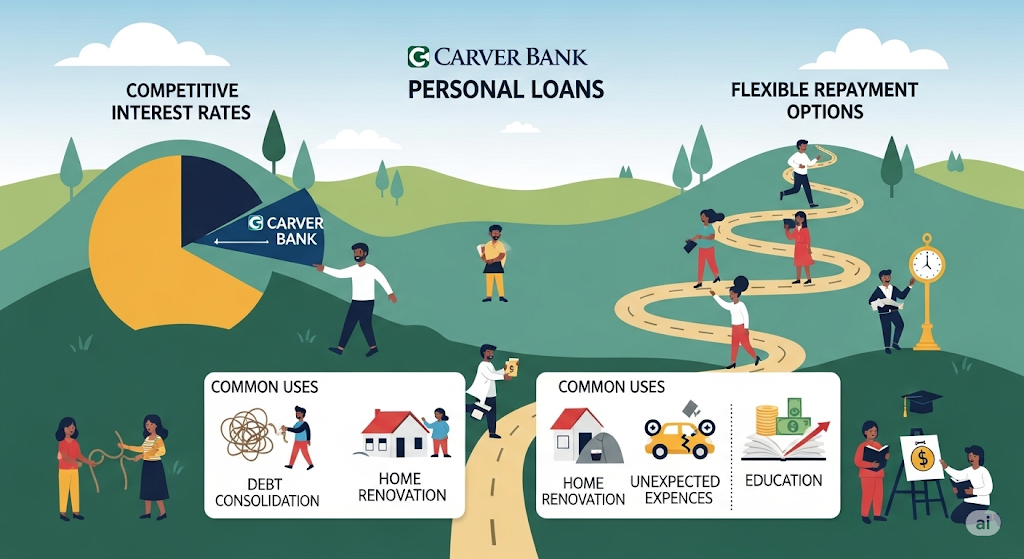

Carver Bank Personal Loans Carver Federal Savings Bank, commonly known as Carver Bank, has a long history of serving underrepresented and minority communities. Established in 1948, Carver Bank continues to offer financial products tailored to meet the needs of everyday Americans. Among these offerings are personal loans, which help individuals cover a range of expenses from emergencies to debt consolidation.

This guide explores everything you need to know about Carver Bank Personal Loans in 2025—eligibility, application process, features, pros and cons, and how they compare to other lenders.

Table of Contents

- What Is a Personal Loan?

- Overview of Carver Bank

- Types of Personal Loans Offered

- Eligibility Criteria

- Application Process

- Interest Rates and Fees

- Loan Terms and Repayment Options

- Pros and Cons

- Carver Bank Personal Loans vs. Competitors

- Tips for Getting Approved

- Real Customer Reviews

- FAQs

- Conclusion

1. What Is a Personal Loan?

A personal loan is a fixed amount of money borrowed from a lender that is paid back in regular installments with interest. Common uses include:

- Emergency medical bills

- Home repairs

- Debt consolidation

- Major purchases

2. Overview of Carver Bank

Carver Bank is a Minority Depository Institution (MDI) headquartered in New York. The bank focuses on:

- Community-oriented lending

- Support for small businesses and individuals in underserved communities

- Financial education and empowerment

3. Types of Personal Loans Offered

Carver Bank may offer:

- Unsecured Personal Loans: No collateral needed.

- Secured Personal Loans: Backed by collateral (e.g., savings account).

- Debt Consolidation Loans

- Emergency Loans

Note: Carver’s product availability may vary by location and borrower profile.

4. Eligibility Criteria

To qualify, applicants typically need:

- Proof of U.S. citizenship or permanent residency

- Government-issued ID

- Proof of income (pay stubs, tax returns)

- Minimum credit score (typically 600+)

- Debt-to-income (DTI) ratio under 40%

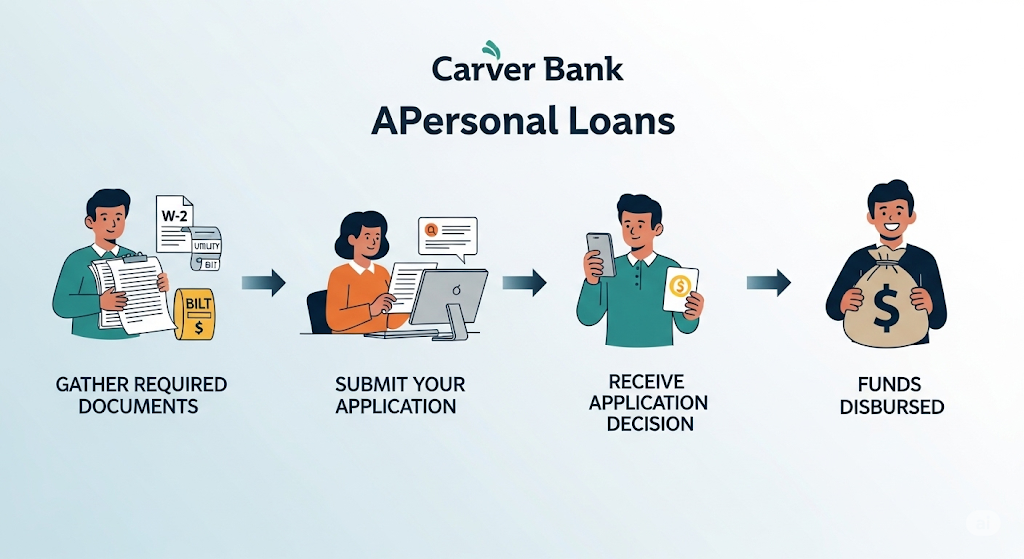

5. Application Process

Step-by-step:

- Visit Carver Bank’s website or local branch.

- Fill out the application with personal and financial information.

- Submit required documents.

- Wait for underwriting and approval (can take 1–5 days).

- Receive loan offer and accept.

- Funds are deposited into your bank account.

6.Interest Rates and Fees

While Carver Bank does not always publish rates online, personal loans typically come with:

- Interest rates ranging from 6% to 25% APR

- Origination fees (1%–5%)

- Late payment penalties

- No prepayment penalties in many cases

7. Loan Terms and Repayment Options

- Loan amounts: $1,000 – $50,000

- Term lengths: 12 – 60 months

- Repayment: Monthly installments via ACH, check, or online payment portal

8. Pros and Cons

Pros:

- Focus on underserved communities

- May consider applicants with fair credit

- Personalized support at local branches

Cons:

- Limited geographic reach

- Limited online tools compared to large fintechs

- Less transparency online

9. Carver Bank Personal Loans vs. Competitors

| Feature | Carver Bank | SoFi | OneMain Financial |

|---|---|---|---|

| APR Range | 6–25% (est.) | 8–24% | 18–35% |

| Minimum Credit Score | 600 | 680 | 580 |

| Max Loan Amount | $50,000 | $100,000 | $20,000 |

| Online Application | Partial | Full | Full |

| Collateral Required | Optional | No | Often yes |

10. Tips for Getting Approved

- Improve your credit score before applying

- Pay down existing debts

- Prepare documents in advance

- Consider applying with a co-signer

11. Real Customer Reviews

Positive:

“Carver really helped me consolidate my debt when big banks said no.” – Marcus H.

Neutral:

“Decent loan terms but the application took a bit longer than expected.” – Jane R.

Negative:

“Hard to apply online; wish they had more digital options.” – Tina L.

12. FAQs

Q: Is Carver Bank FDIC-insured?

A: Yes, deposits are insured up to $250,000.

Q: Can I apply online?

A: Some applications may start online, but branch visit may be required.

Q: What credit score do I need?

A: A score of 600+ is often recommended.

Q: How long does it take to receive funds?

A: 1 to 5 business days after approval.

Q: Are there prepayment penalties?

A: Typically, no.

13. Conclusion

Carver Bank Personal Loans offer a community-focused alternative to big-name lenders. With a mission-driven approach and tailored products, Carver is especially suited for borrowers looking for personalized attention and community impact. While it may lack some of the digital conveniences of larger banks, its commitment to inclusion and financial access sets it apart.