Heloc Rates Wichita KS Updated Trends

Home Equity Line of Credit (HELOC) rates in Wichita, KS, vary depending on the lender, loan terms, and borrower qualifications. Currently, many lenders offer competitive variable rates, often based on an 80% loan-to-value ratio, making HELOCs accessible for homeowners looking to leverage their home equity for remodeling, debt consolidation, or other expenses.

Lenders in Wichita, including local banks and credit unions, typically provide flexible repayment options with an initial interest-only period followed by a set repayment term. Borrowers should compare rates and terms carefully, as small differences in APR or loan structure can significantly impact the overall cost.

Understanding Wichita’s HELOC market helps homeowners make informed decisions quickly. Factors like introductory rates, loan limits, and credit requirements play key roles in selecting the most advantageous option for their financial goals.

Understanding HELOCs in Wichita, KS

Homeowners in Wichita often explore HELOCs to access their home’s equity with flexible borrowing options and variable interest rates. These loans serve specific financial needs and differ significantly from traditional home equity loans.

What Is a HELOC

A Home Equity Line of Credit (HELOC) allows borrowers to tap into the equity of their home as a revolving credit line. Unlike a lump sum loan, it works like a credit card: borrowers can draw funds up to a set limit during the draw period.

HELOC interest rates in Wichita typically vary with market conditions, often tied to the Prime Rate. Rates may start around 8.00%, adjusting over time based on creditworthiness and lender policies.

Borrowers repay only what they use, making it flexible for varying expenses. The line resets after the draw period, shifting to a repayment phase where borrowing stops and balance is paid off.d off.

How HELOCs Differ From Home Equity Loans

HELOCs differ from home equity loans mainly in structure and payment terms. A home equity loan gives a fixed lump sum upfront with a fixed interest rate and set monthly payments.

In contrast, a HELOC offers a variable interest rate and allows funds to be drawn as needed over several years. This flexibility benefits borrowers who want to manage cash flow or plan multiple expenses.

In Wichita, home equity loans often hold a second position on your mortgage lien. HELOCs are also considered second liens but allow ongoing access to funds, unlike one-time distribution of home equity loans.

Typical Uses and Benefits for Wichita Homeowners

Wichita homeowners commonly use HELOCs for home improvements, debt consolidation, or emergency expenses. The variable rate and flexible draw period enable manageable repayments suited to fluctuating costs.

Benefits include:

- Lower initial rates compared to personal loans or credit cards

- Tax-deductible interest if funds are used for home improvements (subject to IRS rules)

- Access to sizable funds without refinancing the primary mortgage

Lenders in Wichita, such as Equity Bank and Credit Union of America, offer competitive HELOC rates and terms catering to local market conditions. This makes HELOCs a practical tool for residents needing a reliable real estate line of credit.

Current HELOC Rates in Wichita, KS

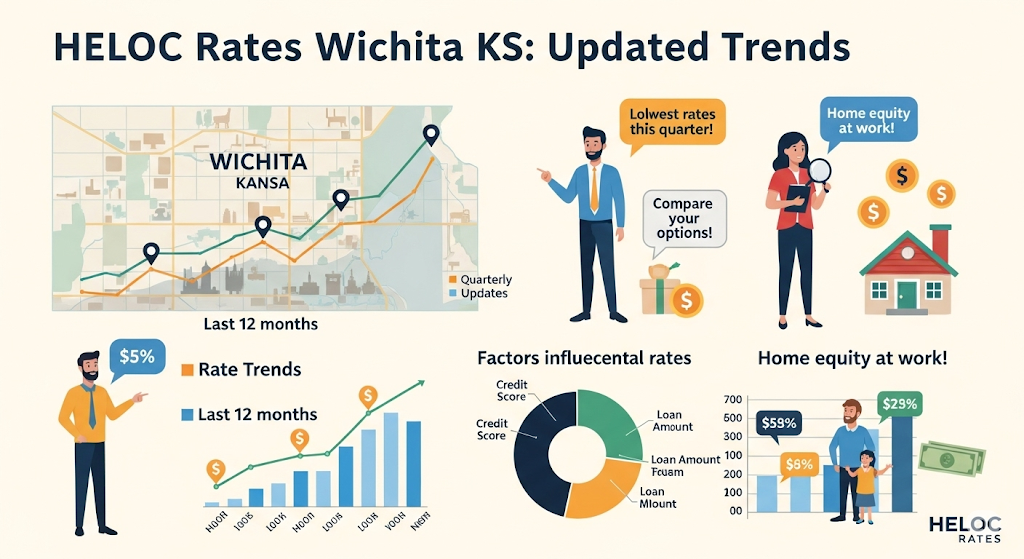

HELOC rates in Wichita, KS, fluctuate based on economic conditions, lender policies, and borrower qualifications. This section breaks down recent trends, compares offers from local lenders, and provides insights into the expected rate movements throughout 2025.

Rate Trends and Influencing Factors

HELOC rates in Wichita typically align with broader market trends influenced by the Federal Reserve’s interest rates and inflation data. Currently, rates vary around 6% to 8%, depending on credit score, loan-to-value ratio, and whether the lender offers promotional rates.

Inflation and economic growth in Kansas also impact these rates. Rising inflation tends to push rates higher as lenders adjust to maintain profitability. Borrowers with strong credit profiles typically secure the lowest rates. Seasonal demand influences rate fluctuations; rates may be more competitive during slower home buying seasons.

Comparing Local Lender Offers

Local lenders in Wichita, such as Equity Bank, Credit Union of America, and Heartland Credit Union, offer diverse HELOC products. Rates often differ by a half to a full percentage point based on fees, repayment flexibility, and customer service reputation.

Key comparison factors include:

- Introductory rates: Some banks offer 0.99% to 3.99% initially, which then adjusts after 6-12 months.

- Annual fees and closing costs: These can add hundreds to your overall cost.

- Draw period length: Often 5-7 years, influencing monthly payments.

Borrowers should evaluate total costs, not just headline rates, to find the best deal.

Rate Forecast for 2025

Economic forecasts suggest relatively stable but slightly rising HELOC rates in Wichita through 2025. The Federal Reserve is expected to hold steady or make minor rate hikes aimed at controlling inflation without stalling growth.

Experts predict rates may increase by 0.25% to 0.5% over the year. Borrowers planning home equity loans in Virginia or other states should monitor local economic shifts as regional differences can affect rates. Locking in rates early or seeking lenders with rate caps can reduce risk over time.

How HELOC Rates Are Determined

HELOC rates in Wichita, KS, depend on several financial factors tied to the borrower’s credit profile and loan specifics. Understanding these components helps homeowners anticipate their borrowing costs, whether for a guidance line of credit or a construction line of credit.

Credit Score Impact

A borrower’s credit score significantly influences the HELOC rate offered. Higher scores usually lead to lower interest rates because lenders view these applicants as lower risk. Scores above 700 often qualify for the most competitive rates, while those below may face higher APRs or stricter loan terms.

Lenders consider credit history, including payment punctuality and prevailing debts. This assessment helps determine risk and sets the initial pricing. In Wichita, borrowers should aim to improve their credit score before applying to secure better rates and reduce overall borrowing costs.

Loan-to-Value Ratio Considerations

The Loan-to-Value (LTV) ratio measures the loan amount relative to the appraised property value. Lenders typically require an LTV below 80% for HELOC approval, especially for construction or guidance lines of credit, to limit risk exposure.

A lower LTV can result in better HELOC rates and higher borrowing limits on home equity lines. If the LTV is high, lenders may impose higher interest rates or fees, reflecting increased default risk. Understanding the home’s current value and remaining mortgage balance is essential when applying for a HELOC in Wichita.

Role of the Prime Rate

The Prime Rate directly affects HELOC interest rates because most HELOCs are variable-rate loans tied to this benchmark. Changes in the Federal Reserve’s monetary policy alter the Prime Rate, which subsequently influences HELOC APRs.

Increases in the Prime Rate raise borrowing costs, while decreases lower them. Wichita homeowners with existing HELOCs should monitor these shifts, as their monthly payments and total interest can fluctuate accordingly. Lenders often add a margin to the Prime Rate depending on individual risk factors before setting the final rate.

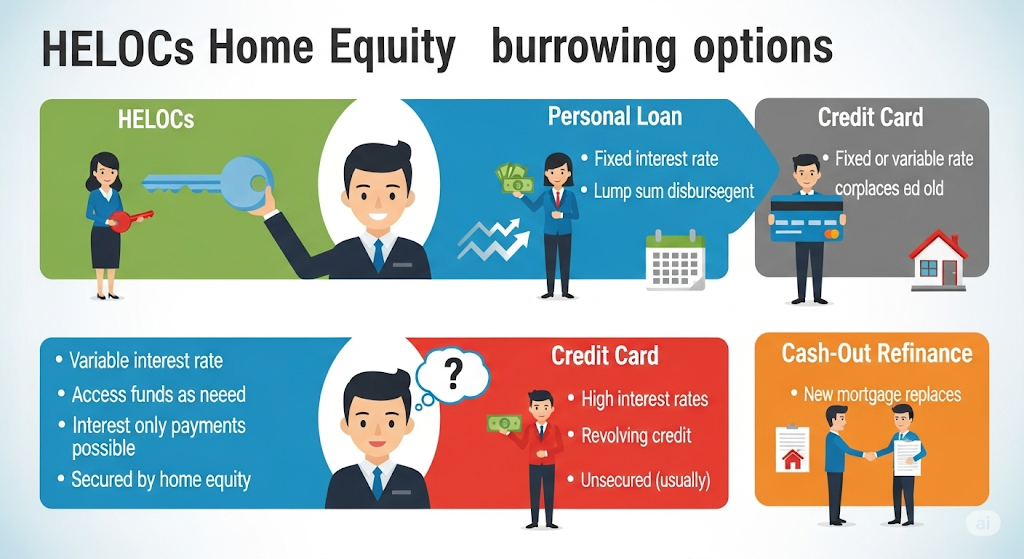

Comparing HELOCs With Other Borrowing Options

Homeowners and business owners often face choices between different types of credit lines and loans. Each option has distinct features that influence costs, repayment structures, and eligibility.

Closed-End Home Equity Loans

Closed-end home equity loans provide a fixed lump sum with a fixed interest rate. Borrowers know their monthly payment and term upfront, which aids in budgeting. Typically, these loans have higher initial interest rates compared to HELOCs but offer stability with predictable payments.

They are suited for borrowers who need a specific amount for one-time expenses like home renovations or debt consolidation. Since payments are fixed, borrowers are not exposed to fluctuating rates or changing credit limits. However, unlike HELOCs, there is no option to borrow again once funds are disbursed.

Cash Value Line of Credit

A cash value line of credit uses the accumulated cash value in a life insurance policy as collateral. It is often faster to obtain and may not require a credit check, making it accessible for those with lower credit scores.

Interest rates on these lines of credit can be competitive but vary based on the policy terms. Borrowers access funds as needed without reapplication, similar to a HELOC. Withdrawals reduce the policy’s death benefit, which should be considered before choosing this option.

Unsecured Business Lines of Credit

Unsecured business lines of credit from lenders like Coast Hill do not require collateral, posing higher risk to the lender. Consequently, they often carry higher interest rates than secured credit like HELOCs or home equity loans.

These lines offer flexibility to businesses needing revolving credit for operational expenses. Approval depends heavily on creditworthiness and business financials. While convenient, the lack of collateral means limits might be lower, and terms can include variable rates with periodic renewals.

Application Process for a HELOC in Wichita, KS

The application for a HELOC in Wichita involves meeting specific eligibility standards and submitting detailed financial paperwork. Applicants can typically expect a clear timeline for approval, and special considerations apply when using a HELOC for home auctions or similar transactions.

Eligibility Criteria

Applicants must own a home with sufficient equity, usually at least 15-20% of the property’s appraised value. Lenders in Wichita require a good credit score, generally above 620, to qualify for competitive HELOC rates.

Stable income and a low debt-to-income ratio, typically below 43%, are also essential. This shows the lender that the applicant can manage additional credit payments. Most lenders will examine existing mortgages and liens on the property, as a HELOC typically takes the second lien position.

Required Documentation

Documentation usually includes proof of income such as pay stubs or tax returns for the last two years. Applicants must provide current mortgage information and a professional home appraisal or automated valuation.

Additional financial documents often involve bank statements, credit reports, and identification. If the HELOC is for a specialized purpose, like automobile down payment assistance or home auctions, documentation related to these plans may be requested.

Timelines and Approval Speed

Most Wichita lenders process HELOC applications within 7 to 14 business days after receiving the full documentation. Pre-qualification can occur within 24 to 48 hours based on credit score and income.

The full approval includes an appraisal of the property and verification of financial items, which can extend timelines. Once approved, funds are usually available within a few days, depending on the lender’s procedures.

How to Open Credit Line for Home Auctions

When using a HELOC to finance home auctions in Wichita, specificity in the credit line setup is crucial. The borrower must inform the lender of the intended use to secure flexible draw options and faster access to funds.

Lenders may require that the credit line amount cover the expected auction down payment and possible closing costs. Borrowers should also maintain clear communication for timely releases of funds since auction timelines are strict and non-negotiable.

Using a HELOC for this purpose may involve additional verification to ensure funds are available immediately upon winning the auction bid.

Managing and Repaying Your HELOC

Managing and repaying a HELOC requires understanding the loan’s unique structure and choosing strategies that fit the borrower’s financial situation. Key factors include handling the draw and repayment periods properly, using available tools like automatic payments, and staying aware of fees that may increase costs.

Repayment Strategies

Borrowers must navigate two phases: the draw period, typically lasting up to seven years, and the repayment period, often ten years. During the draw period, payments usually cover interest only, making monthly costs lower. Afterward, principal plus interest repayments begin, increasing the monthly obligations.

Choosing a strategy to pay down principal early can help reduce overall interest paid. Borrowers might make extra payments during the draw period even if not required. Refinancing the HELOC or converting it to a fixed-rate loan can also stabilize payments when moving into the repayment phase.

Automatic Payment Pools

Automatic payment pools are a method lenders use to process HELOC payments efficiently. Setting up automatic payments ensures timely payments during both the interest-only and principal repayment phases.

Using automatic payments helps avoid late fees and can prevent damage to credit scores. Borrowers usually authorize the lender to withdraw minimum or specified amounts each month from a linked account. This system is particularly useful during the increased payments of the repayment period, preventing missed due dates.

Potential Fees and Penalties

HELOCs often include fees that borrowers should monitor closely. Common fees include annual maintenance fees, appraisal fees, and transaction fees during the draw period. Some lenders charge inactivity fees if no funds are used for an extended time.

Penalties may apply for missed or late payments, including increased interest rates or reduced credit limits. Prepayment penalties are less common but possible. Understanding fees upfront and maintaining consistent payments helps avoid unexpected charges and financial strain.

HELOC Alternatives Available in Wichita, KS

For business owners and homeowners in Wichita, several financing options provide flexibility without relying on traditional HELOCs. These alternatives cater to different needs, from short-term expenses to longer-term projects, with varying credit requirements and terms.

Credit Union Business Credit Cards

Credit unions in Wichita offer business credit cards tailored to local entrepreneurs. These cards often feature competitive interest rates and lower fees compared to national banks.

Business credit cards from local credit unions provide a revolving line of credit, useful for managing everyday expenses and short-term purchases. Many also include rewards programs, which can help offset costs related to travel, office supplies, or other operational needs.

Approval criteria tend to be more flexible at credit unions, making these cards accessible for small businesses with modest credit histories. However, credit limits may be lower than those seen in traditional HELOCs.

Business Lines of Credit

A business line of credit is a flexible funding source that Wichita-based companies can draw from up to a set credit limit. Institutions like TN Bank offer competitive terms specifically designed for local businesses.

These lines of credit allow borrowers to use funds as needed and pay interest only on the amount used, which helps with cash flow management. Typical uses include inventory purchases, payroll coverage, or unforeseen expenses.

Repayment terms and interest rates vary based on the lender, creditworthiness, and business performance. Lines of credit unlike HELOCs are tied to the business, not personal property, reducing risk on personal assets.

Construction Lines of Credit

Construction lines of credit serve contractors and developers needing short-term, sizable funds during projects. Lenders in Wichita provide these to cover costs such as labor, materials, and permits.

Draw periods are usually linked to project phases, with disbursements tied to verified progress. Interest accrues only on drawn amounts until the project concludes, promoting cost efficiency.

Borrowers must meet tighter approval standards due to project risk, often requiring detailed contracts or plans. This option is distinct from HELOCs as it focuses solely on construction financing rather than leveraging home equity.

Legal and Financial Considerations

Understanding timelines and legal rights connected to debt and contracts is essential when managing home equity lines of credit or any related financial matters. Knowing how debts can be pursued and the potential legal risks involved helps protect assets and plan repayments effectively.

Statute of Limitations for Credit Card Debt

The statute of limitations defines how long a creditor can legally pursue debt collection through the courts. In Georgia, this period is typically six years for credit card debt, starting from the date of the last payment or charge made on the account.

If a creditor files a lawsuit after this period, the debtor can use the statute of limitations as a defense to have the case dismissed. However, making a payment or acknowledging the debt can reset this timeline, potentially extending the creditor’s ability to sue.

It is important to note that while the statute limits legal action, creditors can still attempt other collection strategies outside of court after this period.

Potential Liens by Credit Card Companies

Credit card companies rarely place liens on a debtor’s property directly without first filing a lawsuit and obtaining a judgment. A lien is a legal claim against the property, often used to secure repayment.

If a creditor wins a judgment, they may then seek to place a lien on real estate. This lien can affect the homeowner’s ability to sell or refinance the property until the debt is resolved.

In Wichita, KS, as in other jurisdictions, lien laws require that proper court procedures and notifications occur before a lien can be placed on a home.

Can a Contractor Sue for Non Payment Without a Contract

A contractor can sue for unpaid work even if no formal written contract exists, but the case is generally based on implied contracts or verbal agreements. Courts consider evidence such as invoices, communications, or partial payments showing intent to contract.

In such cases, the contractor must prove the work was completed satisfactorily and that payment was agreed upon. Without a contract, disputes may involve more nuanced examination of the agreement terms.

Homeowners should document any work requests and approvals clearly to avoid potential legal conflicts related to payment.

Local Insights and Resources for Wichita Homeowners

Wichita residents have access to a range of financial institutions offering competitive HELOC rates. Understanding the key lenders and how local real estate patterns affect rates can help homeowners make informed borrowing decisions.

Reputable Lenders and Credit Unions

Several prominent lenders in Wichita provide HELOC options with varying terms. Equity Bank and Credit Union of America are well-regarded for offering competitive interest rates and flexible repayment plans.

Local credit unions often feature lower fees and personalized service compared to larger banks. Borrowers should consider their membership benefits, as these institutions may offer exclusive HELOC deals.

Additionally, firms like Emprise Bank and Firstrust Mortgage provide tailored home equity products that consider the borrower’s credit history and home equity amount. Comparing multiple lenders is crucial to find the best available rates and terms specific to Wichita’s market.

Local Real Estate Trends Impacting HELOC Rates

Wichita’s housing market shows moderate growth, influencing HELOC availability and pricing. Steady home values maintain good loan-to-value ratios, which lenders use to set rates.

Low inventory coupled with steady demand can push home prices upward, potentially increasing homeowners’ equity and qualifying them for higher credit lines. Economic factors in Wichita, such as employment growth and construction activity, also affect lender risk assessments.

Interest rates in the area may fluctuate based on these real estate trends, making it important for homeowners to monitor market conditions regularly before locking in a HELOC rate.