A credit card abuse charge occurs when someone uses a credit or debit card without the cardholder’s permission or beyond the authorized scope. This charge typically applies when an individual takes or uses a card to obtain goods, services, or money without consent, leading to potential criminal penalties under the law.

Understanding the specifics of credit card abuse is critical, as laws vary by jurisdiction but often include serious consequences such as fines, restitution, and possible jail time. The charge covers a range of actions, from unauthorized use to fraud, making it important to recognize what behaviors can trigger legal action.

People facing credit card abuse charges might have options depending on factors like the value involved and their criminal history. The legal process is complex, and the penalties depend heavily on the details of the case and local regulations.

Understanding Credit Card Abuse Charges

Credit card abuse charges involve illegal use or misuse of credit cards, with varying degrees of severity depending on the actions taken. These charges can include unauthorized purchases, theft, or fraud, each carrying specific legal consequences based on the circumstances and jurisdiction.

Definition of Credit Card Abuse Charge

A credit card abuse charge refers to illegal activities involving the unauthorized use of credit cards. This generally includes using a credit card without the owner’s permission, whether to make purchases or withdraw funds. It can also cover actions like altering credit card information or using stolen card details for financial gain.

Such charges can vary widely but typically focus on the intentional misuse or theft of a credit card. The term often overlaps with credit card theft but highlights the unauthorized exploitation of a card rather than the physical theft alone.

Common Types of Credit Card Abuse

Common forms of credit card abuse include:

- Unauthorized Purchases: Using a card without permission for transactions.

- Fraudulent Schemes: Creating false accounts or using stolen card information to commit fraud.

- Card Skimming: Illegally copying credit card details using devices.

- Identity Theft: Using someone else’s card information to gain funds or credit.

First-time offenses can sometimes be treated less severely, but repeated or high-value abuse may be charged as felony credit card abuse or felony-level credit card theft. Notably, some cases, like those involving Christell White Paterson, highlight the complexity of prosecution and restitution in such cases.

Legal Implications of Credit Card Abuse

Credit card abuse is a serious offense and can result in criminal charges ranging from misdemeanors to felonies. Felony credit card abuse typically involves larger amounts of money or repeated offenses, carrying prison time and heavy fines.

Conviction impacts more than legal status; credit scores and financial opportunities can suffer long-term consequences. Penalties intensify with the severity of the offense—first-time offense credit card theft cases may result in probation, but felony convictions often lead to incarceration and restitution requirements.

Legal outcomes depend on the evidence, the amount involved, and the defendant’s history. Understanding these implications is crucial for those facing or seeking to avoid credit card abuse charges.

Legal Process and Statutes

Credit card abuse cases typically begin with law enforcement investigations triggered by reports or suspicious activity. The legal framework defining offenses and penalties plays a crucial role in the classification and prosecution of these cases. Statutes of limitations also affect how long charges may be brought.

Filing and Investigating Credit Card Abuse

When credit card abuse is suspected, authorities or the cardholder may file a complaint. Law enforcement then investigates by gathering evidence such as transaction records, surveillance footage, and witness statements. Investigators focus on whether the accused used the card without authorization or exceeded authorized limits.

The investigation may include tracing the source of purchases or reviewing digital footprints linked to the transaction. Chargebacks and collaboration with financial institutions help confirm fraudulent activity. Accurate documentation during this phase is essential to build a solid legal case.

Possible Criminal Charges and Classification

Credit card abuse is usually charged under fraud statutes, like Texas Penal Code § 32.31. Charges depend on the value involved and the nature of the offense. Common classifications include misuse of a credit or debit card, possession of stolen credit cards, or attempted theft via unauthorized transactions.

Severity ranges from a misdemeanor to a felony. For example:

| Charge Type | Value Threshold | Charge Level |

|---|---|---|

| Low-value misuse | Under $2,500 | Class A Misdemeanor |

| Medium-value abuse | $2,500 to $30,000 | State Jail Felony |

| High-value abuse | Above $30,000 | 3rd Degree Felony |

Penalties escalate with repeated offenses and can include fines, restitution, and imprisonment.

Statute of Limitations for Credit Card Abuse

The statute of limitations defines the time period within which legal action must be initiated. For credit card abuse, this period varies by jurisdiction but is often between two to five years. In Texas, fraud-related crimes generally have a statute of limitations of 3 years.

In Georgia, where credit card debt statutes are relevant, civil claims like non-payment often have different limitations, generally four years for contract claims. However, criminal charges for credit card abuse follow their own statutory limits.

This timeframe ensures cases are pursued while evidence is fresh. Once expired, charges cannot usually be filed, emphasizing the need for timely legal intervention.

Identifying Fraudulent Credit Card Activity

Fraudulent credit card activity often involves unfamiliar charges or patterns that differ from normal spending. Quickly spotting these signs can prevent further misuse and reduce financial loss. Awareness of typical suspicious transactions, understanding specific types of charges, and knowing how credit card companies detect fraud are critical components of complaint defense.

Recognizing Unauthorized Transactions

Unauthorized transactions include charges not approved by the cardholder. These might appear as irregular amounts or unexpected merchants, such as an unfamiliar “Blossom Up charge on credit card” or unexpected entries labeled “Corporate Filings LLC charge.”

Cardholders should carefully review statements for small test charges, often placed by fraudsters to validate card details. Charges like “Acqra charge on credit card” may also indicate a merchant or processor unfamiliar to the user. Prompt reporting of unfamiliar activity can limit liability, usually capped by law at $50.

Checking the timing and frequency of transactions helps expose fraud. Multiple declines, whether soft declined or hard declined, may signal attempts to test card validity before making larger unauthorized purchases.

Types of Suspicious Credit Card Charges

Suspicious charges often stand out due to merchant names that are vague or unrelated to the cardholder’s habits. Examples include “Good Sportsman charge on credit card” or “Modern Leasing MI charge on credit card,” which may not correspond to known subscriptions or services.

Recurring charges for services never subscribed to, unknown monthly fees, or charges from merchant descriptors like “Towson CMF charge” can all be indicators of fraud. Sometimes, these represent attempts to disguise fraudulent billing under legitimate-sounding company names.

Charges related to card dump sites, where stolen card data is sold, generate multiple unauthorized transactions rapidly. This activity typically involves multiple, small, or random charges across various locations, helping fraudsters test stolen card details before larger transactions.

Role of Credit Card Companies in Detection

Credit card companies use advanced data analytics and real-time monitoring to detect unusual patterns. They flag suspicious activity and often alert customers before the cardholder even notices irregular charges.

Techniques include tracking location anomalies, rapid multiple transactions, and comparing current spending with historical patterns. For example, if a cardholder consistently shops locally but suddenly has charges from distant or unrelated merchants, the system may generate an alert.

Issuers also differentiate between soft declined and hard declined transactions, using declines as indicators of potential fraud or insufficient funds. Some companies provide immediate alerts via SMS or email, empowering cardholders to act quickly.

These measures, combined with fraud protection policies, help reduce the impact of fraud while offering a clear process for disputing unauthorized charges.

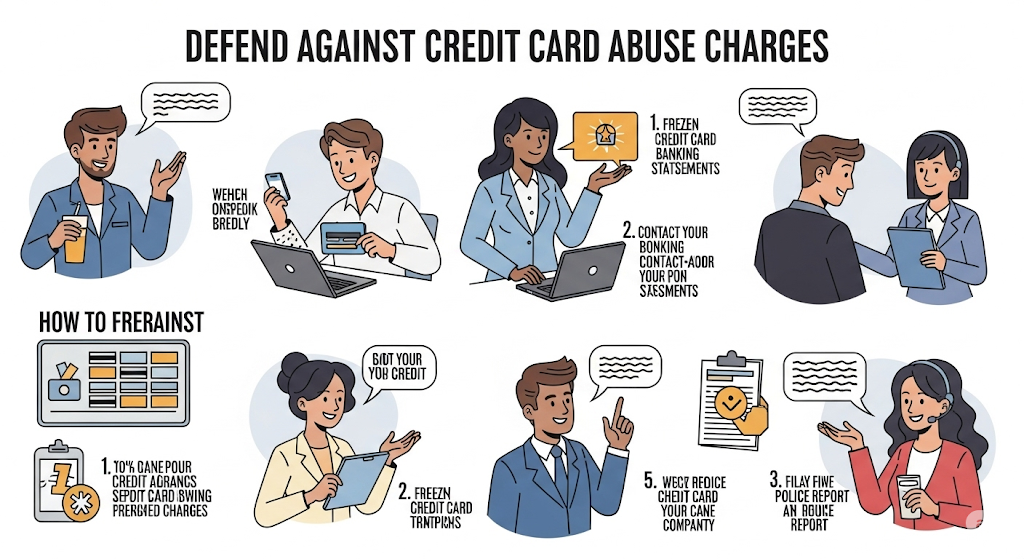

Defending Against Credit Card Abuse Charges

Defending against credit card abuse charges requires understanding specific legal defenses, proving lack of intent or mistaken identity, and often relying on professional legal help. Each element is critical to building an effective defense and protecting rights during the legal process.

Common Legal Defenses

Legal defenses against credit card abuse charges focus on disproving key elements like intent or knowledge of the crime. One common strategy is demonstrating that the defendant did not knowingly use or possess stolen credit card information. Another defense is proving the information was obtained legally or with permission.

The defendant might also argue coercion, where they were forced by another party to commit the act. Lack of evidence or faulty investigation can weaken prosecution claims. Courts often require clear proof that the accused knowingly engaged in fraud or abuse.

Mistaken Identity and Lack of Intent

Mistaken identity is a frequent issue in credit card abuse cases, especially where digital transactions are involved. The accused may show that their identity was stolen or that someone else made the fraudulent charges.

Proving a lack of intent is equally important. If the defendant can show they had no knowledge of the fraud or did not intend to misuse the card, this can invalidate charges. Evidence such as alibis, electronic records, or testimony supports these claims.

Hiring a Criminal Defense Attorney

Engaging a criminal defense attorney experienced in credit card abuse cases significantly improves the chances of a fair trial. Attorneys understand the technical details of credit card fraud laws and can challenge improper evidence or procedural errors.

A lawyer will guide through court proceedings, handle negotiations for plea deals if appropriate, and build a strong case focused on the defendant’s rights. Representation is especially important due to the complexity and potential severity of penalties.

Consequences of Credit Card Abuse Convictions

A credit card abuse conviction carries serious repercussions affecting both legal standing and personal finances. The offender may face criminal punishments while also encountering challenges related to credit history and employment prospects.

Criminal Penalties and Fines

Credit card abuse convictions often result in misdemeanor or felony charges depending on the amount involved. For smaller amounts, convictions typically fall under Class A misdemeanors, with penalties including fines and possible jail time up to one year.

When the value of the fraudulent use exceeds a certain threshold, the case may escalate to a felony. Felony charges can lead to harsher consequences, such as extended imprisonment, sometimes spanning several years, along with substantial fines.

Restitution payments to victims are common. Courts may order offenders to repay stolen amounts, which helps cover the losses sustained by credit card holders or financial institutions.

While credit card companies do not directly place liens on a person’s house, failure to pay court-ordered restitution or fines could lead to civil judgments. In such cases, liens or wage garnishments may be possible if debts remain unpaid.

Long-Term Effects on Credit and Employment

A conviction for credit card abuse often appears on an individual’s criminal record, which employers regularly check. This can limit job opportunities, particularly in fields requiring trustworthy handling of money or sensitive information.

Credit scores may also decline due to unpaid restitution or legal fees. Negative credit reports can hinder the ability to secure loans, mortgages, or even rent apartments.

Certain professions may become off-limits, especially those requiring licenses or government clearances. Employers view credit card abuse as a sign of poor judgment and financial irresponsibility.

Lower credit scores and a criminal record together create significant barriers. Rebuilding trust with financial institutions and employers requires time, consistent behavior, and often professional assistance.

Resolving and Preventing Credit Card Abuse Charges

Addressing credit card abuse charges promptly can reduce financial damage and legal risks. Taking concrete steps to dispute charges and adopting strong security practices helps protect accounts from future abuse.

How to Dispute a Credit Card Abuse Charge

When a credit card abuse charge appears, the individual should first review the statement in detail. They must identify and document any unauthorized or incorrect transactions promptly. Reporting the issue to the card issuer is the next critical step.

Issuers generally require a written dispute within 60 days of the statement date. Submitting supporting evidence, such as receipts or communication records, strengthens the case. Federal laws like the Fair Credit Billing Act limit liability for unauthorized charges, often capping it at $50.

Using credit card reconciliation software can assist in detecting discrepancies early, helping users avoid prolonged disputes. Timely disputes trigger investigations by the issuer and may lead to reversing wrongful charges while protecting credit scores.

Preventive Measures and Security Tips

Implementing proper security measures is key to avoiding credit card abuse charges. Users should set strong, unique passwords and enable two-factor authentication on accounts linked to credit or debit cards.

Regular monitoring of accounts via online banking or reconciliation software helps detect suspicious activity quickly. Protecting physical cards, avoiding sharing card details casually, and being cautious with public Wi-Fi reduce exposure to theft.

Users should also notify their card issuer immediately if the card is lost, stolen, or compromised. Enrolling in transaction alerts by email or SMS can provide real-time updates and help spot fraudulent charges faster.

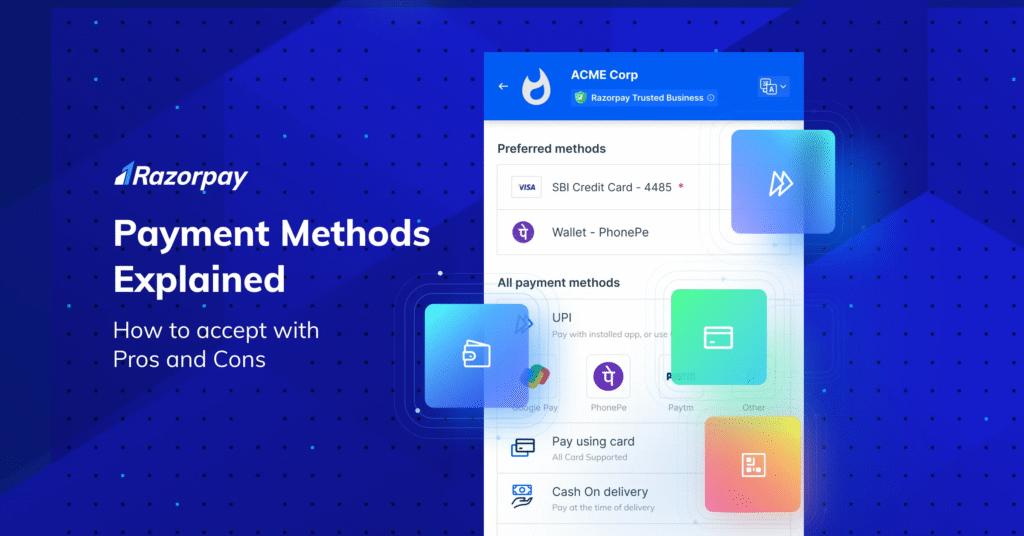

Credit Cards and Related Payment Solutions

Credit cards vary in features, security levels, and intended uses. Selecting the right card involves balancing protection against fraud, rewards, and credit limits suitable for specific spending needs. Different financial institutions offer specialized cards that cater to personal, business, or large purchases.

Choosing Secure Credit Cards

Security features are crucial when selecting any credit card. Cards with EMV chip technology reduce the risk of counterfeit fraud compared to magnetic stripe-only cards. Many issuers offer zero liability policies for unauthorized charges, limiting the cardholder’s responsibility if the card is stolen or compromised.

Additional protections include real-time alerts for transactions, virtual card numbers for online purchases, and robust authentication protocols. Aamco credit card users, for example, should verify their card includes these security measures. Consumers should also monitor statements regularly and report suspicious activity immediately to minimize losses.

Credit Union and Business Credit Cards

Credit union business credit cards often provide lower interest rates and fees compared to traditional bank cards. They may include rewards tailored for everyday business expenses like office supplies or travel. These cards usually have spending limits and features aligned with small to medium enterprises.

Business cards designed for credit unions typically offer detailed expense tracking tools and employee card controls. This enables better management of company finances while reducing misuse risks, a common concern with credit card abuse charges. Selecting a credit union business credit card requires considering reward structures and cardholder agreements carefully.

Using Credit Cards for Large Purchases

Large purchases demand thoughtful payment strategies to avoid financial strain or fraud risks. It is often advisable to use credit cards with high credit limits and purchase protection benefits such as extended warranties or dispute rights.

For medical procedures like LASIK, paying with a credit card can offer protections like chargeback options if services are unsatisfactory. However, cardholders should confirm that the card issuer supports such protections and weigh interest rates if the balance is not paid promptly. Planning payments can help minimize interest and maintain credit health.

Understanding Debit Card and Payment Alternatives

Debit cards come in various types with distinct features, each designed for specific uses and security levels. Users should understand how these cards function, their vulnerabilities, and the range of alternative payment methods available to protect their finances.

Debit Card Types and Features

There are several types of debit cards, including electronic debit cards, chip-enabled cards, and pinless debit cards. An electronic debit card requires an online authorization during transactions, while a chip-enabled card stores data securely on a microchip, improving protection against fraud.

US debit cards differ primarily between Visa debit and US debit, where Visa debit cards often allow global use with security protocols, but US debit cards may restrict international usage.

Some cards, such as the Bank of Bhutan international debit card, are designed specifically for cross-border transactions. Cards like the Shazam debit card operate on specialized networks for merchant processing.

Pins are generally required for most debit transactions, although pinless debit cards allow smaller purchases without entering a PIN, increasing convenience but sometimes reducing security. Users with poor credit may seek cards designed for rebuilding credit, related to queries like the debit card for bad credit crossword clue.

Security Concerns with Debit Cards

Debit cards carry inherent risks, including fraud and unauthorized use. Fraudsters can use stolen card details without the physical card by bypassing the PIN, a process known as bypassing pin on a debit card, leading to unauthorized charges.

Chip malfunctions on debit cards occasionally prevent transactions, potentially leaving users vulnerable if the fallback is less secure magnetic stripe use. Disputing unauthorized charges can differ between credit and debit cards due to the direct link to the user’s bank account.

Cardholders often wonder how someone could use their debit card without physically holding it. This typically involves data theft or phishing. Maintaining vigilance against such threats is critical.

Other concerns include understanding whether debit card transactions are treated as cash or accounts receivable, affecting how transaction disputes and reversals are handled. Some also question whether it’s acceptable to use a business debit card for personal use, which generally is discouraged due to financial tracking and tax complications.

Alternative Payment Methods

Users have multiple alternatives to debit cards for secure transactions. Digital wallets and mobile payment platforms, such as Apple Pay and Google Pay, offer tokenized transactions, reducing exposure of actual card numbers.

Prepaid debit cards provide a controlled spending limit, useful for budgeting or reducing risk of overdraft or fraud. Health Savings Account (HSA) debit cards allow access to medical funds, though some users ask if they can withdraw cash from these cards, which usually depends on the issuer’s policies.

Contactless payments increase convenience and speed but raise similar security questions. Other methods include credit cards, which often have better fraud protection and delayed billing, and electronic bank transfers, which avoid card networks entirely.

These alternatives provide layers of security and flexibility compared to traditional debit cards, allowing users to select the option best suited to their financial and security needs.

Relevant Payment-Related Topics

Payment plans, credit options, and specialized lending products play distinct roles in managing financial obligations. Understanding the terms, availability, and appropriate use of these tools can help individuals and businesses navigate complex payment scenarios effectively.

Credit and Payment Plans

Credit and payment plans provide structured repayment options to manage large or recurring expenses, such as orthodontist payment plans or root canal dentist Seattle payment plans. These plans often offer flexible terms, including low or zero interest over set periods, making costly procedures more accessible.

Automatic payment pools allow for seamless, scheduled deductions to prevent missed payments on credit cards or loans. Supernova payment systems can enhance automation and tracking, improving financial discipline. For tax obligations like Oregon estimated tax payments, installment plans reduce the burden of lump-sum payments.

Understanding the specific terms, fees, and penalties tied to each payment plan is essential. They vary by provider, type of services, and creditworthiness, so selecting a plan aligned with one’s financial situation is critical.

Business and Real Estate Lending Products

Business and real estate lending provide vital capital for growth, acquisition, or construction. Lines of credit such as TN bank business line of credit or unsecured business lines of credit offered by Coast Hill allow businesses to access funds as needed, generally with revolving terms.

Real estate options include home equity loans and home equity lines of credit (HELOC), distinguished by fixed or variable interest rates. These may be closed-end, like many home equity loans, or open-ended HELOCs with fluctuating rates, such as those in Wichita, KS or Virginia.

Specialized products, like guidance line of credit or construction line of credit, support targeted needs. For example, real estate lines of credit often fund home auctions or second-position home equity loans in Daly City. Terms and rates should be compared carefully to optimize financing costs.

Special Payment Situations and Solutions

Certain payment situations require tailored financial solutions. Automobile down payment assistance programs can help buyers manage upfront costs. Military personnel might encounter legacy issues like 5 Cent Military Payment Certificates, which have unique historical and legal considerations.

Social benefits such as the $1800 Social Security payment necessitate understanding timing and eligibility. Tax and estate professionals may advise on these to avoid penalties or delays.

Innovative solutions emerge for niche needs, such as root canal or orthodontic payment plans customized to patient affordability. Specialized tools, like automatic payment setups, minimize defaults in irregular income cases or during complex financial transitions.