Acqra Charge on Credit Card: What It Is

Table of Contents

- Introduction

- What Is Acqra?

- Why Is Acqra Charging Your Credit Card?

- Common Legitimate Sources of Acqra Charges

- How to Recognize Fraud vs Legitimate Use

- What to Do If You Don’t Recognize an Acqra Charge

- How Acqra Appears on Your Statement

- How to Dispute an Unauthorized Acqra Charge

- Protecting Your Card From Future Suspicious Charges

- Global Nature of Acqra Payments

- Businesses That Use Acqra

- The Connection Between Acqra and Chinese E-Commerce

- Recurring Charges: Subscriptions and Memberships

- How to Contact Acqra or Find More Info

- What Credit Card Issuers Say About Acqra

- Tips for Verifying Online Purchases

- Real-Life Examples and Case Studies

- 10 Useful FAQs

- Summary

- Final Thoughts

1. Introduction

If you’ve noticed a strange charge on your credit card statement that says “Acqra” or some variation like “Acqra*HK” or “Acqra*Online Payment”, you’re not alone. Thousands of credit card holders across the globe have asked the same question:

“What is this Acqra charge, and did I authorize it?”

This blog explains in detail what Acqra is, what types of merchants use it, how to identify whether a charge is legitimate or fraudulent, and what steps to take if something feels off.

2. What Is Acqra?

Acqra is a payment service provider (PSP) and payment gateway. It facilitates secure credit card payments for various e-commerce platforms, mobile apps, and global merchants, especially those based in Hong Kong and Mainland China.

Acqra acts as a middleman between businesses and customers, ensuring payment processing, currency conversion, and transaction security.

It’s similar in function to companies like:

- Stripe

- PayPal

- Adyen

- Square

In short: If you’ve shopped from a site that uses Acqra to process payments, your statement might show the charge as “Acqra” + merchant or region name*.

3. Why Is Acqra Charging Your Credit Card?

There are several reasons you might see an Acqra charge:

- You made an online purchase through a website that uses Acqra as their payment processor.

- You signed up for a subscription service (e.g., language app, VPN, gaming service).

- You purchased a digital product like eBooks, cloud software, or streaming access.

- You bought from AliExpress, Temu, or lesser-known Chinese e-commerce platforms.

Even though the merchant name might not appear, Acqra’s name shows up because they processed the transaction on behalf of the retailer.

4. Common Legitimate Sources of Acqra Charges

| Merchant Type | Examples |

|---|---|

| Chinese e-commerce websites | Shein, Temu, AliExpress (less common now) |

| International tech services | VPN subscriptions, language learning apps |

| Mobile apps | Games or tools with international developer bases |

| Online course platforms | Skill-based learning sites hosted overseas |

| Cloud-based tools | Web hosting, graphic software, email tools |

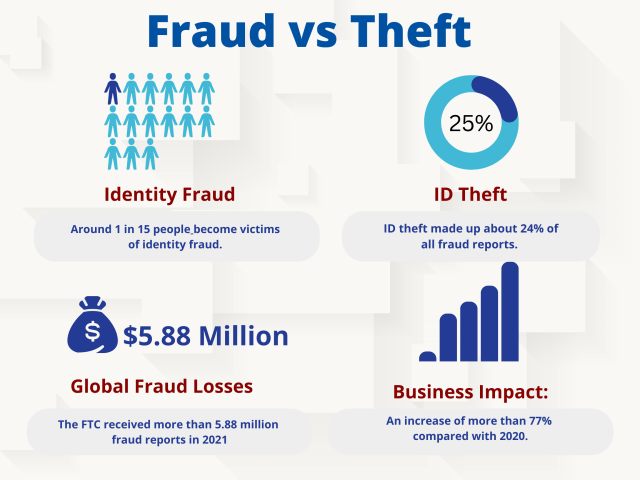

5. How to Recognize Fraud vs Legitimate Use

It’s easy to panic when you see a charge you don’t remember. But not every unfamiliar charge is fraud.

Legit Acqra Charge If:

- You shopped online internationally recently

- You’ve used an app or site based in China or Hong Kong

- You subscribed to a service with recurring billing

Suspicious If:

- You didn’t authorize a purchase

- The amount seems random or strange

- You’ve never used the merchant or product

- You spot multiple small charges (testing stolen cards)

Always look into your recent digital purchases, especially from non-US platforms.

6. What to Do If You Don’t Recognize an Acqra Charge

If the charge seems unfamiliar:

- Google the full charge name (e.g., “Acqra*HK E-comm”).

- Check your emails for order confirmations from that date.

- Review mobile app store purchases or in-app purchases.

- Ask family members who might have used your card.

Still no clue? Move on to the dispute process.

7. How Acqra Appears on Your Statemen

Your bank statement might list Acqra charges like:

Acqra*HKShoppingAcqra*OnlinePaymentAcqra*HK Tech LimitedAcqra*GlobalPayAcqra Ecomm Hong Kong

It may also include:

- A city: HK, SHENZHEN, GUANGZHOU, or MACAU

- A vague merchant code or phone number

Unfortunately, Acqra often doesn’t display the full business name, which adds to confusion.

8. How to Dispute an Unauthorized Acqra Charge

If the charge is definitely unauthorized:

- Call your credit card issuer immediately.

- Freeze or cancel your card to prevent future use.

- Dispute the transaction online or by phone.

- Document everything: time, amount, and reference number.

- Monitor your account for additional suspicious activity.

Most major U.S. credit card companies have zero-liability fraud protection, meaning you won’t be held responsible if you report quickly.

9. Protecting Your Card From Future Suspicious Charges

Best practices to prevent further unauthorized charges:

- Use virtual cards for online purchases.

- Shop only on SSL-secured websites.

- Avoid entering card details into suspicious pop-ups or shady apps.

- Set up instant transaction alerts via email or SMS.

- Enable 2FA (two-factor authentication) on card-linked accounts.

10. Global Nature of Acqra Payments

Acqra is headquartered in Hong Kong, and many of its merchants are Chinese businesses selling internationally. They may not be transparent with customers about their PSP (Acqra).

This is why a completely valid transaction might show up in:

- A foreign currency

- An unrecognizable descriptor

- A strange timezone

Always check currency conversions, especially if you bought something in RMB, HKD, or EUR.

11. Businesses That Use Acqra

While Acqra doesn’t publish a public merchant directory, known businesses that have used it include:

- Shein (earlier years)

- Some VPN providers

- Chinese beauty product retailers

- Educational sites for Mandarin learning

- Cross-border payment platforms

Smaller apps often use Acqra because of its low fees and ease of onboarding.

12. The Connection Between Acqra and Chinese E-Commerce

Acqra is part of the cross-border e-commerce payment ecosystem that links:

- Chinese sellers

- Foreign consumers

- International banks

China’s growing global e-commerce influence means platforms like Acqra, Alipay, and PingPong Payments play a huge role in processing foreign credit cards.

So, if you purchased from a lesser-known online store, Acqra might have been the processor—even if the site never mentioned it.

13. Recurring Charges: Subscriptions and Memberships

Many users forget that they’ve signed up for monthly or annual subscriptions, especially from international platforms. Acqra might be charging you monthly for:

- VPNs (e.g., PandaVPN, TurboVPN)

- Cloud-based software

- Paid mobile apps

- Streaming subscriptions or video courses

Check your recurring charges in your app store, email, or bank dashboard.

14. How to Contact Acqra or Find More Info

Acqra does not provide direct customer support for consumers. Instead, you’re supposed to contact the merchant directly.

Their website is: https://www.acqra.com

If needed, try:

- Emailing the merchant listed in your order confirmation

- Using their “contact us” form if you bought from a store

- Reaching out to your card issuer to track the merchant ID

15. What Credit Card Issuers Say About Acqra

Most banks recognize Acqra as a legitimate payment processor, but:

- They acknowledge confusion due to poor descriptor labels

- They recommend reporting any unrecognized charges immediately

- They advise checking digital receipts before filing disputes

Some banks (like Chase or Citi) offer merchant look-up tools within their apps—use these for more detail.

16. Tips for Verifying Online Purchases

Use this quick checklist:

✅ Did I make a purchase from a global or Chinese website recently?

✅ Did I sign up for a free trial that may have turned into a paid plan?

✅ Did a family member use my card for an app/game?

✅ Is the amount consistent with something I remember?

If all answers are no, investigate deeper or contact your card issuer.

17. Real-Life Examples and Case Studies

Case 1: Jenny’s Skincare Order

Jenny ordered Korean skincare from a site promoted on Instagram. Two weeks later, she saw a $19.95 charge labeled “Acqra*Global Ecomm HK.” It turned out to be a legit charge from the fulfillment partner.

Case 2: Michael’s Fraud Incident

Michael noticed three charges from “Acqra*EcomX” totaling $180. He never made those purchases. He filed a dispute with Amex, and they refunded the amount within 48 hours and issued him a new card.

Case 3: Lisa’s Forgotten Subscription

Lisa had signed up for a Mandarin learning site. She forgot to cancel the trial, and a $9.99 monthly Acqra charge began showing up. Once reminded, she logged in and canceled the plan.

18. 10 FAQs About Acqra Charges

1. Is Acqra a scam?

No, it’s a legitimate payment gateway, but scammers can use it.

2. Why does it say “HK” in the charge?

Because Acqra is based in Hong Kong, the charge shows its origin.

3. How can I tell what the charge is for?

Check your email confirmations, app purchases, or call your card issuer.

4. Can I get a refund for an unauthorized Acqra charge?

Yes—contact your bank or card company and file a dispute.

5. Why didn’t the merchant name appear?

Because Acqra processed the payment, not the actual merchant.

6. Can Acqra charge my card without permission?

Only if your card was compromised or used in a subscription.

7. Is Acqra used by Shein or Temu?

In some earlier instances, yes—but less commonly now.

8. Will I get charged again next month?

If it’s a subscription, yes. You must cancel it directly on the merchant site.

9. Can I block future Acqra charges?

Ask your bank to block the merchant ID or issue a new card.

10. Should I file a police report?

Only if there are large sums or identity theft is suspected.

19. Summary

A charge labeled Acqra on your credit card could be:

- A legitimate transaction from an online store or app

- A recurring subscription you forgot to cancel

- A fraudulent charge from stolen card info

Take the time to verify, report, and protect your account. Acqra itself is not a scam, but like any global payment system, it can be used improperly.

20. Final Thoughts

Seeing a mysterious Acqra charge can be unsettling. But with the right knowledge, you can identify whether it’s a harmless oversight or a real fraud risk.