Lenders evaluate the total value of your assets to determine your borrowing capacity, offering a path to homeownership based on your overall financial health.

Stated Income Loans

Though less common today, stated income loans allow borrowers to declare their income without providing traditional documentation. These loans have become rarer since the 2008 financial crisis, yet they remain an option under stringent conditions. Lenders offering stated income loans typically require higher credit scores and larger down payments to offset the increased risk.

FHA Loans

FHA loans, backed by the Federal Housing Administration, offer more leniency regarding credit and employment history. They are an attractive option for those who meet specific criteria, such as possessing a reasonable credit score and a sufficient down payment. FHA loans provide a more accessible entry point into homeownership for individuals without traditional employment.

Preparing Your Application

Applying for a mortgage without a job requires meticulous preparation and organization. A well-prepared application can substantially increase your chances of approval.

Documenting Your Financial Stability

Thorough documentation of your assets and income sources is crucial. Present bank statements, investment account summaries, and any relevant documents that verify alternative income sources, such as contracts or benefit statements. A comprehensive financial portfolio can help paint a picture of stability for potential lenders.

Crafting a Persuasive Letter of Explanation

A letter of explanation can bolster your application by providing context and clarity. Use this opportunity to explain your employment situation, detail how you plan to manage mortgage payments, and highlight why you are a low-risk borrower. Honesty and transparency in your explanation can build trust and confidence with lenders.

Finding the Right Lender

Not every lender offers no income mortgages, making it essential to shop around. Seek out lenders who specialize in these loans and have experience dealing with clients in non-traditional employment situations. A lender familiar with your circumstances can offer valuable guidance and tailored solutions.

Potential Challenges and Considerations

While obtaining a mortgage without a job is achievable, it’s not without its hurdles. Being aware of the potential challenges can help you prepare and navigate the process more effectively.

Dealing with Higher Interest Rates

No income mortgages often come with higher interest rates due to perceived risk. Be prepared for this financial reality, and consider how it will affect your long-term financial planning. Exploring different lenders and negotiating terms can sometimes yield more favorable rates.

Preparing for a Larger Down Payment

Lenders might require a larger down payment to compensate for the increased risk. This upfront financial commitment can be significant, so it’s essential to plan and save accordingly. A larger down payment also demonstrates your commitment to the investment, potentially strengthening your application.

Understanding Loan Terms

The terms of no income mortgages can differ significantly from traditional loans, including shorter repayment periods or different conditions. Ensure you fully understand the terms and conditions of the loan before proceeding. Consulting with a financial advisor can provide clarity and help you make informed decisions.

Conclusion

Securing a mortgage without a job is indeed possible, albeit with its complexities. By leveraging your assets, maintaining a strong credit score, and exploring the right loan types and lenders, you can successfully navigate this path. Although the journey may require more effort and planning, the dream of homeownership remains within reach.

Whether you’re self-employed, in between jobs, or relying on alternative income sources, there are viable options to support your pursuit of owning a home. With careful preparation and strategic planning, you can achieve your goal and enjoy the stability and satisfaction that homeownership brings.