Farmers Bank Home Equity Loan & HELOC

Table of Contents

- What Are Home Equity Loans & HELOCs?

- Overview of Farmers Bank Home Equity Products

- Current Rates & Key Terms (2025)

- Eligibility & Requirements

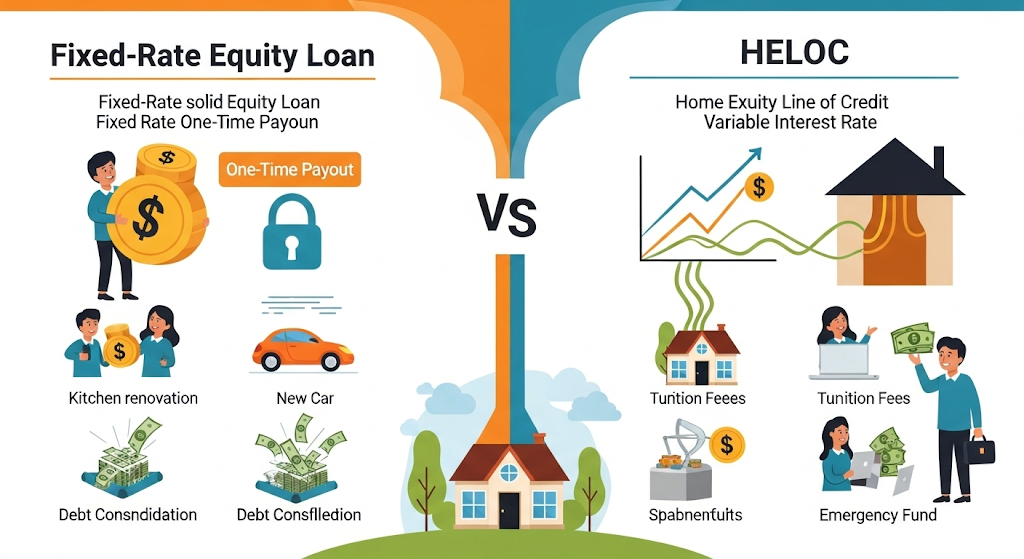

- Fixed‑Rate vs HELOC: Which Is Better for You?

- Popular Use Cases & Financial Benefits

- Pros & Cons of Farmers Bank Home Equity Products

- How to Apply & What to Expect

- Tips to Maximize Your Equity Loan

- FAQs

- Conclusion

1. What Are Home Equity Loans & HELOCs

Home Equity Loan (Fixed)

- A second mortgage: a one-time lump sum secured by your home’s equity.

- Offers fixed interest rates and fixed monthly payments.

HELOC (Home Equity Line of Credit)

- Works like a revolving credit line against your home’s equity.

- You borrow as needed, and interest accrues only on what you draw.

- Flexible draw period followed by a longer repayment phase.

These products generally offer lower rates than personal loans or credit cards and can be used for functions like renovations, debt consolidation, or emergencies.

2. Overview of Farmers Bank Home Equity Products

Farmers & Merchants State Bank (F&M Bank)

- Offers both HELOC and fixed equity loan options.

- HELOC features include flexible, revolving credit, tax-deductible interest, and local decision-making

- Fixed Home Equity Loans provide lump-sum funds with a predictable payment schedule and optional no closing cost promotions.

3. Current Rates & Key Terms (2025)

HELOC Options

- 5.50% introductory APR (6-month fixed) for loans ≥ $25,000, credit score ≥ 720; variable rate thereafter based on Prime (max 20%, min 4%)

- 6.50% introductory APR (5-year fixed) for qualifying borrowers; repayment then switches to Prime + 1.00%–1.75%.

- Borrow up to 85% of your home’s equity, with no closing costs up to $250,000 (loan origination fee ~$300).

Fixed Installment Loans

- Available as 10-, 15-, or 20-year fixed rate loans.

- Borrow up to 85% LTV, with consistent monthly payments.

- .25% rate discount for setting up automatic payments via bank checking account.

4. Eligibility & Requirements

- Minimum credit score: usually 720 (some lenders may accept 760 or higher for best rates).

- Minimum loan amount: $25,000 in new money or line increase for HELOC promotions.

- Maximum LTV: up to 85% of your home’s equity.

- Property type: owner-occupied single-family homes (investment properties typically ineligible) .

- Closing costs: typically waived up to $250 K loans, title insurance and origination fees may apply for larger amounts.

5. Fixed‑Rate Equity Loan vs HELOC

| Feature | Fixed Equity Loan | HELOC |

|---|---|---|

| Disbursement | Lump sum | Flexible draw period |

| Interest Rate | Fixed for life | Intro APR fixed, then variable |

| Payments | Amortized, fixed monthly | Interest-only during draw period |

| Rates & Fees | Lower closing cost options, discount for autopay | Loan origination fee (~$300), annual fee $60 after one year |

| Repayment Period | Tenures of 10–20 years | 120 months draw, then 240 months repayment |

Choose a fixed loan if you want stability and long-term planning. Choose HELOC if you need flexibility or anticipate variable usage over time.

6. Popular Use Cases & Benefits

- Home renovations: Improve your home and increase its value.

- Debt consolidation: Replace high-interest debt with a lower-cost option.

- College tuition or medical bills: Access funds with structured repayment.

- Emergency buffer: Keep credit available for unexpected events.

- Potential tax benefits: Interest may be deductible—consult your tax advisor.

7. Pros & Cons of Farmers Bank Home Equity Options

✅ Pros

- Competitive introductory rates and discounts for autopay.

- Borrow up to 85% LTV.

- No closing costs for smaller loan amounts.

- Local decision-making and personalized customer service.

- Tax-deductible interest (consult a tax professional).

❌ Cons

- Minimum loan requirement ($25,000 problem).

- Variable rates after promo periods.

- Annual fees ($60 after first year) and early termination penalties ($400 if closed within first 3 years) for HELOC.

- Not available for investment properties or second homes.

8. How to Apply & What to Expect

Preparation

- Gather documentation: pay stubs, tax returns, proof of insurance, mortgage statements.

- Consider your desired loan type and amount.

- Ensure you have adequate home equity.

Application Steps

- Visit a local Farmers Bank branch or start the online application.

- Submit documentation and authorize appraisal/title.

- Lock in your introductory rate by setting up autopay with their checking account.

- Understand terms: draw period, repayment schedule, fees, and caps.

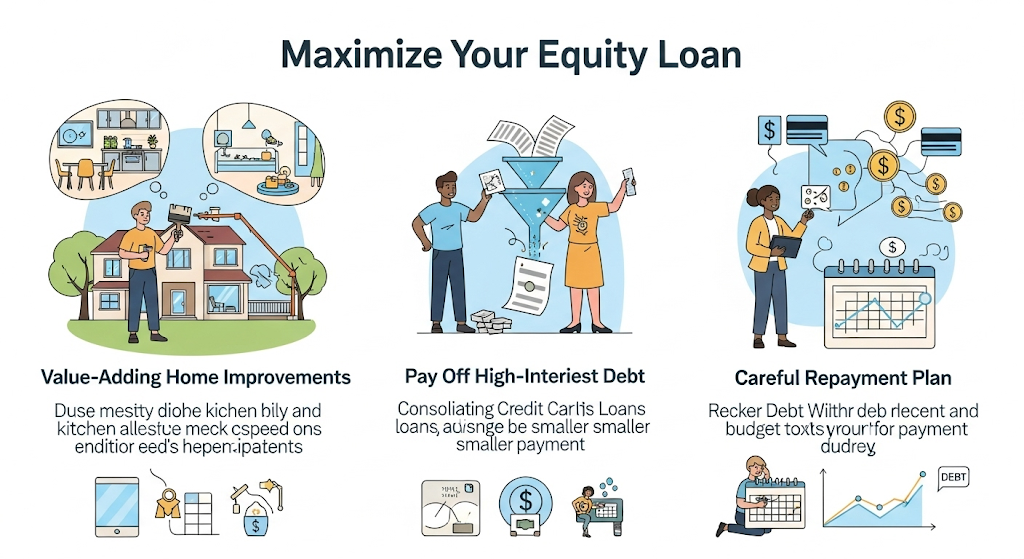

9. Tips to Maximize Your Equity Loan

- Opt for fixed interest loan if you want predictability.

- Use HELOC with discipline: borrow only what you need and repay quickly.

- Avoid closing the HELOC within 3 years to avoid termination penalties.

- Maintain autopay for rate discounts and waived fees.

- Consider a CD ladder strategy if you want better yield on spare funds before tying them up.

10. FAQs

- What’s the difference between home equity loan and HELOC?

→ Loan = lump sum with fixed rate; HELOC = revolving credit with variable rates. - How much equity can I borrow?

→ Up to 85% of your home’s value minus current mortgage balances. - What credit score do I need?

→ Typically 720+ for promotional rates; higher scores may qualify for better pricing. - Is interest tax-deductible?

→ Often yes—borrowers must consult a tax advisor based on how funds are used. - What fees apply?

→ $300 origination fee (F&M), annual fee ~$60 after first year, $400 pre-payment penalty if HELOC closed before 3 years. - Can I repay early?

→ For fixed loans, yes without penalty. For HELOC, avoid closing early to escape penalties. - Is it right for all homeowners?

→ Best suited for emergency funding, home improvements, or debt consolidation. Not ideal for short-term smaller needs.

11. Conclusion

Farmers Bank’s home equity offerings—whether a fixed installment loan or HELOC—provide flexibility, competitive rates, and local support ideal for homeowners seeking structured credit. With attractive introductory APRs, favorable loan-to-value ratios, and relatively low fees, these products can help finance renovations, debt payoff, and more.

If you’re considering leveraging your home equity in 2025, contact your local Farmers Bank branch to learn more or apply. Be sure to review all terms carefully—and determine whether fixed or revolving credit best suits your financial needs.