Christell White, a 42-year-old woman from Paterson, is accused of stealing the identity of a Totowa resident to open multiple credit cards fraudulently. Authorities say she used the stolen information to make purchases and accumulate debt in the victim’s name. She faces several charges including impersonation, theft of identity, and theft by deception related to these credit card fraud activities. The case highlights the risks of identity theft and the serious legal consequences for those involved. This story draws attention to the importance of monitoring personal financial information closely and remaining vigilant against potential fraud. Understanding such cases can help individuals protect themselves from similar threats.

Understanding the christell white paterson Credit Card

The christell white paterson credit card refers to a case involving alleged misuse of credit cards linked to identity fraud and impersonation. The discussion covers the card’s typical features, how people apply for credit cards, and the legal boundaries concerning misuse like felony credit card abuse. It also explains the impact of credit card abuse charges.

Overview and Key Features

The christell white paterson credit card is not a specific branded card but relates to a case where credit cards were obtained through impersonation. Standard credit cards generally include features like a credit limit, interest rates, and reward programs such as cashback. Cards used fraudulently in identity theft cases usually involve unauthorized account access or use. In legal terms, misuse can trigger felony credit card abuse charges, which involve knowingly using someone else’s credit information for financial gain without permission.

Application Process and Eligibility

Regular credit card applications require proof of identity, income, and creditworthiness. Legitimate issuers verify applicant details through credit bureaus before approval. In the case linked to Christell White, this verification was allegedly bypassed by impersonating a different resident. Eligibility for credit cards depends on factors like credit score, income level, and residence. However, illegal methods—such as identity theft—violates fraud laws. Understanding this distinction is key to avoiding credit card abuse charges, which carry serious legal consequences including theft of identity and impersonation counts.

Common Uses and Limitations

Legitimate credit cards support purchases, bill payments, and credit building. They carry limits to control spending and prevent fraud. Misuse, as in felony credit card abuse, includes fraudulent charges, unauthorized transactions, and impersonation to gain credit illegitimately. Legal limits include requiring the cardholder’s consent and identity verification. Violations often lead to criminal charges, reflecting the seriousness of credit card abuse. Charges linked to Christell White highlight the legal risks when credit cards are used without authorization, emphasizing the need for responsible use and thorough identity checks.

Credit Card Security and Abuse Prevention

Credit card misuse involves serious risks, including theft and unauthorized spending that can quickly impact victims’ finances. Legal consequences are significant, especially for felony-level offenses. Preventive measures and understanding the law are essential to avoid becoming a victim or offender.

Risks of Credit Card Theft

Credit card theft occurs when someone gains unauthorized access to another person’s card information. This can happen through physical theft, data breaches, or identity theft. Stolen information is often used to open new accounts or make purchases fraudulently, causing immediate financial harm. Victims may face damaged credit scores and lengthy disputes with financial institutions. Because credit card data can be sold on the dark web, risks extend beyond a single incident to ongoing unauthorized transactions. Awareness of these risks encourages better protection of sensitive data.

Preventing Unauthorized Charges

To reduce unauthorized credit card transactions, it is important to use strong, unique passwords for online accounts and regularly monitor statements for suspicious activity. Contacting the card issuer immediately when unauthorized charges appear helps limit liability. Additional preventive steps include enabling transaction alerts, using secure websites for online shopping, and avoiding public Wi-Fi for financial transactions. Many issuers offer fraud protection tools, such as temporary card locks and secure chip technology, which help detect and stop abuse early.

Legal Implications of Credit Card Misuse

Credit card theft and fraud are typically classified as felonies when the value exceeds certain limits or involves multiple offenses. Felony credit card abuse can include theft of another’s information, using it to apply for or make fraudulent purchases, and impersonating the victim. Charges may cover identity theft, theft by deception, and multiple counts of impersonation. Penalties include fines, restitution, and imprisonment. Legal consequences worsen with repeated violations or large-scale fraud, underscoring the seriousness of these crimes.

First Time Offense Considerations

For first-time offenders accused of credit card theft, legal outcomes may vary based on the offense’s scope and jurisdiction. Courts often consider the offender’s intent, value involved, and whether they cooperated with authorities. Some jurisdictions offer diversion programs or reduced charges for first offenses, especially if restitution is made promptly. However, felony-level credit card theft, involving significant financial harm or multiple counts, generally results in harsher penalties even for first-time cases. Early legal counsel is crucial to navigate these circumstances.

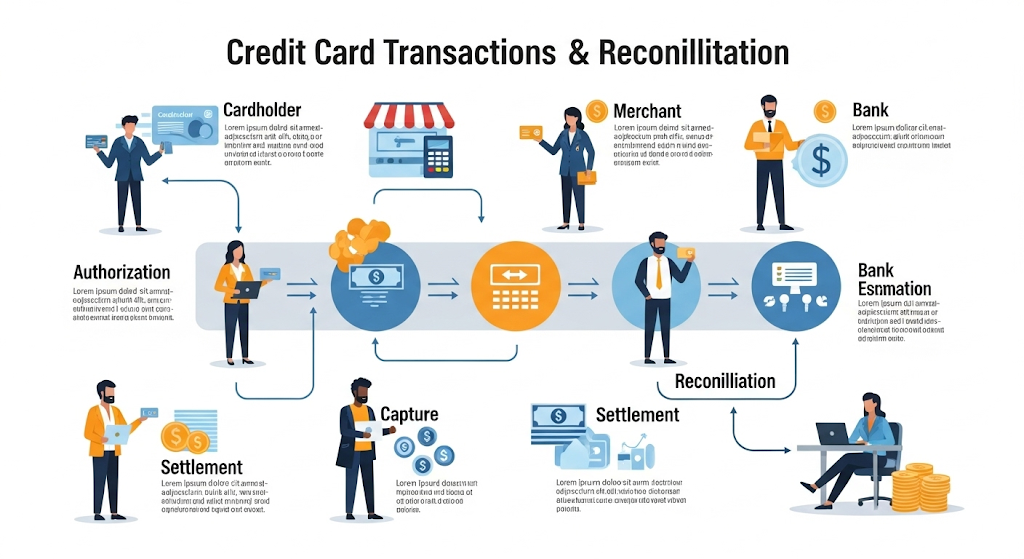

Credit Card Transactions and Reconciliation

Credit card activity often involves declines, unexpected charges, and the need for careful statement reviews. Effective reconciliation requires identifying transaction types and using software tools designed to spot discrepancies and clarify unfamiliar entries.

Hard Decline and Soft Decline Explained

A hard decline occurs when a credit card issuer rejects a transaction due to permanent reasons. These include insufficient funds, invalid card number, or suspected fraud. Hard declines cannot be bypassed by retrying the transaction. In contrast, a soft decline is usually temporary. It happens when a bank declines due to a daily limit, communication issues, or suspected fraud monitoring. Soft declines might approve if attempted later or with a different payment method. Merchants also need to understand that these declines impact customer experience. For example, in sales, knowing the difference between soft and hard declines helps decide whether to reattempt a charge or ask for alternative payment.

Identifying Unknown Charges

Unfamiliar credit card entries like Acqra Charge, Good Sportsman Charge, or Blossom Up Charge often confuse cardholders. These typically represent merchant billing names different from the store’s public brand. For example:

- Acqra Charge often relates to acquisition processing fees.

- Good Sportsman Charge may be connected to sports merchandise retailers.

- Blossom Up Charge might pertain to floral or subscription services.

Other unusual listings include:

- Modern Leasing MI charge which is associated with property management or leasing services.

- Corporate Filings LLC charge, often tied to business filing services.

- Towson CMF charge, which could relate to a healthcare or services facility.

Cardholders should review receipts and statements carefully. When in doubt, contacting the credit card issuer or the merchant directly helps clarify legitimacy.

Reconciliation Tools and Software

Credit card reconciliation software streamlines matching statement transactions against internal records. Tools designed for this task highlight mismatches and alert users to disputed or erroneous charges. Popular features include:

- Automated transaction imports.

- Detailed reporting of discrepancies.

- Direct access to vendor payment details.

- Integration with accounting systems.

Such software is especially important for businesses facing complex billing entries, like those seen with JPMCB Card Services or multiple vendor charges. Using software reduces errors and saves time in monthly and quarterly reconciliation. Businesses can track each transaction, confirm refund processes, and identify unauthorized entries swiftly through these tools, increasing financial accuracy and compliance.

Credit Limits, Lines, and Loans

Credit limits define the maximum amount a cardholder can borrow at one time. Lines of credit offer flexibility to borrow funds as needed, often with lower interest rates. Loans provide lump sums for specific purposes. Understanding these distinctions helps in managing credit effectively.

Setting and Increasing Credit Limits

Credit limits are set based on factors like credit score, income, and repayment history. Lenders assess these to determine a safe borrowing cap. Initially, credit limits may be conservative to reduce risk. To increase a credit limit, one usually must request a review and demonstrate responsible credit use. This can include timely payments and reduced debt balances. Automatic increases may occur after several months of consistent account management. Higher credit limits can improve credit utilization ratios, which may positively impact credit scores. However, increasing limits without control can lead to overspending and potential debt.

Secured vs Unsecured Credit Lines

Secured credit lines require collateral, such as property or savings, to back the loan. This lowers risk for lenders and often results in lower interest rates and higher credit limits. Examples include construction and real estate lines of credit. Unsecured credit lines don’t require collateral, relying solely on creditworthiness. These typically have higher interest rates and lower limits. Unsecured business lines of credit, like those offered by some Tennessee banks or Credit Union Business Credit Cards, are common for startups or businesses without assets. Choosing between secured and unsecured depends on the borrower’s financial situation, business needs, and risk tolerance.

Business Credit Card Solutions

Business credit cards help manage expenses and build credit profiles. They often come with rewards, expense tracking, and higher limits tailored for business needs. Banks and credit unions provide various business credit products, including unsecured business lines of credit and specialized cards for industries like construction or real estate. These products may also offer overdraft protection or digital banking access. Understanding how to open a credit line for specific uses, like home auctions or business expansion, requires evaluating fees, interest rates, and credit limits carefully. Guidance lines of credit can also support businesses needing flexible cash flow management.

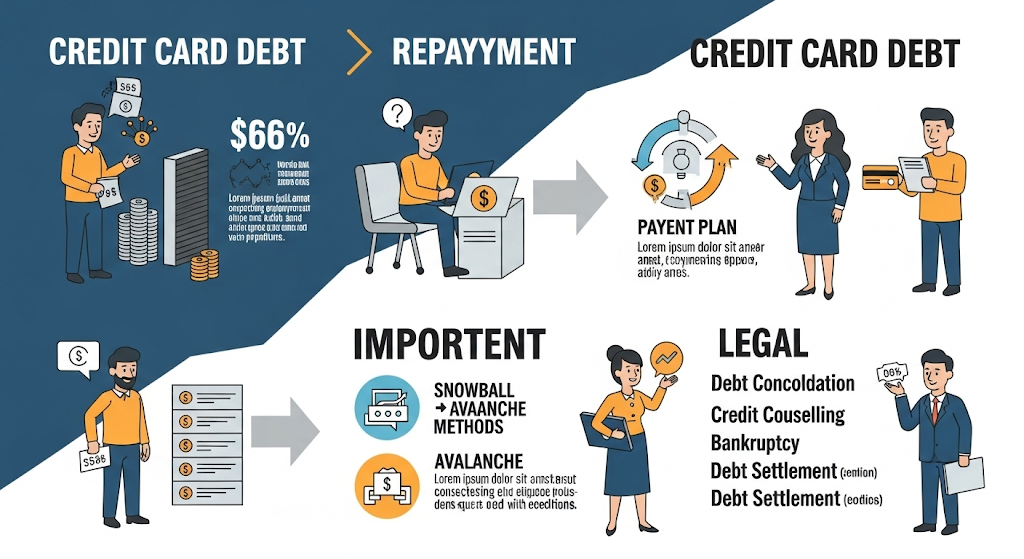

Credit Card Debt, Repayment, and Legal Considerations

Credit card debt requires strategic management to avoid long-term financial damage. Understanding the timing and limitations of legal actions is essential, as is knowing how debt-related liens and wage garnishments may affect personal assets.

Managing Credit Card Debt

Effective management of credit card debt often involves negotiating repayment terms or pursuing debt consolidation. Options include debt settlement, debt management programs, or balance transfers to cards with lower interest rates. These methods can reduce monthly payments or interest but may extend repayment periods. Debt forgiveness typically involves negotiating with creditors to reduce the total amount owed. However, this can negatively impact credit scores and may have tax consequences. Bankruptcy remains a last resort when debt becomes unmanageable and other alternatives fail.

Statute of Limitations and Legal Actions

In Georgia, the statute of limitations for most credit card debts is typically four years from the date of the last payment or activity on the account. After this period, creditors generally cannot sue to collect the debt, though the debt itself does not disappear. Legal actions for unpaid credit card debts often begin with collection calls and letters. If unresolved, creditors or debt buyers may file lawsuits to recover the owed amount. It is important to respond to lawsuits promptly to avoid default judgments.

Liens and Garnishments

Credit card companies generally cannot place liens on a debtor’s home without first obtaining a court judgment. If a creditor wins a lawsuit, they may then seek a lien to secure repayment. Wage garnishments are another tool creditors use after winning a judgment. Garnishments can legally withhold a portion of the debtor’s wages to pay off the debt. However, federal and state laws limit the amount that can be garnished. Regarding contractors, even without a written contract, a contractor may sue for non-payment if they can prove the work was done and payment terms were agreed upon. The absence of a contract makes cases more complex but does not necessarily prevent legal action.

Credit Card Usage for Everyday Expenses

Using a credit card for everyday expenses can offer flexibility and benefits when managed properly. Certain recurring payments and medical costs are commonly charged on credit cards to maximize convenience, rewards, or payment plans.

Dental and Orthodontist Payments

Dental expenses, including root canals and orthodontic treatments, often involve significant costs. Many dental offices in Seattle, for example, offer payment plans that can be complemented by credit card use to spread out payments without interest if the balance is paid monthly. Using a credit card for orthodontist payments can provide additional benefits such as rewards and improved credit history. However, patients should ensure they understand any fees associated with credit payments and choose a card that offers low interest rates or promotional APRs. This can make managing high dental bills easier, especially if combined with office payment plans.

Medical and Procedure Payments

Credit cards are frequently used for medical procedures not fully covered by insurance, like LASIK surgery. Paying with a credit card can provide immediate payment flexibility and allow individuals to earn rewards on these larger expenditures. It is important to consider the interest rates, as medical expenses can be costly. Some providers offer financing options or payment plans, but credit cards can be a beneficial alternative for those aiming to build credit or take advantage of reward points. Patients should weigh the card’s terms against in-house financing offers to make a financially sound choice.

Automobile and Home Payments

For large expenses like automobile down payments or home-related bills, credit cards can provide convenience but may not always be the best financial tool. Some lenders allow a portion of an automobile down payment to be made via credit card, but higher interest rates may apply, so it’s wise to be cautious. Using a credit card for home-related expenses, such as utility bills or home repairs, can help consolidate spending and boost rewards. However, recurring payments should be scheduled carefully to avoid missing due dates and incurring fees. People should also check if their card offers extra benefits like purchase protection or extended warranties for home and auto purchases.

Special Credit Card Charges and Unusual Transactions

Certain credit card charges can appear unfamiliar or suspicious due to their nature or merchant description. These may involve military-specific currency transactions, fees related to legal services, or purchases from questionable online sources. Understanding these helps consumers identify legitimate charges versus potential fraud or errors.

Military Payment Certificates and Proxy Purchases

Military Payment Certificates (MPCs), like the 5 Cent Military Payment Certificate, were once used by the U.S. military as currency in certain overseas locations. Though obsolete, transactions referencing MPCs can occasionally surface in error or through fraudulent listings. Proxy purchases involve buying goods or services on behalf of another person. When “buy proxy with credit card” is referenced, it often relates to someone using a third party to complete a purchase. These transactions may raise flags if they seem unusual or involve large amounts, requiring careful verification to avoid identity theft or fraud.

Transaction Fee Questions

It is common to question if attorneys can charge credit card transaction fees. Typically, such fees are allowed when disclosed upfront, but vary depending on local regulations and the attorney’s policies. Consumers should review agreements or ask directly about any credit card transaction fees related to legal services. Fees can be labeled variably on statements, so clear communication is essential. If uncertain, contacting the card issuer or legal provider can clarify whether such charges are legitimate or require dispute.

Online Purchases and Dump Sites

Credit card dump sites refer to illegal online platforms where stolen card data is bought and sold. Charges related to these are unauthorized and often part of identity theft schemes. Consumers spotting strange online purchase transactions should act quickly. Verifying merchant legitimacy and the purchase context helps prevent further fraud. If a user suspects their card info is compromised through such credit card dump sites, they must immediately notify their card issuer and consider reporting to authorities.

Debit Cards versus Credit Cards

Understanding the operational differences and practical benefits of debit and credit cards helps consumers make informed choices. Each card type serves specific financial needs based on how transactions are processed and how the user manages funds.

Key Differences and Pros of Each

Debit cards pull funds directly from a linked bank account, typically a checking account, making them a straightforward option for spending available money. Transactions made with a debit card are treated as immediate withdrawals, not credit, so there is no interest or debt accumulation. Debit cards such as the Shazam debit card often use networks like Visa or Mastercard to facilitate payments worldwide. However, unlike credit cards, debit cards may have limited fraud protection, and transactions are recorded as cash account activity, not accounts receivable for merchants. Credit cards offer a line of credit allowing users to buy now and pay later. They provide stronger fraud protection and often come with rewards like cash back or travel points. Additionally, credit usage impacts credit history and credit scores. This makes credit cards preferable for building credit. However, users must manage payments carefully to avoid interest charges.

When to Use Credit Cards over Debit Cards

Credit cards are more suitable for purchases requiring fraud protection or for building credit history. For example, charges on a credit card can be disputed relatively easily if a merchant error occurs or fraud is detected. They are also preferred for large or online purchases where zero-liability protection is important. In contrast, debit cards suit everyday spending when avoiding debt is a priority. Using debit cards makes it easier to stick within a budget since the funds are limited to what is in the account. For those with bad credit or no credit history, debit cards provide access to electronic payments without risking increased debt or impacting credit scores.

Summary:

| Feature | Debit Card | Credit Card |

|---|---|---|

| Source of Funds | Linked bank account (immediate debit) | Line of credit (borrowed funds) |

| Fraud Protection | Limited | Enhanced |

| Credit Building | No | Yes |

| Debt Risk | None (no borrowing) | Possible if balance not paid |

| Typical Rewards | Few or none | Common (points, cash back) |

Debit Card Security and Features

Debit cards include multiple security elements designed to protect users’ funds and personal information. These features vary by issuer but consistently involve PINs, chip technology, and transaction monitoring. The ability to use cards internationally adds complexity, requiring additional safeguards.

PIN Usage and Security Measures

A Personal Identification Number (PIN) is fundamental for accessing debit card funds. Most debit cards, including electronic versions, require a PIN to authorize purchases and ATM withdrawals. Users should create strong, unique PINs and avoid sharing them. Banks often implement limits on PIN attempts to prevent unauthorized access. Additional security measures include chip technology, which encrypts transaction data, and real-time account monitoring for suspicious activities. Some institutions also offer pinless debit cards, allowing small purchases without a PIN, but these typically have spending limits and increased fraud risks.

International Debit Card Options

Debit cards like the Bank of Bhutan’s international debit card provide access to funds globally. These cards support multiple currencies and enable ATM withdrawals abroad with applicable foreign exchange fees. International debit cards usually require a PIN, but some regions support contactless or pinless transactions under preset limits. Users should notify their bank before traveling to avoid transaction blocks. Foreign transaction monitoring and encryption help protect cardholders, but users must be cautious of chip malfunction or compromised terminals when abroad. Scanning unknown ATMs or point-of-sale devices can be a risk.

Bypassing PINs and Security Risks

Bypassing a debit card’s PIN can occur through methods like identity theft or use of compromised card data. In these cases, fraudsters may conduct transactions without physically possessing the card. Unauthorized PIN bypasses often exploit weak online verification or stolen security codes. When a PIN is bypassed, the card issuer’s liability policies vary; with debit cards, the victim’s actual funds are at risk. Proper security measures include regularly reviewing account statements, enabling transaction alerts, and reporting lost or stolen cards immediately. Enhanced protections, such as zero liability policies, are offered by some issuers but differ per card terms.

Managing Debit Card Payments and Associated Charges

Debit cards allow direct access to funds, but managing payments and fees requires attention to specific regulations and practical matters. Users often need clarity on withdrawing cash, identifying unfamiliar charges, and balancing business versus personal expenses on one card.

Withdrawing Cash and Health Spending Accounts

Withdrawing cash using a debit card is a common feature, but users should confirm if their card supports this, especially with specialized accounts like Health Spending Accounts (HSAs). Many HSA debit cards allow cash withdrawals, but some only permit payments at designated healthcare providers or pharmacies. Banks or account managers at places like 100 Deerfield Lane may apply transaction fees or restrictions on cash withdrawals from HSAs. Users should check terms of service to avoid unexpected costs or denied transactions. ATM withdrawals often involve fees from both the bank and the ATM operator. Using in-network ATMs or business branches tied to the account reduces these fees. It is also important to keep withdrawal limits in mind, as exceeding them can trigger additional charges.

Explaining Unknown Debit Card Charges

Mysterious charges, such as unfamiliar line items like a “100 Deerfield Lane” charge, can arise from recurring subscriptions, one-time purchases, or merchant processing names different from the retailer’s storefront. Identifying these requires reviewing recent transactions, comparing receipts, and contacting the merchant directly. If a charge cannot be verified, cardholders should report unauthorized transactions promptly to their bank. Debit card disputes differ from credit card disputes because the money is withdrawn directly from the user’s account. Banks typically require a swift reporting process to initiate reimbursements and avoid permanent losses. Regularly reviewing statements helps catch fraudulent or incorrect charges early. Tools like transaction alert services or apps can assist users in monitoring for suspicious activity in real time.

Business and Personal Use Considerations

Using a business debit card for personal expenses can lead to complications with bookkeeping, taxes, and account management. Many financial institutions advise against mixing personal and business transactions on the same card to maintain clear records and avoid auditing issues. Business debit cards usually carry higher scrutiny on purchases or withdrawals. Unapproved personal use may violate company policies or terms of service, potentially resulting in account freezes or penalties. For individuals managing both types of spending, using separate cards is the best practice. Digital tools or expense tracking apps can support managing mixed expenses but should not replace distinct account separation. In cases where personal charges accidentally occur on a business card, correcting them quickly with clear documentation helps maintain transparent financial records and simplifies tax compliance.

Home Equity and Other Payment Solutions

Home equity-based financing offers homeowners an option to manage debt with potentially lower interest rates. Understanding the differences in loan types, regional rate variations, and account structures helps in choosing the right solution.

Home Equity Lines and Loan Options

Home equity loans and lines of credit (HELOCs) convert home equity into usable funds. A home equity loan provides a lump sum at a fixed interest rate, often used for one-time expenses. A HELOC acts like a credit line with variable rates, allowing multiple draws over time. For example, home equity loan 2nd position Daly City reflects loans subordinate to the primary mortgage, which might carry higher risk but often provide access to needed cash. HELOC rates vary widely; HELOC rates in Wichita, KS tend to be competitive, sometimes lower than credit card rates, but are subject to change. Borrowers must consider loan term, interest rate stability, and repayment flexibility before choosing between these options.

Regional Loan Rate Comparisons

Interest rates on home equity products fluctuate by region due to market demand, lender competition, and local economic conditions. In Connecticut, home equity line of credit rates often range near 6-8%, influenced by stricter lending qualifications. Virginia typically shows slightly lower home equity loan rates, averaging closer to 5-7%, reflecting a stable housing market. Wichita, KS frequently offers more aggressive HELOC rates, sometimes below 6%, appealing to borrowers seeking cost-effective credit. Comparing these regional figures helps borrowers assess which location-specific product may offer the best value relative to their financial needs and credit profile.

Closed End and Cash Value Accounts

A closed end home equity loan provides a fixed amount upfront, requiring regular fixed payments until fully repaid. This contrasts with open-end arrangements like HELOCs. Closed-end loans are ideal for borrowers who want predictable monthly payments for debt consolidation or specific expenses. Cash value lines of credit tap into the cash surrender value of life insurance policies. They provide an alternative borrowing method without using home equity, often with different risk profiles and credit terms. Both loan types have unique advantages but should be evaluated carefully against personal financial priorities and risk tolerance.

Alternative and Automated Payment Methods

Alternative and automated payment methods are increasingly important for individuals and businesses managing finances efficiently. These approaches include scheduled payments, tax installment options, and special payment initiatives that help streamline transactions while ensuring compliance and convenience.

Automatic Payment Pools and Planning

Automatic payment pools allow users to group multiple recurring payments into a single scheduled transaction. This system simplifies managing bills and subscriptions by reducing manual effort and minimizing missed payments. These pools often integrate with bank accounts or digital wallets, offering control over payment timing and amounts. Users can plan cash flow better, avoid late fees, and track outgoing payments more effectively through automated alerts and summaries. Businesses and individuals alike benefit from this method, as it enhances budgeting accuracy and ensures timely payments without repeated manual inputs. Security protocols usually protect these payments to prevent unauthorized activity.

Oregon Estimated Tax Payment

Oregon’s estimated tax payment system requires individuals and businesses to prepay taxes in installments throughout the year. This approach prevents large lump-sum payments, easing the burden during tax season. Taxpayers calculate their estimated tax liability based on income projections and submit payments quarterly. Oregon offers online portals to automate and schedule these payments, increasing compliance and reducing errors. Failure to pay estimated taxes on time can result in penalties. Automated reminders and options to adjust payment amounts allow taxpayers to stay current with changing income levels or financial situations.

Supernova Payments and Special Programs

Supernova payments refer to specific government-issued or program-based payments designed to support economic needs. Examples include stimulus payments, such as the $1800 Social Security payment issued to eligible recipients during designated relief efforts. These special programs often use automated systems to distribute funds directly to beneficiaries’ bank accounts or through prepaid cards. This method speeds up delivery and reduces administrative overhead. Recipients should verify eligibility and track payment schedules through official channels. Understanding these payment programs helps individuals maximize benefits and anticipate financial inflows accurately.