What is a Mortgage Loan Modification?

When financial hardships strike, keeping up with mortgage payments can become challenging. Economic downturns, sudden job losses, or unexpected medical expenses can place a significant strain on your finances, making it difficult to meet your mortgage obligations. Fortunately, there are options available to homeowners facing difficulty. Among these solutions is a mortgage loan modification, a process that can offer a lifeline during tough financial times. But what exactly does this entail, and how can it help you?

Understanding Mortgage Loan Modification

Mortgage loan modification is a change made to the terms of your existing loan by your lender. It’s designed to make your monthly payments more manageable and help you avoid foreclosure. This strategic adjustment can be a critical intervention to preserve homeownership during prolonged financial struggles. Unlike refinancing, which replaces your existing loan with a new one, a modification alters the conditions of your current loan.

How Does It Work?

In a loan modification, lenders might reduce the interest rate, extend the term of the loan, or, in some cases, reduce the principal balance. Each of these adjustments is aimed at lowering monthly payments to a level that the borrower can afford. The goal is to adjust the loan terms so that the monthly payments are more affordable for the borrower. This can be particularly beneficial for homeowners experiencing temporary income loss or long-term financial difficulties but who wish to keep their homes.

Key Differences from Refinancing

Refinancing involves taking out a new loan to replace your existing mortgage, often to secure a lower interest rate or better terms. In contrast, loan modification restructures your current loan without the need to refinance. This distinction is crucial because refinancing may not be an option for those with poor credit scores or insufficient equity in their homes. Therefore, loan modifications offer a more accessible alternative for those unable to qualify for refinancing.

Long-term Benefits

The primary advantage of a loan modification is its potential to prevent foreclosure. By restructuring your loan, you can maintain your homeownership and protect your credit score from the severe impact of foreclosure. In the long run, a modification can help stabilize your financial situation, allowing you to focus on rebuilding your financial health without the looming threat of losing your home.

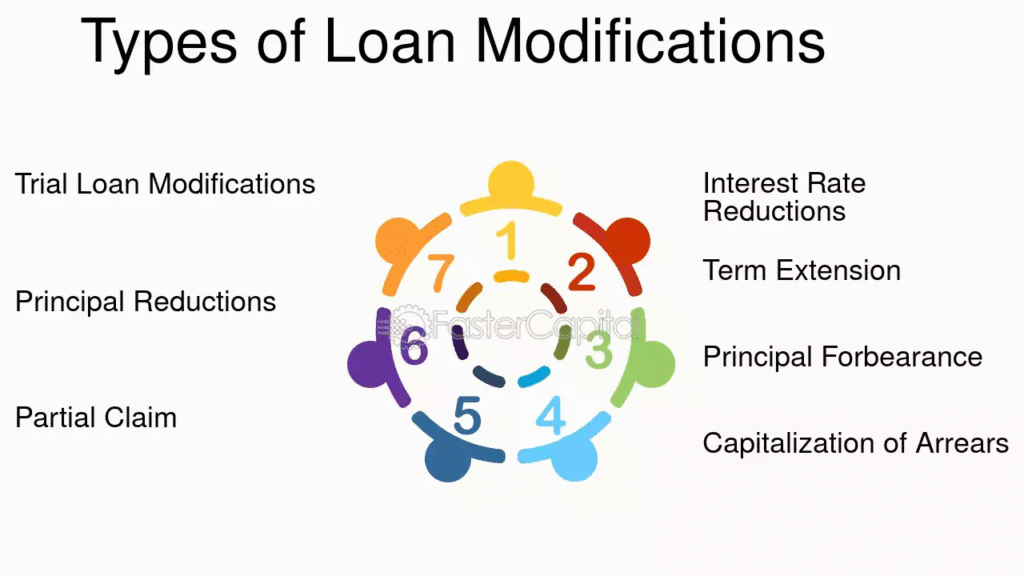

Types of Loan Modifications

There are several types of modifications available, depending on your lender and your financial situation. Each type offers different mechanisms to make your mortgage more affordable, addressing specific financial challenges you may face.

Interest Rate Reduction

One common type of modification is reducing the interest rate. By lowering the rate, your monthly payments can become more affordable. This adjustment can significantly decrease the amount of interest you pay over the life of the loan, providing immediate relief for your monthly budget. An interest rate reduction is particularly beneficial if your financial hardship is expected to last for a limited time, as it can provide temporary relief while you regain financial stability.

Term Extension

Another option is extending the term of your loan. If your mortgage is extended from a 20-year to a 30-year term, the payments will be spread over a longer period, thereby reducing the monthly amount. While this can ease immediate financial pressures, it may result in paying more interest over time. However, for those facing long-term financial difficulties, a term extension can provide necessary breathing room, allowing for a gradual improvement in financial circumstances.

Principal Forbearance

In some cases, lenders may agree to forbear a portion of the principal, effectively reducing the balance that you owe. This reduction can significantly decrease your monthly payments. Principal forbearance is particularly useful for homeowners with substantial negative equity, where the home’s market value has fallen below the outstanding loan balance. This type of modification is often used in conjunction with other adjustments to maximize the reduction in monthly payments.

Combination Modifications

Sometimes, lenders offer a combination of the above modifications to provide the most effective relief. For instance, a lender might reduce the interest rate while extending the loan term to achieve the desired payment reduction. This flexibility allows for tailored solutions that best meet the borrower’s unique financial situation, enhancing the likelihood of successful payment restructuring.

Mortgage Assistance Programs

Lenders like Wells Fargo offer mortgage assistance programs to help homeowners who are struggling. These programs are often tailored to meet the specific needs of borrowers. They aim to provide structured pathways for homeowners to regain financial stability while maintaining homeownership.

Wells Fargo Mortgage Loan Modification

Wells Fargo, for instance, provides various solutions for those having trouble making their mortgage payments. Their mortgage loan modification program aims to provide relief by adjusting the loan terms. These programs are designed to be accessible, offering multiple avenues for assistance, including online resources and personalized consultations. Homeowners can apply by reaching out to Wells Fargo directly, where they will be guided through the modification process. This guidance is crucial, as it helps borrowers understand the requirements and benefits of the modification process, ensuring they have all the necessary information to make informed decisions.

Government-backed Programs

Apart from lender-specific programs, there are also government-backed initiatives designed to assist homeowners. Programs like the Home Affordable Modification Program (HAMP) have been instrumental in providing relief during nationwide financial crises. These programs often offer standardized guidelines and benefits, making them an attractive option for many borrowers. Understanding the differences between lender-specific and government-backed programs can help you choose the best path for your situation.

Non-profit Counseling Services

In addition to lender and government programs, non-profit organizations offer counseling services to assist homeowners. These organizations provide free or low-cost guidance on navigating the loan modification process, budgeting, and understanding mortgage terms. By leveraging these resources, homeowners can better prepare their applications and improve their chances of securing a favorable modification.

Eligibility for Loan Modification

Eligibility for a mortgage loan modification depends on several factors, including:

- Demonstrated financial hardship

- Proof of income

- Occupancy status of the property

- Current loan status

Lenders will require documentation to verify your financial situation, such as pay stubs, tax returns, and a letter detailing your hardship. Meeting these criteria ensures that the modification process is reserved for those who truly need assistance.

Steps to Apply

- Contact Your Lender: The first step is to reach out to your lender and explain your situation. They can inform you about available options. Early communication is vital, as it demonstrates your willingness to address the issue proactively.

- Submit Documentation: Gather and submit necessary documents such as proof of income, tax returns, and a hardship letter. These documents provide a comprehensive view of your financial situation, allowing the lender to assess your eligibility accurately.

- Evaluation: Your lender will review your application and determine if you qualify for a modification. This process may take some time, as lenders need to thoroughly evaluate your financial circumstances and determine the best course of action.

- Modification Offer: If approved, you will receive an offer outlining the new terms of your loan. It’s important to review these terms carefully and understand their implications on your financial future. Accepting the offer means committing to the adjusted payment plan, so ensure it aligns with your long-term goals.

Important Considerations

When applying for a loan modification, it’s crucial to be honest and thorough in your documentation. Incomplete or inaccurate information can delay the process or result in denial. Additionally, maintaining open communication with your lender throughout the process can help address any issues that arise and demonstrate your commitment to resolving your financial challenges.

Benefits of Mortgage Loan Modification

Loan modification can offer several benefits to struggling homeowners. By adjusting the terms of your mortgage, you can gain significant financial relief and maintain homeownership.

Avoiding Foreclosure

The primary benefit is the ability to avoid foreclosure. By making your mortgage payments more affordable, you can remain in your home and maintain ownership. Avoiding foreclosure not only protects your home but also preserves your credit score from the severe impact that foreclosure can have. This is essential for maintaining future borrowing power and financial credibility.

Financial Relief

A modified loan can provide significant financial relief, allowing you to use your resources for other essential expenses. This relief can create breathing room in your budget, enabling you to address other financial obligations such as medical bills, education expenses, or debt repayment. With less financial stress, you can focus on rebuilding your financial health and planning for the future.

Stabilizing Your Financial Future

With more manageable payments, you can stabilize your financial future and work toward rebuilding your credit. Consistent, on-time payments following a modification can gradually improve your credit score, opening doors to future financial opportunities. This stability is crucial for long-term financial planning and achieving your personal financial goals.

Emotional and Psychological Benefits

Beyond financial advantages, loan modification can also provide emotional and psychological relief. The stress of potential foreclosure can take a toll on your mental health, affecting your daily life and personal relationships. By securing a loan modification, you can alleviate these stressors, leading to improved overall well-being.

Drawbacks to Consider

While loan modification can be beneficial, there are potential drawbacks to consider. Understanding these drawbacks is essential for making an informed decision.

Impact on Credit Score

Though not as severe as foreclosure, a loan modification can impact your credit score. This is because modifications are typically reported to credit agencies. While the impact may be temporary, it can affect your ability to secure new loans or lines of credit in the short term. It’s important to weigh this impact against the benefits of securing a more manageable mortgage payment.

Extended Loan Term

While extending the loan term reduces monthly payments, it may result in paying more interest over the life of the loan. This can increase the overall cost of the mortgage, affecting your long-term financial plans. It’s essential to consider whether the short-term relief is worth the potential long-term financial implications.

Potential Fees

Some lenders may charge fees for processing a loan modification, so it’s essential to understand all costs involved. These fees can vary widely depending on the lender and the complexity of the modification process. Be sure to ask your lender about any potential fees upfront to avoid unexpected costs.

Limited Eligibility

Not all borrowers will qualify for a loan modification, as eligibility criteria can be stringent. This limitation means that some homeowners may need to explore alternative solutions, such as refinancing or selling the property, to address their financial challenges.

Conclusion

A mortgage loan modification is a viable option for homeowners facing financial challenges. By working with your lender, you can adjust the terms of your loan to make payments more manageable. Whether it’s through an interest rate reduction or a term extension, a loan modification can help you avoid foreclosure and provide financial relief.

If you’re struggling with mortgage payments, consider reaching out to your lender to explore your options. With the right modification, you can secure a more stable financial future and keep your home. Remember, proactive communication and thorough preparation are key to navigating the loan modification process successfully. By taking these steps, you can regain control of your financial situation and work towards a more secure future.