Table of Contents

- Introduction

- What Are Car Bankruptcy Loans?

- Can You Get a Car Loan After Bankruptcy?

- Types of Bankruptcy and How They Affect Auto Loans

- How Soon After Bankruptcy Can You Apply?

- Steps to Get a Car Loan After Bankruptcy

- Where to Find Bankruptcy Car Loans

- Interest Rates and Terms to Expect

- Should You Consider Buy Here Pay Here Lots?

- Pros and Cons of Car Loans After Bankruptcy

- How to Improve Your Loan Terms

- FAQs

- Final Thoughts

1. Introduction

Filing for bankruptcy can be financially and emotionally overwhelming. Whether it’s Chapter 7 or Chapter 13, it impacts your credit and your ability to get future loans. But what if you need a car?

The good news: you can get a car loan after bankruptcy. These are known as car bankruptcy loans, and many lenders in 2025 cater to borrowers with poor or damaged credit. This guide walks you through the process.

2. What Are Car Bankruptcy Loans?

A car bankruptcy loan is a type of auto loan tailored for people who have filed for bankruptcy. It helps individuals rebuild their credit by financing a vehicle—often with higher interest rates and stricter terms.

Key Features:

- Available even with recent bankruptcy

- Requires proof of income

- May need a down payment

- Usually involves a higher APR

3. Can You Get a Car Loan After Bankruptcy?

Yes. Car loans are one of the first types of credit many consumers re-qualify for after bankruptcy. It depends on:

- The type of bankruptcy filed

- The time since discharge

- Your current credit score

- Income and employment status

4. Types of Bankruptcy and How They Affect Auto Loans

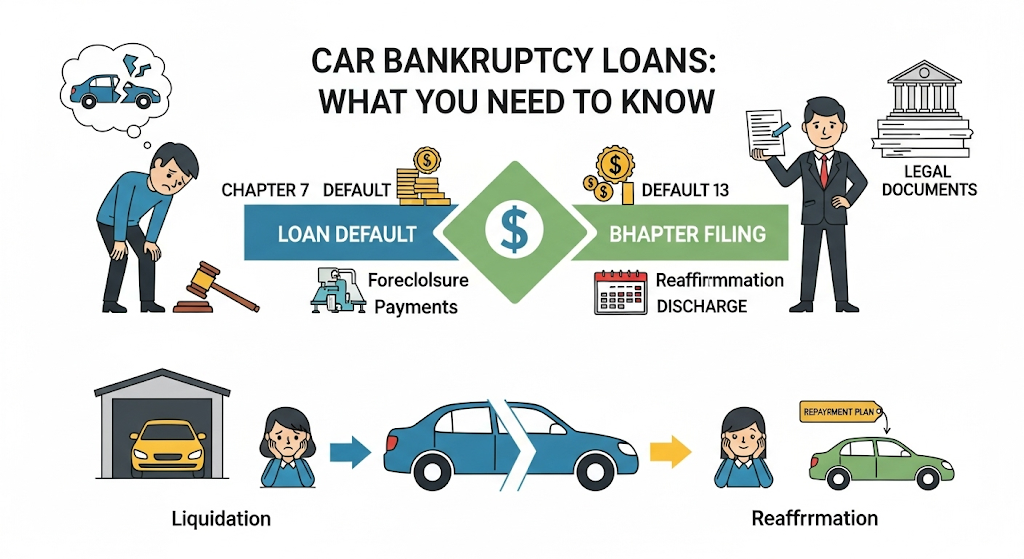

📍 Chapter 7 Bankruptcy

- Liquidation bankruptcy

- Usually discharged in 3–6 months

- After discharge, you can apply for an auto loan

- Most lenders prefer at least 6 months post-discharge

📍 Chapter 13 Bankruptcy

- Debt reorganization

- Lasts 3–5 years

- You must get court permission to take out a loan

- Trustee may require documentation

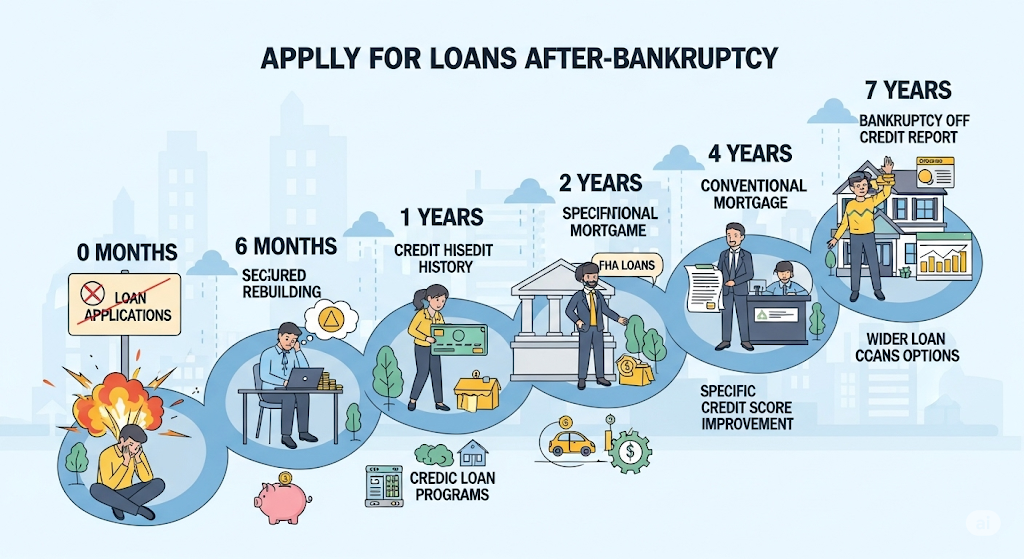

5. How Soon After Bankruptcy Can You Apply?

| Bankruptcy Type | When Can You Apply for Car Loan? |

|---|---|

| Chapter 7 | Typically after discharge (3–6 months) |

| Chapter 13 | During repayment (with court approval) or after discharge |

Note: Some “buy here pay here” dealerships and subprime lenders allow loans even during bankruptcy, but terms can be costly.

6. Steps to Get a Car Loan After Bankruptcy

✅ Step 1: Review Your Credit Report

Check for errors post-bankruptcy. Use free reports from Equifax, Experian, and TransUnion.

✅ Step 2: Set a Budget

Know what you can afford monthly. Factor in insurance, taxes, and fuel.

✅ Step 3: Save for a Down Payment

A higher down payment reduces risk for the lender and improves your approval odds.

✅ Step 4: Get Preapproved

Use preapproval tools from lenders who cater to low-credit or bankruptcy borrowers.

✅ Step 5: Compare Offers

Look at APR, term length, total repayment cost—not just monthly payment.

7. Where to Find Bankruptcy Car Loans

📌 Online Lenders

- myAutoloan

- Auto Credit Express

- RoadLoans

- Capital One Auto Finance (prequalification option)

📌 Credit Unions

Often more flexible with members—even those with bankruptcy.

📌 Special Finance Dealerships

“Buy Here Pay Here” lots work directly with bankruptcy customers.

📌 Subprime Lenders

Lenders that specialize in poor-credit borrowers:

- Carvana

- DriveTime

- Byrider

8. Interest Rates and Terms to Expect

| Credit Score Range | Expected APR (2025 Avg) |

|---|---|

| 700+ | 5.5% – 7% |

| 620–699 | 9% – 12% |

| 580–619 | 13% – 18% |

| < 580 / Recent BK | 18% – 29%+ |

Loan Terms:

- 24 to 72 months

- Some lenders limit terms to 36 months for high-risk borrowers

9. Should You Consider Buy Here Pay Here Lots?

Pros:

- Approve even with bankruptcy and no credit

- Little or no documentation

- Fast approvals

Cons:

- Very high interest rates

- Vehicles often overpriced or older

- No credit score improvement unless reported to bureaus

✅ Tip: Always confirm if the dealership reports payments to credit bureaus.

10. Pros and Cons of Car Loans After Bankruptcy

👍 Pros:

- Rebuilds credit score if paid on time

- Helps restore financial independence

- Opportunity to drive a reliable vehicle

👎 Cons:

- Higher interest rates

- Risk of repossession if missed payments

- May limit vehicle choice

11. How to Improve Your Loan Terms

- Improve Credit Score: Use secured cards and pay all bills on time

- Bigger Down Payment: Lowers loan amount and APR

- Get a Co-signer: Someone with good credit can improve your chances

- Wait if You Can: Even waiting 6–12 months post-bankruptcy can reduce your rate

12. FAQs

Q1: Can I get a car loan while still in bankruptcy?

Yes, if you’re in Chapter 13 and get court/trustee approval. Chapter 7 must be discharged first.

Q2: Will getting a car loan help rebuild my credit?

Absolutely, if payments are reported and made on time.

Q3: What kind of car should I buy?

Aim for reliable, modestly priced used cars to avoid over-borrowing.

Q4: Do I need a co-signer?

Not always, but it helps if your income or credit is too low.

Q5: Can I refinance later?

Yes. After 12–18 months of on-time payments, refinance to a lower rate.

13. Final Thoughts

Getting a car loan after bankruptcy is possible—and for many, it’s the first step toward rebuilding credit and financial freedom. While your options may be limited at first, smart decisions—like a reasonable loan, timely payments, and avoiding predatory lenders—can set you up for long-term success.

If you’re shopping in 2025, make sure to:

- Check your credit

- Research lenders

- Avoid overborrowing

- Consider improving your credit score before applying