In today’s fast-paced world, access to convenient and secure cash services remains a vital component of the financial ecosystem. One of the key players facilitating this access is Cardtronics, the world’s largest non-bank ATM operator. Whether you’re grabbing cash at a gas station, a convenience store, or a shopping center, there’s a high likelihood the ATM you’re using is operated by Cardtronics.

This comprehensive guide explores the operations, history, features, network, advantages, fees, user experience, and the evolving role of Cardtronics ATMs in the modern financial landscape.

1. What Is Cardtronics?

Cardtronics is a global financial services company that operates ATMs on behalf of retailers, banks, and independent operators. While most ATMs are associated with traditional banks, Cardtronics fills a niche as an Independent ATM Deployer (IAD). That means they provide ATM services without being a bank themselves.

Key Facts:

- Headquartered in Houston, Texas

- Over 285,000 ATMs worldwide

- Acquired by NCR Corporation in 2021

- Operates in over 10 countries including the U.S., Canada, U.K., and Australia

2. History and Growth

Cardtronics was founded in 1989 as a small operator focused on providing ATMs to retail locations. Over the years, the company expanded aggressively through acquisitions and strategic partnerships.

Key Milestones:

- 2001: Expanded across the U.S.

- 2012: Entered European market through acquisition

- 2015: Acquired Columbus Data Services

- 2021: Acquired by NCR Corporation in a $2.5 billion deal

3. Where You’ll Find Cardtronics ATMs

Cardtronics ATMs are located in a wide range of retail and high-traffic locations, making them highly accessible to the average consumer.

Common Locations:

- CVS Pharmacy

- Walgreens

- 7-Eleven

- Target

- Walmart

- Gas stations (Shell, BP, Chevron)

- Airports and transit stations

This broad placement ensures users don’t need to visit a traditional bank to withdraw cash.

4. How Cardtronics Operates

Cardtronics partners with both retailers and banks. For retailers, they provide ATMs as an added convenience for customers. For banks, Cardtronics allows them to extend their network without the overhead of installing and managing their own ATMs.

Types of Deployments:

- Branded ATM programs: Cardtronics installs ATMs that carry the branding of partner banks.

- Surcharge-free networks: Cardtronics ATMs are often part of fee-free networks like Allpoint.

5. The Allpoint Network

One of Cardtronics’ biggest value additions is its ownership of the Allpoint Network, the largest surcharge-free ATM network in the U.S.

Benefits of Allpoint:

- Over 55,000 surcharge-free ATMs globally

- Available to customers of over 1,200 financial institutions

- Commonly located in retail outlets

If your bank is partnered with Allpoint, you can use Cardtronics ATMs without paying out-of-network fees.

6. User Experience at Cardtronics ATMs

Key Features:

- Multi-language support

- ADA compliance

- Receipt printing and paperless options

- Touchscreen interfaces on newer models

- Chip and contactless card compatibility

- Enhanced security with anti-skimming technology

Cash Withdrawal Process:

- Insert your card

- Enter your PIN

- Choose transaction type (withdrawal, balance inquiry, etc.)

- Select account (checking or savings)

- Choose amount

- Confirm and collect cash and receipt

7. Cardtronics ATM Fees

While Cardtronics provides fee-free access through Allpoint, using a Cardtronics ATM without an Allpoint-affiliated bank account may incur fees.

Types of Fees:

- ATM Operator Fee: Usually $2.00–$3.50

- Bank Out-of-Network Fee: Charged by your own bank

Always read the fee disclosure before completing your transaction.

8. Security and Reliability

Cardtronics employs multiple layers of security to ensure user safety and ATM reliability.

Measures Include:

- EMV chip card support

- End-to-end encryption

- Anti-skimming devices

- Surveillance integration at some locations

- Routine cash replenishment and servicing

They also offer 24/7 support in case users encounter problems.

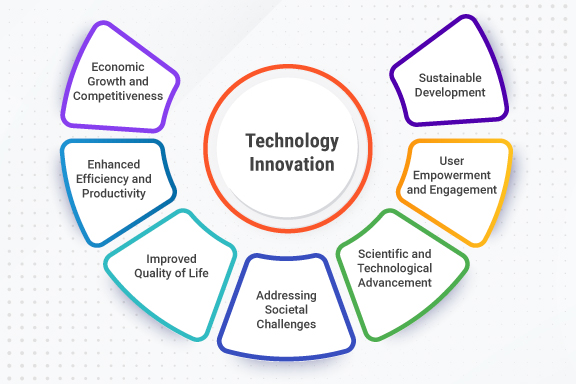

9. Innovations and Technology

As the industry evolves, Cardtronics is adopting new technologies:

Notable Developments:

- Contactless Withdrawals: Using mobile wallets like Apple Pay or Google Pay

- QR Code Transactions: Integrating mobile apps with ATMs

- Dynamic Branding: Banks can customize the ATM interface remotely

- Real-Time Transaction Data: For better analytics and fraud prevention

10. Cardtronics and Financial Inclusion

By placing ATMs in underserved communities, Cardtronics helps improve access to cash and basic banking services for unbanked and underbanked populations.

This is particularly important in:

- Rural areas

- Low-income urban neighborhoods

- Areas without local bank branches

Cardtronics plays a role in reducing cash deserts.

11. Benefits for Retailers

Retailers gain significant advantages by hosting a Cardtronics ATM:

- Increased foot traffic

- Potential for impulse purchases

- Commission from ATM transactions

- No maintenance or ownership responsibilities

It’s a win-win scenario for both consumers and business owners.

12. Cardtronics vs. Traditional Bank ATMs

Pros:

- More widespread in everyday locations

- Easier to access outside of banking hours

- Often part of surcharge-free networks

Cons:

- May charge higher fees if not within Allpoint

- Limited banking services (no deposits in many cases)

13. Cardtronics’ Role in a Cashless Society

Even as digital payments rise, Cardtronics plays an essential role in maintaining cash access for:

- Older adults

- Low-income individuals

- People in cash-dominant economies

The future may be cash-light, but not cashless—at least for now.

14. Frequently Asked Questions (FAQs)

Q: How do I find a Cardtronics ATM near me?

A: Use the Allpoint Network ATM locator online or through your bank’s app if they’re partnered.

Q: Can I deposit money at a Cardtronics ATM?

A: Only some Cardtronics ATMs offer deposit functionality. It depends on the bank partnership and location.

Q: Is my transaction safe?

A: Yes, Cardtronics ATMs use encryption, anti-skimming devices, and other security protocols.

Q: Are Cardtronics ATMs available internationally?

A: Yes, especially in Canada, U.K., and Australia.

15. Final Thoughts

Cardtronics has transformed how and where people access their money. By placing ATMs in highly convenient locations and forming strategic partnerships with banks and retailers, they’ve become a cornerstone of modern banking convenience.

Whether you’re a frequent traveler, an Allpoint network user, or someone living in an underserved area, Cardtronics likely plays a part in your financial life—often without you even realizing it.

As financial technology continues to evolve, Cardtronics remains a key player bridging the gap between traditional banking and modern accessibility.