Buy proxy with credit card offers a simple and secure way to access reliable proxy services for various online needs. Many providers support major credit and debit cards, allowing instant activation and seamless payments. Using a credit card to buy proxies combines convenience, speed, and reliability, making it easy to enhance online privacy and data access without hassle.

This payment method is favored by businesses and individuals who require fast transactions and easy account management. Credit card payments often come with added benefits such as PCI compliance and secure processing, ensuring a safe experience while acquiring residential, datacenter, or SOCKS5 proxies. The flexibility to pay with credit cards is supported by a wide range of proxy providers globally.

As online operations become more complex, the ability to quickly purchase proxies with credit cards supports greater operational agility. It removes barriers that might otherwise slow down access to essential proxy resources, offering instant proxy activation and global IP availability tailored to diverse use cases.

Understanding Proxies and Payments

Purchasing proxies involves understanding their function, typical uses, and the mechanics of online payments. Choosing a payment method impacts convenience, security, and transaction speed, especially when using credit cards, which remain a prevalent option despite potential risks like fraud.

What Are Proxies

Proxies act as intermediaries between a user’s device and the internet. They route traffic through a different IP address, masking the user’s actual location and identity. This helps maintain privacy, avoid geo-blocking, and manage multiple connections from one point.

There are various proxy types, such as residential, datacenter, and SOCKS5, each serving distinct purposes. Residential proxies use IPs from real devices, making them harder to detect, while datacenter proxies come from servers but provide high speed and volume. SOCKS5 is favored for its versatility and support for different protocols.

Common Use Cases for Proxies

Proxies are widely used for web scraping, accessing geo-restricted content, enhancing online privacy, and managing multiple accounts without IP bans. Businesses rely on proxies to gather competitive intelligence or test ads in different regions.

Individuals use proxies to secure personal data or bypass regional content restrictions on streaming platforms. Proxies also assist in ad verification to ensure marketing campaigns run correctly worldwide.

How Online Payment Methods Work

Online payments process transactions by securely transmitting cardholder information through payment gateways. These systems verify credit card details, check available funds, and authorize the charge almost instantly.

Common payment issues include soft declines, where a transaction is temporarily rejected due to factors like insufficient funds, and hard declines, which occur when the card is permanently blocked or details are incorrect. Fraud protection measures monitor suspicious behaviors to prevent credit card theft during online purchases.

Why Use a Credit Card to Buy Proxies

Credit cards offer widely accepted, fast, and secure payments for proxy purchases. Many providers enable instant activation after payment, improving operational agility for businesses.

Using credit cards backed by fraud detection reduces risks of chargebacks or abuse charges from unauthorized transactions. Some users prefer credit union business credit cards due to competitive rates and added security features.

Users should be aware of regional laws, such as Georgia’s statute of limitations for credit card debt, to manage liability. Choosing to pay with credit cards balances convenience and protection but requires vigilance against potential theft or misuse.

Step-by-Step Guide: How to Buy Proxy With Credit Card

Buying a proxy with a credit card involves selecting a reliable provider, choosing the right proxy type, verifying payment methods, and completing the purchase securely. Each step ensures the buyer’s needs are met while minimizing risks related to payment and service quality.

Choosing a Trusted Proxy Provider

A trusted proxy provider offers PCI-compliant payment processing and a wide pool of IP addresses suitable for various tasks. Buyers should verify the provider’s reputation through reviews, uptime guarantees, and customer support availability.

Providers like IPFLY or ProxyScrape are known for instant proxy activation and large IP pools, which reduce downtime and improve access. It is important to avoid providers with unclear refund policies or vague terms, as issues like unauthorized acqra charges on a credit card can occur with less transparent vendors.

Selecting the Right Type of Proxy

Different proxy types serve distinct purposes: datacenter proxies for speed and volume, residential proxies for anonymity, and mobile proxies for location flexibility. Choosing the suitable proxy depends on the use case, such as data scraping, privacy, or bypassing geo-blocks.

Buyers should understand the limitations of each type to avoid unnecessary costs or reduced performance. For example, residential proxies are pricier but reduce the risk of credit card flags or fraud alerts, which is important given the concerns around first time offense credit card theft detection.

Reviewing Credit Card Payment Options

Not all proxy providers offer credit card payments, but many streamline the process with PCI-compliant gateways ensuring security. Customers should confirm accepted credit card types, fees involved, and safeguards against fraud.

Watch for additional charges, including acqra fees on credit card transactions that might appear unexpectedly. Verifying the presence of fraud prevention measures is crucial to prevent issues like good sportsman charge on credit card disputes that arise from suspicious activities.

Completing a Proxy Purchase Online

To finalize a purchase, users enter their payment details and proxy preferences on the provider’s platform. Accurate information is critical to avoid declines or fraud flags, especially with cards linked to services like AAMCO credit card payments, where merchants require clear billing information.

After payment, instant activation is common, allowing immediate use of proxies. Buyers should keep transaction receipts and check for confirmation emails to resolve any possible discrepancies swiftly.

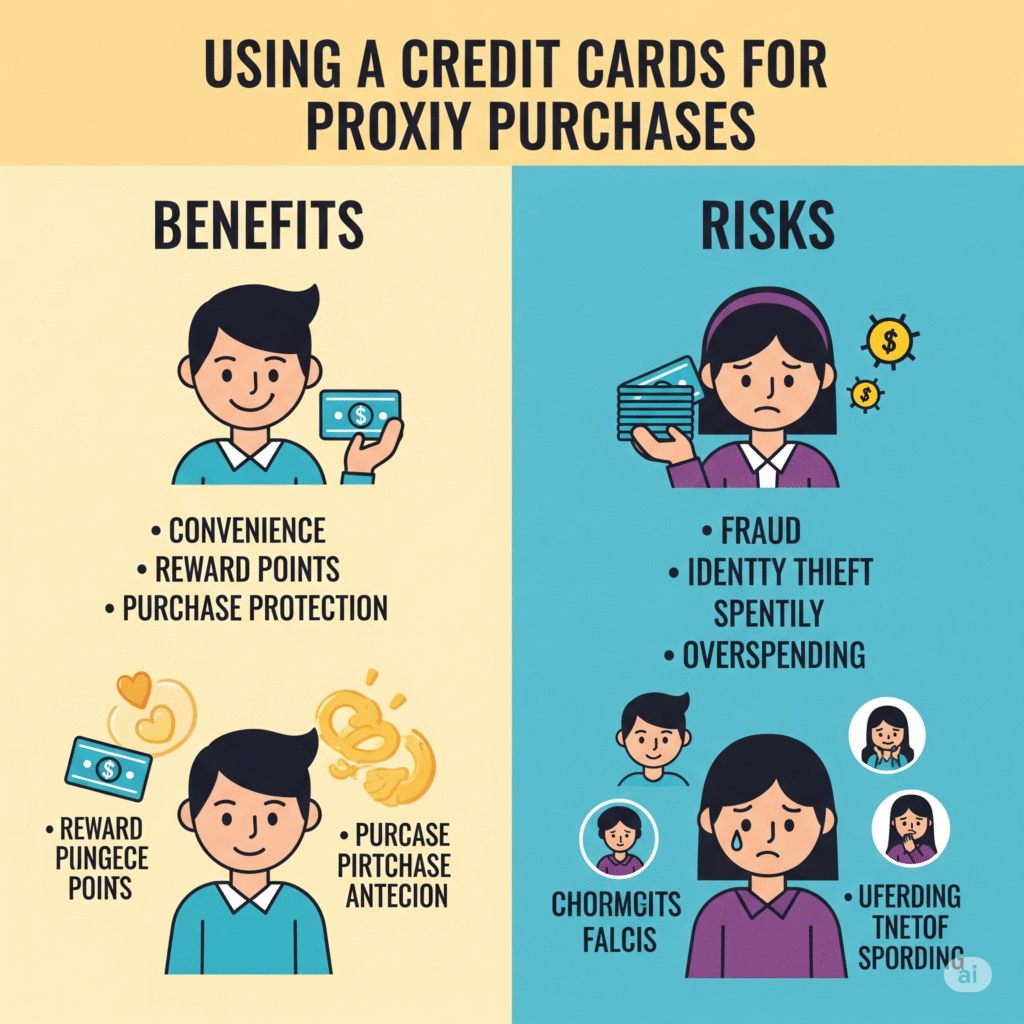

Benefits and Risks of Using Credit Cards for Proxy Purchases

Using a credit card for purchasing proxies offers fast, widely accepted payment with built-in protections. However, buyers should be aware of security vulnerabilities and how disputes can be handled effectively. Understanding the balance between convenience and risk helps businesses make informed decisions.

Advantages of Credit Card Payments

Credit card payments provide immediate transaction confirmation, allowing proxy services to provision accounts in real time. This speed is critical for enterprises managing multi-market operations requiring quick proxy deployment.

Cards also come with fraud detection systems that monitor unusual activities, reducing unauthorized transactions. Many credit cards offer purchase protection, giving buyers recourse in case of service non-delivery or fraud.

Additionally, credit cards may provide rewards such as cashback or points, which can reduce overall costs. Despite these benefits, users should remain aware of potential fees and the importance of responsible spending to avoid chargebacks or overspending.

Potential Security Risks

Using credit cards for proxy purchases poses risks including information theft and exposure to credit card dumps—illegal databases containing stolen card details. Such risks can lead to fraudulent charges or identity theft.

Purchasers must ensure the proxy provider uses secure payment gateways and follows strict data protection practices to limit exposure. Misuse or illegal use of a credit card can result in felony credit card abuse charges, emphasizing the need for compliance with legal and ethical standards.

There is also a misconception some may have that credit card companies can put a lien on personal property like a house, but liens typically relate to unpaid debts after legal proceedings, not directly from credit card purchases.

Resolving Credit Card Disputes

Credit card companies often provide dispute resolution mechanisms that protect buyers from fraudulent or unsatisfactory proxy purchases. If a service is not delivered or is misrepresented, the cardholder can file a chargeback, potentially recovering lost funds.

Timely communication with the credit card issuer and proxy provider is crucial. Documentation such as receipts and correspondence supports these claims.

Understanding the process helps avoid lengthy litigation or escalations such as those involving cases like Christell White Paterson, where misuse of funds led to complex disputes. Proper documentation and transparent transactions minimize such risks.

Security Measures When Buying Proxies With Credit Cards

When purchasing proxies with a credit card, safeguarding financial details and confirming the legitimacy of providers are essential. Implementing proper security measures protects against unauthorized transactions and ensures smooth payment processing.

Protecting Card Information Online

Users should avoid entering credit card details on unsecured websites. Always check for HTTPS in the URL and a valid security certificate before submitting payment information. Using a virtual credit card or single-use card numbers adds a layer of protection, limiting exposure if data is compromised.

Because debit card fraud can occur without physically possessing the card, monitoring statements regularly is crucial. Employing credit card reconciliation software can help detect unauthorized charges promptly. Additionally, users must be wary of chip malfunction on debit cards, which can lead to failed transactions or potential data interception in rare cases.

Recognizing Fraudulent Providers

Before buying proxies, customers should verify provider authenticity. This includes checking for customer reviews, confirming physical business addresses, and ensuring clear sales and refund policies. Fraudulent providers often lack reliable support or provide suspiciously low prices to lure buyers.

Using known proxy vendors that require verified business documentation can reduce risk. If a provider pushes for unusual payment methods or requests sensitive information beyond what’s necessary, it should raise concerns. Being vigilant about the provider’s reputation protects both financial information and proxy service quality.

Importance of Secure Payment Gateways

Secure payment gateways encrypt transaction data, preventing interception by cybercriminals. Choosing providers that use gateways compliant with PCI DSS (Payment Card Industry Data Security Standard) ensures credit card details are processed safely.

These gateways also support fraud detection tools like address verification and 3D Secure authentication. Using gateways integrated with credit card reconciliation software allows businesses to track and reconcile payments more efficiently, minimizing errors and fraud risks during proxy purchases.

Credit Card Types and Alternatives for Proxy Purchases

Payment methods for buying proxies vary, including traditional credit cards, prepaid options, and debit cards. Each option has specific benefits and limitations related to security, convenience, and acceptance.

Business Credit Cards

Business credit cards are ideal for companies or freelancers purchasing proxies for professional use. They offer higher spending limits and detailed transaction tracking, which helps with accounting and budgeting.

Often, business credit cards include rewards or cashback on purchases, potentially lowering overall costs when buying proxies in volume. They also provide fraud protection and dispute resolution support, crucial when dealing with online proxy services.

However, approval for these cards usually requires a business entity or tax ID. Using a business credit card ensures clear separation between personal and business expenses, simplifying financial management for proxy-related activities.

Prepaid and Virtual Credit Cards

Prepaid and virtual credit cards are popular for proxy purchases due to their security benefits. These cards limit the spending amount to a predefined balance, reducing the risk from fraud or theft.

Virtual credit cards, generated through online banking apps, provide unique card numbers for one-time or limited use. This feature safeguards the user’s primary credit card details during proxy transactions.

Prepaid cards are also accessible for users without strong credit history, unlike traditional cards. However, some proxy providers may restrict acceptance of prepaid or virtual cards, so checking payment options before purchase is advised.

Debit Card Alternatives

Debit cards can serve as a payment method for proxies, especially those branded by Visa or Mastercard, which offer global merchant acceptance. For example, the difference between US Debit and Visa Debit impacts where the card can be used; Visa Debit is widely accepted online.

For people with bad credit, alternatives like a Shazam debit card or Bank of Bhutan International debit card provide access to international transactions, including proxy payments, without needing a credit card.

Some debit cards have fewer protections compared to credit cards. Users should confirm that their card provider supports secure online payments and offers fraud prevention. Using a debit card tied to a modern leasing or banking service also ensures clearer tracking of proxy purchase charges.

Legal and Compliance Considerations

When purchasing a proxy with a credit card, businesses and individuals must navigate various rules and procedures to remain compliant. Important factors include understanding jurisdictional laws, preventing misuse such as credit card theft, and managing disputes that arise from transactions.

Regional Regulations and Restrictions

Regulations for proxy purchases vary widely across regions. In some countries, using proxies to bypass geographical restrictions or for anonymity may be legal, while in others it may conflict with local laws or telecommunications regulations.

Businesses must verify the legal status of proxy use within their operating regions. Some jurisdictions require explicit disclosure of proxy usage to maintain transparency and prevent fraud.

Failure to comply with regional rules can lead to penalties. For example, the use of proxies in locations with strict internet laws may be seen as a violation, potentially resulting in legal actions or service discontinuation.

Addressing Credit Card Abuse and Theft

Credit card theft is a felony offense that involves unauthorized use of payment information. First-time offenders may face serious penalties, including fines and imprisonment, depending on jurisdiction and offense severity.

Providers need robust verification to prevent stolen credit cards from being used to purchase proxies. Customers should expect identity checks or multi-factor authentication to help protect against fraud.

If credit card details are compromised during a proxy purchase, it may trigger investigations. Companies and users must cooperate with legal authorities to resolve potential abuse and limit financial losses.

Chargebacks and Dispute Processes

Chargebacks happen when cardholders contest a proxy purchase through their credit card issuer. This can occur due to fraud claims or dissatisfaction with the service.

Providers should maintain clear refund and dispute policies to manage chargebacks efficiently. Transparency in billing and transaction records is critical for defending against unfounded disputes.

Attorneys typically cannot charge clients for credit card transaction fees related to disputes. However, legal costs may arise if the issue escalates to formal proceedings requiring representation.

Handling disputes proactively reduces financial risks for both buyers and proxy providers, preserving trust and compliance with payment processing standards.

Managing Payments and Transactions for Online Services

Effective payment management involves maintaining clear records, addressing issues promptly, and automating transactions where possible. Businesses should focus on accurate tracking, swift resolution of payment failures, and reliable automatic payment setups to ensure smooth operations when purchasing proxies or similar online services.

Tracking and Reconciling Payments

Tracking payments accurately is essential for business financial health. Using credit card reconciliation software helps to match payments made with invoices, reducing errors and improving accountability. This software supports identifying discrepancies quickly, which is critical for online services that rely on recurring payments or multiple transactions.

Reconciling bank statements regularly ensures that all credit card charges, especially from automatic payment pools, are accounted for. Clear records allow swift dispute resolution if unauthorized or duplicate charges occur. This practice safeguards business funds and simplifies tax reporting by providing detailed transaction histories.

Handling Payment Failures

Payment failures can disrupt service access and damage vendor relationships. Identifying the cause of failure—whether due to expired credit cards, insufficient funds, or restrictions like those on business debit cards used for personal purposes—helps resolve issues efficiently.

Implementing alerts for failed transactions notifies users to update payment details promptly. For online proxy services, maintaining current payment information reduces service interruptions. Clear communication protocols with customers help manage expectations and encourage quick resolution.

Setting Up Automatic Payments

Automatic payment setups minimize late payments and improve cash flow predictability. When configuring automatic payment pools, businesses should verify that credit card details, billing cycles, and limits align with usage patterns to avoid unexpected declines or overdrafts.

Security is crucial. Businesses must ensure their payment platforms comply with standards such as PCI-DSS to protect credit card data. Automating payments through trusted providers reduces manual errors and supports scalable proxy purchasing without administrative overhead.

Tips for Safe and Successful Proxy Purchases

When buying proxies with a credit card, several key strategies help ensure the process is secure and meets the buyer’s needs. These include recognizing risks in the proxy marketplace, evaluating provider terms carefully, and maintaining vigilance on payment security as threats continuously evolve.

Avoiding Common Pitfalls

Proxy buyers should be cautious of providers that offer suspiciously low prices or lack transparent service details. Such offers often signal unreliable proxies or potential scams. Users must verify provider credibility through reviews and avoid services without clear refund policies.

Data security risks exist when entering credit card information, especially if the provider’s site lacks SSL encryption or uses outdated payment systems. Avoid using public Wi-Fi to purchase proxies with a credit card to prevent interception of sensitive information like card numbers and CVV codes.

Unexpected charges such as “acqra charge” or unfamiliar merchant names like “blossom up charge on credit card” may indicate unauthorized transactions or billing errors. Buyers should monitor their statements carefully and report any suspicious activity immediately.

Comparing Provider Policies

Not all proxy services offer the same terms regarding refunds, privacy, and usage limits. Buyers must closely read the service agreement to confirm what is covered if the service fails or if the proxy IPs become blocked.

Privacy policies vary widely: some companies store payment data, increasing the risk of exposure in data breaches. Services that accept credit card payments should ideally provide PCI DSS compliance, ensuring industry-standard protection of financial data.

Additionally, comparing geographic coverage and proxy types (residential vs. datacenter) helps determine value. Buyers should prioritize providers with established customer support and transparent pricing to avoid hidden fees often encountered with lesser-known vendors.

Staying Updated on Payment Security

Credit card fraud remains a significant issue for online transactions, including proxy purchases. Staying informed about evolving threats such as phishing schemes or malware targeting payment details is essential.

Using virtual cards or single-use credit card numbers adds a layer of security by limiting the exposure of the main credit card information. Many banks offer such features to protect against fraud.

It is also important to routinely check credit card statements for unexpected charges, including those labeled vaguely like “what is corporate filings llc charge on credit card” or “what is towson cmf charge credit card.” These may be signs of fraudulent activity unrelated to the known proxy purchase. Setting up alerts for large or unusual transactions can help detect issues early.