Who is the Underwriter for a Mortgage Loan?

A mortgage loan underwriter is a financial professional who evaluates your application to determine if you qualify for a home loan. They play a key role in the loan approval process by assessing your financial health and ensuring that the loan is a good fit for both you and the lender.

Evaluating Financial Health

At the core of an underwriter’s responsibilities is evaluating your financial health. This involves a thorough review of your credit score, income, and employment history. By understanding these elements, the underwriter can gauge your ability to repay the loan. They will also assess your debt-to-income ratio to ensure you’re not over-leveraged.

Verifying Information

The underwriter is responsible for verifying your income, assets, debt, and property details. Verification ensures that the details you’ve provided are accurate and truthful. This step might involve contacting your employer to confirm your job status or requesting additional documentation if something seems unclear.

Assessing Risk

The underwriter also looks at your credit score, employment history, and other factors to decide whether you’re a good candidate for a mortgage. They weigh the risks associated with lending to you and determine the likelihood of default. This risk assessment helps protect the lender from potential financial losses.

The Underwriting Process Explained

The underwriting process can seem complicated, but it’s designed to protect both the lender and the borrower. Let’s break it down into simpler terms.

Step 1: Pre-approval

Before the underwriting process begins, you typically go through a pre-approval phase. This is when you submit basic financial information to get an idea of how much you might be able to borrow. It’s not a guarantee, but it can give you a ballpark figure.

Gathering Basic Financial Information

During pre-approval, you’ll submit basic financial information like your income, debts, and assets. This preliminary data helps the lender assess your borrowing capacity. It’s an initial look into your financial standing and gives you an idea of what price range you should consider.

Benefits of Pre-approval

Pre-approval offers several advantages. It shows sellers you’re a serious buyer, which can be advantageous in competitive markets. Additionally, it helps you understand your budget better, so you don’t waste time on homes outside your financial reach.

Limitations of Pre-approval

However, pre-approval has its limitations. It’s not a final loan offer, and the terms can change once detailed underwriting begins. Also, pre-approval is typically valid for a limited time, usually 60 to 90 days, after which you’ll need to update your financial information.

Step 2: Application Submission

Once you’ve found a home and made an offer, you’ll submit a formal mortgage application. This includes detailed information about your finances, such as income statements, tax returns, and bank statements.

Compiling Necessary Documents

When submitting a formal application, compiling all necessary documents is crucial. This may include recent pay stubs, tax returns, and a list of assets. Accuracy and completeness are vital, as any missing information can delay the process.

Providing Detailed Financial Insights

The application offers a detailed financial snapshot that the underwriter will scrutinize. It includes your employment details, credit history, and existing debts, providing the foundation for the underwriting process.

Understanding the Importance of Transparency

Being transparent in your application is essential. Any discrepancies or omissions can raise red flags for the underwriter. It’s better to provide more information upfront than to be asked for additional documentation later.

Step 3: Document Verification

The underwriter will verify all the documents you’ve submitted. They will cross-check your income, assets, and employment details to ensure everything is accurate. This step is critical because any discrepancies can delay or derail the loan approval process.

Methods of Verification

Verification can take various forms. The underwriter might contact your employer directly or request third-party verification. They might also use automated systems to cross-check your credit history and financial records.

Importance of Accuracy

Accuracy is paramount in document verification. Any inconsistencies could lead to further inquiries or even jeopardize your loan approval. Double-checking your documents before submission can help avoid unnecessary delays.

Common Verification Challenges

Common challenges during verification include outdated information or missing documents. Having a checklist of required documents and regularly updating your records can help smooth this step.

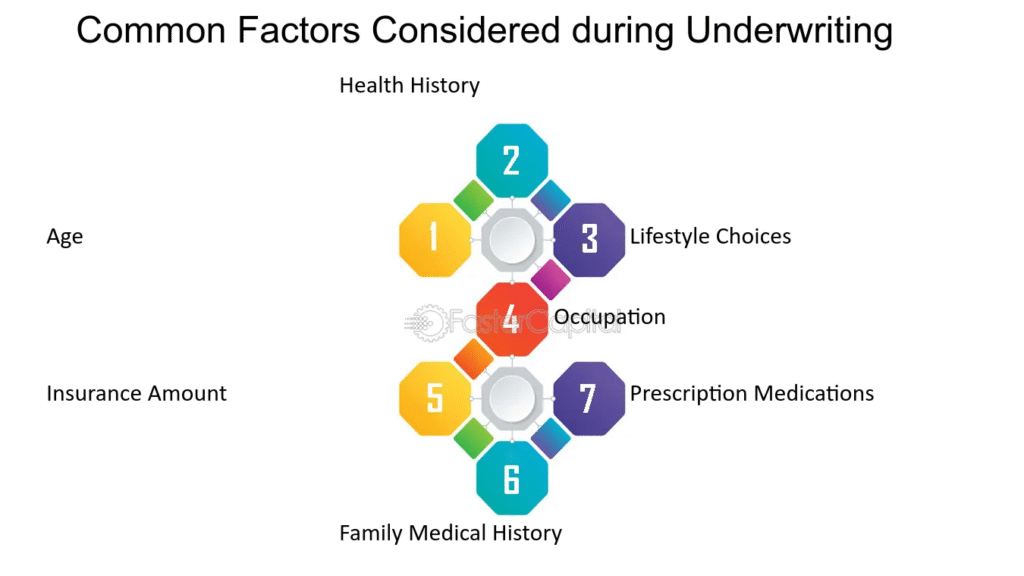

Step 4: Risk Assessment

Using the verified information, the underwriter assesses the risk involved in lending to you. They look at your debt-to-income ratio, credit history, and the value of the property you wish to purchase. They might use automated underwriting systems to speed up this process, but human judgment is still a big part of the decision.

Debt-to-Income Ratio Analysis

The debt-to-income ratio is a critical metric in risk assessment. It indicates how much of your income goes toward debt payments. A high ratio might suggest financial strain, whereas a lower ratio indicates better financial health.

Role of Automated Systems

While automated systems streamline risk assessment, they aren’t foolproof. These systems provide initial guidance, but the underwriter’s expertise is crucial in interpreting results and making nuanced decisions.

Human Judgment in Risk Assessment

Human judgment remains vital in assessing risk. Experienced underwriters can spot potential issues that automated systems might miss. Their ability to consider unique circumstances and provide tailored recommendations is invaluable.

Step 5: Decision Making

Based on their assessment, the underwriter will make a decision. This can be an approval, a conditional approval (where you need to meet certain conditions), or a denial. If approved, you’ll move on to the next steps in the mortgage process.

Types of Decisions

Decisions can vary. A straightforward approval means the loan proceeds without additional conditions. Conditional approval requires fulfilling specific criteria before final approval. Denial indicates significant issues with the application.

Communicating the Decision

Once a decision is made, the underwriter communicates it to you and the lender. If conditions are attached, detailed instructions on how to meet them are provided. Clear communication ensures you understand the next steps.

Preparing for Next Steps

If approved, the next steps involve finalizing loan terms and closing. For conditional approvals, focus on satisfying the conditions promptly. In case of denial, seek feedback and address the issues before reapplying.

Why is the Underwriter Important?

The underwriter is essential because they ensure that the mortgage loan is a sound decision for both you and the lender. By thoroughly evaluating your financial situation, they help prevent situations where borrowers might struggle to make payments, which could lead to foreclosure.

Preventing Foreclosure

One of the underwriter’s primary roles is to prevent foreclosure. By assessing your ability to repay the loan, they help ensure you won’t face financial hardship down the line. Their careful evaluation protects you from overcommitting.

Ensuring Compliance

Their role also involves ensuring the loan complies with all regulations and guidelines, which protects both parties from legal issues down the line. Compliance with lending standards is crucial for maintaining the integrity of the financial system.

Balancing Interests

The underwriter balances the interests of both the lender and the borrower. They ensure that loans are extended to those who can repay them, safeguarding the lender’s investment while helping borrowers achieve homeownership responsibly.

Common Underwriting Conditions

Sometimes, an underwriter may approve a loan with conditions. These conditions must be met before the loan can close. Here are some common conditions you might encounter:

Proof of Income

You might need to provide additional pay stubs or tax returns. This ensures your income is sufficient and stable enough to cover loan payments. It’s a critical step in verifying your financial reliability.

Providing Additional Documentation

If additional documentation is needed, be prepared to respond quickly. Gathering the necessary paperwork in advance can expedite this process. Timely submission of documents helps maintain the momentum of your application.

Understanding Income Requirements

Understanding income requirements can help you prepare better. Lenders typically require a certain level of income stability, so knowing these standards can guide you in gathering the right documentation.

Addressing Income Discrepancies

If there are discrepancies in your income records, address them proactively. Providing explanations or supplementary documentation can help clarify any misunderstandings and keep your application on track.

Proof of Assets

Bank statements might be required to verify your savings and other assets. This is crucial for demonstrating your ability to cover the down payment and closing costs. It also indicates financial stability.

Verifying Asset Holdings

Asset verification involves confirming the existence and value of your financial holdings. This step ensures you have the necessary funds to complete the transaction.

Importance of Liquid Assets

Liquid assets, like savings and checking accounts, are particularly important. They demonstrate your ability to access funds quickly, which is reassuring for lenders.

Resolving Asset Discrepancies

If discrepancies arise in asset verification, resolving them promptly is key. Providing additional bank statements or explanations can help clarify any issues and keep the process moving.

Debt Clarifications

If there are discrepancies in your credit report, you may need to provide explanations or documentation. Understanding your credit history helps the underwriter assess your financial responsibility.

Explaining Credit Report Issues

If your credit report has issues, providing explanations is essential. This might include clarifying late payments or disputed accounts. Transparency helps the underwriter understand your financial situation better.

Addressing Credit Score Concerns

If your credit score is a concern, consider proactive measures. Paying down existing debts and avoiding new ones can improve your score. Demonstrating creditworthiness can positively impact the underwriting decision.

Providing Documentation for Debt

Providing documentation for outstanding debts can help clarify your financial obligations. This might include loan statements or payment histories, giving the underwriter a complete picture of your financial commitments.

Property Appraisal

The property must be appraised to ensure its value supports the loan amount. This protects the lender from over-lending and ensures the property is a sound investment.

Understanding the Appraisal Process

Understanding the appraisal process can help you prepare for it. Appraisers assess the property’s condition, location, and market value to determine its worth.

Addressing Low Appraisal Values

If the appraisal comes in lower than expected, be prepared to address it. This might involve negotiating with the seller or providing additional documentation to support a higher value.

Importance of a Fair Appraisal

A fair appraisal is crucial for both the lender and borrower. It ensures the loan amount aligns with the property’s value, protecting both parties from financial risk.

How to Improve Your Chances of Loan Approval

Getting approved for a mortgage can be challenging, but there are steps you can take to improve your chances:

Maintain a Good Credit Score

A higher credit score can make you a more attractive candidate. It demonstrates financial responsibility and increases your borrowing power. Regularly monitoring your credit report can help you identify and address issues promptly.

Tips for Improving Your Credit Score

Improving your credit score involves timely bill payments and reducing outstanding debts. Avoid opening new credit accounts, as this can lower your score. Consistent financial behavior can lead to gradual score improvements.

Monitoring Your Credit Report

Regularly checking your credit report is essential. This allows you to spot errors or fraudulent activity early. Correcting inaccuracies can boost your score and improve your loan approval chances.

Importance of Credit Utilization

Credit utilization ratio plays a significant role in your credit score. Keeping your credit card balances low relative to your credit limit can positively impact your score, making you a more attractive loan candidate.

Reduce Your Debt

Lowering your debt-to-income ratio can help your case. Paying down existing debts increases your financial flexibility and reduces perceived risk for lenders. Prioritizing high-interest debts can lead to quicker financial relief.

Strategies for Debt Reduction

Effective debt reduction strategies include creating a budget and focusing on paying off high-interest debts first. Consider consolidating debts if it lowers your overall interest payments. Consistent efforts can lead to significant improvements over time.

Importance of Debt Management

Managing your debts demonstrates financial responsibility. Lenders view lower debt levels as an indicator of your ability to handle additional financial obligations. Responsible debt management can improve your loan approval prospects.

Impact on Loan Approval

Reducing your debts positively impacts your loan approval chances. Lower debt levels translate to lower monthly obligations, freeing up more of your income for mortgage payments.

Provide Complete Documentation

Ensure all your financial documents are accurate and up-to-date. This demonstrates your readiness and responsibility in handling financial matters. Proper organization of documents can expedite the application process.

Importance of Document Organization

Organizing your financial documents is crucial. It ensures you can quickly respond to the underwriter’s requests. A well-prepared application reflects positively on your ability to manage financial responsibilities.

Common Documentation Mistakes

Avoid common documentation mistakes, such as submitting incomplete or outdated records. Double-checking your documents before submission can prevent unnecessary delays and frustrations.

Responding Promptly to Document Requests

If additional documentation is requested, respond promptly. Timely submission of documents helps maintain the momentum of your application and demonstrates your commitment to the process.

Stable Employment

A steady job history can work in your favor. It indicates income stability and reliability, important factors for lenders assessing your financial health. Employment consistency can be a strong point in your application.

Demonstrating Employment Stability

Demonstrating employment stability involves maintaining continuous employment and avoiding frequent job changes. This reassures lenders of your financial reliability.

Handling Employment Gaps

If you have employment gaps, be prepared to explain them. Providing context and showing how you’ve regained stability can mitigate concerns for the underwriter.

Importance of Employment Verification

Employment verification ensures your job status and income are accurate. Providing contact information for your employer can expedite this process and strengthen your application.

Save for a Down Payment

A larger down payment can reduce the lender’s risk. It shows your commitment to the investment and can lead to more favorable loan terms. Saving diligently can significantly impact your mortgage journey.

Strategies for Saving

Effective saving strategies include setting a budget and automating savings. Consider cutting unnecessary expenses and directing extra funds toward your down payment savings goal.

Importance of a Substantial Down Payment

A substantial down payment reduces the loan amount, lowering monthly payments and total interest paid over the loan term. It also demonstrates financial discipline, reassuring the lender of your commitment.

Impact on Loan Terms

A larger down payment can lead to better loan terms, such as lower interest rates or reduced private mortgage insurance (PMI) requirements. It strengthens your negotiating position and enhances your loan approval chances.

Conclusion

The mortgage loan underwriter plays a crucial role in determining whether you can secure a home loan. By understanding the underwriting process and preparing accordingly, you can navigate this part of the mortgage journey with confidence. Remember, the underwriter isn’t just a gatekeeper; they’re there to ensure the loan is a good fit for everyone involved. With the right preparation, you can improve your chances of getting the keys to your new home.