Are Separate Bank Accounts Marital Property

Table of Contents

- Introduction

- What Is Marital Property?

- What Are Separate Bank Accounts?

- Common Misconceptions About Separate Accounts

- Community Property vs. Equitable Distribution States

- Factors Courts Consider When Determining Marital Property

- How Commingling Affects the Status of Separate Accounts

- Prenuptial and Postnuptial Agreements

- Real-Life Scenarios and Case Studies

- How to Protect Your Separate Bank Accounts

- Role of Financial Transparency in Divorce

- Can a Spouse Legally Access a Separate Account?

- Tips for Managing Finances in a Marriage

- FAQs

- Conclusion

1. Introduction

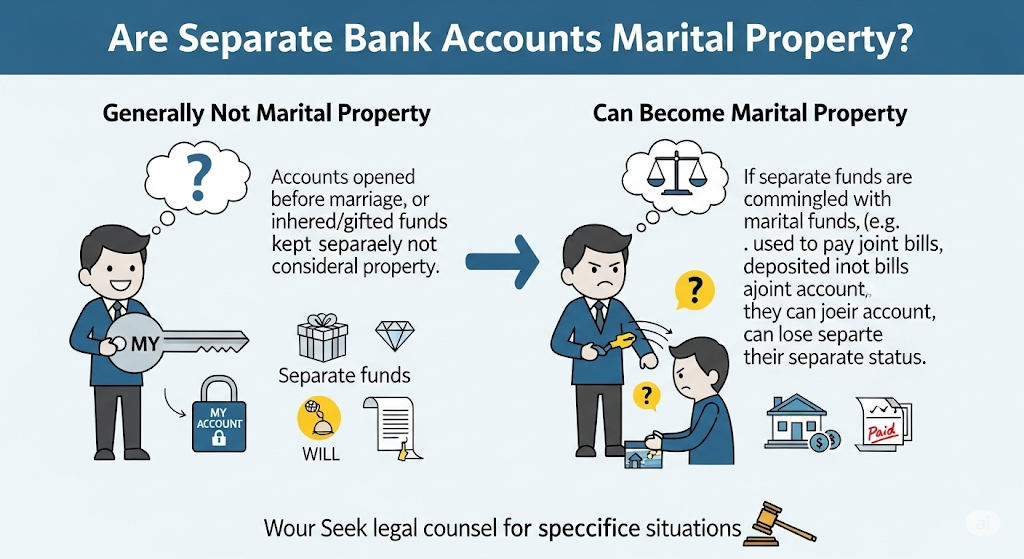

Money matters can become one of the most contentious issues during a divorce. A common question that arises is: Are separate bank accounts considered marital property? Many assume that having an account solely in their name means the money belongs to them alone. However, the legal answer is more complex and depends on a variety of factors including state law, timing, and the origin of the funds.

This blog will explore how separate bank accounts are treated during divorce, with insights into marital property law, practical case studies, and tips for protecting your assets.

2. What Is Marital Property?

Marital property refers to assets and debts acquired during the marriage, regardless of whose name is on the title or account. This includes:

- Income earned by either spouse

- Retirement accounts

- Real estate purchased during the marriage

- Business interests acquired post-marriage

- Bank accounts, even if in one spouse’s name

By contrast, separate property usually includes:

- Assets owned before the marriage

- Inheritances

- Personal gifts (from a third party)

- Property designated as separate by a valid prenuptial or postnuptial agreement

3. What Are Separate Bank Accounts?

A separate bank account is one held in the name of only one spouse. These are often used to:

- Maintain financial independence

- Handle premarital savings or inheritances

- Receive direct deposits from personal businesses

However, just because it’s a separate account doesn’t mean it’s automatically separate property in divorce proceedings.

4. Common Misconceptions About Separate Accounts

Here are a few misconceptions many people have:

- My name is the only one on the account—so it’s mine.

➤ Not necessarily. Courts look at when and how the money was earned or deposited. - If I never added my spouse to the account, it stays separate.

➤ If marital funds were deposited, the account may be partially or fully marital. - I only used it for personal expenses, so it shouldn’t be considered marital.

➤ Use doesn’t always define ownership. Origin of funds and state laws matter more.

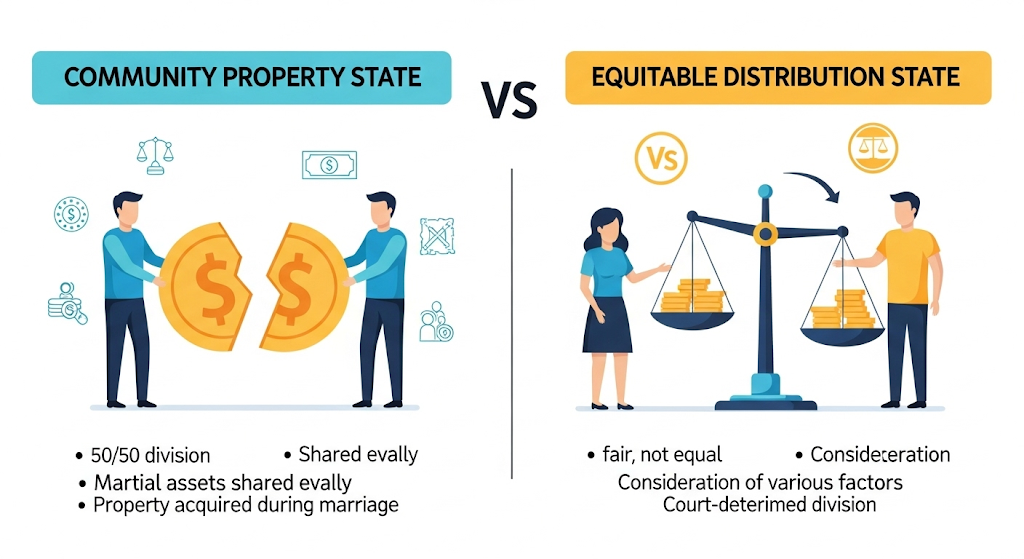

5. Community Property vs. Equitable Distribution State

Community Property States

These include states like California, Texas, Arizona, Nevada, and Washington. In these jurisdictions:

- Most assets (and debts) acquired during marriage are split 50/50, regardless of title.

- Income deposited into a separate account is still considered community property.

Equitable Distribution States

The majority of U.S. states fall into this category:

- Courts divide property equitably, which may not mean equally.

- They assess factors like each spouse’s income, contribution to the marriage, and future needs.

In either case, a separate account can still be subject to division depending on the source of funds and how they were handled.

6. Factors Courts Consider When Determining Marital Propert

Courts evaluate several criteria when deciding whether a bank account is marital property:

| Factor | Impact |

|---|---|

| When the account was opened | Pre-marriage accounts may be separate, unless commingled |

| Source of deposits | Income earned during marriage may make the account marital |

| Commingling of funds | Mixing marital and separate funds can “convert” the account |

| Use of account | Paying joint expenses may indicate shared ownership |

| State law | Community vs. equitable distribution can change the outcome |

7. How Commingling Affects the Status of Separate Accounts

Commingling occurs when separate and marital assets are mixed in one account, making it hard to distinguish ownership. Common examples:

- Using a separate account to pay for joint expenses (mortgage, groceries, kids’ tuition)

- Depositing salary (marital income) into a personal account

- Transferring funds between joint and separate accounts frequently

Once commingled, it becomes difficult to trace the original source of funds—leading courts to treat it as marital property.

8. Prenuptial and Postnuptial Agreements

A prenup or postnup can clearly define which assets, including bank accounts, will remain separate during the marriage or in the event of a divorce.

What They Can Do:

- Designate certain accounts as separate

- Set rules for income earned during marriage

- Prevent commingling by stipulation

Without one, courts rely on default state law, which may not favor the account holder.

9. Real-Life Scenarios and Case Studies

Case Study 1: Amanda and Brian

Amanda opened an account before her marriage to Brian. After they married, she deposited her salary into it and used the account to pay household bills.

➡ Despite being in her name only, the account was ruled marital property due to commingling.

Case Study 2: Raj and Lisa

Raj received a $100,000 inheritance and kept it in a separate savings account. He didn’t touch it or use it for any joint expenses.

➡ The court upheld the account as separate property.

10. How to Protect Your Separate Bank Accounts

To maintain separation:

- Avoid depositing marital income into the account

- Keep clear documentation of where funds originated

- Refrain from paying joint bills from the account

- Consider a postnuptial agreement if you’re already married

- Keep inheritance funds in a separate account and do not commingle

11. Role of Financial Transparency in Divorc

Hiding separate accounts or failing to disclose them can result in:

- Court penalties

- Loss of credibility

- A more aggressive division of assets in favor of your spouse

Being open and honest with your finances is not only legally required—it can also lead to a more amicable divorce process.

12. Can a Spouse Legally Access a Separate Account?

During marriage, a spouse cannot usually access an account they’re not named on—unless:

- They’re granted power of attorney

- There’s fraud or concealment

- It’s during legal proceedings like divorce, where court orders can compel account disclosure

Post-divorce, the division is enforced through legal means, regardless of who can physically access the funds.

13. Tips for Managing Finances in a Marriage

- Use joint accounts for shared expenses

- Maintain separate accounts for personal or premarital funds

- Set clear financial goals and roles

- Update or draft a prenup/postnup if needed

- Keep communication open to avoid future conflict

14. FAQs

Q1. Is my spouse entitled to money in my separate bank account?

A: If the money was earned during marriage or commingled, yes. Otherwise, not necessarily.

Q2. Can I protect my bank account from divorce?

A: Yes—through a prenuptial agreement or by keeping premarital funds completely separate.

Q3. What if I opened the account before marriage?

A: It’s likely separate unless you deposited marital income or used it for shared expenses.

Q4. Can courts divide only what’s in joint accounts?

A: No. They look at the nature of the funds, not the name on the account.

Q5. Is an inheritance in a separate account protected?

A: Yes—if it’s not commingled or used jointly.

Q6. What happens to joint accounts in divorce?

A: Usually split equally or equitably depending on state law.

Q7. Can I withdraw funds before filing for divorce?

A: Technically yes, but it may be viewed negatively by courts. Some states issue automatic temporary restraining orders (ATROs).

15. Conclusion

Just because a bank account has your name on it doesn’t mean it’s exclusively yours during a divorce. The key question is: Where did the money come from, and how was it used? Courts across the U.S. focus on the source of funds, commingling, and state law when deciding whether separate bank accounts qualify as marital property.

To avoid unpleasant surprises, maintain clear financial records, communicate openly, and consider legal tools like prenuptial or postnuptial agreements. In uncertain situations, consult a family law attorney to protect your interests and ensure compliance with state laws.