How to Transfer Mortgage Loan to Another Person

The first question many people ask is whether it’s even possible to transfer a mortgage loan. The answer largely depends on the terms and conditions of your existing mortgage agreement. Generally, a mortgage loan can be transferred if it includes a “due-on-sale” clause, which allows the lender to demand full repayment of the loan if the property is sold or transferred.

Understanding Assumable Mortgages

Some loans are “assumable,” meaning the new borrower can take over the existing mortgage under the same terms. Assumable mortgages are not very common, but they offer significant advantages when available. FHA, VA, and USDA loans are often assumable, providing an opportunity for the new borrower to take on the loan without altering the interest rate or repayment schedule.

The Role of Conventional Loans

Conventional loans, on the other hand, are typically not assumable. This can complicate the transfer process since these loans often include stricter terms regarding transferability. Lenders usually require the full repayment of the loan upon the sale or transfer of the property, which can necessitate exploring alternative options if an assumption isn’t possible.

Legal Framework and Mortgage Agreements

Mortgage agreements are legally binding documents that outline the terms of the loan, including any clauses related to transferability. It’s essential to thoroughly review your mortgage agreement to understand your rights and responsibilities. Consulting with a legal expert can clarify any uncertainties and help determine the feasibility of transferring your mortgage.

Why Transfer a Mortgage?

There are several reasons why someone might want to transfer a mortgage. Here are a few common scenarios:

Divorce or Separation

Divorce or separation can significantly impact financial arrangements, including homeownership. When couples split, one party may wish to keep the home. Transferring the mortgage to the person remaining can simplify the financial separation, allowing them to maintain stability and continuity in their living arrangements.

Selling a Home

If the new buyer is willing and able to take over the existing mortgage, it might save them from securing a new loan. This can be particularly beneficial in a rising interest rate environment, allowing the buyer to benefit from the existing lower rate. It can also expedite the sales process by eliminating the need for the buyer to go through a lengthy mortgage application process.

Inheritance

When someone inherits a property, they might need to take over the mortgage to retain ownership. This situation often arises when a family member passes away, and the heir wishes to keep the property within the family. Transferring the mortgage helps avoid the need to sell the property, preserving the familial asset for future generations.

Financial Relief

If the original borrower can no longer afford the payments, transferring the mortgage to a financially stable party can prevent foreclosure. This transfer can be a lifeline for borrowers facing financial difficulties, allowing them to avoid the negative consequences of default while ensuring the property remains in responsible hands.

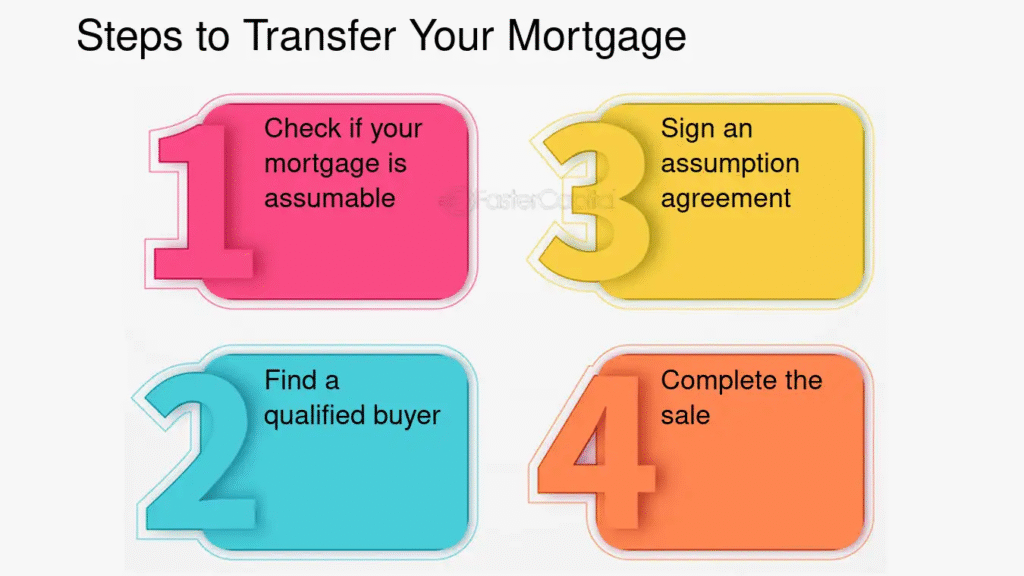

Steps to Transfer a Mortgage Loan

Transferring a mortgage involves several steps, and it’s important to proceed carefully to avoid any potential pitfalls. Here’s how you can transfer a mortgage loan to another person:

1. Review Your Mortgage Agreement

Begin by checking your mortgage documents to see if your loan is assumable. Look for clauses that specify whether a transfer is possible and any associated requirements. If you’re uncertain, contact your lender for clarification. Understanding the terms of your mortgage agreement is the first step in determining whether a transfer is feasible.

2. Obtain Lender Approval

If your mortgage is assumable, you’ll need to get permission from your lender to proceed with the transfer. The lender will evaluate the new borrower to ensure they meet the credit and income requirements. This process is similar to applying for a new mortgage, and the new borrower will likely need to provide financial documentation. The lender’s approval is crucial, as it ensures that the new borrower can fulfill the loan obligations.

3. Assess the New Borrower’s Eligibility

The new borrower must qualify for the mortgage, which includes passing a credit check and demonstrating adequate income. They will also need to pay any applicable fees associated with the transfer, such as assumption fees or closing costs. Ensuring the new borrower meets all eligibility criteria is vital to a successful transfer, as it safeguards against future financial issues.

4. Prepare the Necessary Documentation

Both parties should prepare and sign the necessary legal documents to facilitate the transfer. This might include a mortgage assumption agreement, a title transfer, and any additional paperwork your lender requires. Proper documentation ensures that the transfer is legally binding and protects the interests of both parties involved.

5. Finalize the Transfer

Once all documentation is in order and the lender has approved the transfer, the process can be finalized. The new borrower will assume responsibility for the mortgage payments, and ownership of the property will be officially transferred. Finalizing the transfer marks the culmination of the process, providing peace of mind to both the original borrower and the new borrower.

Considerations Before Transferring a Mortgage

Before proceeding with a mortgage transfer, there are a few key considerations to keep in mind:

Financial Implications

Transferring a mortgage could have financial implications for both parties. The original borrower should be aware that their credit score might still be affected if the new borrower defaults on the loan. Additionally, there might be fees associated with the transfer, including assumption fees or legal costs. It’s crucial to weigh these financial implications carefully and consider the long-term impact on both parties.

Legal Considerations

It’s essential to ensure that the transfer is legally binding and that all necessary documents are correctly executed. Consulting with a real estate attorney can provide valuable guidance and ensure that all legal aspects are covered. Legal advice can help prevent future disputes and ensure that both parties are protected throughout the transfer process.

Tax Implications

Transferring a mortgage might also have tax implications, especially if the transfer involves a sale or inheritance. It’s advisable to consult with a tax professional to understand any potential tax liabilities. Tax considerations can vary based on the nature of the transfer, making professional guidance invaluable in navigating complex tax laws.

Alternatives to Mortgage Transfer

If transferring the mortgage isn’t feasible, there are alternative options to consider:

Refinancing

If the new borrower cannot assume the mortgage, refinancing might be an option. This involves paying off the existing mortgage and securing a new loan. While this can be more complex and costly, it might be necessary if the current mortgage is not assumable. Refinancing can provide an opportunity to adjust the terms of the loan to better suit the new borrower’s financial situation.

Co-Signing

In some cases, the original borrower might remain on the loan as a co-signer, sharing responsibility with the new borrower. This can be a temporary solution while the new borrower builds their credit or financial standing. Co-signing can offer a way to facilitate the transfer without fully releasing the original borrower from their obligations, providing a measure of security for the lender.

Selling the Property

If transferring the mortgage is not possible and other options are unsuitable, selling the property might be the best course of action. This would involve paying off the existing mortgage with the proceeds from the sale. Selling the property can provide a clean break from the mortgage, allowing the original borrower to settle their financial obligations and move forward.

Conclusion

Transferring a mortgage loan to another person can be a viable solution in various circumstances, but it’s important to understand the process and implications fully. By reviewing your mortgage agreement, obtaining lender approval, and considering alternative options, you can make an informed decision that suits your needs. Whether you’re facing a divorce, selling a home, or dealing with an inheritance, knowing your options can help you navigate the process effectively.

In any case, consulting with professionals such as mortgage advisors, attorneys, and tax experts can provide the guidance needed to ensure a successful transfer. Their expertise can help you avoid common pitfalls and make the process as smooth and stress-free as possible, ensuring a positive outcome for all parties involved.