Understanding Payday Loans: The Basics

What are Payday Loans?

Are payday loans installment or revolving, high-cost loans designed to bridge the gap until your next paycheck. They’re typically due on your next payday, hence the name. Borrowers often use them for unexpected expenses like car repairs or medical bills. However, the high interest rates and fees associated with payday loans can quickly trap borrowers in a cycle of debt. The Consumer Financial Protection Bureau (CFPB) has documented numerous instances of borrowers struggling to repay these loans.

These loans are typically small, ranging from a few hundred dollars to a thousand dollars, depending on state regulations and lender policies. Crucially, they are not installment loans or revolving credit. Unlike installment loans, which are repaid in fixed monthly payments over a set period, payday loans require full repayment on the next payday. They also differ significantly from revolving credit like credit cards, which allow for repeated borrowing up to a credit limit. “Understanding this fundamental difference is vital to avoid the pitfalls of payday lending.”

How Payday Loans Work: A Step-by-Step Guide

Payday loans are short-term, high-interest loans designed to be repaid on your next payday. The process typically begins with an online application, requiring basic personal and financial information. After approval (which can be surprisingly quick), funds are usually deposited directly into your bank account. This speed is a key attraction, but it’s crucial to understand the implications before borrowing. Lenders often verify employment and income to assess your ability to repay.

Repayment is usually due on your next payday, as the name suggests. The total amount due includes the principal borrowed, plus substantial fees and interest. Failure to repay on time results in significant penalties and often triggers a cycle of debt. Unlike installment loans with fixed monthly payments, payday loans are structured differently, often resembling revolving credit, depending on the lender and the terms. “Understanding the specific repayment terms and potential consequences of default is critical before considering a payday loan.” Always compare options and consider alternative financing solutions before opting for a payday loan.

Who Typically Uses Payday Loans?

Payday loans are often utilized by individuals facing short-term financial emergencies. These could include unexpected car repairs, medical bills, or temporary job loss. A 2018 CFPB report highlighted that many borrowers use payday loans to cover essential living expenses like food and rent, indicating a concerning reliance on these high-cost loans for basic needs. This underscores the vulnerability of many borrowers to the high interest rates and fees associated with payday loans.

The typical payday loan borrower often has limited access to traditional credit options. This might be due to a poor credit history, insufficient income, or lack of collateral. “Many find themselves trapped in a cycle of debt, repeatedly taking out new loans to repay existing ones, leading to significant financial hardship.” Consequently, understanding the risks and exploring alternative solutions, such as credit counseling or negotiating with creditors, is crucial before considering a payday loan as a financial solution. This emphasizes the importance of responsible borrowing and seeking advice from financial professionals.

Payday Loans vs. Installment Loans: Key Differences

Repayment Terms and Schedules

Payday loans demand repayment in full on your next payday. This typically means a repayment period of just two to four weeks. The short timeframe creates a significant challenge for many borrowers. Failing to repay on time incurs steep fees and potentially rolls the loan over into a new cycle of debt, escalating the cost significantly. Consider, for instance, a $500 payday loan with a $75 fee. Defaulting leads to further fees, quickly creating a debt spiral that’s hard to escape.

In contrast, installment loans offer a more manageable repayment plan. They typically span several months or even years, with fixed monthly payments. This structured approach allows borrowers to budget more effectively. The predictable payments improve financial stability compared to the unpredictable and often overwhelming demands of a payday loan. “Installment loans provide a far clearer path to debt repayment, minimizing the risk of spiraling debt.” This predictability, along with longer repayment terms, is a critical difference separating them from the potentially predatory nature of payday loans.

Interest Rates and APR

Payday loans are notorious for their extremely high interest rates. These rates are often expressed as an Annual Percentage Rate (APR), but the actual cost can be far higher than the advertised APR due to short repayment periods and frequent rollovers. For example, a payday loan with a seemingly modest 15% interest might translate to a triple-digit APR when considering the loan’s short term. This makes them far more expensive than other forms of borrowing.

In contrast, installment loans typically have significantly lower interest rates and APRs. While the APR will vary depending on the lender and borrower’s creditworthiness, it’s generally much more manageable than a payday loan’s. “This is because installment loans are designed for larger loan amounts repaid over longer periods, lessening the impact of interest accumulation.” The longer repayment schedule reduces the total interest paid over the life of the loan, making them a more responsible borrowing option compared to the predatory practices often associated with payday loans.

Total Cost of Borrowing

Understanding the true cost of a payday loan versus an installment loan is crucial before borrowing. Payday loans are notorious for their extremely high Annual Percentage Rates (APRs), often exceeding 400%. This means the interest charges quickly dwarf the initial loan amount. Consider a $500 payday loan with a two-week repayment period and a $75 fee; that translates to an APR of nearly 400%. This stark contrast highlights the significantly higher total cost associated with payday loans compared to installment loans.

Installment loans, while carrying interest, generally offer much lower APRs. These rates vary depending on creditworthiness and the lender, but they typically fall well below the triple-digit APRs common with payday loans. The repayment schedule is also spread over months, rather than weeks, leading to smaller, more manageable payments. “This structured repayment plan, coupled with lower interest, results in a substantially lower total borrowing cost compared to the short-term, high-interest trap of a payday loan.” Always compare APRs and total repayment amounts before committing to any loan to avoid unexpected financial burdens.

Payday Loans vs. Revolving Credit: A Comparison

Access to Funds and Credit Limits

Payday loans offer quick access to relatively small sums of money. You typically receive the funds within one to two business days of application approval. However, credit limits are severely restricted, often capped at a few hundred dollars, depending on state regulations and the lender’s policies. This makes them unsuitable for larger financial emergencies. For example, a broken appliance might require more than a typical payday loan offers.

Conversely, revolving credit, such as credit cards, provides a pre-approved credit limit that you can borrow against repeatedly. This limit varies widely depending on your creditworthiness and the card issuer. Access to these funds is generally immediate, available with a simple swipe or online transaction. “While offering greater flexibility than payday loans, revolving credit demands responsible management to avoid high-interest charges and debt accumulation.” This requires careful budgeting and paying off balances promptly. The consequences of mismanaging revolving credit can be far more significant and long-lasting than those of a short-term payday loan.

Interest Charges and Fees

Payday loans are notorious for their incredibly high interest charges. These charges are often expressed as an Annual Percentage Rate (APR), but the effective interest can be far higher due to short repayment periods and frequent rollovers. For example, a $500 payday loan with a $75 fee and a two-week repayment term translates to a triple-digit APR, far exceeding the rates of most other forms of credit. This makes them a very expensive way to borrow money. Defaulting on a payday loan can lead to crippling debt due to accumulating fees and penalties.

In contrast, revolving credit, like credit cards, typically features a much lower APR, although this varies greatly depending on your creditworthiness. Interest charges are usually calculated monthly on the outstanding balance. While still expensive compared to other loan options, the interest on revolving credit is significantly lower than that on payday loans. “The key difference lies in the accessibility and the cost of borrowing: payday loans are easily accessible but devastatingly expensive, while revolving credit, though more readily available than many other forms of credit, is significantly more affordable in the long run.” Responsible credit card usage and budgeting are crucial to avoid spiraling debt.

Impact on Credit Score

Payday loans significantly differ from revolving credit regarding their impact on your credit score. Unlike credit cards, which report your payment history to credit bureaus, most payday loans don’t. This lack of reporting means a missed payment won’t directly damage your credit score in the same way. However, this doesn’t mean payday loans are credit-score friendly. Repeated borrowing or defaulting on a payday loan can lead to collection agency involvement, and these negative marks *dramatically* impact your score. Furthermore, high debt-to-income ratios, often associated with frequent payday loan usage, can negatively influence your creditworthiness.

Conversely, responsible use of revolving credit, like credit cards, can build your credit history positively. On-time payments demonstrate creditworthiness, and building a positive payment history is crucial for securing favorable interest rates on future loans and financial products. Credit utilization, another key factor, should be kept low to showcase responsible credit management. “While payday loans might seem like a quick solution, their long-term impact on your financial health and credit score can be severely detrimental compared to the potential benefits of managing revolving credit wisely.” Consider the long-term consequences before choosing a payday loan.

The Risks and Dangers of Payday Loans

High Interest Rates and Debt Traps

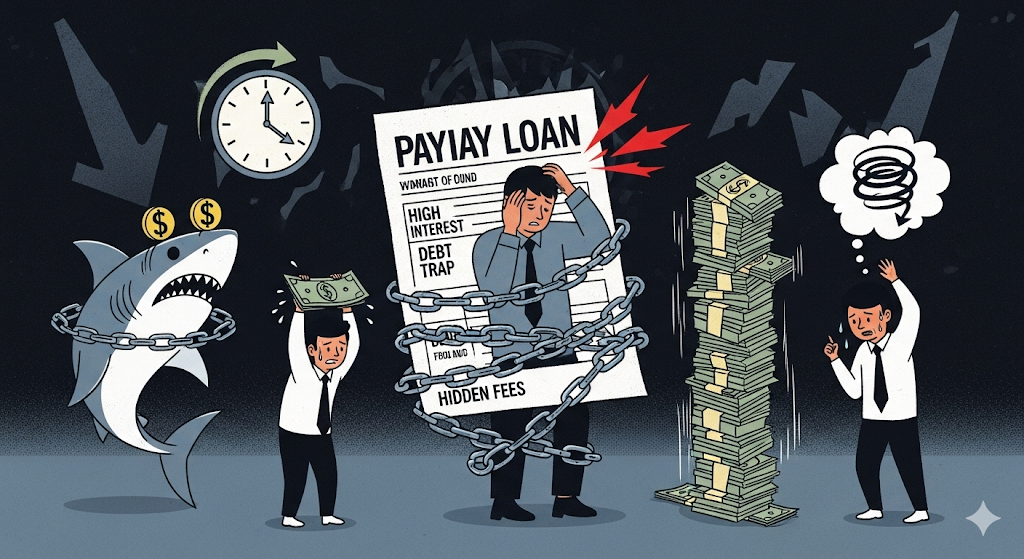

Payday loans are notorious for their exorbitantly high interest rates, often exceeding 400% APR. This means the cost of borrowing is drastically inflated, making it incredibly difficult to repay the loan on time. Even a small loan can quickly snowball into a significant debt burden, especially if you face unexpected expenses or job loss. Consumer Financial Protection Bureau (CFPB) data consistently reveals that borrowers frequently roll over loans, extending their repayment period and accruing even more interest. This cycle of debt can be devastating.

The high interest rates directly contribute to a dangerous debt trap. Many borrowers find themselves trapped in a vicious cycle of borrowing to repay previous loans. This cycle is perpetuated by the short repayment periods and the difficulty of making even the smallest payments. “Missing even one payment can trigger a cascade of penalties and fees, further pushing borrowers deeper into debt.” The CFPB has documented countless cases of individuals struggling for years to escape the clutches of payday loans, highlighting the severity of this financial predicament. Understanding these risks is crucial before considering such a high-cost lending option.

Potential for Multiple Loans and Rollovers

The biggest danger with payday loans isn’t just the high interest rates; it’s the ease with which borrowers can get trapped in a cycle of debt. Many payday lenders actively encourage borrowers to take out multiple loans simultaneously or to “roll over” existing loans, essentially extending the repayment period and accruing even more interest. This is a predatory practice, designed to maximize profits at the expense of the borrower’s financial well-being. Think of it like quicksand – the more you struggle, the deeper you sink.

The Consumer Financial Protection Bureau (CFPB) has documented numerous cases where borrowers have become indebted to multiple payday lenders, juggling several loans with escalating interest charges. This can quickly lead to financial ruin, with borrowers finding themselves unable to meet basic living expenses. Multiple loans and rollovers drastically increase the total cost of borrowing, potentially exceeding the initial loan amount many times over. “Failing to repay a payday loan on time can have severe consequences, including damage to your credit score and potential legal action.” Careful consideration of the repayment terms and potential for debt escalation is crucial before considering any payday loan.

The Impact on Your Financial Wellbeing

Payday loans, whether structured as installment or revolving credit, severely impact your financial well-being. The high interest rates, often exceeding 400% APR, quickly lead to a debt trap. Even small loans snowball into insurmountable amounts due to compounding interest and fees. Missed payments trigger further penalties, pushing borrowers deeper into a cycle of debt. This can severely damage your credit score, making it harder to secure loans, rent an apartment, or even get a job in the future.

“The financial consequences extend beyond just credit scores.” Debt from payday loans can force difficult choices, like sacrificing essential needs such as food or medicine, to meet repayment deadlines. This often leads to increased stress and mental health issues. The Consumer Financial Protection Bureau (CFPB) has documented countless cases of individuals facing devastating financial hardship due to the predatory nature of these loans. Consider the long-term repercussions before considering a payday loan; it might seem like a quick fix, but it’s often a costly mistake.

Responsible Alternatives to Payday Loans

Small Personal Loans from Banks or Credit Unions

Banks and credit unions offer small personal loans as a responsible alternative to payday loans. These loans typically have lower interest rates than payday loans. They also offer longer repayment periods, making them more manageable. This means you’re less likely to fall into a debt trap. Many financial institutions offer online applications, simplifying the borrowing process.

Consider your credit score before applying. A higher score often qualifies you for better loan terms. Shop around and compare interest rates and fees from different lenders. “Choosing a reputable bank or credit union with a history of fair lending practices is crucial to protect yourself from predatory lending.” Look for institutions that prioritize financial education and offer resources to help borrowers manage their debt effectively. Remember, responsible borrowing involves understanding the terms and committing to timely repayments.

Online Lending Platforms and Peer-to-Peer Lending

Online lending platforms offer a more transparent alternative to payday loans. They often provide personal loans with fixed interest rates and repayment schedules, unlike the unpredictable nature of revolving credit options like payday loans. Platforms like LendingClub and Upstart connect borrowers with investors, fostering competition and potentially leading to lower interest rates. Remember to carefully compare APRs and fees before committing. Thoroughly research the platform’s reputation and check for customer reviews to ensure a trustworthy experience.

Peer-to-peer (P2P) lending operates on a similar principle. These platforms facilitate loans between individuals, cutting out traditional banks. This can sometimes result in more flexible loan terms and potentially lower interest rates than those offered by traditional lenders or payday loan providers. However, “it’s crucial to understand the risks involved, including potential higher interest rates than some traditional loans depending on your credit score.” Always assess your financial situation and repayment capacity before applying for any online loan, regardless of the platform. Compare offers from multiple lenders to find the best fit for your needs.

Budgeting and Financial Planning Resources

Taking control of your finances is the best way to avoid needing a payday loan, revolving credit or any high-interest short-term borrowing. Many free resources can help you create a realistic budget and develop a sound financial plan. Websites like the Consumer Financial Protection Bureau (CFPB) offer valuable guides and tools for budgeting, tracking expenses, and setting financial goals. These resources often include interactive worksheets and calculators to simplify the process.

Learning to budget effectively is a crucial life skill. “Mastering budgeting helps you understand your spending habits and identify areas where you can cut back.” Numerous apps and online platforms provide further assistance, allowing you to monitor your spending and track your progress towards your financial objectives. Remember to explore resources specific to your location, as many local non-profit organizations offer free financial counseling and debt management workshops. These services provide personalized support and guidance to help you navigate your unique financial circumstances.

Making Informed Decisions: Practical Advice

Comparing Loan Offers Carefully

Before committing to a payday loan, meticulously compare offers from different lenders. Look beyond the advertised interest rate. Consider all fees, including origination fees, late payment penalties, and any other charges. These can significantly increase your total cost. Don’t hesitate to use online loan comparison tools to easily see the full picture. Remember, a seemingly low interest rate can be offset by hefty fees, making one loan far more expensive than another.

Pay close attention to the loan terms. Understand the repayment schedule clearly. Ensure you can comfortably manage the monthly payments without jeopardizing your financial stability. Choose a repayment plan that aligns with your budget and income. “Failing to understand the terms can lead to a debt trap, making it incredibly difficult to repay the loan.” Prioritize lenders with transparent fee structures and clear communication. Research the lender’s reputation and customer reviews before you apply for a short-term loan.

Checking Your Credit Report Regularly

Regularly reviewing your credit report is crucial before considering any loan, including payday loans, installment loans, or revolving credit options. This proactive step allows you to identify any errors that could negatively impact your credit score and potentially your eligibility for favorable loan terms. Checking your report also helps you understand your current credit standing, enabling you to make more informed decisions about managing your finances. Sites like AnnualCreditReport.com allow you to access your credit reports from the three major credit bureaus—Equifax, Experian, and TransUnion—for free once a year. This free access is a valuable resource you should utilize.

By monitoring your credit report, you can detect signs of potential identity theft or fraudulent activity that might be affecting your creditworthiness. Early detection allows for swift action to resolve these issues. Furthermore, understanding your credit utilization ratio—the amount of available credit you’re using—can highlight potential areas for improvement. “Maintaining a low credit utilization ratio is a key factor in securing better interest rates and loan terms.” This simple step, coupled with a thorough understanding of your credit history, significantly reduces the risks associated with high-interest loan products like payday loans and can help you navigate the complexities of installment loans and revolving credit more effectively.

Seeking Help from Financial Advisors

Before diving into payday loans, especially considering them as installment loans or a form of revolving credit, seek professional financial guidance. A certified financial advisor can assess your unique financial situation, understanding your income, expenses, and debt load. They can provide objective advice, free from the pressure often associated with loan applications. This independent perspective is invaluable.

Consider the potential long-term implications of any loan. A financial advisor can help you explore alternative solutions, such as budgeting strategies or debt consolidation options, which might be far more beneficial than the short-term relief a payday loan offers. “Remember, understanding your financial health is crucial before considering high-interest debt products like payday loans, regardless of their structure as installment or revolving credit.” They can help you make an informed decision aligned with your long-term financial well-being, providing a much-needed safety net.