When a charge labeled “100 Deerfield Lane” appears on a debit card statement, it can create immediate concern due to its unclear origin. This charge typically comes from Cantaloupe, Inc., a company that handles payments for vending machines, convenience store services, and equipment like tire air pumps, rather than being a direct merchant name. Many people mistake it for a fraudulent charge, but it is often a legitimate transaction processed through third-party systems.

The name “100 Deerfield Lane” refers to the company’s office address in Malvern, Pennsylvania, which appears on billing statements instead of the actual vendor or location. This generic description can cover a variety of small purchases, subscriptions, or automated payments, making it important for cardholders to review their recent activities and receipts carefully. Understanding this can help avoid confusion and unnecessary concern when encountering these types of charges.

Understanding the 100 Deerfield Lane Charge on Debit Card

The 100 Deerfield Lane charge often appears as a vague description on debit or credit card statements. It is not a direct reference to a single merchant but usually linked to third-party processors or specific service providers. Differentiating between legitimate transactions and potential abuse requires careful review.

What Is the 100 Deerfield Lane Charge?

The 100 Deerfield Lane charge refers primarily to transactions processed by USA Technologies, now known as Cantaloupe, Inc. This company provides payment processing services for vending machines, kiosks, and similar automated retail devices.

When customers buy snacks, beverages, or use services like air pumps at convenience stores, their card payment may appear under this descriptor. The address “100 Deerfield Lane, Malvern, PA” is the headquarters of the payment processor rather than the store where the purchase occurred.

This label can be confusing, as it lacks a clear merchant name. It is not uncommon for customers unfamiliar with the term to investigate its legitimacy. The charge itself is typically valid if the cardholder recently used vending or automated services.

Common Sources of 100 Deerfield Lane Transactions

Most transactions linked to this charge originate from vending machines, snack kiosks, and small retail stations that use cashless payment systems. These systems rely on Cantaloupe’s technology to authorize and settle payments.

Other sources include automated fuel stations or convenience stores that incorporate payment terminals powered by the same network. Charges can also appear from airport vending services or on-campus machines at universities.

This charge may occasionally be confused with others appearing on statements such as “Good Sportsman,” “Acqra,” “Blossom Up,” “Modern Leasing MI,” “Towson CMF,” or “Corporate Filings LLC.” Each represents separate entities, often associated with subscription services, leasing, or business filings, and requires its own verification.

Identifying Legitimate vs. Suspicious Charges

To verify a 100 Deerfield Lane charge, users should first check their recent activity for vending machine or self-service purchases. Legitimate charges often match small-dollar amounts consistent with snacks or drinks.

If the cardholder did not use any such service, the transaction could be unauthorized. In that case, it’s important to contact the bank or card issuer immediately to report possible fraud or credit card abuse.

Keeping an eye on recurring charges helps identify subscription scams disguised with vague names like “Corporate Filings LLC” or unknown vendors such as “Towson CMF.” Promptly flagging unexpected or high-value charges reduces the risk of extended losses.

Cards compromised by fraud require immediate freezing or replacement to prevent further unauthorized use, especially since debit card transactions deduct funds directly from accounts without delay.

Possible Businesses and Services Linked to 100 Deerfield Lane

The charge from 100 Deerfield Lane on a debit card often originates from specific payment processors or service providers rather than traditional retailers. This location serves as a hub for companies managing transactions across various platforms, including vending, subscription services, and payment gateways.

Retail Stores and Service Providers

The address at 100 Deerfield Lane in Malvern, PA, is linked to vending machine suppliers and service companies. USA Technologies, also known as Cantaloupe, Inc., operates here and processes payments related to snack and soda vending machines nationwide.

Charges may appear under this address when customers purchase items from vending machines using credit or debit cards. It is not unusual for these transactions to be recorded under the payment processor’s business address rather than the individual vending location.

Other retail-related businesses that use automatic payment pools or process credit card payments, such as automotive services like AAMCO, might also appear indirectly linked through third-party processors. These charges sometimes raise questions but are generally legitimate transactions facilitated by companies operating out of this address.

Online Payment Gateways

100 Deerfield Lane is associated with multiple third-party payment gateways. These payment processors handle transactions for diverse merchants who do not operate physical stores.

For example, Supernova Payment and similar platforms might use this location for transaction processing, which explains why charges linked to online buys or payments—like buying proxies with credit cards—may carry the 100 Deerfield Lane descriptor. It serves as a generic merchant descriptor for the backend payment system managing these payments, not the actual seller.

This setup often causes confusion when consumers review statements, but understanding that 100 Deerfield Lane is primarily a processing center clarifies the source of such charges.

Subscription and Membership Charges

Subscription services may also show charges from 100 Deerfield Lane due to payment processing by companies based there. Membership-based businesses, including mental health treatment centers or other community services, sometimes use billing systems tied to this address.

Because the charge reflects the payment processor’s location rather than the service provider’s, it can be difficult to identify at first glance. Services that rely on recurring automatic payments, including memberships or digital subscriptions, might appear under this charge description.

Users seeing repeated or automatic charges marked with 100 Deerfield Lane should verify the source by cross-checking recent subscriptions or memberships linked to their accounts, to ensure accurate billing recognition.

How to Investigate and Verify Debit Card Charges

When unusual charges appear on a debit card, it is critical to act quickly and methodically. Verification includes contacting the card issuer, analyzing transactions with reconciliation tools, researching merchant details, and recognizing signs of fraud. These steps help clarify the legitimacy of a charge and protect the account from further unauthorized use.

Contacting Your Bank or Card Issuer

The first step is to notify the bank or card issuer immediately. Most banks offer customer service via phone, website, or mobile app. Reporting suspicious charges quickly can activate fraud protection and limit liability, especially for first-time offenses related to credit card theft or abuse.

During the call or online inquiry, the cardholder should provide transaction details like date, amount, and merchant descriptor—often a generic address such as “100 Deerfield Lane.” The bank will typically place a temporary hold or begin an investigation while advising on next steps.

Banks differentiate between soft declined and hard declined transactions. A soft decline might indicate insufficient funds or minor issues, while a hard decline often flags potential fraud or serious account problems. Understanding this can help when disputes arise.

Using Credit Card Reconciliation Software

Credit card reconciliation software can simplify tracking and verifying charges by comparing statements against approved transactions. This is especially useful for users managing multiple card payments or businesses aiming to spot discrepancies early.

By importing transactions, the software highlights unmatched or suspicious entries. Recurring transactions tied to unknown vendors or soft declined payments may signal a need for further inquiry. These tools also help detect credit card dump sites selling stolen data by flagging unusual spending patterns or repeated minor charges.

Systems vary in complexity but typically produce reports that categorize transactions by date, merchant, and amount. This organization aids in quickly spotting the “100 Deerfield Lane” charge if it belongs to a subscription or third-party payment processor rather than a direct merchant purchase.

Searching for Merchant Information

Charges labeled with vague descriptions like “100 Deerfield Lane” often originate from third-party processors or fulfillment centers. Investigating such entries requires searching merchant directories, online reviews, or payment platform details.

Users should verify if recent purchases, subscriptions, or trial services match the charge date and amount. Checking emails for receipt confirmations or merchant notifications can provide clarity. Sometimes, legitimate vendors use generic billing addresses for processing.

If no connection emerges, the charge may warrant a dispute or even suspicion of identity theft. In such cases, researching who owns the listed address or contacting the merchant via official channels can help confirm or deny authorization.

Recognizing Credit Card Fraud Patterns

Detecting fraud requires awareness of common patterns, such as multiple small charges, identical amounts recurring daily, or transactions just below authorization limits. Fraudsters often test stolen cards this way before larger purchases.

Felony credit card abuse and felony-level credit card theft cases typically involve significant unauthorized spending or systematic fraud schemes. Recognizing these patterns early can save considerable financial loss.

Users should be cautious if unfamiliar merchants repeatedly appear or if their card is used in different locations simultaneously. Monitoring activity reports and setting alerts through the bank or reconciliation software enhances fraud detection and response capabilities.

Security Measures and Prevention of Unauthorized Debit Card Charges

Debit card security relies on multiple layers of protection to prevent unauthorized transactions. Understanding how to manage a debit card account securely, how card data can be compromised, and the risks of bypassing PIN verification is essential for safeguarding funds.

Proper Security Practices for Debit Card Accounts

Consumers should use a strong, unique PIN to reduce the risk of fraud. Debit cards usually require a PIN for in-person transactions, which acts as the primary defense against unauthorized use. It is important to never share the PIN or write it down where others can find it.

Enabling account alerts for every transaction can quickly notify the owner of suspicious activity. Regularly reviewing bank statements further helps in identifying fraudulent charges early.

Additional security includes using chip-enabled cards to prevent skimming, though chip malfunctions can happen. In such cases, contacting the bank immediately and avoiding manual entry is advised. Avoid using unsecured public Wi-Fi when accessing banking apps.

How Debit Card Data Is Compromised

Data theft often occurs through skimming devices attached to ATMs or point-of-sale terminals. These devices read the card’s magnetic strip and capture PINs entered on tampered keypads. Phishing scams and malware can also steal card data online.

A pinless debit card allows transactions without entering a PIN, increasing convenience but potentially raising fraud risks if lost or stolen. Fraudsters can use stolen card information to make purchases online or in stores without needing the physical card.

Unauthorized use can also happen if the card number is skimmed or stolen digitally without the cardholder realizing it. Monitoring transactions and reporting any unfamiliar charge promptly can limit losses.

What Happens When You Bypass PIN on Debit Card

Bypassing the PIN removes a critical security step designed to verify the cardholder’s identity in transactions. This can occur if a merchant processes a debit purchase as a credit transaction or if the card has a pinless debit card feature enabled.

When the PIN is bypassed, unauthorized users with access to card details can complete purchases, increasing the risk of fraud. Banks may have different policies on consumer liability, often depending on how soon the cardholder reports the unauthorized use.

If the chip malfunctions and the cardholder cannot enter a PIN, merchants might process transactions without it, but this should be minimal. Cardholders should immediately report lost cards and suspicious transactions to their bank to prevent further misuse.

Steps to Dispute or Report Unauthorized Transactions

When an unfamiliar charge like “100 Deerfield Lane” appears on a debit card, the account holder should act quickly to prevent further issues. This process involves formally disputing the charge with the bank, notifying proper authorities if necessary, and carefully monitoring the account afterward.

Filing a Dispute with Your Bank

The first step is to contact the bank or card issuer immediately after noticing the charge. The cardholder should use the customer service number on the back of the debit card and explain the unauthorized transaction.

Banks typically require a written dispute to officially start the investigation. This can include filling out a dispute form or sending a letter that details the specific charge and the reason it is unauthorized.

Under the Electronic Funds Transfer Act (EFTA), the bank must investigate and resolve certain disputes within 10 business days, although some cases may take longer depending on complexity.

The customer should also request that the bank block or replace the card to avoid additional fraudulent transactions.

Reporting to Regulatory Authorities

If the bank’s response is unsatisfactory or the fraud is significant, reporting the unauthorized charge to regulatory agencies is necessary.

The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) accept complaints about debit card fraud and disputes. Filing a complaint helps track fraudulent activity and may prompt additional investigations.

Victims can also report unauthorized debit card transactions to local law enforcement, especially in cases involving identity theft or suspected criminal behavior.

Providing detailed documentation of the disputed charge and communication with the bank is critical when reporting to these entities.

Monitoring Account Activity After a Dispute

After filing a dispute, it is essential to continuously review all account statements and transactions for any new suspicious activity.

Setting up instant alerts from the bank for every transaction can help the cardholder stay informed and quickly spot further unauthorized charges.

It is advisable to check linked accounts or business debit cards if used for personal transactions, as unauthorized charges might affect multiple accounts.

Keeping detailed records of all correspondence and transaction history supports any ongoing investigations and protects against future liabilities, such as potential overdrafts caused by fraudulent activity.

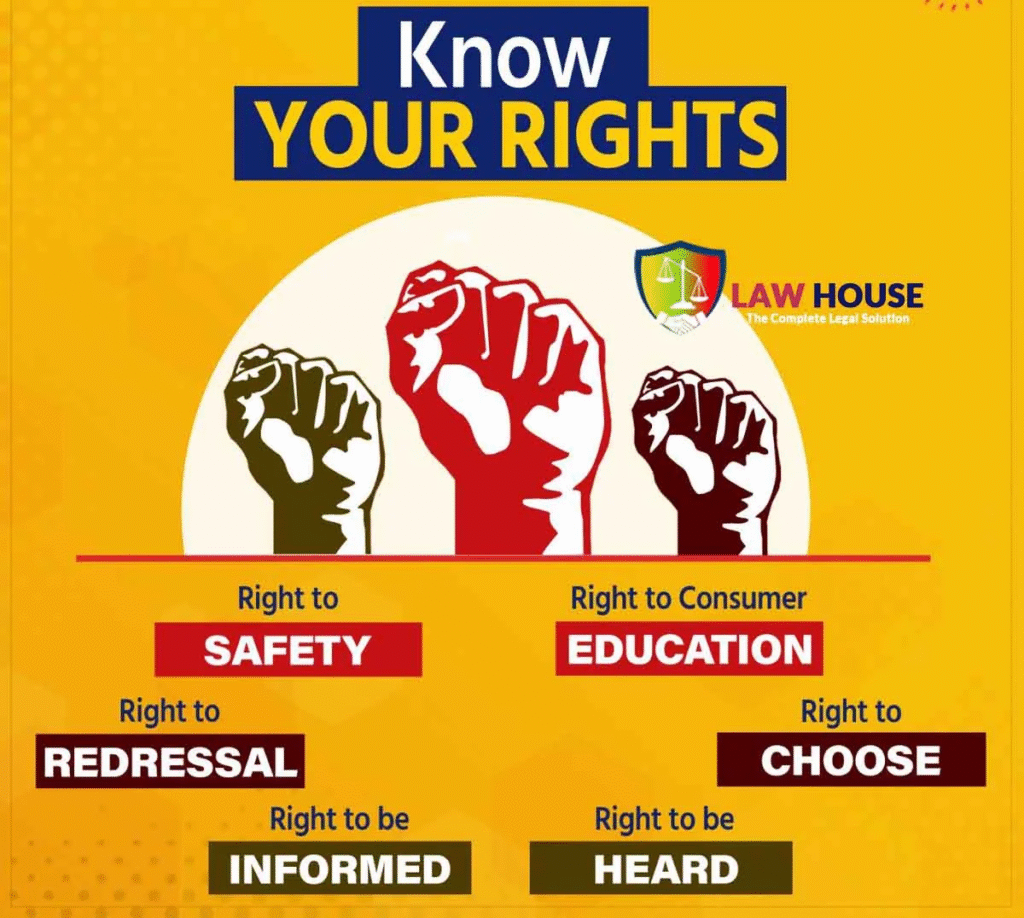

Legal Considerations and Consumer Rights

Charges like “100 Deerfield Lane” can prompt questions about legality and rights. Knowing the time limits for debts, options for addressing fraud, and responsibilities related to debit cards helps consumers protect themselves effectively.

Statute of Limitations for Credit Card Debt

The statute of limitations defines how long a creditor can legally pursue debt collection. In Georgia, this period is typically six years for written contracts, including most credit card agreements. Debts unpaid beyond this can no longer be enforced through court action, though they still exist.

Consumers should note that making a payment or acknowledging the debt can reset the limitations clock. This means renewed activity may extend the creditor’s ability to sue.

Contractors seeking payment without a written contract face different rules. Georgia applies a four-year statute for oral contracts, complicating claims where documentation is absent. Clear records are crucial in such cases.

Legal Recourse for Victims of Credit Card Fraud

Victims of unauthorized charges, including first-time credit card theft offenders, have protections under federal law. The Electronic Funds Transfer Act (EFTA) limits consumer liability to $50 if reported promptly. Delays can increase personal responsibility.

Reporting fraud quickly to the bank or card issuer is vital. Disputing charges formally can trigger investigations and potential refunds.

If a bank refuses to resolve disputes, consumers may pursue legal action. Some specialize in suing banks over unauthorized charges, emphasizing that victims are generally not liable for fraud they did not authorize.

Understanding Debit Card Liability

Debit cards differ legally from credit cards in liability protections. Under the EFTA, liability depends on timing. Reporting unauthorized use within two business days limits losses to $50. After that, liability can rise to $500 or full losses if unreported after 60 days.

Consumers must review statements regularly. Identifying unknown charges, like those labeled “100 Deerfield Lane,” early is critical to limit financial damage.

Surcharging on debit card transactions is prohibited by the Durbin Amendment, which means merchants cannot legally add fees for using these cards. Consumers should report illegal surcharges to authorities or card issuers to protect their rights.

Managing Debit Card Accounts and Payment Methods

Selecting and managing debit cards requires attention to features, fees, and personal financial needs. The types of debit cards and their usability vary significantly, especially when considering credit history or international use. Understanding distinct card types and options helps optimize financial control.

Choosing the Right Debit Card for Your Needs

Choosing a debit card depends on factors like fee structure, spending habits, and account features. Some cards offer no monthly fees, while others provide perks like rewards or fraud protection. Customers should verify available daily spending limits and ease of transactions.

For example, the Bank of Bhutan International Debit Card enables seamless international transactions, useful for travelers. Meanwhile, cards linked to apps like Shazam Debit Card focus on digital integration, ideal for tech-savvy users seeking real-time tracking.

Users should also check for security features such as chip technology, alerts, and easy dispute resolution. A careful review of terms and conditions helps avoid unexpected charges and ensures the card suits the intended use.

Differences Between U.S. Debit and Visa Debit

U.S. debit cards generally provide direct access to funds from a bank account, usable nationwide and sometimes internationally. A Visa Debit card is a type of debit card accepted globally, often with additional fraud protection and broader merchant acceptance.

Visa Debit cards carry the Visa brand, allowing users to shop online and abroad with fewer restrictions compared to local bank-issued debit cards. However, Visa Debit may have slightly different fee structures, including foreign transaction fees.

In short, U.S. debit cards can be domestic-only, while Visa Debit increases flexibility. Users should confirm if their card is Visa-branded to understand where it works and the protections available.

Debit Card Options for Bad Credit

Debit cards do not require credit approval, making them a practical option for individuals with bad credit or no credit history. They offer controlled spending by using only available funds, preventing debt accumulation.

Some prepaid or reloadable debit cards, often hinted at in contexts like “debit card for bad credit crossword clue,” provide features without credit checks. These cards may have fees but grant access to banking services otherwise unavailable.

When selecting such cards, users should compare fees, reload options, and customer support. Though they don’t improve credit scores directly, these cards help manage money safely while rebuilding financial habits.

Financial Planning Related to Debit and Credit Card Payments

Managing debit and credit card payments effectively involves strategic budgeting for ongoing expenses, understanding available payment options, and leveraging various lines of credit. Proper planning helps avoid unexpected debt and supports both personal and business financial goals.

Budgeting for Recurring Expenses

Budgeting for recurring charges such as subscriptions or medical services is essential to maintain financial stability. He or she should track monthly payments like orthodontist payment plans or root canal dentist Seattle payment plans. Setting aside funds each month for these predictable expenses reduces the risk of overdraft or declined transactions.

Tools like spreadsheets or budgeting apps help categorize recurring fees, including automobile down payment assistance or Oregon estimated tax payments. Regularly reviewing statements can catch unfamiliar charges, such as the “100 Deerfield Lane” debits, which may be linked to vending machine payment processors or third-party services. This vigilance helps maintain accuracy and control over personal finances.

Exploring Payment Plan Options

Payment plans provide flexibility to manage large expenses over time without overwhelming immediate cash flow. Patients with orthodontic treatments or dental procedures often benefit from tailored payment plans that align with their income schedules.

For businesses, installment options may apply to construction projects or other significant purchases. Understanding the terms, interest rates, and fees is critical before committing. Careful comparison ensures the chosen plan suits cash flow patterns, minimizing unnecessary costs while maintaining creditworthiness.

Lines of Credit for Personal and Small Business Use

Lines of credit offer adaptable borrowing solutions for both individuals and businesses. For someone needing funds for home-related expenses, a home equity loan in 2nd position (such as in Daly City) can provide workable financing. Real estate lines of credit are useful for auctions or property investments, allowing draws based on equity value.

Small business owners should consider unsecured business lines of credit or credit union business credit cards for working capital needs, including construction lines of credit. Opening a line of credit requires a review of eligibility and credit profiles. Access to such resources can improve liquidity and support timely payments on debit or credit card accounts without disrupting operations.

Understanding Related Payment Methods and Terms

Different types of home equity borrowing and specialized payment certificates provide borrowers with varied options depending on their financial needs and credit situations. Interest rates, loan structures, and specific payment instruments all influence how consumers manage debt and access funds.

Closed-End vs. Open-End Home Equity Loans

A closed-end home equity loan is a lump-sum loan with a fixed repayment schedule and interest rate, often used for one-time expenses. Borrowers in places like Daly City seeking a home equity loan in second position might prefer this for predictable monthly payments.

In contrast, an open-end home equity loan, commonly called a Home Equity Line of Credit (HELOC), allows repeated borrowing up to a credit limit with variable interest rates. This flexibility suits ongoing expenses or emergencies but requires careful rate monitoring, especially where HELOC rates vary widely, such as in Connecticut or Wichita, KS.

Both lending types involve mortgage liens but differ in structure: closed-end loans function like installment loans, while open-end loans act more like credit cards secured by home equity.

Home Equity Line of Credit Rates and Terms

HELOC rates fluctuate with market interest rates and borrower credit profiles. In states like Connecticut, current HELOC rates typically range around 5% to 7%, influenced by creditworthiness and loan-to-value ratios.

Terms usually include a draw period (5-10 years), during which borrowers access funds and pay interest only. Afterward, the repayment period begins, increasing monthly payments significantly. Lenders may offer guidance line of credit options tied to credit scores or equity value for more tailored loan management.

Borrowers should compare offers carefully, considering factors such as variable rates, early repayment penalties, and credit reporting. Local market conditions, like those in Wichita, KS, also affect available rate structures.

Other Payment Certificates and Value Instruments

Payment certificates like the 5 Cent Military Payment Certificate historically served U.S. military personnel overseas as controlled currency. While not directly related to home equity borrowing, such instruments reflect alternatives to standard currency and credit systems.

In modern finance, value instruments like the Cash Value Line of Credit allow borrowers to draw on accrued cash value in insurance policies or savings, providing additional liquidity beyond traditional home equity loans.

Understanding these alternatives helps borrowers recognize various financing and repayment methods outside standard mortgages, potentially supplementing loans or managing cash flow in unique circumstances.