Table of Contents

- Introduction

- What is a Power of Attorney (POA)?

- Types of POA and Their Banking Powers

- Can a POA Withdraw Money from a Bank Account?

- How a POA Gains Access to Bank Accounts

- Bank Requirements for POA Authorization

- What Can a POA Legally Do with a Bank Account?

- Limitations of a POA in Banking

- Can a POA Be Used to Steal Money?

- Red Flags and Misuse of POA

- How to Protect Against POA Abuse

- Revoking POA Access to a Bank Account

- Real-Life Examples and Court Cases

- FAQs

- Conclusion

1. Introduction

The Power of Attorney (POA) is a powerful legal tool that lets someone act on your behalf for personal, financial, or medical decisions. One of the most common questions people ask is:

“Can a Power of Attorney withdraw money from my bank account?”

The short answer: Yes, but only under certain conditions. This guide breaks down the legal boundaries, protections, and risks related to bank account access by a POA.

2. What Is a Power of Attorney (POA)?

A Power of Attorney is a legal document that gives someone (called an “agent” or “attorney-in-fact”) the authority to act on behalf of another person (called the “principal”). It can be:

- Durable POA: Remains effective even if the principal becomes incapacitated.

- Springing POA: Becomes effective only after a specific condition is met (usually mental incapacity).

- Limited POA: Grants authority for a specific task or time period.

- General POA: Grants broad powers for managing finances, legal issues, and more.

3. Types of POA and Their Banking Powers

Different POAs offer different levels of access:

| Type of POA | Can Withdraw Money? | Scope |

|---|---|---|

| General POA | ✅ Yes | All financial matters |

| Durable POA | ✅ Yes | Continues even if principal is incapacitated |

| Limited POA | ⚠️ Maybe | Only if specifically mentioned |

| Springing POA | ⚠️ Maybe | Once conditions are met |

| Medical POA | ❌ No | Healthcare decisions only |

Always read the language in the POA document to know what’s authorized.

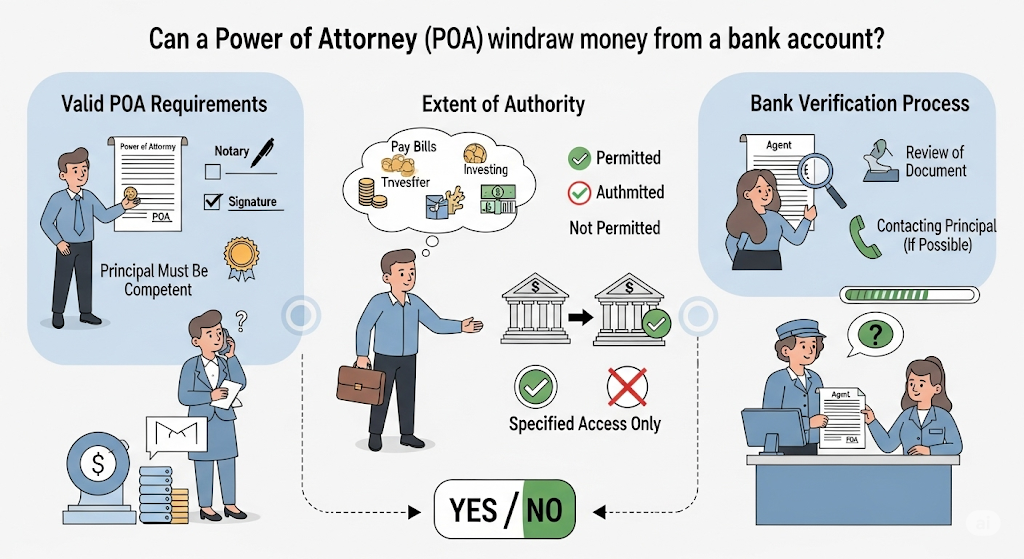

4. Can a POA Withdraw Money from a Bank Account?

Yes — if the POA document explicitly authorizes banking transactions, an agent can withdraw money on the principal’s behalf.

Example:

If the POA says:

“My agent is authorized to manage and access all my financial accounts, including the ability to withdraw, deposit, and transfer funds.”

Then the agent can legally withdraw money, subject to the laws of the state and banking rules.

5. How a POA Gains Access to Bank Accounts

Here’s what typically happens:

- Present POA Document: The agent must take the notarized POA to the bank.

- Bank Reviews Document: Legal or compliance department verifies its validity.

- Signature Verification: The bank may request signature samples or ID.

- Access Granted: The agent may be allowed to act as a signer, create checks, make deposits/withdrawals, or open/close accounts.

6. Bank Requirements for POA Authorization

Banks will not allow account access until the following are fulfilled:

- Original or certified copy of POA

- Valid government-issued ID of agent

- Completed internal forms (banks often require POA to be recorded internally)

- Bank-specific requirements, which may include legal team approval

Pro tip: Some banks reject POAs older than 6 months–1 year unless reaffirmed.

7. What Can a POA Legally Do with a Bank Account?

If authorized, an agent can:

- Withdraw and deposit funds

- Pay bills or write checks

- Access online banking

- Transfer funds between accounts

- Apply for loans or credit lines (if allowed)

- Close or open new accounts

But they cannot mix your money with theirs or use it for personal gain.

8. Limitations of a POA in Banking

Here’s what a POA cannot do unless explicitly stated:

- Make gifts or donations

- Change beneficiaries

- Open joint accounts

- Add themselves as co-owners

- Withdraw funds for their personal benefit

Also, some states require explicit gifting authority for the agent to give money on the principal’s behalf.

9. Can a POA Be Used to Steal Money?

Yes — sadly, POA abuse is common, especially involving elderly people. An agent may:

- Empty bank accounts

- Write checks to themselves

- Buy personal items

- Transfer property or assets

This is financial elder abuse and is a criminal offense in most U.S. states.

10. Red Flags and Misuse of POA

Watch out for these signs:

- Sudden large withdrawals

- Frequent unexplained ATM usage

- New debts or unpaid bills

- Lifestyle upgrades by the agent

- Agent refuses to show account statements

If you suspect misuse, you can file a report with Adult Protective Services, the bank, or take legal action.

11. How to Protect Against POA Abuse

✅ Choose a trustworthy agent – ideally a family member with integrity

✅ Use a Limited or Specific POA

✅ Require dual signature for large withdrawals

✅ Notify your bank in advance

✅ Monitor your account activity regularly

✅ Work with an attorney to set clear boundaries

12. Revoking POA Access to a Bank Account

You can revoke a POA at any time (if you’re mentally competent):

- Draft a revocation document

- Notify your bank in writing

- Retrieve original POA copies from your agent

- File revocation with the county recorder if originally recorded

Important: Always inform all financial institutions immediately.

13. Real-Life Examples and Court Cases

Case 1:

A daughter with POA transferred her elderly mother’s funds into her own account. The court found her guilty of fiduciary misconduct, and the funds were returned.

Case 2:

An agent used a POA to sell a property without the owner’s consent. The judge ruled the POA didn’t include real estate authority.

These show the importance of clear documentation and accountability.

14. FAQs

Q1: Can a POA write checks?

Yes, if authorized, they can write and sign checks on behalf of the principal.

Q2: Can a POA add themselves to the account?

No, unless the POA document explicitly allows it, which is rare.

Q3: Can a POA withdraw all the money from an account?

Only if it’s necessary for the principal’s benefit. Draining the account for personal use is illegal.

Q4: Can a POA withdraw money after death?

No, POA terminates upon death. After that, only an executor or administrator has authority.

Q5: Can a bank deny a valid POA?

Yes, if the document doesn’t meet state law requirements or if they suspect fraud.

15. Conclusion

A Power of Attorney can withdraw money from a bank account, but it must be explicitly allowed in the document and only used for the benefit of the principal. While POA can simplify financial management for those who are ill, elderly, or unavailable, it also comes with risk if abused.

To protect your money and your future:

- Choose a reliable agent

- Use specific, limited language in your POA

- Monitor accounts regularly

- Revoke the POA if any misuse is suspected

When in doubt, consult a financial advisor or estate planning attorney. A well-drafted POA should give peace of mind — not invite financial harm.