Easiest Car to Lease with Bad Credit (2025 Guide)

Table of Contents

- Introduction

- Can You Lease a Car with Bad Credit?

- Credit Score Ranges and Leasing Eligibility

- Why Leasing May Be Easier Than Buying with Bad Credit

- Key Factors Leasing Companies Consider

- Easiest Car Brands to Lease with Bad Credit

- Best Car Models to Lease with Poor Credit (2025)

- How to Improve Your Lease Approval Chances

- Tips for Negotiating a Lease with Bad Credit

- Alternatives If You Can’t Lease

- Final Thoughts

- FAQs

1. Introduction

Leasing a car is often seen as a luxury for people with good credit. However, if you have a less-than-perfect credit score, leasing might still be possible — especially if you know which brands and models are more forgiving.

In this guide, we’ll explore the easiest cars to lease with bad credit in 2025 and provide tips to improve your chances of approval without breaking your budget.

2. Can You Lease a Car with Bad Credit?

Yes, you can lease a car with bad credit, but it won’t be as straightforward. Leasing companies often look for credit scores above 620, but many will still consider applicants in the 500s, especially with larger down payments or co-signers.

Most importantly, leasing decisions aren’t based on credit scores alone — your income, payment history, and employment stability also play key roles.

3. Credit Score Ranges and Leasing Eligibility

Here’s how credit score ranges affect leasing options:

| Credit Score | Rating | Lease Eligibility |

|---|---|---|

| 750+ | Excellent | Easy approval and best rates |

| 700–749 | Good | Strong approval odds, competitive rates |

| 620–699 | Fair | Likely approved with average terms |

| 580–619 | Poor | Higher down payment or co-signer may be needed |

| Below 580 | Very Poor/Bad | Challenging, but some subprime leasing is possible |

4. Why Leasing May Be Easier Than Buying with Bad Credit

Many assume buying is the better option with bad credit. But leasing may actually offer advantages:

- Lower monthly payments

- Shorter terms (24–36 months)

- Access to newer, more reliable vehicles

- Some dealerships offer special lease programs for subprime credit

However, leasing companies still need assurance you’ll pay on time — so income verification and past payment records are crucial.

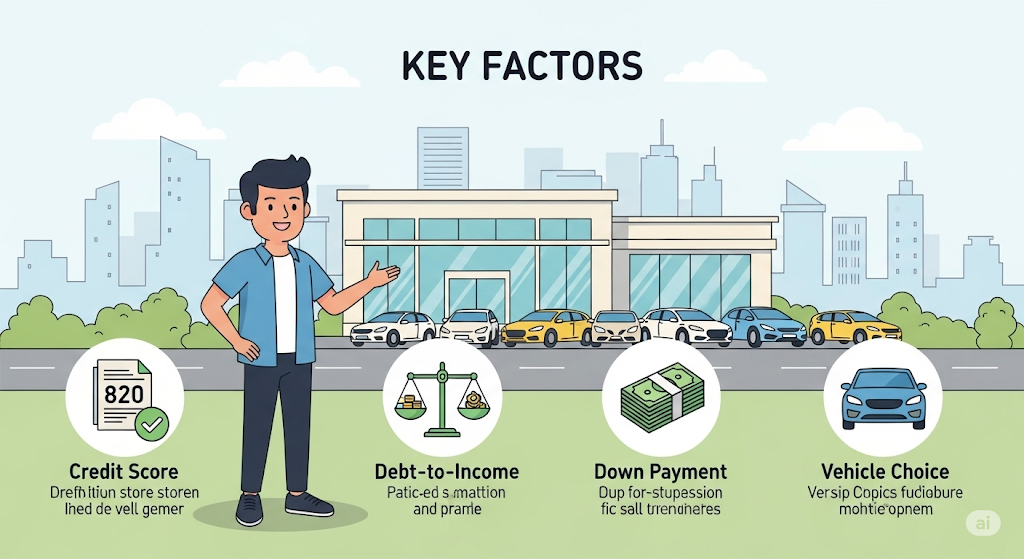

5. Key Factors Leasing Companies Consider

Leasing isn’t only about your credit score. Dealers and leasing agents also evaluate:

- Stable income (W-2s, pay stubs, bank statements)

- Debt-to-income ratio

- Down payment ability

- Job stability

- Rental/mortgage payment history

- Open bankruptcies or repossessions

Some leasing companies even allow “soft pull” pre-approvals, which don’t affect your credit score.

6. Easiest Car Brands to Lease with Bad Credit

Some automakers have more lenient in-house financing options or stronger relationships with subprime lenders.

Top Brands That Offer Flexible Leasing:

- Kia – Known for leasing affordable models like the Forte and Soul.

- Hyundai – Offers generous warranty and leasing programs.

- Nissan – Frequently runs specials for lower credit score brackets.

- Chevrolet – Particularly helpful through GM Financial.

- Ford – Some dealerships offer in-house or bad-credit lease programs.

- Toyota – While more selective, they sometimes allow leases for mid-600 scores with solid income.

7. Best Car Models to Lease with Poor Credit (2025)

These models offer a combination of affordability, reliability, and lower leasing thresholds:

| Car Model | Why It’s Easy to Lease |

|---|---|

| Kia Forte | Low MSRP, forgiving credit terms, compact & fuel-efficient |

| Hyundai Elantra | Affordable lease rates, safety features, and a long warranty |

| Nissan Sentra | Widely available, modest upfront costs |

| Chevrolet Malibu | Midsize comfort at compact pricing — good deals via GM Financial |

| Toyota Corolla | Reliable with high resale value — easier for some lenders to approve |

| Ford Escape | SUV option often offered with low down payment lease options |

8. How to Improve Your Lease Approval Chances

Even with bad credit, you can take steps to increase your chances:

1. Save for a Bigger Down Payment

Putting down 10–20% shows commitment and lowers your monthly obligation.

2. Bring a Co-Signer

A co-signer with good credit can instantly boost your approval odds.

3. Choose Less Expensive Cars

Leasing an economy vehicle reduces the risk for the dealership.

4. Get Pre-Approved by Subprime Lenders

Work with banks or credit unions that cater to bad credit customers.

5. Provide Proof of Income

Stable employment and consistent income go a long way.

6. Fix Errors in Your Credit Report

Check your credit report at annualcreditreport.com and dispute any mistakes.

9. Tips for Negotiating a Lease with Bad Credit

- Don’t lead with your credit score: Focus on income and payment history.

- Ask about in-house financing: Some dealerships offer “buy-here-pay-here” leases.

- Negotiate mileage limits and fees: Avoid surprises later.

- Be ready to walk away: Some offers are predatory — don’t take sky-high interest or hidden fees.

- Get all terms in writing: Understand early termination, maintenance, and buyout costs.

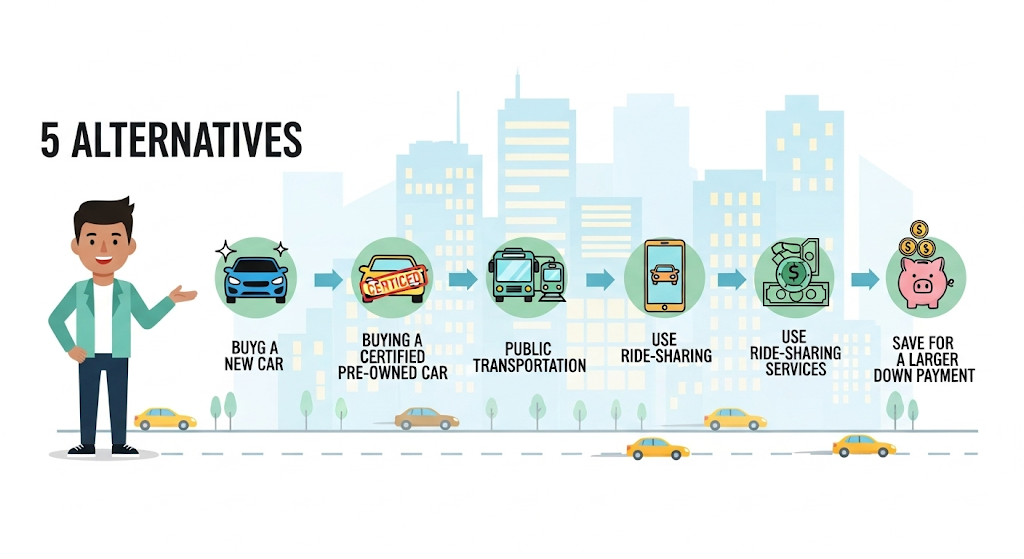

10. Alternatives If You Can’t Lease

If leasing is not an option due to bad credit, consider:

- Certified Pre-Owned (CPO) Financing: Often easier to get approved than a lease.

- Car Subscription Services: Monthly fee includes maintenance, insurance, and flexibility.

- Rent-to-Own Auto Programs: High fees, but no credit check.

- Buying with a Subprime Loan: May cost more over time but easier to get approved.

- Paying Cash for a Used Vehicle: Avoid credit checks altogether.

11. Final Thoughts

Leasing a car with bad credit is challenging but possible. The key is knowing which vehicles and brands are easiest to lease, preparing your finances ahead of time, and being ready to negotiate. Affordable models like the Kia Forte, Hyundai Elantra, and Nissan Sentra are great starting points.

With patience, preparation, and the right approach, you can drive away in a new vehicle even if your credit isn’t perfect.

12. FAQs

1. Can I lease a car with a 500 credit score?

Yes, though it’s difficult. You may need a co-signer or larger down payment.

2. Is leasing better than buying with bad credit?

Leasing can offer lower monthly payments, but buying builds equity. It depends on your long-term needs.

3. Do I need a job to lease a car?

Yes, proof of stable income is crucial.

4. How much should I put down to lease with bad credit?

Aim for 10–20% of the car’s value or $2,000–$3,000 minimum.

5. Can a co-signer help me lease a car?

Absolutely. A co-signer with good credit can make leasing far easier.

6. Which leasing company is best for bad credit?

GM Financial, Ford Credit, and some dealership-specific programs cater to subprime borrowers.

7. What’s the easiest car brand to lease with bad credit?

Kia and Hyundai often offer the most flexible options.

8. Does leasing help build credit?

Yes, if your lease is reported and you make on-time payments.

9. Can I get out of a lease early if needed?

Yes, but early termination fees apply unless you transfer the lease.

10. Is it better to lease or use a car subscription with bad credit?

Car subscriptions don’t check credit but may cost more monthly. Leasing is better for long-term use.