If you’re thinking about buying a home in Arizona, chances are you’ve come across the term “conventional loan.” But what exactly is a conventional mortgage, and how does it work in the Grand Canyon State?

In this comprehensive guide, we’ll explain how conventional loans in Arizona work, eligibility requirements, loan limits, pros and cons, and how they compare to FHA, VA, and USDA loans. Whether you’re a first-time homebuyer or a seasoned investor, this blog will help you make informed decisions about financing a home in Arizona.

What Is a Conventional Loan?

A conventional loan is a mortgage that is not insured or guaranteed by the federal government, unlike FHA or VA loans. These loans are typically backed by private lenders like banks or credit unions and conform to the guidelines set by Fannie Mae and Freddie Mac.

There are two types of conventional loans:

- Conforming loans: Meet Fannie Mae/Freddie Mac limits and guidelines.

- Non-conforming loans: Don’t meet those guidelines (e.g., jumbo loans).

Why Conventional Loans Are Popular in Arizona

Arizona’s real estate market has been red-hot in recent years. With moderate property taxes and a mix of urban and rural areas, conventional loans make sense for many homebuyers. Cities like Phoenix, Tucson, Scottsdale, Mesa, and Flagstaff all see strong demand for conventional mortgages.

As of 2024, the median home price in Arizona hovers around $425,000, well within the 2024 conforming loan limit of $766,550 for most counties.

Eligibility Requirements in Arizona

To qualify for a conventional loan in Arizona, you’ll need to meet specific criteria:

1. Credit Score

Most lenders require a minimum credit score of 620, but to get the best rates, aim for 740+.

2. Down Payment

- Typically 3% to 20%, depending on your credit score and loan program.

- First-time buyers may qualify for a 3% down payment through Fannie Mae’s HomeReady or Freddie Mac’s Home Possible.

3. Debt-to-Income Ratio (DTI)

- Must be below 43%, but some lenders accept up to 50% with strong compensating factors.

4. Stable Income

- You’ll need to show steady employment or self-employment for at least 2 years.

5. Private Mortgage Insurance (PMI)

- Required if your down payment is less than 20%.

- PMI can be removed once you reach 20% equity in the home.

Arizona Loan Limits by County (2024)

| County | Conforming Loan Limit |

|---|---|

| Maricopa | $766,550 |

| Pima | $766,550 |

| Coconino | $856,750 |

| Yavapai | $766,550 |

| Pinal | $766,550 |

Coconino County has a higher limit due to elevated housing costs in Flagstaff and surrounding areas.

Pros of Conventional Loans in Arizona

- Lower interest rates for borrowers with strong credit

- No upfront mortgage insurance premium like FHA loans

- Can be used for investment properties or second homes

- No funding fee (unlike VA loans)

- PMI can be canceled once equity reaches 20%

Cons of Conventional Loans

- Higher credit and income requirements than FHA

- PMI adds to monthly costs if less than 20% down

- Not ideal for those with low credit scores or high DTI

Conventional vs. FHA Loan in Arizona

| Feature | Conventional Loan | FHA Loan |

|---|---|---|

| Credit Score Needed | 620+ | 580+ |

| Down Payment | 3%-20% | 3.5% minimum |

| Mortgage Insurance | PMI (removable) | MIP (for life) |

| Income Flexibility | Stricter | More lenient |

| Home Types Allowed | Primary/Second/Invest | Primary only |

How to Apply for a Conventional Loan in Arizona

- Check your credit score

- Gather documents (W-2s, tax returns, bank statements)

- Compare lenders – Look at interest rates, fees, and service

- Get pre-approved before house hunting

- Choose your home and make an offer

- Complete underwriting and submit final documents

- Close the loan and get your keys!

Tips for Arizona Homebuyers

- If you’re buying in Phoenix or Scottsdale, consider a larger down payment to reduce your monthly mortgage.

- In Flagstaff or Sedona, where prices are higher, jumbo conventional loans may be necessary.

- Take advantage of state-level programs like the Arizona Industrial Development Authority (AZIDA) which offers down payment assistance for conventional loans.

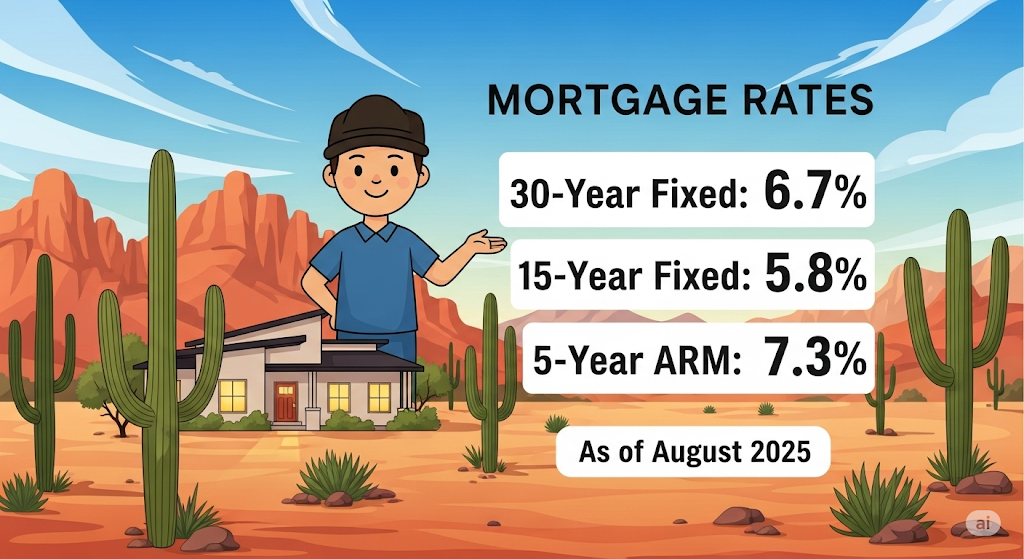

Current Mortgage Rates in Arizona (As of July 2024)

| Loan Type | Interest Rate (Avg.) |

|---|---|

| 30-Year Fixed | 6.45% |

| 15-Year Fixed | 5.75% |

| 5/1 ARM | 6.10% |

Rates vary based on credit score, down payment, and lender.

FAQs About Conventional Loans in Arizona

Q1. Can I get a conventional loan with a 5% down payment in Arizona?

Yes. Most lenders allow 5% down, and even 3% for first-time buyers.

Q2. Is PMI required for conventional loans?

Yes, if your down payment is less than 20%. However, PMI can be removed once equity reaches 20%.

Q3. What credit score do I need for the best rates?

Typically 740 or higher qualifies for the most competitive rates.

Q4. Can I use a conventional loan for a vacation home in Arizona?

Yes. Unlike FHA or VA, conventional loans allow financing for second homes and investment properties.

Q5. Do conventional loans have prepayment penalties?

Most do not, but confirm with your lender.

Conclusion

A conventional loan is a powerful, flexible option for homebuyers in Arizona—especially if you have a good credit profile and some savings. With higher loan limits, the ability to cancel PMI, and access to competitive rates, it remains one of the top choices for financing a home in 2024.

Whether you’re buying your first home in Tucson, investing in Scottsdale, or refinancing in Phoenix, a conventional mortgage might be the right fit.

Need help choosing the right loan in Arizona? Talk to a licensed mortgage lender to explore your conventional loan options today.