Table of Contents

- Introduction

- What Are CD Rates and Why Do They Matter?

- Overview of Farmers and Merchants Bank

- Types of CDs Offered by Farmers and Merchants Bank

- Farmers and Merchants Bank CD Rates (2025 Update)

- How F&M CD Rates Compare to Competitors

- Pros and Cons of Investing in CDs with F&M

- How to Open a CD at Farmers and Merchants Bank

- Strategies to Maximize Your CD Investment

- Common FAQs About F&M Bank CD Rates

- Conclusion

1. Introduction

In an age of financial uncertainty, Certificates of Deposit (CDs) offer a secure and predictable way to grow your savings. One bank that has consistently provided trustworthy CD options is Farmers and Merchants Bank (F&M). With competitive interest rates and flexible terms, many conservative investors turn to F&M CDs for financial security.

In this comprehensive guide, we will explore Farmers and Merchants Bank CD rates in 2025, break down your options, and help you determine if these savings tools are right for your investment portfolio.

2. What Are CD Rates and Why Do They Matter?

CDs, or Certificates of Deposit, are fixed-term deposit accounts that pay interest on a lump sum of money over a specified period. The main features of a CD include:

- Fixed interest rate

- Locked-in term (anywhere from 3 months to 5 years or more)

- Penalty for early withdrawal

Why CD Rates Matter

- Higher Yields Than Savings Accounts: Especially when the Fed raises interest rates.

- Guaranteed Returns: Unlike stocks or mutual funds, CDs are low risk.

- Financial Planning Tool: Useful for short-to-medium term goals (e.g., down payment, college fund).

3. Overview of Farmers and Merchants Bank

Farmers and Merchants Bank (F&M), founded in 1907, has deep roots in local communities throughout California and beyond. Known for conservative banking practices and customer trust, it offers personal and business banking solutions, including:

- Checking and savings accounts

- Home loans and commercial lending

- Retirement accounts

- Certificate of Deposit accounts

F&M has retained strong financial ratings, including an A+ from BBB and multiple years of recognition from BauerFinancial for being one of the safest banks in the U.S.

4. Types of CDs Offered by Farmers and Merchants Bank

Farmers and Merchants Bank offers various CD products to meet different savings goals. As of 2025, the following are common types:

A. Standard CDs

- Terms: 3 months to 60 months

- Minimum deposit: $1,000

- Interest: Fixed for the entire term

B. Jumbo CDs

- Minimum deposit: $100,000

- Higher interest rates

- Customizable terms

C. IRA CDs

- Combine the security of CDs with tax advantages

- Best for long-term retirement planning

D. Promotional CDs

Occasionally, F&M offers limited-time promotional rates on certain term lengths (e.g., 13-month or 25-month CDs) that beat national averages.

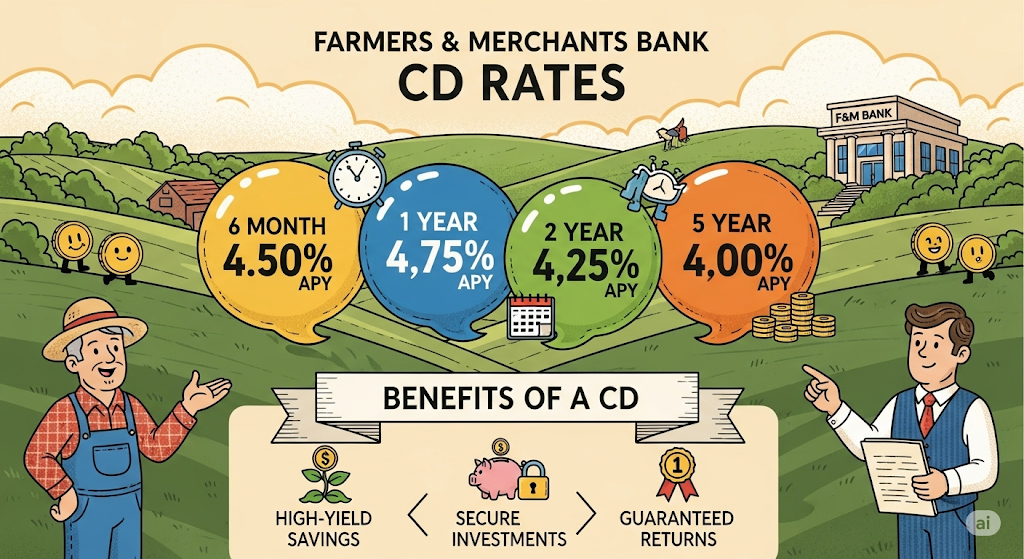

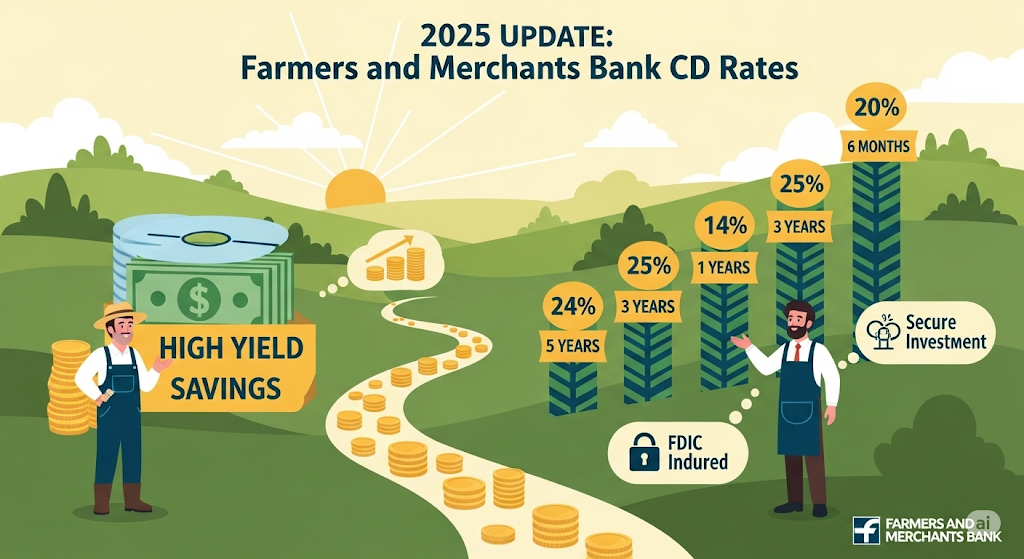

5. Farmers and Merchants Bank CD Rates (2025 Update)

As of July 2025, the following are indicative CD rates from Farmers and Merchants Bank (rates may vary by location and branch):

| Term Length | Interest Rate (APY) | Minimum Deposit |

|---|---|---|

| 3 months | 4.05% | $1,000 |

| 6 months | 4.25% | $1,000 |

| 12 months | 4.40% | $1,000 |

| 24 months | 4.55% | $1,000 |

| 36 months | 4.60% | $1,000 |

| 60 months | 4.70% | $1,000 |

Jumbo CDs offer rates 0.10%–0.20% higher.

Note: Always call your local branch or visit the official site to confirm the current CD rates.

6. How F&M CD Rates Compare to Competitors

Let’s compare F&M Bank to other popular institutions:

| Bank Name | 12-Month CD APY | 60-Month CD APY | Minimum Deposit |

|---|---|---|---|

| Farmers & Merchants Bank | 4.40% | 4.70% | $1,000 |

| Chase Bank | 3.00% | 3.50% | $1,000 |

| Wells Fargo | 3.25% | 3.80% | $2,500 |

| Ally Bank (Online) | 4.35% | 4.60% | No minimum |

| Capital One | 4.30% | 4.50% | $0 |

F&M Bank performs above average, especially for local branches offering strong community relationships and personalized service.

7. Pros and Cons of Investing in CDs with F&M

✅ Pros

- High Fixed Interest Rates

- Safe and FDIC-Insured (up to $250,000)

- Reliable Customer Service

- Good Reputation in California

- Options for IRA & Jumbo CDs

❌ Cons

- Limited Online Tools

- May Not Have Nationwide Access

- Early Withdrawal Penalties

- Minimum deposit required

8. How to Open a CD at Farmers and Merchants Bank

You can open a CD in just a few steps:

Step-by-Step Guide:

- Visit a Local Branch: F&M emphasizes in-person service.

- Choose a Term: Based on your savings timeline.

- Make Your Deposit: Minimum of $1,000 for standard CDs.

- Lock in Your Rate: Your interest rate is fixed.

- Receive Confirmation: You’ll receive documentation with all terms.

Tip:

If you’re unsure which CD to pick, speak to a banking advisor at F&M for personalized suggestions.

9. Strategies to Maximize Your CD Investment

A. CD Laddering

Spread your investment across multiple CDs with different maturity dates. This way, you maintain liquidity while earning better returns over time.

Example:

- $2,000 in 1-year CD

- $2,000 in 2-year CD

- $2,000 in 3-year CD

- $2,000 in 4-year CD

- $2,000 in 5-year CD

Each year, a CD matures, and you can either cash out or reinvest at a new, higher rate.

B. Combine with Other Accounts

Use F&M CDs alongside high-yield savings accounts for emergency access + fixed returns.

C. Jumbo CD Bonuses

If you have over $100,000 to invest, opt for Jumbo CDs for better yields and possibly negotiated rates.

10. Common FAQs About F&M Bank CD Rates

Q1. Are CD rates at F&M better than national banks?

Yes, especially for longer terms and Jumbo CDs.

Q2. Can I open an F&M CD online?

In most cases, you must visit a branch to complete the process.

Q3. What is the penalty for early withdrawal?

Typically:

- 90 days interest for terms under 1 year

- 180 days interest for terms 1+ years

Exact details are in your CD agreement.

Q4. Can I use a CD in my retirement plan?

Yes! IRA CDs are available at F&M and offer tax advantages.

Q5. Are CD rates fixed?

Yes. Once opened, the rate is locked in until maturity.

Q6. Is my money safe in a CD?

Yes. F&M CDs are FDIC insured up to $250,000 per depositor.

Q7. When should I choose a CD over a savings account?

- If you don’t need immediate access to funds

- If you want higher, fixed returns

- If you’re saving for a goal in 6–60 months

11. Conclusion

Farmers and Merchants Bank CD rates in 2025 are an attractive option for conservative savers and investors looking for fixed, secure growth. Whether you’re saving for a home, college, retirement, or simply building wealth, F&M offers CD products tailored to your timeline and financial goals.

With competitive interest rates, low-risk investment options, and a solid reputation, Farmers and Merchants Bank continues to be a reliable choice for CD investments.

If you’re ready to grow your money the smart way, consider speaking with a representative at your nearest F&M Bank branch and ask about their latest CD offers.