What Documents Do I Need for a Mortgage Loan

When you’re ready to buy a home, one of the most crucial steps is getting a mortgage loan. But before you can secure that loan, you’ll need to gather various documents to satisfy the lender’s requirements. This guide will walk you through the necessary paperwork, making your loan application process as smooth as possible.

Understanding the Mortgage Loan Process

Before diving into the specific documents, it’s essential to understand the mortgage loan process. When you apply for a mortgage, the lender needs to verify your financial status to ensure you can repay the loan. This involves evaluating your income, credit history, assets, and debts. Collecting the right documents will help demonstrate your financial health to the lender.

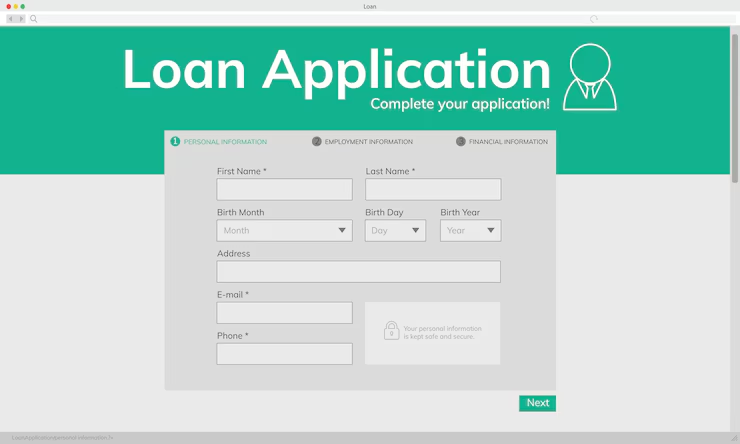

The Initial Application Phase

The mortgage loan process begins with the initial application. During this phase, you will submit basic information about yourself and your financial situation. This includes your employment details, income, and the type of mortgage you are interested in. The lender uses this information to conduct a preliminary assessment of your eligibility for a loan.

Pre-Approval and Pre-Qualification

Once the initial application is reviewed, you might go through pre-qualification or pre-approval. Pre-qualification is a less formal process where the lender gives you an estimate of how much you might be able to borrow based on the information you provide. Pre-approval, on the other hand, is more comprehensive and involves a thorough check of your financial background, providing a more accurate picture of your borrowing capacity.

Underwriting and Approval

After pre-approval, the next step is underwriting. This is where the lender scrutinizes your financial documents to assess your risk level as a borrower. They will verify your income, assets, and credit history in detail. If everything checks out, the lender will approve your loan, moving you closer to securing your new home.

Essential Documents for a Mortgage Loan

Let’s explore the key documents you’ll need for your mortgage loan application.

Proof of Identity

To begin with, you’ll need to prove your identity. You can use:

- Driver’s License or State ID: A government-issued ID with your photo. This is the most commonly used form of identification and is required to verify your identity and age.

- Passport: Another form of government-issued identification. A passport is especially useful if you are not a U.S. citizen or if your driver’s license is not available.

- Social Security Card: To verify your social security number. This number is critical for tracking your credit history and tax records.

These documents help the lender confirm your identity and citizenship status. Ensuring that these are current and valid is crucial, as any discrepancies can delay the loan process.

Proof of Income

Your lender needs to confirm that you have a stable income to make your mortgage payments. Here are the documents you’ll need:

- Pay Stubs: Typically, your last two pay stubs. These show your current income and employment status. Consistent pay stubs demonstrate steady income, reassuring the lender of your ability to meet monthly payments.

- W-2 Forms: Your W-2 forms from the past two years. They provide a summary of your earnings and taxes withheld. This helps the lender verify your employment history and determine any fluctuations in your income.

- Tax Returns: Copies of your federal tax returns from the past two years. These offer a comprehensive view of your income and financial situation. Lenders use tax returns to understand your overall financial health and confirm income consistency.

If you are self-employed or have additional income sources, you may also need:

- 1099 Forms: For any freelance or contract work. These forms report income not covered by traditional employment, crucial for self-employed individuals.

- Profit and Loss Statements: To show your business income and expenses. Lenders use these statements to gauge the profitability and stability of your business.

- Business Tax Returns: If you own a business, provide the last two years of business tax returns. These documents offer a detailed financial history of your business, aiding in the assessment of your financial stability.

Credit History

Your credit history is a vital part of the loan application process. Lenders will check your credit report to assess your creditworthiness. While you don’t need to provide this document yourself, it’s good to review your credit report beforehand to ensure there are no errors.

Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness. It’s calculated based on your credit history, including payment history, amounts owed, length of credit history, and types of credit in use. A higher credit score generally results in better loan terms.

Rectifying Credit Report Errors

Before applying for a mortgage, obtain a copy of your credit report from major credit bureaus. Carefully review it for any inaccuracies or discrepancies. If you find errors, dispute them with the credit bureau to correct your report and improve your credit standing.

Building a Strong Credit History

If your credit history needs improvement, take proactive steps to boost your score. This includes paying bills on time, reducing outstanding debts, and avoiding new credit inquiries. A strong credit history not only increases your chances of loan approval but also secures more favorable interest rates.

Asset Statements

Lenders want to know about your assets, as these can be a source of down payment and reserves. Documents you may need include:

- Bank Statements: Your last two months of statements for all accounts. These show your savings and checking account balances. Lenders assess these statements to ensure you have sufficient funds for the down payment and closing costs.

- Investment Account Statements: Proof of any stocks, bonds, or other investments. These statements provide a view of your financial portfolio, indicating additional resources available for your mortgage.

- Retirement Account Statements: Such as 401(k) or IRA statements, to demonstrate your financial stability. While these funds are typically not used for mortgage payments, they reflect long-term financial planning, which is a positive indicator for lenders.

Debt Information

To evaluate your debt-to-income ratio, lenders will need information about your debts. Gather:

- Credit Card Statements: Showing your current balances and minimum payments. These statements help the lender understand your existing financial obligations.

- Loan Statements: For any existing loans, such as car loans or student loans. Providing details of your existing loans assists the lender in calculating your debt-to-income ratio, a crucial factor in loan approval.

- Other Financial Obligations: Include any child support, alimony, or other regular payments. These obligations are considered in your overall debt calculation and affect your borrowing capacity.

Additional Documents

Depending on your situation, you might need a few additional documents:

- Rent History: If you are currently renting, provide a history of your rental payments. This demonstrates your reliability in making regular payments, similar to a mortgage.

- Gift Letter: If you’re receiving a financial gift for your down payment, a letter from the donor explaining the gift is necessary. This letter should state that the money is a gift and not a loan that needs repayment.

- Divorce Decree: If applicable, to verify any alimony or child support payments. This document is essential to provide a complete picture of your financial obligations and income sources.

Tips for a Smooth Loan Application

Here are some tips to ensure a seamless mortgage loan application process:

- Organize Your Documents: Keep all your documents in one place, either digitally or in a physical folder, for easy access. Having organized documents saves time and reduces stress during the application process.

- Double-Check for Completeness: Make sure all your documents are complete and up-to-date before submitting them to your lender. Incomplete or outdated documents can delay the approval process.

- Stay in Communication: Maintain open communication with your lender. Promptly respond to any requests for additional information. Clear and consistent communication helps address any issues quickly, keeping the process moving smoothly.

- Seek Professional Advice: Consider consulting with a mortgage advisor or financial planner. They can provide valuable insights and help you navigate the complexities of the mortgage process, enhancing your chances of success.

- Be Patient and Persistent: The mortgage application process can be lengthy and requires patience. Stay persistent in gathering necessary documents and following up with your lender as needed.

Conclusion

Securing a mortgage loan involves gathering a variety of documents that verify your identity, income, assets, and debts. By understanding the requirements and preparing your paperwork in advance, you’ll navigate the mortgage process with confidence and ease. Remember, being organized and thorough will help you present a strong application, ultimately bringing you one step closer to your dream home.

By following this guide, you’ll be well-prepared for your mortgage loan application, ensuring that the process is as straightforward as possible. Good luck with your journey to homeownership!