Table of Contents

- Introduction

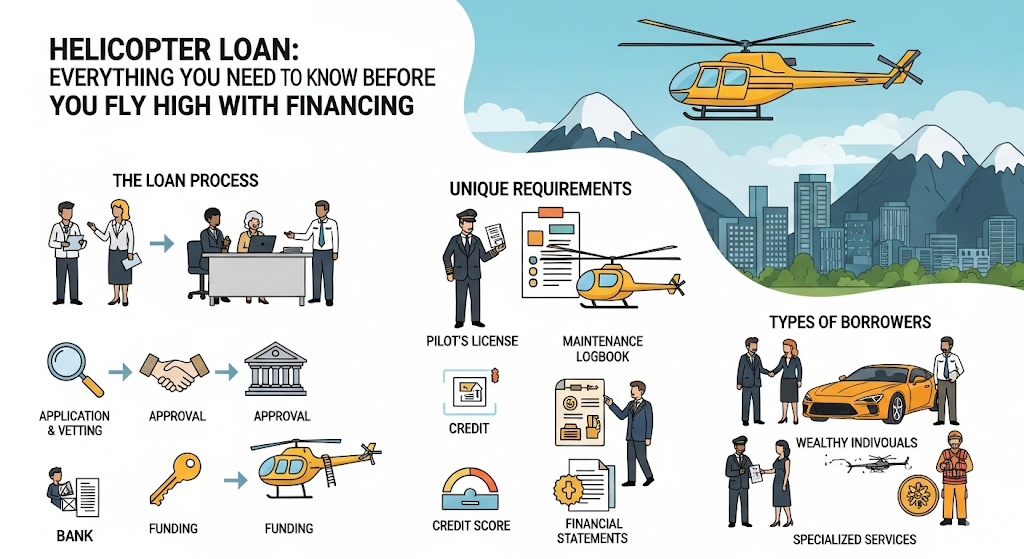

- What is a Helicopter Loan?

- Who Takes Helicopter Loans?

- Types of Helicopters You Can Finance

- How Helicopter Loans Work

- Eligibility Criteria

- Documents Required

- Helicopter Loan Interest Rates & Terms

- Secured vs. Unsecured Helicopter Loans

- Down Payment Requirements

- Top Helicopter Financing Companies

- Steps to Apply for a Helicopter Loan

- Pros and Cons

- Leasing vs. Buying with a Loan

- Maintenance and Operating Costs

- Tax Implications

- Refinancing a Helicopter Loan

- Common Mistakes to Avoid

- FAQs on Helicopter Loans

- Conclusion

1. Introduction

Helicopters are no longer just for military or billionaires. With increased availability and varied models, private individuals, corporations, medical institutions, and law enforcement agencies are increasingly turning to helicopters for both leisure and work purposes.

However, helicopters come with a hefty price tag. That’s where helicopter loans come into play. In this comprehensive guide, we’ll walk you through the nuances of helicopter financing — from eligibility to hidden costs — so you can soar through your purchase without turbulence.

2. What is a Helicopter Loan?

A helicopter loan is a specialized aviation financing product designed to help individuals or organizations purchase a helicopter. Similar to auto or boat loans, these loans are typically secured by the helicopter itself and can range from $100,000 to several million dollars, depending on the model and condition.

3. Who Takes Helicopter Loans?

Helicopter loans are used by:

- Private individuals for personal travel or recreation

- Corporations for executive travel

- Medical services (e.g., air ambulances)

- News agencies for aerial coverage

- Law enforcement and emergency services

- Charter services and tourism companies

4. Types of Helicopters You Can Finance

You can get financing for:

- New or used helicopters

- Piston or turbine helicopters

- Single-engine or twin-engine

- Models from brands like:

- Bell

- Airbus Helicopters

- Robinson

- Leonardo

- Sikorsky

5. How Helicopter Loans Work

Helicopter loans function similarly to equipment loans or aircraft loans. A lender provides funds upfront, which you repay in monthly installments over 5–20 years.

- Loan-to-Value (LTV): Usually 70–90%

- Terms: 5 to 20 years

- Collateral: The helicopter itself

- Insurance requirement: Mandatory

6. Eligibility Criteria

While each lender has their own policies, common eligibility includes:

- Minimum age: 21+

- Stable income or business revenue

- Good to excellent credit score (650+ preferred)

- Down payment capacity

- Valid FAA (or regional) pilot certificate for private use

For business borrowers:

- Business registration documents

- Financial statements

- Usage justification (tourism, transport, emergency, etc.)

7. Documents Required

To apply, you’ll likely need:

- Identity and address proof

- Tax returns (2–3 years)

- Bank statements

- Business financials (for commercial borrowers)

- Helicopter purchase agreement

- Appraisal and inspection report

8. Helicopter Loan Interest Rates & Terms

Interest rates for helicopter loans typically range from 5% to 12%, depending on the lender, loan term, and your financial profile.

Typical Terms:

| Factor | Range |

|---|---|

| Loan Amount | $100,000 to $10M+ |

| Interest Rate | 5% to 12% APR |

| Loan Tenure | 5 – 20 years |

| Processing Fee | 1% – 3% |

| Down Payment | 10% – 30% |

9. Secured vs. Unsecured Helicopter Loans

- Secured Loans: Backed by the helicopter. Lower interest rates.

- Unsecured Loans: No collateral. Higher rates, usually reserved for excellent credit borrowers or small loan amounts.

10. Down Payment Requirements

Most lenders expect a down payment of 10% to 30% of the total cost.

For example:

- Helicopter price: $800,000

- Down payment @ 20%: $160,000

- Loan amount: $640,000

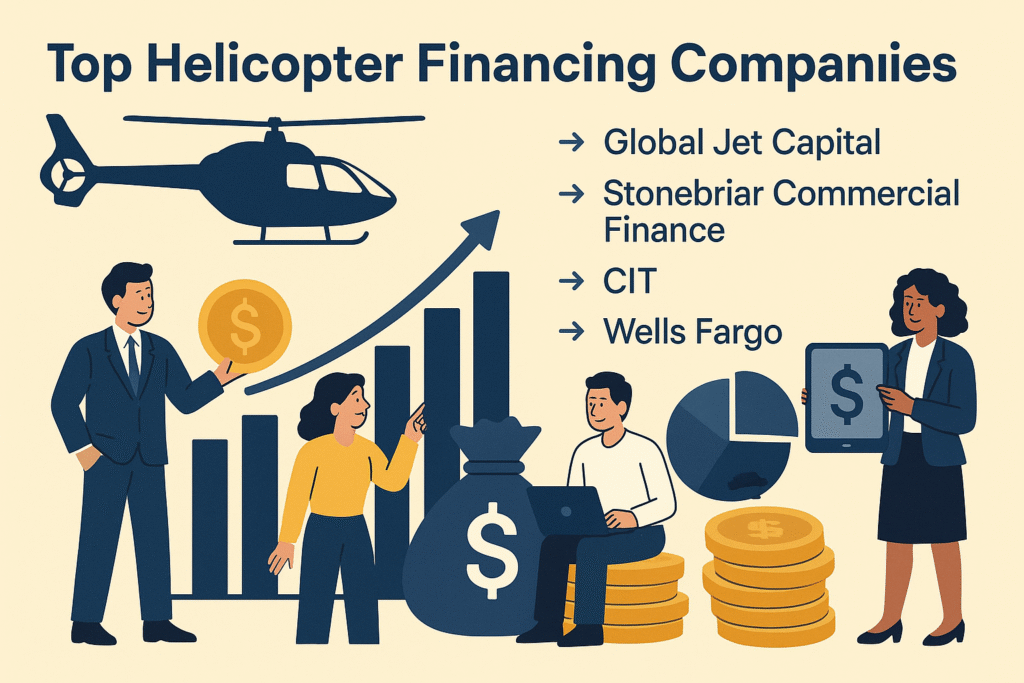

11. Top Helicopter Financing Companies

Some top lenders that offer helicopter financing include:

- AirFleet Capital

- AOPA Finance

- Wells Fargo Equipment Finance

- Aircraft Finance Corporation

- Global Jet Capital

- Private banks and HNW lenders

12. Steps to Apply for a Helicopter Loan

- Choose a helicopter model

- Get an appraisal

- Shortlist lenders

- Submit documents and loan application

- Undergo financial evaluation

- Receive approval and sign loan terms

- Disbursement and ownership transfer

- Start monthly repayments

13. Pros and Cons

Pros

- Makes helicopter ownership accessible

- Spreads cost over time

- Fixed interest rates provide predictability

- Preserves cash flow for businesses

Cons

- Requires high creditworthiness

- High maintenance and insurance costs

- Possible depreciation

- Helicopter may be repossessed if payments default

14. Leasing vs. Buying with a Loan

| Factor | Leasing | Buying (Loan) |

|---|---|---|

| Ownership | Lessor owns | You own |

| Upfront Cost | Lower | Higher (due to down payment) |

| Customization | Limited | Full control |

| Equity | None | Build asset over time |

15. Maintenance and Operating Costs

Owning a helicopter involves more than just loan payments. Expect additional annual expenses such as:

- Maintenance: $50,000–$100,000+

- Insurance: $15,000–$50,000+

- Fuel & hangar: Variable

- Pilot (if hired): $75,000+ per year

16. Tax Implications

In many countries, helicopter purchases can be written off as:

- Business expenses

- Depreciation (MACRS in the US)

- Section 179 deduction (US)

- Sales tax exemptions (for interstate or business use)

Always consult a tax advisor to explore aviation tax benefits.

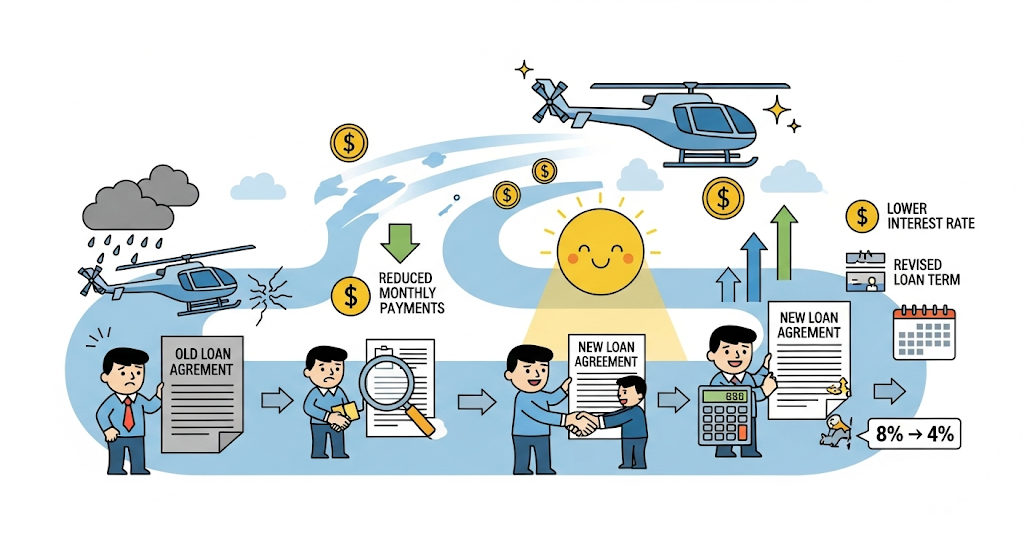

17. Refinancing a Helicopter Loan

Refinancing lets you:

- Lower your monthly payments

- Reduce interest rates

- Adjust the tenure

- Get cash out (in some cases)

This may be ideal if rates have dropped or your credit has improved since the original loan.

18. Common Mistakes to Avoid

- Underestimating operating costs

- Not getting the helicopter professionally inspected

- Choosing the wrong loan term

- Ignoring insurance coverage

- Not comparing multiple lenders

19. FAQs on Helicopter Loans

Q1. Can I get a helicopter loan with bad credit?

A: It’s difficult. You may need a co-signer, larger down payment, or higher interest rates.

Q2. Is insurance mandatory?

Yes. Comprehensive helicopter insurance is usually required by lenders.

Q3. Can I buy a used helicopter with a loan?

Yes, many lenders finance both new and used helicopters.

Q4. Are interest payments tax deductible?

If used for business, interest payments may be deductible. Always consult a CPA.

Q5. What happens if I default?

The lender can repossess the helicopter and report it to credit agencies.

20. Conclusion

A helicopter loan can turn the dream of owning your own aircraft into a reality—whether you’re flying for business, adventure, or emergency services. But it’s a serious financial commitment that demands thorough planning.

By understanding the ins and outs of helicopter loans—from eligibility to taxes—you’ll be better equipped to take off with confidence.

Before you fly high, ground yourself with the right financial knowledge. Compare lenders, ask the right questions, and make informed decisions that keep your dreams—and your finances—soaring.