Venmo has become a go-to payment app in the U.S. for splitting dinner bills, sending money to friends, or even paying small businesses. With over 90 million users, it’s no surprise that people want to maximize convenience—including using their credit cards for payments.

But here’s the question: Can you use a credit card on Venmo?

The answer is yes—but it comes with fees, limits, and considerations that many users don’t know about.

In this in-depth 2025 guide, we’ll cover:

- Whether you can link and use credit cards on Venmo

- What the fees are (and how to avoid them)

- Pros and cons of using credit cards with Venmo

- How it affects your credit score

- Security concerns and fraud protection

- Alternative payment options

- Smart strategies to use Venmo with credit responsibly

Let’s break down everything you need to know before you swipe your credit card on Venmo.

Venmo has become a go-to payment app in the U.S. for splitting dinner bills, sending money to friends, or even paying small businesses. With over 90 million users, it’s no surprise that people want to maximize convenience—including using their credit cards for payments.

But here’s the question: Can you use a credit card on Venmo?

The answer is yes—but it comes with fees, limits, and considerations that many users don’t know about.

In this in-depth 2025 guide, we’ll cover:

- Whether you can link and use credit cards on Venmo

- What the fees are (and how to avoid them)

- Pros and cons of using credit cards with Venmo

- How it affects your credit score

- Security concerns and fraud protection

- Alternative payment options

- Smart strategies to use Venmo with credit responsibly

Let’s break down everything you need to know before you swipe your credit card on Venmo.

Chapter 1: The Basics — What Is Venmo and How It Works (300–400 words)

1.1 What is Venmo?

Venmo is a mobile payment service owned by PayPal. It allows users to:

- Send and receive money instantly

- Pay for goods and services

- Split bills and share expenses

- Use the Venmo Debit Card or Venmo Credit Card

The app is most commonly linked to:

- A bank account (via ACH)

- A debit card

- A credit card

1.2 Venmo in 2025

Venmo continues to expand its reach beyond peer-to-peer (P2P) transactions. Today, you can:

- Pay at merchants using Venmo QR codes

- Use Venmo for online checkout

- Buy crypto through the app

- Direct deposit paychecks

- Use Venmo to pay taxes or rent

Which brings us back to the main question: can you do all this with a credit card?

Chapter 2: Can You Use a Credit Card on Venmo? (Answer: Yes, But…) (300–400 words)

2.1 The Short Answer: Yes

Venmo does allow users to add and use a credit card to fund transactions. You can:

- Send money to friends/family

- Pay a small business using Venmo for Business

- Pay at merchants that accept Venmo

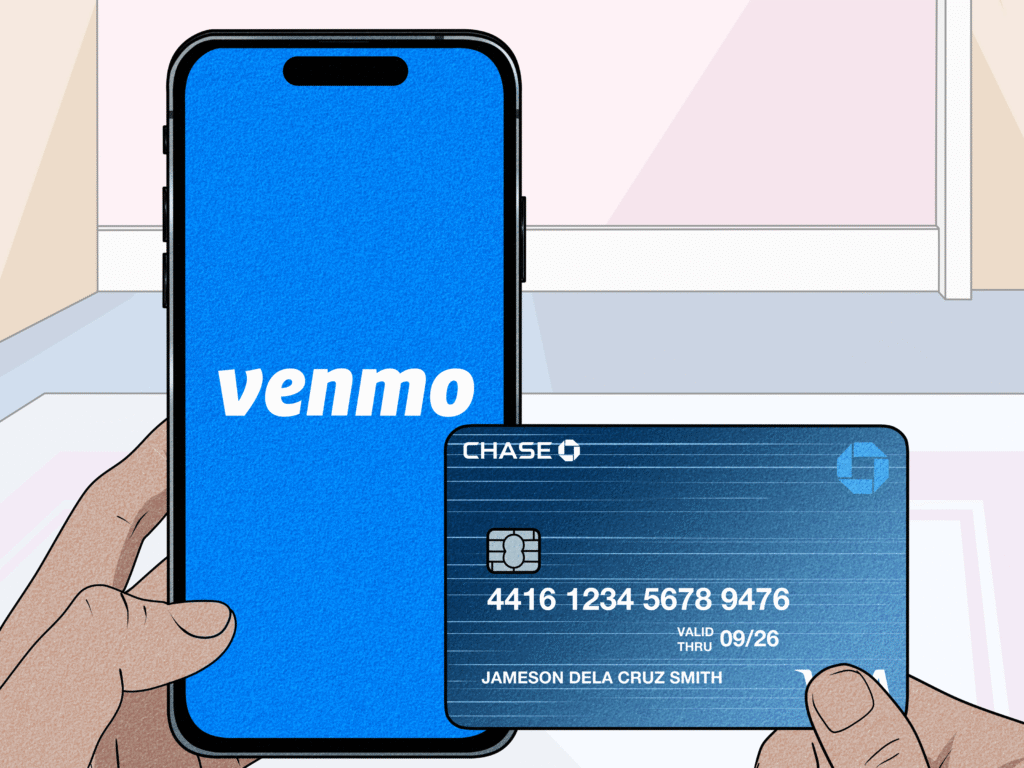

2.2 How to Add a Credit Card to Venmo

- Open the Venmo app

- Tap the “☰” menu > Settings

- Tap “Payment Methods”

- Tap “Add bank or card…” > Choose “Card”

- Enter your credit card number, expiration, CVV, and zip code

- Confirm the card and verify if required

Venmo supports Visa, Mastercard, American Express, and Discover credit cards.

2.3 Fees to Watch Out For

While adding a credit card is free, using one comes with a 3% fee for most person-to-person transactions.

| Transaction Type | Fee with Credit Card |

|---|---|

| Sending money to friends | 3% |

| Paying merchants | No fee |

| Receiving funds | Free |

| Venmo card reloads | Not allowed with credit cards |

Note: Some transactions (like paying a business) do not incur the 3% fee, but P2P transfers do.

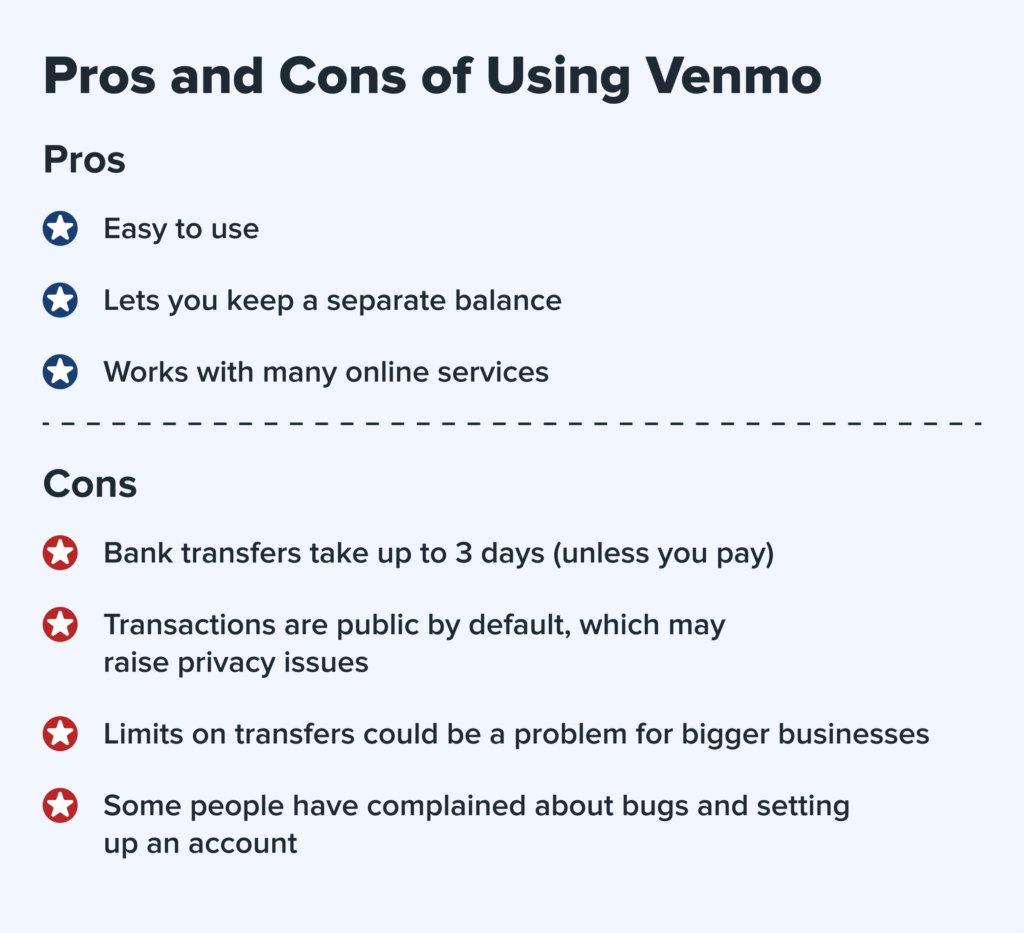

Chapter 3: The Pros of Using a Credit Card on Venmo (400–500 words)

Why would anyone pay a 3% fee to use a credit card? In some cases, the benefits outweigh the cost.

✅ 3.1 Credit Card Rewards

Many people use rewards cards to earn:

- 1.5%–2% cash back

- Airline miles

- Hotel points

- Sign-up bonuses

If your card earns 3%+ back in rewards (or has a large signup bonus you’re chasing), using it through Venmo might make sense—even with the fee.

✅ 3.2 Emergency or Backup Option

If you’re short on cash and need to send money urgently, a credit card can serve as a fallback option.

✅ 3.3 Builds Credit (Indirectly)

Using a credit card responsibly—even via Venmo—adds to your overall usage and payment history, which affects your credit score.

✅ 3.4 Business Use Cases

Small business owners can:

- Use Venmo to pay freelancers or vendors

- Track transactions for bookkeeping

- Use cards with business rewards or accounting integrations

Chapter 4: The Cons of Using a Credit Card on Venmo (400–500 words)

Despite the advantages, there are real risks and drawbacks to be aware of.

❌ 4.1 High Fees

3% of every transaction adds up. For example:

- $100 = $3 fee

- $1,000 = $30 fee

Over time, that can erase any rewards.

❌ 4.2 Credit Card Debt Risk

Using Venmo can make spending feel easy and casual. But if you’re funding it with a credit card and not paying it off monthly, interest can quickly snowball.

❌ 4.3 Some Cards May Charge Cash Advance Fees

Some issuers may treat peer-to-peer payments via Venmo as cash advances, which come with:

- No grace period

- Immediate interest

- Additional cash advance fee

❌ 4.4 Not All Transactions Are Eligible

You can’t use a credit card to:

- Add money to your Venmo balance

- Reload a Venmo debit card

- Withdraw funds

Chapter 5: Credit Cards and Your Credit Score (300–400 words)

Venmo itself doesn’t report to credit bureaus—but using your credit card through Venmo can impact your credit score.

How It Affects Your Score:

- Positive: On-time payments on your card build credit

- Negative: High balances from Venmo spending can increase utilization and hurt your score

- Neutral: Venmo doesn’t report anything directly

Avoid These Credit Score Pitfalls:

- Using over 30% of your credit limit via Venmo

- Missing card payments

- Applying for new credit just to fund Venmo spending

The best approach: treat Venmo credit card spending like any other bill—pay it off in full monthly.

Chapter 6: Venmo Purchase Protection and Security (300–400 words)

When you use a credit card, you’re adding an extra layer of fraud protection to your Venmo payments.

✅ Benefits of Using a Credit Card:

- Most issuers offer zero liability for unauthorized charges

- Disputes are easier to resolve than with debit cards

- Chargebacks possible in some cases

🔐 Venmo’s Built-in Security:

- Data encryption

- Two-factor authentication (2FA)

- Venmo Purchase Protection (for certain business purchases)

⚠️ Beware:

- Personal transactions are not protected

- If you send money to the wrong person, you can’t cancel it

- Venmo does not offer buyer/seller protection for personal P2P transactions—even if funded by a credit card

Chapter 7: Alternatives to Using a Credit Card on Venmo (300–400 words)

Want to avoid the 3% fee? Here are your options:

✅ Link a Bank Account

- No fees for sending money

- Safe and easy with ACH linking

- Slower transfers (1–3 business days)

✅ Use a Debit Card

- Free for sending and receiving money

- Instant transfers possible

- No interest or debt risk

✅ Venmo Balance

- Load money from your bank and use balance

- No fees for transfers or purchases

✅ Venmo Credit Card

Venmo offers its own credit card with cash back on popular categories and full app integration.

- No annual fee

- 3% back on top spending category

- No fee when used for Venmo purchases

✅ PayPal or Zelle

If you’re looking for fee-free credit card options, you might compare Venmo with its competitors.

Chapter 8: Smart Tips for Using a Credit Card on Venmo (300–400 words)

If you decide to link your credit card to Venmo, follow these smart practices:

💡 1. Only Use It for Planned Expenses

Don’t treat it like free money. Plan to pay off your credit card balance every billing cycle.

💡 2. Know When It’s Worth Paying the Fee

Use your card when:

- You’re meeting a sign-up bonus

- Your card offers more than 3% in rewards

- It’s a business expense you can deduct

💡 3. Avoid Using Cards With Poor Rewards

If your card earns less than 1.5% back—or none at all—the 3% fee isn’t worth it.

💡 4. Monitor Your Statements Closely

Track both your Venmo history and your credit card bill to avoid surprises.

💡 5. Set Payment Reminders

Even one missed credit card payment can damage your credit.

Chapter 9: FAQs (Frequently Asked Questions)

1. Can I pay rent or bills with a credit card via Venmo?

Only if your landlord accepts Venmo. Otherwise, you may need a third-party app like Plastiq.

2. Can I transfer money from Venmo to my credit card?

No. You can transfer funds to your bank account, not back to the credit card.

3. Do I earn points if I use a credit card on Venmo?

Yes, as long as the card issuer counts Venmo transactions as eligible purchases.

4. Are Venmo credit card payments reported to credit bureaus?

Yes. Venmo’s own credit card (issued by Synchrony Bank) reports to all three bureaus.

Conclusion: Should You Use a Credit Card on Venmo?

So, can you use a credit card on Venmo? Yes—but it depends on your goals and discipline.

If you’re:

- Chasing rewards or a sign-up bonus

- Managing short-term cash flow

- Making business-related transactions

…then using a credit card may make sense—even with the 3% fee.

But if you’re:

- Trying to avoid debt

- Living paycheck to paycheck

- Not earning significant rewards

…it’s smarter to stick with bank accounts, debit cards, or Venmo balance for fee-free transfers.

Venmo is a convenient platform—but always remember: credit is a tool, not a crutch. Use it wisely, and your financial health will thank you.